Finding The Best Mortgage For You

Now that you know what credit score you need to get the best mortgage rates and how to improve your score, you should be well on your way to getting the best mortgage rate. But how do you find the best mortgage for you?

There are a few different routes you can take when looking for a mortgage. You can go to your big bank and choose from the options they make available. You can also opt for a mortgage broker. A mortgage broker is a licensed professional that will compare mortgages on your behalf from a variety of lenders to help you find the best rates available to you.

A mortgage broker can save you time and effort because they have access to many different lenders, including the major banks, credit unions, alternative lenders, and private lenders. They can compare lenders and look for the most competitive mortgage rates without being obligated to pick from any singular lender.

Minimum Credit Score Required For Mortgage Approval In 2022

Home \ Mortgage \ Minimum Credit Score Required For Mortgage Approval in 2022

Join millions of Canadians who have already trusted Loans Canada

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

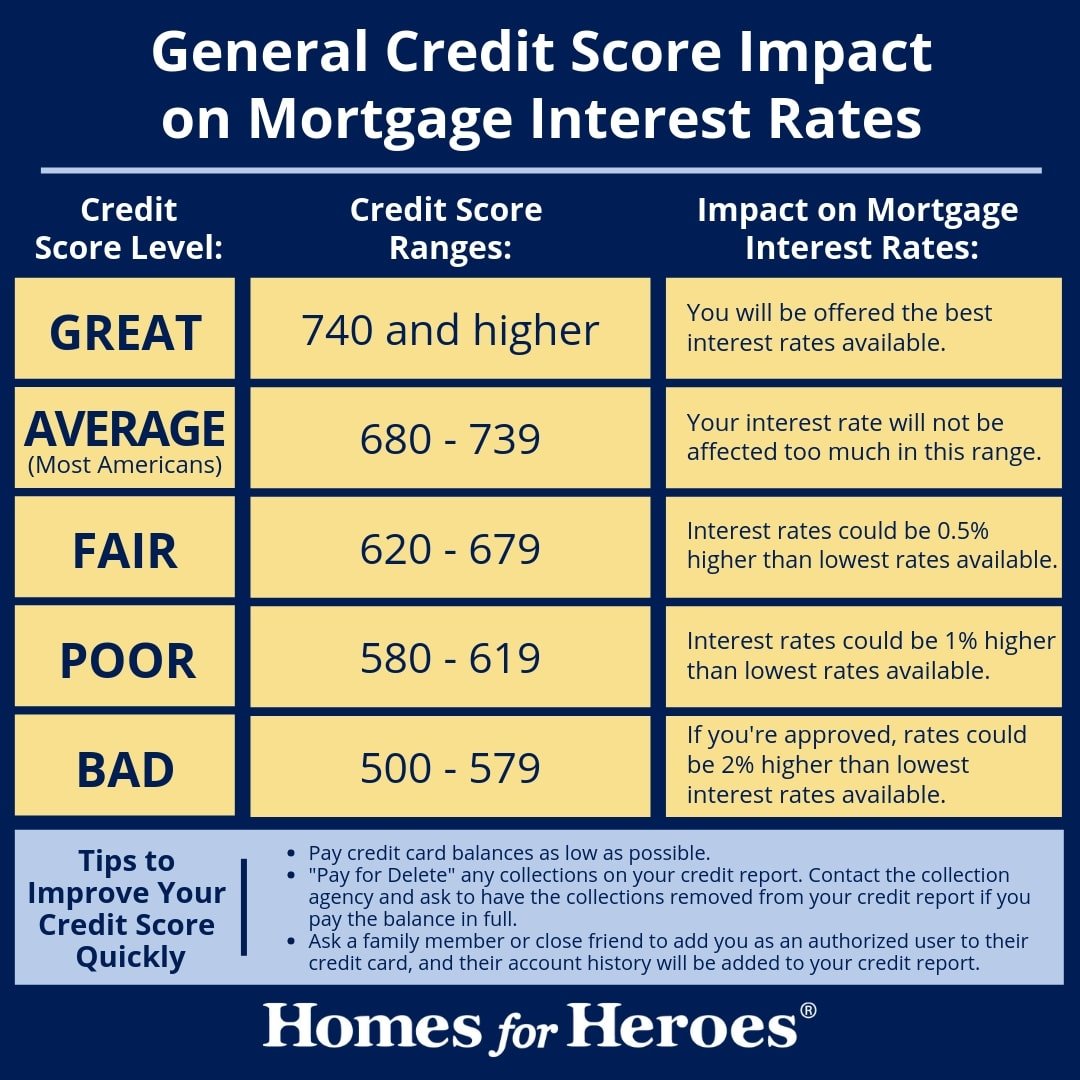

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

How Your Credit Score Affects Your Mortgage

Your credit score can have a positive or negative impact on your mortgage. A high credit score will work in your favour, while a low score or no credit history will work against you. This is because your credit determines how much of a risk you are for defaulting on your mortgage loan.

If your credit score indicates that you dont have a lot of debt and make regular, timely payments, youll have a higher credit score and will be seen as low-risk. If you have lots of debt and pay your bills late, youll have a lower score and will be seen as high-risk.

Understandably, banks dont want to lend lots of money to someone they deem as potentially unlikely to pay it back. If they do, it will be at a much higher interest rate that reflects that risk. Those higher interest rates mean higher mortgage payments and a larger cost over time.

Also Check: How To Notify Credit Reporting Agencies Of Death

How To Raise Your Credit Score To Get The Best Refi Rate

If your you for the refinance or interest rate you need, you might consider increasing your score before applying.

You can do this by:

- Paying down your balances

- Settling any late or overdue accounts

- Reporting errors you find on your credit report

- Asking for a credit line increase on an existing account

- Becoming an authorized user on a high-credit borrowers credit card

Its critical to compare multiple lenders so that you can find the best rate for your situation. Credible can help you streamline the process by filling out a single form instead of many.

Aly J. Yale is a mortgage and real estate authority. Her work has appeared in Forbes, Fox Business, The Motley Fool, Bankrate, The Balance, and more.

Continue Making Monthly Debt Payments On

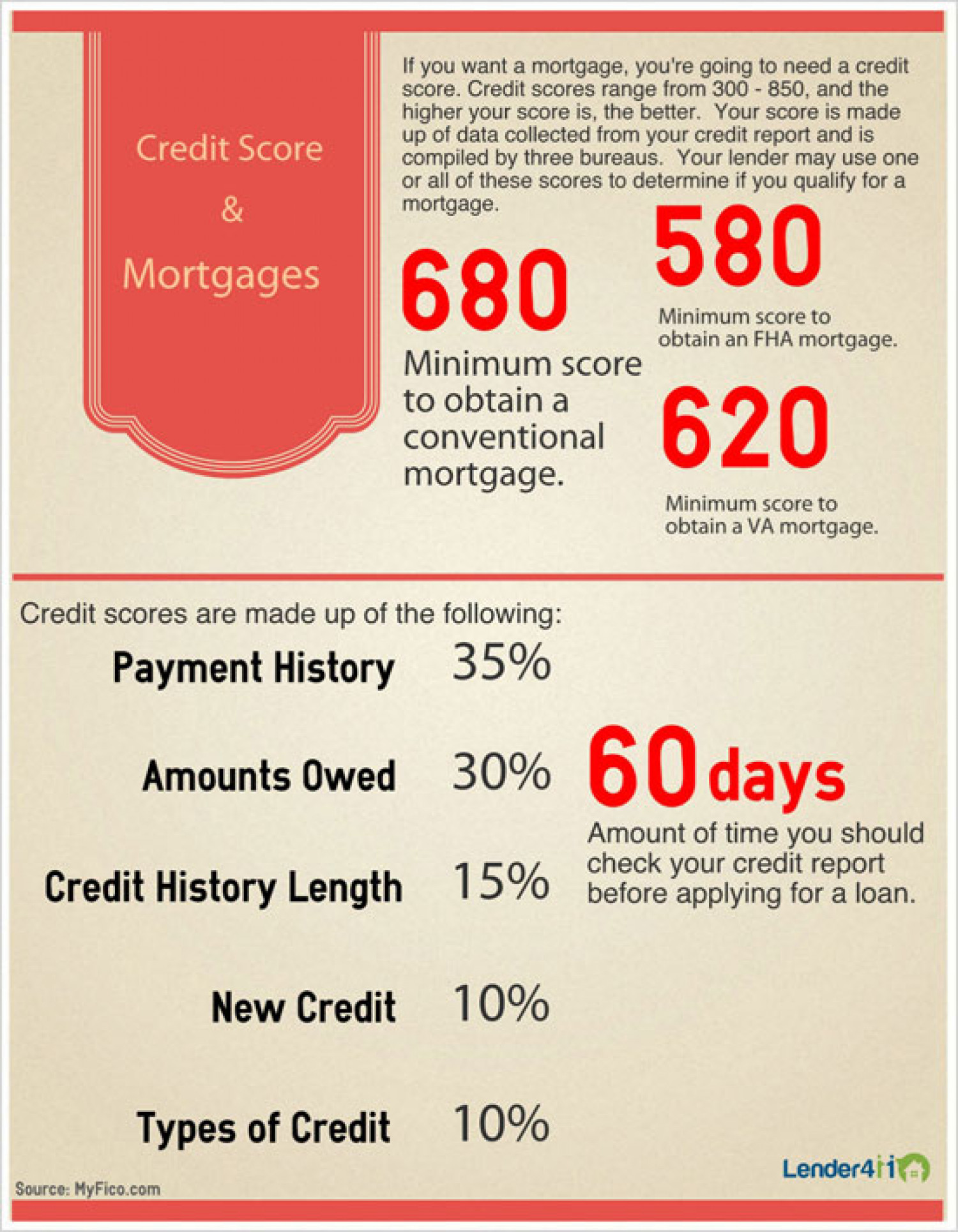

Paying your bills on time is the most important thing you can do to help raise your score. That’s because payment history makes up 35% of your FICO® score, making it the most influential factor when determining a person’s credit score. For lenders, a person’s ability to keep up with their credit card payments indicates that they are capable of taking out a loan and paying it back.

But your credit score isn’t just impacted by your credit card bills. You need to pay all your bills on time. That includes all your utilities, student loan debt and any medical bills you might have.

Missing a payment or making a late payment is actually easier than you think. When life gets extra busy, your credit card bill or loan due date can very easily sneak by you. This is why experts recommend using autopay or setting up automatic transfers from your bank account to your bills. This way, you don’t have to remember to manually make payments. This reduces the likelihood that you’ll incur a missing payment, which can hurt your credit score.

Recommended Reading: How Long Does Defaulted Student Loan Stay On Caivrs

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Pay It Off And Keep Balances Low

If the available credit on your card isnt very high, this is important to pay attention to. The best way to utilize a credit card is to pay the entire balance off every single month before the date that it is due. All credit cards will give you a grace period by which you need to make the monthly payment.

Theres really no benefit at all in using the grace period to bide your time in making the monthly payment. Interest rates are pretty low currently, and paying your entire monthly balance is a much better approach to credit card statements.

You May Like: When Does Self Lender Report To Credit Bureaus

What You Should Know

- The minimum credit score required for a mortgage is 600 for banks, 550 for B lenders, no minimum for private lenders, and600 for CMHC insured mortgages

- If you have bad credit, B lenders and private lenders are generally your only options, but they can require you to have a large down payment or home equity

- Typically, the lower your credit score, the higher your mortgage interest rate

- Youll want to aim to have a credit score above 680 to gain access to lower mortgage rates

- If you’re a senior with a low credit score, a reverse mortgage can be an option that allows you to receive a steady stream of income

Dispute Any Credit Report Errors

Whether or not you’re trying to increase your credit score to prepare for mortgage applications, it’s always a smart idea to monitor your credit reports for any inaccuracies including any instances where lines of credit were taken out in your name that you weren’t aware of.

This can be a very serious issue, especially since inaccuracies and lines of credit you didn’t know about can drag down your credit score by contributing to your utilization rate and debt-to-income ratio.

You might be thinking that it seems unlikely that an error could be made on one of your credit reports, however, 26% of participants in a study by the Federal Trade Commission found at least one error on their reports that could make them appear riskier to lenders.

Common mistakes, according to My FICO, occur when a person applies for credit cards under different names, if a clerical error is made when information is typed from a hand-written application or if an ex-spouse’s information is still on your report. If you spot an error, you should then gather any supporting evidence and dispute the mistake either online or by phone with the respective bureau who issued the incorrect report.

You can use Experian, or another , to easily dispute any errors and to monitor your credit from each of the three major credit bureaus . You can also receive yearly free credit reports by going to annualcreditreport.com.

Don’t Miss: Aargon Agency Phone Number

What Credit Report Do Mortgage Lenders Use

Mortgage lenders dont use one credit report or credit agency. When you apply for a mortgage, lenders will look for as much information as they can see about you before they offer you a mortgage. When they do this its called a hard check. This means theyll look carefully at your credit history and the check will appear on your credit history too. They do it to check theyre happy to lend to you. A hard check will only ever happen if youre making a new application, and the creditor will always have to ask your permission first before they do a hard search.

There are three main credit report agencies in the UK: Experian, Equifax and TransUnion. They all use a different formula to give you a credit score, and all use different parameters. For example, Experian rates your score out of 999, whereas Equifax rates you out of 700. So youll have a different score depending on which one you check.

The credit checking agencies also decide what category you fall into depending on what your score is, for example, excellent, good, fair or poor. Lenders dont take these categories into consideration when making a lending decision. Instead, they look at the detail of your credit history like:

-

Do you use your overdraft, and if so, how often and whats the limit on it?

Is A Credit Score Of 595 Good

This depends on what credit reference agency youre using to check your credit score. If youre checking on Experian, a score of 595 is categorised as poor. That means you might struggle to get a mortgage approved by a lot of lenders, so we recommend working with a specialist mortgage broker to help. Get in touch and we can help with that.

If youre checking on Equifax, 595 is categorised as Excellent. If youre checking on TransUnion, 595 is categorised as Fair.

Read Also: How To Get Inquiries Off Your Credit Report

What Credit Score Do You Need To Refinance A Home

The exact credit score youll need to refinance your mortgage depends on the type of loan, as well as your specific lenders requirements. In many cases, your loan-to-value ratio , will also determine what credit score youll need to qualify.

| Loan type | Min. credit score |

|---|---|

| Conventional | 620 to 720, depending on your loans LTV, your debt-to-income ratio, and how much you have in cash reserves |

| FHA |

|

| FHA | |

| USDA | No specific minimum, but will need to demonstrate your ability to manage debt |

Keep in mind that these are minimum credit scores for the loan programs. Lenders that offer these loans might require a higher credit score to lessen the risk.

Find Out: Does Refinancing Your Mortgage Hurt Your Credit? Heres the Truth

What Makes Up Your Credit Score

The FICO credit score takes into account the information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score ismade up of the following:

- Payment history: 35% of your total score

- Total amounts owed: 30% of your total score

- Length of credit history: 15% of your total score

- New credit: 10% of your total score

- Type of credit in use: 10% of your total score

Based on this formula,the largest part of your credit score is derived from your payment history, andthe amount of debt you carry versus the amount of credit available to you.These two elements account for 65% of your FICO score.

To put yourself in thebest position to qualify for a mortgage, focus on these areas first. Payyour bills on-time whenever possible, and try to reduce your credit utilization ratio.

Your credit utilizationratio compares the total amount of credit available to you against your currentbalances try to keep it under 30%.

This will improve your FICO scores and mortgage loan terms measurably.

Recommended Reading: How Long Do A Repo Stay On Your Credit

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Does Pre Approval Hurt Credit Score

How Do I Improve My Credit Score

Hereâs a more detailed breakdown of steps you can take to improve your credit score and qualify for better mortgage rates in the future.

1. Check your credit score and regularly monitor it

Checking your credit score is the first step to improving your financial well-being. You can use Borrowell to check your credit score for free. Getting a handle on your credit score will help you access better products and get the best interest rates possible. Also, data says that checking your score can actually help you improve your credit!

2. Watch Your credit utilization

The amount of credit you have available is more important than you might think. Oftentimes, we run up balances on our cards and are unaware of the damages it can cause. Credit utilization is the ratio of your credit card balance to your credit limit as listed on your credit report. You should never use more than 30% of your available credit limit. For example, if you have a combined credit limit of $10,000, keep your total balance under $3,000.

3. Pay your bills on time

Paying your bills on time accounts for 35% of your credit score. Itâs the largest factor that impacts your credit score, so itâs important that you stay on top of your regular bill payments. Late or missed bill payments will have a negative impact on your credit score even one missed bill payment can decrease your score by up to 150 points.

What Are Credit Reference Agencies Do Lenders Look At

UK mortgage lenders tend to use three credit reference agencies Experian, Equifax and TransUnion, although there are many others that are referred to by lenders across the UK.

If youve ever checked your credit score before, you may already know that each of these agencies and the many others that provide information about your credit history, use different scoring systems.

This can be frustrating because one lender may refer to Experian and use their scoring system whereas another may use data from Transunion.

Read Also: 877-795-9819

What Is Considered A Good Credit Score

Since different credit agencies use different rating systems, a good score will vary from one agency to the next. For Experian, a score of 881-960 is considered good, and a score of 961-999 is considered excellent. For Equifax, a score of 420-465 is considered good, and a score of 466-700 is considered excellent. For TransUnion , a credit score of 604-627 is considered good, and a score of 628-710 is considered excellent.

Mortgage Credit Score Tip

Mortgage lenders typically pull credit history from all three of the main credit reporting bureaus, using the middle score to quote you a rate and approve your loan. Although you may obtain a free credit report, that information is typically from only one of those credit reporting agencies Equifax, Experian or TransUnion. On the other hand, a mortgage credit report obtained when applying with a lender will give you a better idea of where you stand for a home loan application. The typical cost for a mortgage credit report is $30.

Read Also: Paypal Credit Reporting To Credit Bureaus

What Credit Reference Agencies Do Mortgage Lenders Use

The credit reference agencies that the majority of mortgage lenders use are:

- Experian

- Equifax

- TransUnion

Lenders may just use one or a combination of credit reference agencies to make their assessment. Its important to check each credit report, as they could vary. This is because credit agencies each use different scoring systems.