Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

How To Improve Your Score Before Applying For Credit

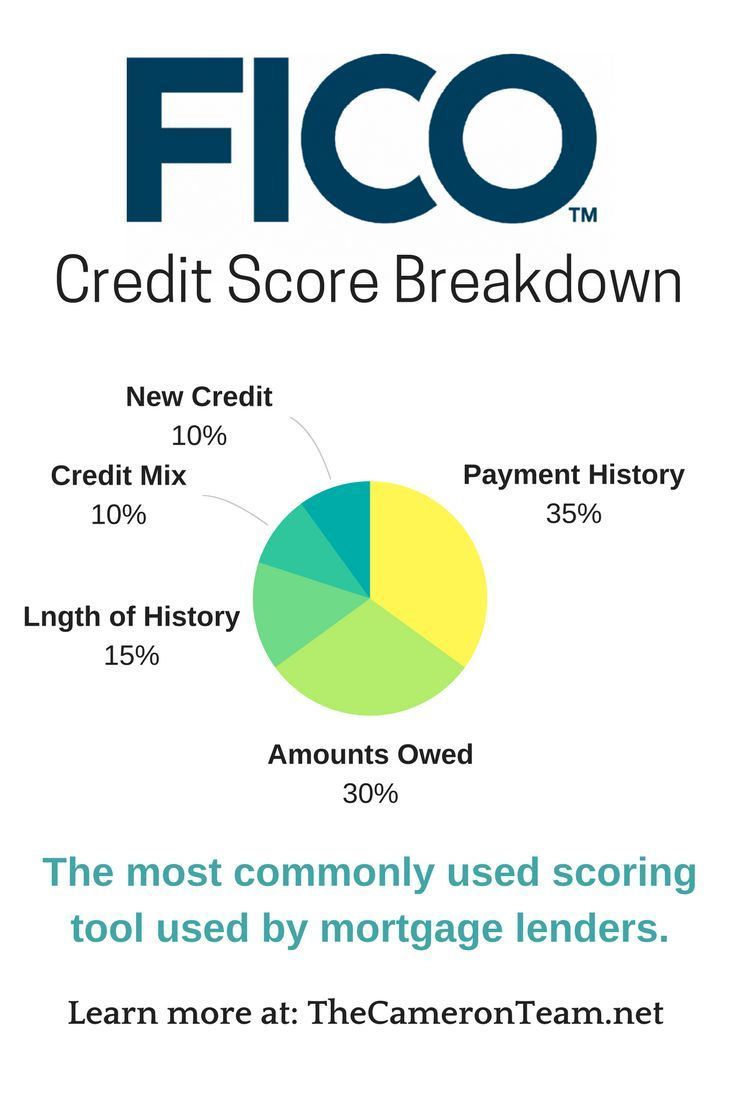

A tried-and-true way to establish excellent credit is to pay all your bills on time, across each of your credit accounts. This isn’t a fast way to improve a credit score, but done consistently, it will strengthen your scores no matter the model or version you look at. Paying off debt balances, if possible, will also lower your credit utilization, similarly improving your score.

If you’re applying for credit very soon, avoid other hard inquiries in the weeks leading up to the application, as these could cause a temporary drop in your score. Also avoid closing old credit accountsas long as they’re not expensive or unwieldy to maintainso your scores benefit from the account’s credit limit and long credit history. Lenders will be glad to see that you’ve been able to responsibly manage an account over an extended period of time.

Which Fico Score Do Lenders Use

This is completely dependent on the lender. In most cases, credit card issuers and loan providers will follow FICOs advice and use niche-relevant scores. But, bureau-reporting companies are often slow to take on the new score algorithms. Sometimes the credit report bureaus will also take a while before adapting to the more recent scores.

Take a look below for a breakdown of what credit scores might get pulled based on the bureau the lender uses.

The specific credit scores used by the credit report bureau Innovis are not well-documented at this time.

While most lenders currently use FICO Score 8, its important to note that a FICO Score 9 exists and is technically newer.

These are just some of the more common FICO scores, as well over 50 different algorithms exist.

Read Also: How To Get Comcast Collection Removed From Credit Report

Work With A Trusted Mortgage Loan Officer

Your mortgage lender is the ideal resource for asking questions about any part of the homebuying process before you are even ready to apply.

The professional loan officers at home.com by Homefinity can get you pre-approved so you can solidify your budget and take the proper next steps. or apply now to get started.

Image by StartupStockPhotos from Pixabay

How Your Credit Score Impacts Your Apr

Your credit score has a major effect on the APR of your loan. The APR of any installment loan, such as a mortgage, reflects the cost of interest expense and fees over the life of the loan. The higher the APR, the more the borrower will have to pay.

If you apply for a $250,000, 30-year mortgage, you can wind up paying wildly different amounts depending on your credit score, as shown below.

Don’t Miss: What Credit Score Do You Need For Apple Card

Where To Check Your Fico Score Before Applying For A Mortgage

Many free credit services dont use the FICO scoring model, which is the one your mortgage lender will be looking at. To be sure the score you check is comparable to what a mortgage lender will see, you should use one of these sites:

- AnnualCreditReport.com: This is the only official source for your free credit report. Youre typically entitled to one free credit report per year

- MyFico.com

Whether its free or you pay a nominal fee, the end result will be worthwhile. You can save time and energy by knowing the scores you see are in line with what your lender will see.

A good credit score is achievable as long as you continue to make your payments on time, keep your credit utilization relatively low, and dont shop for new credit. Over time, your score will increase for every credit scoring model.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Don’t Miss: Does National Grid Report To Credit Bureaus

What Credit Scores Do Car Lenders Use

Although you might not know exactly which credit score an auto lender will use, the following types of credit scores are popular options:

FICO® Score 8 and 9. These are the latest generic FICO® scoring models. Although FICO® didn’t create these models specifically for auto lenders, they are widely used credit scores, and auto lenders may use a base FICO® Score when reviewing auto loan applications.

FICO® Auto Scores. There are multiple versions of the industry-specific FICO® Auto Score, which is created specifically for auto lenders. The FICO® Auto Scores are based on a generic FICO® Score, and then the score is altered to better predict a person’s likelihood of repaying an auto loan on time. Your history with auto loans could be especially important in determining your FICO® Auto Scores.

VantageScore® 3.0 and 4.0. These are the two latest versions of the credit scoring model created by VantageScore, a credit scoring agency founded by the three major credit bureaus . According to a 2017 report from VantageScore Solutions and financial consulting firm Oliver Wyman, auto lenders used a VantageScore credit score for more than 70% of new auto loan and lease decisions from July 2016 to June 2017.

Is Fico Score The Same As Credit Score

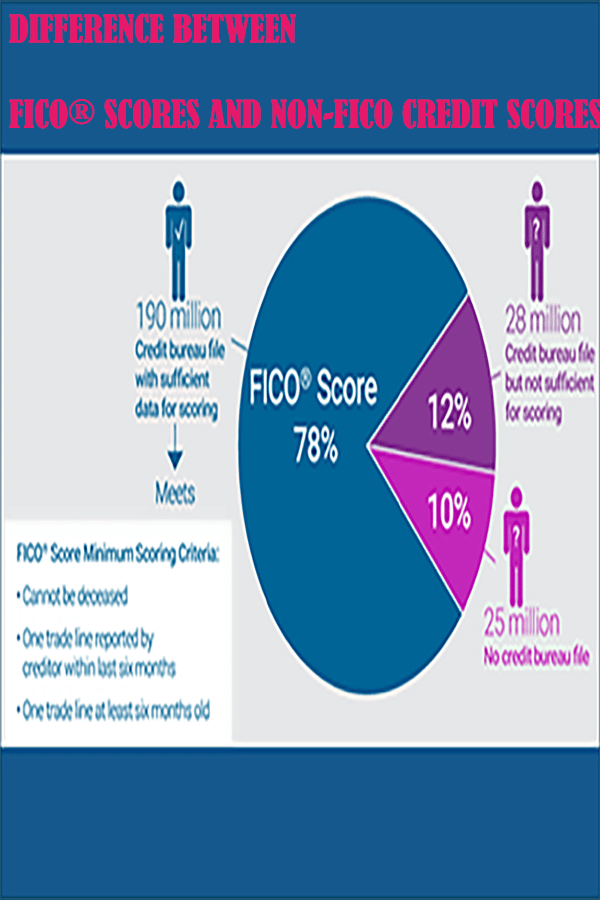

On the one hand, the terms credit score and FICO® Score are often used interchangeably. However, be advised: A FICO® Score is just one type of credit score noting that different scoring providers and methods exist.

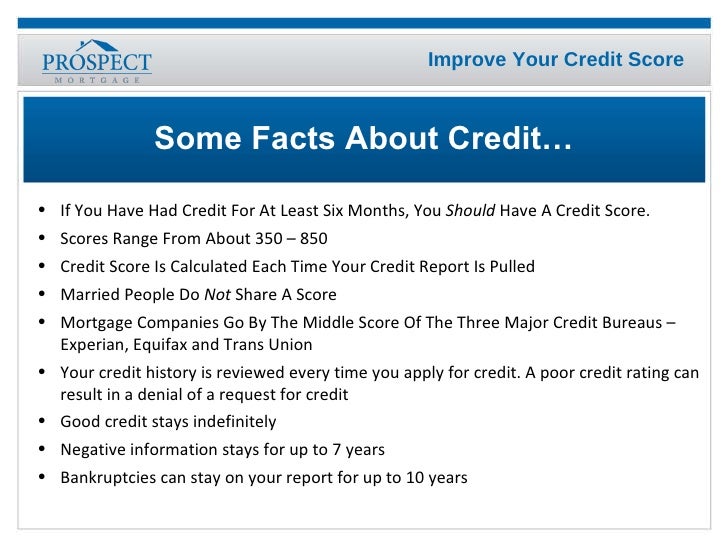

Most FICO® scores hover within the 300 850 range, with tallies above 670 considered a good score.

Financial providers can look to various choices of credit bureau and reporting methods when seeking to compute your credit score. That said, typically, when mortgage lenders are seeking to gauge your creditworthiness, the credit score theyre likeliest to consider is that provided by FICO®.

Having a higher FICO® Score can help increase your chances of obtaining a loan and securing it from a wider pool of potential providers significantly.

Read Also: How Bad Is My Credit Rating

Talk To The Mortgage Pros For Guidance During The Loan Process

If you are trying to secure a favorable home loan for your real estate purchase and are concerned about your credit or would like to learn more about your options given your current creditworthiness, be sure to talk with a real estate and mortgage financing expert.

The professionals at Fairfax Mortgage Investments would be happy to help you achieve advantageous terms on your mortgage and prepare you for the process of closing on a home. Reach out to schedule an appointment to discuss your situation and develop a strategy to put you in the best position possible for this important financial decision.

How To Get Started

If youre ready to begin the homebuying or refinance process but are unsure about your credit situation, check with your bank or credit card issuer to get an idea of your score. You also should download your full report yearly to evaluate your history and ensure there are no errors.

Your credit history might be complicated.

To help you learn more about your situation and improve your score, consider working with your lender or a financial counselor to help you get where you need to be.

Also Check: What Can You Do To Improve Your Credit Rating

Why Is Your Credit Score Different With Each Bureau

If youre wondering the differences among the three bureaus, the answer is not much. The main difference, and really the only difference, is how they use the information in your credit report to calculate your score. They each have their own algorithms and ways they weigh your debt to generate your score. Additionally, each bureau might rely on the FICO or VantageScore model to determine your score.

The credit score an auto lender obtains can be different from the like Credit Karma. According to CNBC, your scores can differ for six reasons. First, depending on which scoring model and version are used, along with which bureau is used, your credit score can be different because each model and bureau have slightly different formulas they use.

Additionally, lenders are not required to report information to all three credit bureaus, so one credit report might have information the other does not. Also, the time a lender performs a credit inquiry and any errors on your report contribute to different scores.

Your credit score is a major part of determining whether you can get a car loan and a good interest rate. Dealerships want to buy a car from them, but their lenders have some restrictions for financing based on your score and debt-to-income ratio. For instance, you might get a loan even if you have a low score, but youll likely pay a high annual percentage rate .

How Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person. But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game. The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

Also Check: Which Credit Score Is Used

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

- FICO® Score 2

- FICO® Score 5

- FICO® Score 4

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

Read Also: How To Raise Credit Score

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Monitor Your Credit For Free

Join the millions using CreditWise from Capital One.

Will Checking My Scores Hurt My Credit?

Checking your scores wonât affect your credit, as long as the service uses a soft inquiryâlike CreditWise does. That means you can check your credit as many times as you want without hurting your scores.

According to Experian, you should do a credit check once a year to keep an eye on your credit score range and check to make sure the information in your credit report is accurate. If you find inaccurate information, you may file a dispute with the credit bureau where you found itâor directly with the lender.

Don’t Miss: How To Add A Tradeline To Credit Report

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

How Can You Get Your Credit Report For Free

You are entitled to a free credit report once a year from each of the credit bureaus. This report can be requested directly or through AnnualCreditReport, the only permitted website for distributing the free annual credit report.

You might want to pull your Innovis credit report to make sure its not a mess. While each of the three major bureaus reports are available through AnnualCreditReport, your free report from Innovis must be requested by mail or phone. Still, its advised that you make an effort to get a copy of your Innovis report at least once a year if not for borrowing purposes, at least to protect yourself from identity theft.

To get a copy of your Innovis credit report, call Innovis toll-free at 1-800-540-2505. If you request your report by mail, you can use the printable request form.

Read Also: Does Carecredit Affect Credit Score

Understanding Your Credit Score

Once you have a basic understanding of what credit score is needed for each type of loan, its time to take your own score into consideration. That means looking at your credit report.

Your credit report is an essential part of understanding your credit score, as it details your credit history. Any mistake on this report could lower your score, so you should get in the habit of checking your credit report at least once a year and report any errors to the credit reporting agency as soon as you find them. Youre entitled to a free credit report from all three major credit reporting agencies once a year.

If youd like to check your credit score, Rocket Homes, a sister company to Rocket Mortgage, can help. Rocket Homes helps you track and understand your credit profile. Rocket Homes allows you to view your TransUnion® credit report, which is conveniently updated every 7 days to ensure you get the most up-to-date information, as well as your VantageScore® 3.0 credit score.

Once you know your score, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

What If My Credit Scores Are Different

Your FICO score will fluctuate, but to what extent will depend on what information your report shows.

The credit score calculation algorithm remains the same, but the specific details that get factored in could weigh differently between bureaus. For example, you could have a much lower FICO score calculation at one of the bureaus if they mistakenly left your oldest account unreported.

You need to know approximately what your credit score is at any given point in time. If you want to be more precise, you can request your credit score from all the credit-reporting agencies. This way, you can determine the lowest and highest score that a lender could see when pulling your credit report.

If you want to keep up with your credit scores all across the board, its a good idea to request it at least once every four months. You would need to get your rating from all of the bureaus every time, though. This is because the score can fluctuate a lot depending on many variables, and watching like a hawk would mean you can see what causes particular score fluctuations.

Also Check: What Credit Score Does Affirm Use