Is Your Credit Fair

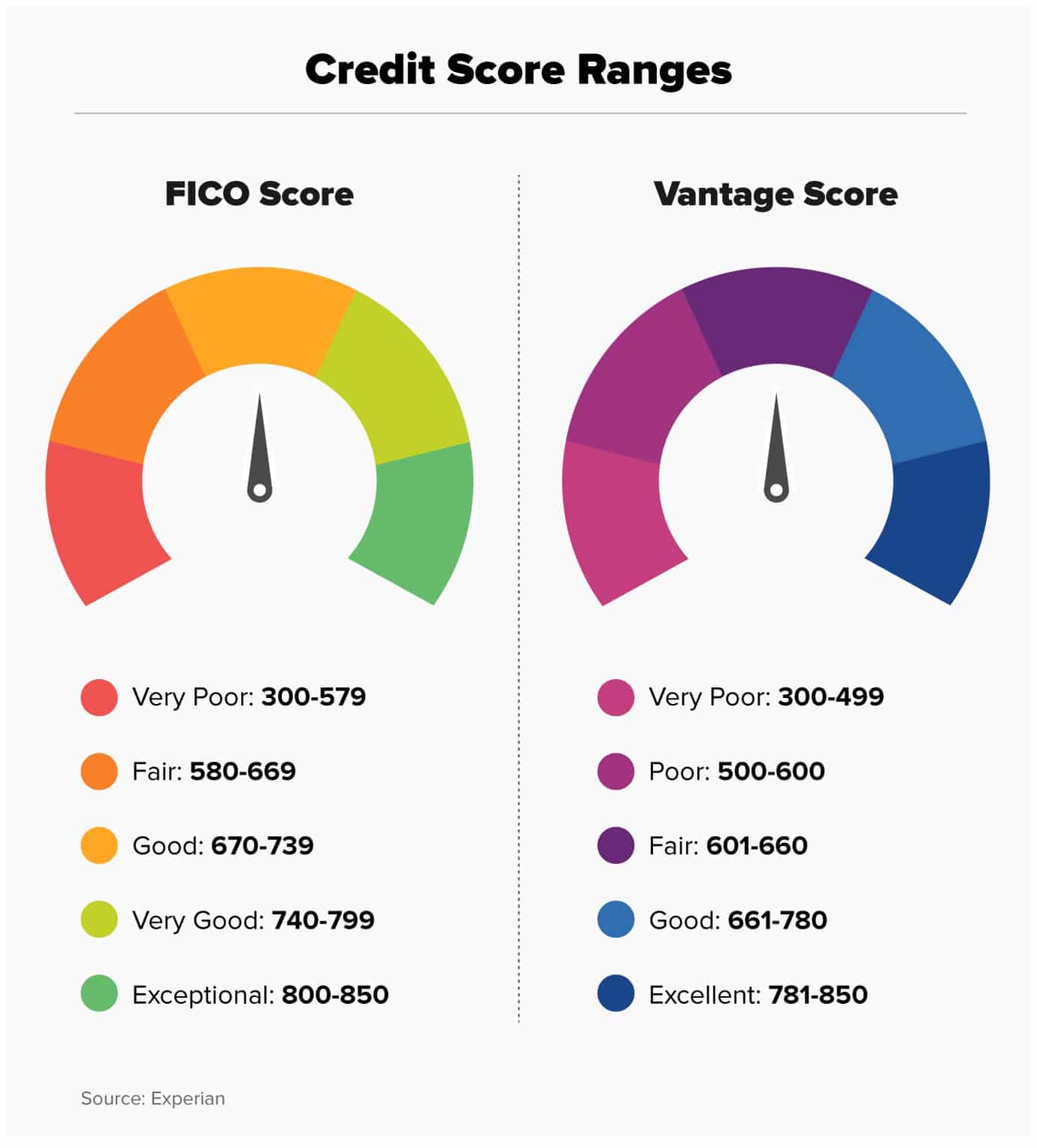

Whatâs considered fair credit may differ slightly based on what credit scores youâre looking atâand what credit-scoring company it came from. You can see the differences in models from two commonly used companies:

- FICO® considers a fair credit score to be between 580 and 669.

- VantageScore® says fair scores fall between 601 and 660.

Ultimately, itâs up to lenders to decide for themselves whatâs considered a fair credit score. But here are a few details about how scores might be classified:

Fair FICO Credit Scores

- Exceptional : Borrowers in the exceptional credit score range are the most likely to qualify for credit and get good interest rates, according to Experian®, a major credit bureau.

- Very good : FICO says these borrowers also tend to have higher-than-average credit scores. That makes it easier to qualify and get favorable credit terms.

- Good : Lenders are generally willing to give credit to people with good credit scores because theyâve typically proven they will repay borrowed money.

- Fair : While credit scores in the fair range are below average in the U.S., lenders may still approve borrowers for credit products. Options could be limited, though.

- Poor : Applicants may be turned down with credit scores in this range. Or the lender may approve the application but require a fee or deposit first.

Keep in mind that scoring companies have different versions of their own scores. And that could result in slight differences in how scoring ranges are reported.

Key Things That You Must Know About Credit Score

If you are new to the concept of credit or CIBIL score, you may have several questions about how it works, what impacts credit score, etc. Here are some of the additional aspects you must know about credit score.

1. You can check your credit score and get a credit report for free

Most credit bureaus and third-party websites provide credit scores for free. You can sign up with them and check your credit score for free at any time. It is good to check your credit score frequently to keep a close watch on your credit health. While checking your credit report, you can look for any errors and get them resolved by raising a dispute with the credit bureaus.

2. Not everyone has a credit score

A credit score is available only after an individual takes some form of credit from banks, NBFCs or online lenders. This can include credit card, personal loan, home loan, two-wheeler loans, loan against property, gold loan, car loan, etc. If you have never borrowed before, you would not have any credit score.

3. Factors that Make your Credit Score

If you are wondering how a credit score is calculated, you must know that it is based on factors such as your repayment history, credit utilisation ratio, credit age, credit mix and number of hard enquiries, etc. You will have a good credit score if you have a good combination of all of these factors.

4. It takes time to build an excellent credit score

5. Poor credit score can be improved

6. Checking your own credit score doesnt hurt it

What Is A Bad Credit Score

Credit score ranges vary based on the credit scoring model used and the credit bureau that pulls the score. Below, you can check which credit score range you fall into, using estimates from Experian. Take note that the lenders use varies, though 90% pull your FICO score.

FICO Score

- Excellent: 781 to 850

Recommended Reading: How To Get Debt Off Credit Report

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Do You Need Excellent Credit

No, you don’t need excellent credit. It doesn’t hurt, but a good credit score can be more than enough.

A FICO® Score of at least 720, which is within FICO’s good credit score range, will get you most of the same benefits as excellent credit. You should have no trouble passing a credit check or securing low interest rates on a loan. Your credit score will also be high enough to qualify for any credit card on the market. Keep in mind that a high credit score never guarantees an approval.

The only area where a higher credit score can help is a mortgage. To get the lowest mortgage interest rates, it typically takes a FICO® Score of 760 or higher. That’s still below the threshold for excellent credit, though.

Read Also: Is There Only One Type Of Credit Report

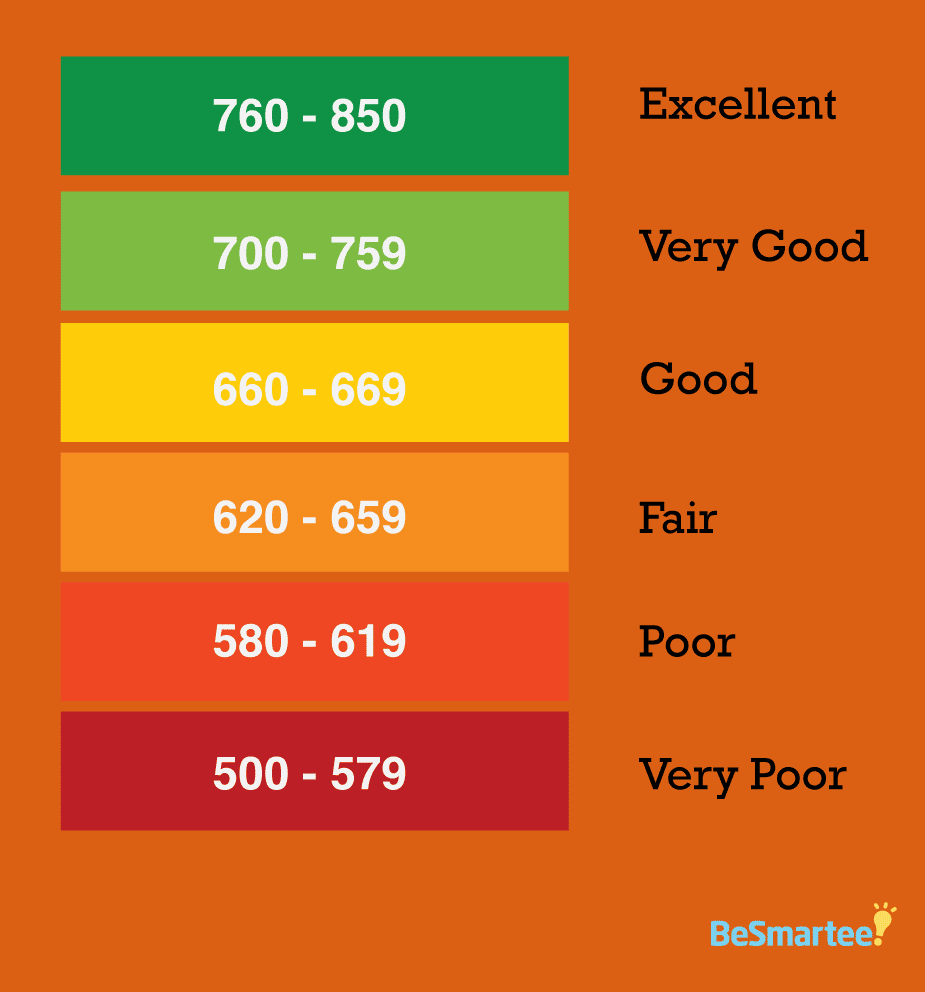

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Frequently Asked Questions About Credit Cards For Average Credit

You may have average credit or even no credit and need a credit card and its likely you have questions about cards in general. Weve rounded up answers to some questions most commonly asked.

Which Credit Cards Should I Apply for If I Have Fair Credit?

The good news is that if you have fair credit, you’re eligible for a decent number of credit cards geared for people with fair credit. As for which card you should apply for, it’s hard to say because a good fit for you will depend on factors like whether you want to earn rewards, prefer no fees, or other perks. Also, if you travel a lot look for cards that offer rewards. If you are just starting to build credit, a secured credit card is the way to go.

What is the Minimum Credit Score Required to Get a Credit Card?

There technically is no minimum credit score to get a credit card. However, the lower your credit score, the less likely you’ll be approved or have more options available to you. There are some credit cards that dont check your credit score, such as secured credit cards.

With these, youll most likely be required to put down collateral which acts as your line of credit.

How to Get a Credit Card with Fair Credit?

Contributor Sarah Li-Cain is a personal finance writer based in Jacksonville, Florida, specializing in real estate, insurance, banking, loans and credit. She is the host of the Buzzsprout and Beyond the Dollar podcasts. Writer Timothy Moore contributed to this report.

Read Also: How To Print Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Lenders Decide What Different Scores Mean

While the tables above provide a general guideline of how lenders view credit scores, every lender has its own criteria for defining different credit score ranges, which may or may not match what you see here. For example, one lender may consider a score of 675 to be good, while another lender defines it as fair.

And dont forget that while credit scores are important criteria used in lending decisions, theyre not necessarily the only ones. Lenders may also look at your ability to repay, debt-to-income ratio and other factors when deciding whether to approve an application for credit.

Read Also: How Do You Dispute Something On Your Credit Report

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Ways To Improve Your Credit Score

There are a number of things you can do to improve your credit score, but the most important is to make sure that you make all of your payments on time, every time. Other things you can do include:

-Keeping your balances low. Your credit utilization ratio should ideally be below 30%.-Having a mix of different types of credit .-Keeping old accounts open. A longer credit history is generally better for your score.-Checking your credit report regularly for errors and disputing any that you find.

Read Also: Can A Paid Charge Off Be Removed From Credit Report

Waived Security Deposits And Collateral

Landlords and service providers sometimes require new customers with lower credit scores to make sizable security deposits. The same applies to loan products collateral may be required to get approved. But if you improve your credit score, you could qualify for waived security deposits along with unsecured loan products that dont require collateral.

How To Improve Your Credit Score From Fair To Good

While credit scores are important tools to help you determine your financial health, they also can make a significant difference when it comes to getting approved for credit cards and loans. In order to be eligible for these various items , you’ll likely need to have a “good” credit score.

A “good” credit scoring range is around 670-739. The good news is that the average U.S. FICO score rose to 716 in 2021, so most Americans are already in this category. But it’s not uncommon to have a score slightly below that. A “fair” falls between 580 and 669. While lenders may still approve you for credit in this range, interest rates will likely be higher.

If you’re concerned about your credit score, there are several online tools available to help you improve it. Consider reaching out to a credit counseling service for a free consultation today.

If you improve your credit score from fair to good – or better yet, “excellent” – you are in a better position to be approved for mortgages, auto loans and other credit products with better interest rates, which can potentially save you thousands of dollars over time.

Also Check: How Often Does Discover Report To Credit Bureaus

Stay On Top Of Industry Trends And New Offers With Our Weekly Newsletter

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

Follow us

ADVERTISER DISCLOSURE CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Other factors, such as our proprietary website’s rules and the likelihood of applicants’ credit approval also impact how and where products appear on the site. CreditCards.com does not include the entire universe of available financial or credit offers.CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

What Impacts Your Credit Score

Your credit score is calculated based on the information in your credit reports from the three major credit bureaus: TransUnion, Experian or Equifax.

Understanding the scoring factors can help you determine the actions that could impact your score, and what you can do to improve your credit.

The general categories examined when calculating your score are:

Don’t Miss: How To Get A Free Credit Report Mailed To Me

Learn More About Credit Cards For Fair Credit

When used responsibly, credit cards could be one way to build credit. By making on-time payments and keeping your balance low, you may help boost your credit scores over time.

You can see a few options by checking out Capital Oneâs . If any interest you, you can also see whether youâre pre-approved, without affecting your credit score.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

What Is An Excellent Credit Score

An excellent credit score is a FICO® Score of 800 to 850 or a VantageScore of 781 to 850.

To clarify what these different scores mean, FICO is the credit scoring system that’s most widely used by lenders. VantageScore isn’t as popular, but it’s often the score provided by free credit score tools.

Having a credit score in this range is great for your personal finances. With excellent credit, you’re likely to qualify for the top credit cards and the lowest interest rate on loans. Whether you have excellent credit and you want to take advantage of it or you’re trying to get there, here’s everything you need to know.

Also Check: How Long To Raise Credit Score 100 Points

Why A Good Credit Score Is Important

Building a good credit score can help you in many ways. It could be a requirement for renting a home, and in some states, good credit may lead to lower insurance premiums.

But the biggest benefits of good credit come when you apply for a new loan, line of credit or credit card. Having a high credit score can increase your chances of getting approved, as well as lower the interest rates youre offered when you borrow money.

Another thing to keep in mind is that increasing your credit score could save you money when applying for new credit.

For instance, in a September 2022 study, LendingTree found that raising your credit score from fair to very good could save you nearly $50,000 in interest charges and fees. This isnt a lump sum of money instead, this figure shows the difference in the total cost to borrow for a consumer with a fair credit score and one with a very good score.

The Best Credit Cards For Fair Credit

-

Capital One Platinum Credit Card: Best for no annual fee

-

Capital One QuicksilverOne Cash Rewards Credit Card: Best for Cash Back

-

Discover it Student Cash Back: Best for Students

-

Best for Travel

-

OpenSky Secured Visa Credit Card: Best Secured Credit Card

-

Petal 1 Visa Credit Card: Best for Broad Approval Criteria

-

Deserve MasterCard: Best for International Students

Recommended Reading: What To Dispute On Credit Report

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Do I Have Fair Credit

In addition to a score in the same range, people with fair credit tend to share other traits. For example, they usually have less than $5,000 in available credit.

You can see how you compare to the other credit tiers and to the average person with fair credit below:

| Category |

|

Never 60+ days late on payment Never declared bankruptcy |

Also Check: What Day Does Usaa Report To The Credit Bureaus