A Good Income And Low Monthly Bills Help Too

Having a good income and reasonable rent or mortgage expenses are desirable too. Amex has been issuing cards for decades and can predict how often most cardholders use their Amex card.

The bank wants to make sure you have the income to pay your monthly balance if your spending trends are similar to current Amex Gold cardholders.

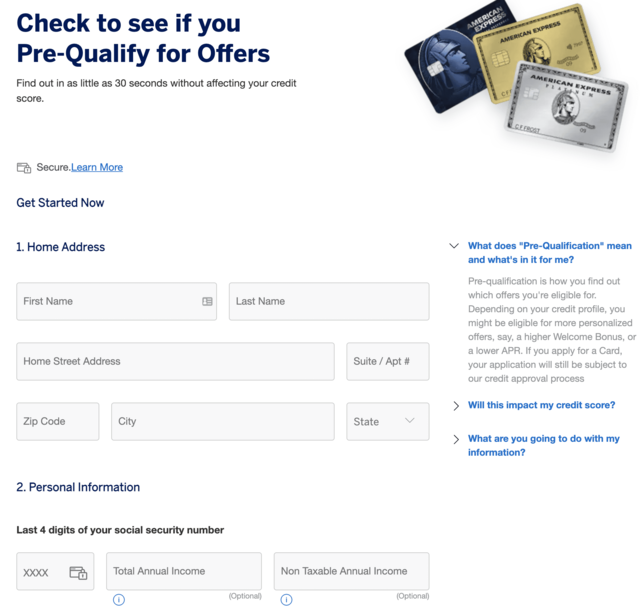

Like other banks, you will answer several personal questions about your current finances. Amex crunches the numbers to make an application decision.

Best Unsecured Credit Cards For Building Credit

You can build credit in several different ways. You can increase your credit usage and diversify your types of credit. Applying for unsecured cards does both of these simultaneously. Youll increase your mix of credit, and youll increase your credit limit. Both of these things are good to credit reporting agencies. They see you as being responsible with your credit and will slowly boost your score the longer youve had your card.

Blue From American Express Vs Blue Cash Everyday Card From American Express

If youre purely interested in getting the most rewards per dollar spent, then youll almost certainly get more value from the Blue Cash Everyday® Card from American Express assuming you can qualify for it. Unlike the Blue from American Express® card, the Blue Cash Everyday® Card from American Express offers a generous welcome offer and a significant amount of bonus cash for U.S. supermarket, department store and U.S. gas station purchases . For example, you could earn up to $180 just from spending $500 a month on groceries. If you spent the same amount of money buying groceries with the Blue from American Express® , youd earn just 6,000 Membership Rewards points. That, in turn, would be worth just $30 to $60 or so in value, depending on how you redeem your points.

The Blue Cash Everyday® Card from American Express may not be for you, though, if youre a frequent traveler who’s trying to collect points that you can use with one or more American Express travel partners. In that case, the Blue from American Express® may be a better fit for you. Or, if you can qualify for it, the American Everyday card or another American Express points card may be a better choice.

For rates and fees of Blue Cash Everyday® Card from American Express, please click here.

Also Check: How To Place Fraud Alert On Credit Report

Factors That American Express Considers

Many things are taken into account during the decision process. Consider these factors to help improve your AMEX Platinum approval odds:

Note

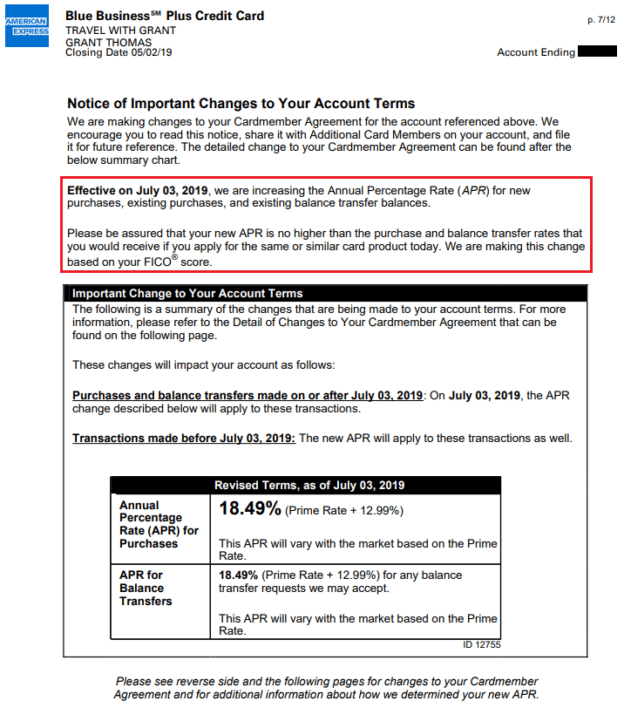

- Your credit score: Banks will usually pull your credit report from a couple of the three credit bureaus , as your scores may be different across each bureau. AMEX usually pulls from Experian, so know your score from this report before applying.

Note

To find out if you qualify, visit the website.

If you think you may not meet any of these factors, it doesn’t mean you can’t get approved. Read on.

Is The Platinum Card From American Express Right For You

If you’re an occasional traveler who flies coach and stays at the Holiday Inn, The Platinum Card® from American Express isn’t going to magically get you into first class and the presidential suite at the Ritz-Carlton at no extra charge.

For many, the usability of the card’s many annual credits may make it or break it. If you can maximize the credits, they can more than make up for the card’s steep annual fee. But if you won’t be able to make use of many of the annual credits that come with the card, it may not make sense for you.

If you’re a frequent-to-constant traveler who doesn’t mind spending money for quality and would love to be rewarded for doing so, then it might be a perfect fit for your wallet.

You May Like: Why Did My Credit Score Drop 2020

How To Improve Your Credit Score Before Applying

Even if you meet the minimum requirements to get an American Express credit cardor any other card for that matterit’s still usually a good idea to work on your credit score for a better chance of approval, or better terms such as a lower interest rate.

Here are some things you can do to improve your credit:

- Pay your bills on time every month.

- Get caught up on past-due payments and accounts in collections.

- Get added as an authorized user on a family member’s credit card account with a positive history.

- Use Experian Boost®ø to get credit for on-time utility, cellphone and streaming payments.

- Pay down credit card balances and keep them low.

- Avoid closing unused credit card accounts.

- Take on new credit only when necessary.

- Dispute inaccurate information on your credit reports.

Building credit can take some time, but as you start making positive changes, you may start seeing results as quickly as a few months. Experian Boost can help you improve your scores instantly.

Why Did I Get Declined By American Express

If your application for an American Express card was declined there are a number of possible reasons. A less-than-stellar credit history is one. But another factor that could affect your appeal to an issuer is your debt-to-available credit ratio. If an issuer sees you are close to maxed out on your other cards, it could signal a problem. And, if youve applied for too many cards within a short period of time, issuers generally consider that a red flag.

If you dont think you should have been denied, you can reach out to the issuer and ask for reconsideration. This is when you contact the issuer and ask them to reconsider your application. Theres no harm in doing so and it may result in your application being approved.

Recommended Reading: Why Do You Need A Credit Report

What Credit Score Is Needed For An American Express Card

American Express groups credit scores into three categories. They consider both FICO and VantageScore credit scoring models in determining creditworthiness.

According to the credit score range chart listed on the American Express website, credit scores are broken down into the following levels:

- Excellent: 781 and above

- Fair to Poor: 661 and below

How Hard Is It To Get The American Express Platinum

If you have the credit score needed for The Platinum Card® from American Express, you will enjoy some of the best travel rewards when you are approved.

If you have a credit score in the upper 600s or low 700s but have a decent credit history, your odds of getting approved are higher. The Platinum Card is one of the best American Express credit cards to have in your wallet. So, its somewhat understandable that the required credit score may be higher.

Also Check: What Credit Report Do Lenders Use

How To Check Your Credit Score

Before you apply for a credit card, it makes sense to know where you stand. You can check your credit in several different ways:

- Use a free credit report site. Its a good idea to check your report through a reputable site like AnnualCreditReport.com once per year to make sure there arent any errors on your report that could have an adverse impact on your score. Note that these reports dont give you your actual score but contain all the information that goes into calculating your score.

Suggested Credit Cards For Average Credit:

If you have OK but not great credit, Capital One should be your first stop for a new credit card. Capital One is a major card issuer that has some cards well-suited for consumers with average but not-quite excellent credit. Because theyre such a big bank, Capital One has lots of great cards and you may be able to upgrade your card as your credit improves.

Read Also: How To Get Inquiries Off Your Credit Report

Approved After Calling Amex

AddictedtoApprovals had an 800 FICO score when trying for the Amex Gold. They didnt get an instant approval decision but were approved after calling Amex customer service to check their application status.

Having an excellent credit score doesnt always guarantee an instant approval decision. In some cases, an excellent credit score can mean a rejected application.

In this persons case, they applied for 6 different Amex cards between September 2019 and November 2020. The Amex Gold was the final application, but two personal card applications in early 2020 were declined.

Due to the volume of recent card applications, their Amex Gold application likely didnt get an instant approval decision. Taking the time to call Amex can be worth it to prioritize your application and answer any remaining questions.

How Do You Improve Your Credit Score

American Express credit cards are not targeted at people establishing new credit or rebuilding poor credit. People whose applications have been rejected in the past or those who wish to increase their chances of approval may want to focus on building their credit score before re-applying.

- Lowering debt-to-income ratio: Pay off smaller debts in full to lower the total amount of debt compared to total income. This shows lenders that a person is more likely to repay their debts.

- Lowering credit utilization: If a credit card is maxed out each month, this will lower the credit score. Aim for using a credit card to reach 30% of available credit before paying it off in full.

- Paying bills on time: Late or missed payments are two factors that may bring credit scores down.

- Checking credit reports for errors: In some cases, incorrect information on a credit report can significantly affect the overall score. However, credit scores can be improved by resolving errors with the credit bureau.

- Using a secured credit card: Secured cards are an excellent way to start for people with poor credit or those who are just beginning to build credit. Unfortunately, American Express doesnt offer secured cards. As a result, it may take time to build enough credit to apply for an American Express credit card.

Recommended Reading: When Does Bankruptcy Clear From Credit Report Canada

How To Get Approved For Amex Platinum

The American Express Platinum has long been the premium travel reward card.

Surprisingly, for a luxury card with a $695 annual fee , the average cardholder credit score isn’t quite as high as you would expect.

Read on to learn about Amex Platinum and what it takes to get approved. See if you qualify.

We’ll explain more below. But first, let’s highlight the current American Express Platinum promotions.

Re: What Credit Score Is Needed For Amex Cli

Your score is OK, but the problem with scores are that they aren’t representative of the whole picture. There’s something specific to your profile that makes them uncomfortable.

Have you for example ever had a single late payment with them or had an issue with a failed payment that you caught and rectified before a due date?

What’s your DTI? While they claim it is a score issue, it could be something else

My DTI is 16%

@sxa001 wrote:

It’s an SP, you are past the 91 day mark, and your score is higher than 720 now, I probably would go for it. Good luck!

If 720 is a good benchmark hopefully they say yes! Thank you! I appreciate the info and well wishes!

@coldfusion wrote:

Your score is OK, but the problem with scores are that they aren’t representative of the whole picture. There’s something specific to your profile that makes them uncomfortable.

Have you for example ever had a single late payment with them or had an issue with a failed payment that you caught and rectified before a due date?

No late payments. I just got the card in April. I have 100% payment history with them and all my other cards. I’ve paid in full each month since getting the card. Usually put about $800 of spend on it each month. Also on all my other cards my utilization is 0%. I do AZEO so I usually have a balance on one card ranging $5 to $20. Other than that they all report $0 balances.

You May Like: What Credit Score Is Needed For A Mortgage

What Could Be Improved

There are a few areas where American Express could make this card better.

Limited bonus categories

The rewards rate on this card is somewhat disappointing. Even if you only look at no annual fee cards, there are plenty of options available that have more bonus categories and earn more. You may want to compare credit cards to see if another rewards card would better fit your spending habits.

Incentivizes spending money

The 20% points bonus you’ll get for making at least 20 purchases per month is nice, but it can also motivate you to buy things you don’t really need. Make sure you avoid the temptation to overspend if you get this card.

Foreign transaction fee

It could get costly to use the card outside the country, as it charges a 2.7% foreign transaction fee. For international travel, you’re better off checking out travel credit cards that won’t charge you this fee.

What Is The Easiest American Express Card To Get Approved For

Since American Express cards are primarily recommended for those with good or better credit, there isnt a card aimed at someone whose credit doesnt fit that description. In general, income requirements and credit profile reviews may be less restrictive for the entry level American Express cards with no annual fees over the premium annual fee cards. If youre new to credit, your profile may be better suited to a simple low annual fee cash-back card rather than a pricey premium rewards card.

You May Like: How To Get Rid Of Collections On Credit Report Canada

Benefits Of The The Platinum Card From American Express

With most travel cards, the rewards you earn for your spending are the signature feature. Not with The Platinum Card® from American Express. To be sure, the welcome offer for new cardholders is lucrative, but even earning 5X points on eligible flights and hotel stays, you’ll have to book an awful lot of travel before you earn back that fat annual fee. The bulk of this card’s value lies instead in its annual statement credits for specific purchases, along with automatic upgrades, premium services, exclusive access and other “soft” benefits.

Understand How Welcome Offers Work

Like many other credit card issuers, American Express provides upfront incentives called welcome offers to new cardholders. These initiatives allow you to earn a bonus when you meet a minimum spending requirement in the first few months.

However, American Express only allows you to earn a card’s welcome offer once. This means that if you’ve had a certain American Express card before and canceled it, you can’t get its welcome offer ever again.

Other card issuers may have similar restrictions, so make sure you do your research before applying.

Read Also: How To Raise Credit Score By 200 Points

What Other Issuers To Consider If Amex Doesnt Approve You

If your application for an Amex card is denied, your best bet is to try and figure out why you werent approved and what you can do about it. That advice goes for Amex and all other issuers.

For example, if your credit score needs work, use our tips to improve your score, which will increase your odds of approval next time you want a rewards card. Regardless of whether youre applying for an Amex card, Chase card, Capital One card or Citi card, most of the top rewards cards require good to excellent credit scores and a solid credit history.

What Credit Score Is Needed For Amex Platinum

Under the FICO credit scoring model, anyone with a score of 670 to 739 has good credit, anyone with a score of 740 to 799 has very good credit and anyone with an 800 or higher has exceptional credit.

If you havent yet built a good credit history, you might want to hold off on your Amex Platinum application.

You May Like: Is 783 A Good Credit Score

For Good To Excellent Credit: American Express Gold Card

Individuals with good or excellent credit may consider applying for the American Express® Gold Card . Although the American Express® Gold Card does not offer any airline or travel lounge benefits, the card earns impressive rewards on restaurants and U.S. supermarket spending. American Express® Gold Card comes with an annual fee of $250 and has the following rewards structure:

- 4 Membership Rewards® points per dollar at restaurants, plus takeout and delivery in the U.S., 4 Membership Rewards® points per dollar at U.S. supermarkets , 3 Membership Rewards® points per dollar on flights booked directly with airlines or through American Express travel and 1 point per dollar on other eligible purchases

In addition to the American Express® Gold Cards industry-leading rewards structure, it also comes with up to $120 in dining credits each year toward eligible restaurants and up to $120 in Uber Cash each year toward U.S. Uber Rides or Uber Eats after you link your eligible card to your Uber account, which if fully utilized could nearly break even with the annual fee.