Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Does Your Credit Report Show Inquiries You Did Not Make Here’s How Donotpay Can Help You Remove Them

Any credit inquiries from the past two years will typically show up on your credit report, and periodically checking your report for errors or signs of possible identity theft is a must to make sure you are not losing points for inquiries you are not responsible for. Although you generally cannot remove legitimate credit inquiries, you may have several options forremoving inquiries that you did not make from your credit report. Here is an overview of what credit inquiries are, how they can impact your credit report, and how DoNotPay can help you improve your credit score if you notice fraudulent inquiries or other errors on your credit report!

How Do I Protect Myself From Fraudulent Hard Inquiries

Inaccurate information on your credit report is uncommon, but it does happen. Check your regularly to avoid fraudulent and other incorrect information going unnoticed. Review whats listed and keep an eye out for anything unfamiliar.

Its impossible to prevent all identity theft, but keeping track of your credit history will keep you in a better position to stop a bad situation from getting much worse.

You should also consider placing a fraud alert on your credit record as soon as you think you are or may be a victim of identity theft. This will make it more difficult for criminals to start a new account in your name.

Putting your credit report under a credit freeze provides even more security. A freeze prevents companies from making any inquiries. While youre looking for a loan or credit, you can unfreeze your credit report to allow a legitimate hard inquiry to go through.

Dont Miss: Does Removing An Authorized User Hurt Their Credit Score

Don’t Miss: How To Check Your Child’s Credit Report Free

Common Credit Report Errors

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit

How Do Hard Inquiries Affect Your Credit Score

Hard inquiries send your credit score up a few points and account for 10% of your overall score. The other thing to be aware of is how lenders view hard inquiries. Too many hard inquiries often make you look risky because it seems like you are applying for too many loans. Lenders view this unfavorably.

It also takes two years for a hard inquiry to vanish from your credit score. So, hard inquiries are there for the foreseeable future.

Recommended Reading: When Do Closed Accounts Fall Off Your Credit Report

Avoid Unnecessary Applications Prior To Applying For Home Or Auto Loan

While a single hard inquiry on your credit report can cause a small, short-term decline in your credit score, it shouldnt have a major negative impact, especially if you have good credit. Having several hard inquiries for different types of credit in a short time, however, could cause a more significant dip in scores and cause lenders to worry that you are having financial difficulty or that you could become overextended.

If youre seeking a loan for a big purchase like a home or a car, first get a copy of your and review it. Avoid applying for new credit until you apply for your mortgage or auto loan. And consider signing up for free credit monitoringit will help you stay on top of your credit situation and can also help alert you to signs of fraud or identity theft, including unauthorized hard inquiries.

Will Disputing An Inquiry Improve Your Credit

In the case of fraud, it is always important to take steps to investigate the unauthorized inquiry as this can help prevent future fraudulent activity. There is no guarantee that disputing the inquiry will impact your credit score. FICO estimates that a single inquiry has less than a 5 point impact on your credit score.

Hard inquiries are part of what makes up the New Credit portion of your credit score. However, this factor accounts for only 10% of your overall credit score. Not all hard inquiries are weighted the same way. Newer inquiries have the most significant impact. Once inquiries are 1 year old, they no longer affect your credit score. And after 2 years, they fall off your credit report.

Read Also: Does It Hurt Your Credit To Check Your Credit Report

Can You Dispute Inquiries From Your Credit Report Faqs

How much do hard inquiries hurt my credit score?

A hard inquiry only deducts a few points from your credit report . FICO considers hard credit inquiries as 10% to determine your credit score. The only real problem is if you have many hard credit inquiries in a short period of time .

Where can I find a sample letter to dispute a hard credit inquiry?

You can find a sample letter as well as all the details you need to include in the post above.

How to remove unauthorized credit inquiries from my credit report?

You can wait for the 24 months period to fall off naturally or send a letter/email to the credit reporting bureaus.

Do soft credit inquiries hurt my personal credit score?

No, soft inquiries dont affect your credit score at all.

What credit inquiries can I remove from my credit report?

You can only dispute hard credit inquiries that you didnt give your consent like identity theft or fraudulent activity.

How to remove inquiries from Equifax, Experian, or TransUnion?

If youre sure a hard credit inquiry is conducted without your permission, you can contact by phone, letter, or email any of the credit reporting agencies that mention this inquiry on your credit report.

Can I dispute a hard inquiry if I got declined for the loan or credit card?

Unfortunately not. It doesnt matter if they rejected or approved your application.

Can I remove authorized inquiries from my credit report?

No, its impossible to dispute hard credit inquiries you gave your consent for.

How To Tell If An Inquiry Is Unauthorized

If you are not already signed up for a , it can be difficult to spot a fraudulent or unauthorized credit inquiry.

You will start by pulling your credit reports. Not just one, but all of them. Many lenders will pull just one credit bureau when making a hard inquiry, so you will have to search through all of your reports.

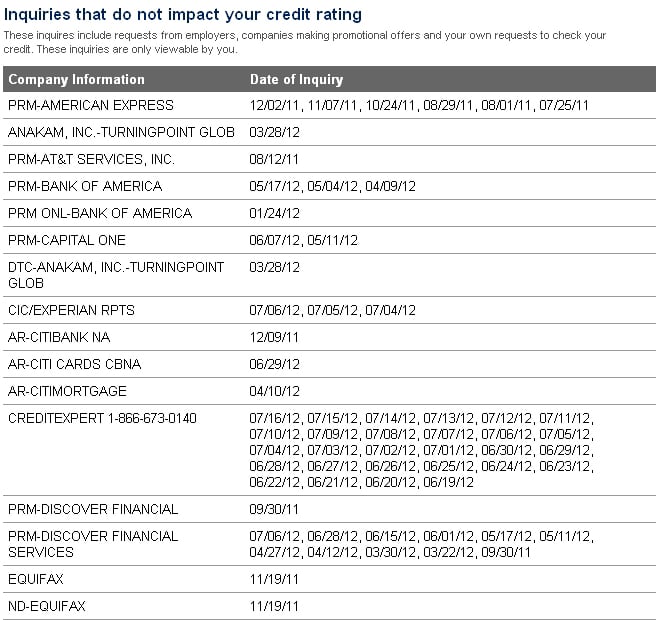

Hard inquiries will appear in your credit reports Inquiries/Requests for Your Credit History section. Each inquiry will display the lender that performed the inquiry along with the date the inquiry was completed.

If you dont immediately recognize the inquiry, a good first step is to contact the lender listed. They will be able to help you confirm why your credit was pulled and who authorized it.

If the inquiry was a simple mistake, i.e., someone typed in the wrong social security number, they should be able to resolve the error for you. You may have also authorized an inquiry without realizing it.

If the lender confirms that the inquiry was unauthorized and not a clerical error, you will need to remove the inquiry from your report and take steps to prevent future fraudulent activity.

Also Check: What Is The Connection Between Credit Report And Credit Score

A Credit Inquiry Is A Record Of When A Lender Or Creditor Requests Your Credit File

While a single hard inquiry, also known as a hard pull, is unlikely to impact your eligibility for new credit products such as a new credit card, it can affect your credit scores for up to two years.

When reviewing hard inquiries on your credit reports, you want to make sure that they are legitimate. What does that mean? For each hard inquiry line item you see, did you authorize the creditor or lender to pull your credit? If you did, you dont need to take any action.

But its possible that when youre monitoring your credit reports that youll flag instances of unauthorized hard inquiries. If you find one of these, youll want to file a dispute with the credit bureau that generated the report and ask the bureau to remove the unauthorized inquiry.

Heres how to dispute inaccurate hard inquiries from your credit reports.

Review Your Reports For Mistakes Inaccuracies Items That Shouldnt Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If youre planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

Read Also: What Is The Difference Between Fico Score And Credit Score

Locate The Hard Inquiries Listed On Your Report

Locate the section in your report containing the Hard Inquiry information. Equifax and Experian make it incredibly easy for you. You will see a header titled Hard Inquiries. With TransUnion, you will want to look for the Regular Inquiries section.

Take a look at all the inquiries listed. Pay close attention did you authorize this lender to access your information? If you arent sure if this is worth your time to review your report, believe me, it is. There are over 1.3 billion transactions monthlybeing reported to the credit agencies. Its very possible a mistake could occur! If they are notlegitimate, then you have recourse. Once youve identified the unauthorized hard inquiry, then its time to dispute it.

Sample Dispute Letter To Remove Inquiries

To further simplify the process of inquiry removal for you, we have provided a sample dispute letter that you can refer to. You can modify it as per your requirements but ensure to include all the aspects mentioned here.

Mail it out to each of the credit bureaus via certified mail, enclose a copy of each of the following:1. SSN card ,2. Recent utility bill 3. State-issued identification.

RE: Investigation Request to Delete Credit Inquires

To whom it may concern,

Following the Fair Credit Reporting Act Section 611 , I am practicing my right to challenge questionable information that I have found on my credit report. I request that you investigate the source of these inquiries, and ascertain that the creditor has a valid purpose, and can verify all my personal information including full name, address, date of birth, and SSN.

I am disputing the following inquiries:1. 2. 3. 4.

If your investigation reveals the inquiry is valid, I request that you provide me with your method of verification as well as the contact information of the source of this verification.

I am granting you a period of 30 days to complete this investigation.

Truly,

Recommended Reading: How To Start A Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

A Comparison Of Hard Versus Soft Credit Inquiries

While creditors and other entities can check your credit report and score through either a hard or a soft credit inquiry, there are some key differences between these types of credit pulls.

First, different information may be shown in a hard versus soft credit inquiry. For example, a creditor or other entity performing a soft credit pull for promotional or marketing purposes will only be able to view a limited report. To obtain your full credit file, theyd have to use a hard credit inquiry.

Also, hard credit inquiries can have a negative effect on your credit by lowering your credit score. Even though soft inquiries are still noted on your credit report, these cannot lower your credit score nor do they show up as a negative on your credit report.

Finally, for a lender or a creditor to conduct a hard inquiry, you must first have granted them permission to do so. Therefore, if you discover a hard credit inquiry was conducted without your knowledge or permission, you can often dispute it.

Also Check: How To Grow Your Credit Score

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently at the very least annually, if not more often to catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major once a year. However, because of the pandemic, all three bureaus are offering free weekly reports through the end of 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to check your reports from all three bureaus since each one can include different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Other ways to get your credit report

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance or employment in the past 60 days based on your credit

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

To request additional copies, contact the bureaus directly. Heres how to do it:

For a more detailed guide on how to request copies, make sure to read our article on how to check your credit report.

Review Your Credit Reports

You should make it a habit to regularly review your credit reports from the three major consumer credit bureaus Equifax, Experian and TransUnion. The may not know which information is incorrect unless you flag it.

To check for incorrect hard inquiries on your credit reports, look for a section labeled something like

- Requests viewed by others

- Regular inquiries

There may also be a separate section for soft inquiries, which should be labeled something like requests viewed only by you. Unlike hard inquiries, soft inquiries wont affect your credit scores.

Not sure how to read the information your credit reports? Learn more about whats on your credit reports and how to read them.

Recommended Reading: How To Get My Credit Report

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

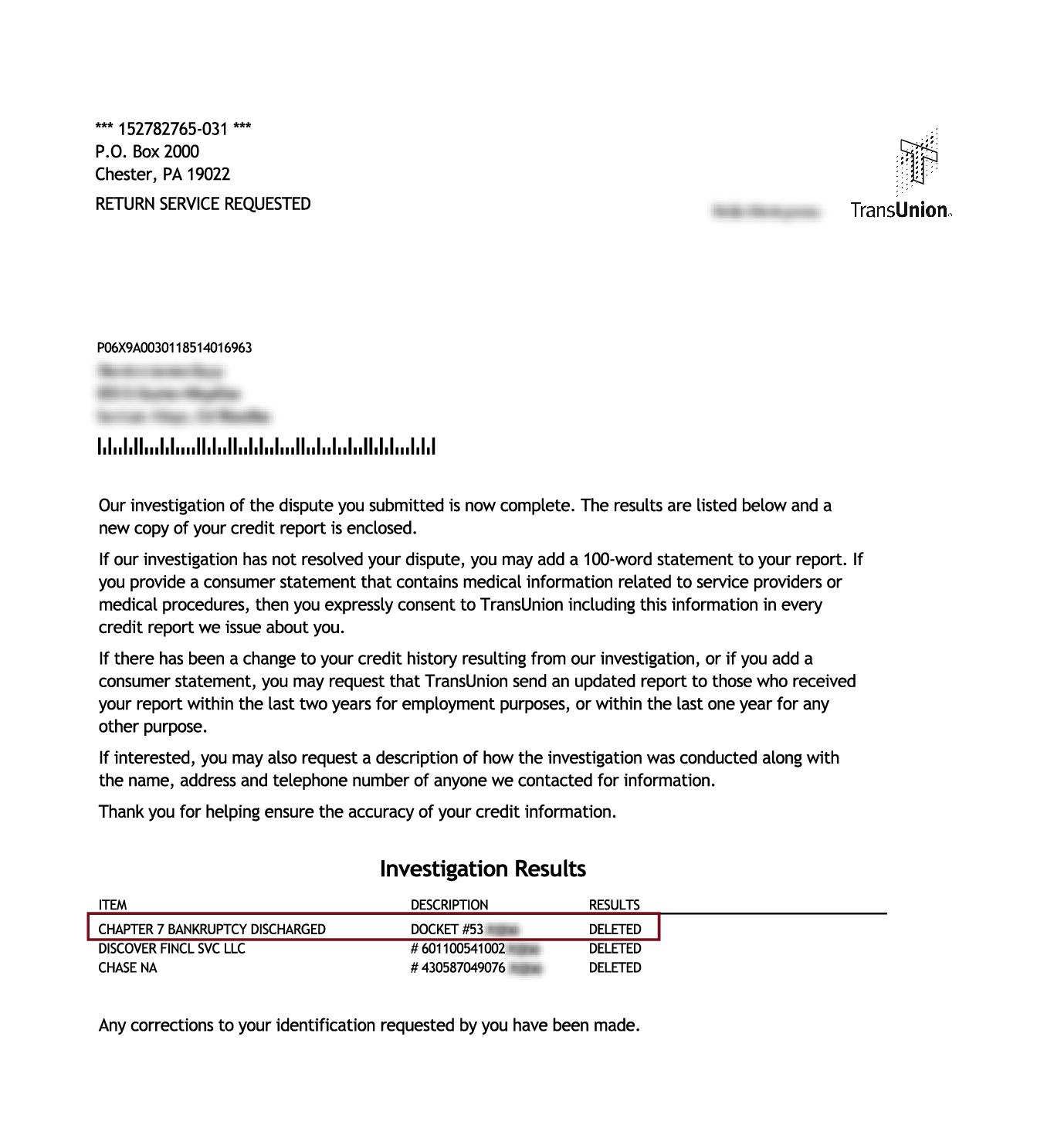

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender finds that the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request, which can help the bureau evaluate any information it might have missed the first time around.

Also Check: Can Am Financing Credit Score Needed