Pay Your Credit Cards Twice Each Month

This is probably the most low-maintenance way to keep your utilization low. This way, even if youre using the cards throughout the month, a mid-month payment can pay the card back down to a level that stays below the 30% threshold.

Fortunately, a high credit utilization won’t hurt your credit score forever. As soon as you reduce your credit card balances or increase your credit limits, your credit utilization will decrease, and your credit score will go up.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

Bad Credit Can Mean Fewer Credit Card Options And Higher Interest Rates

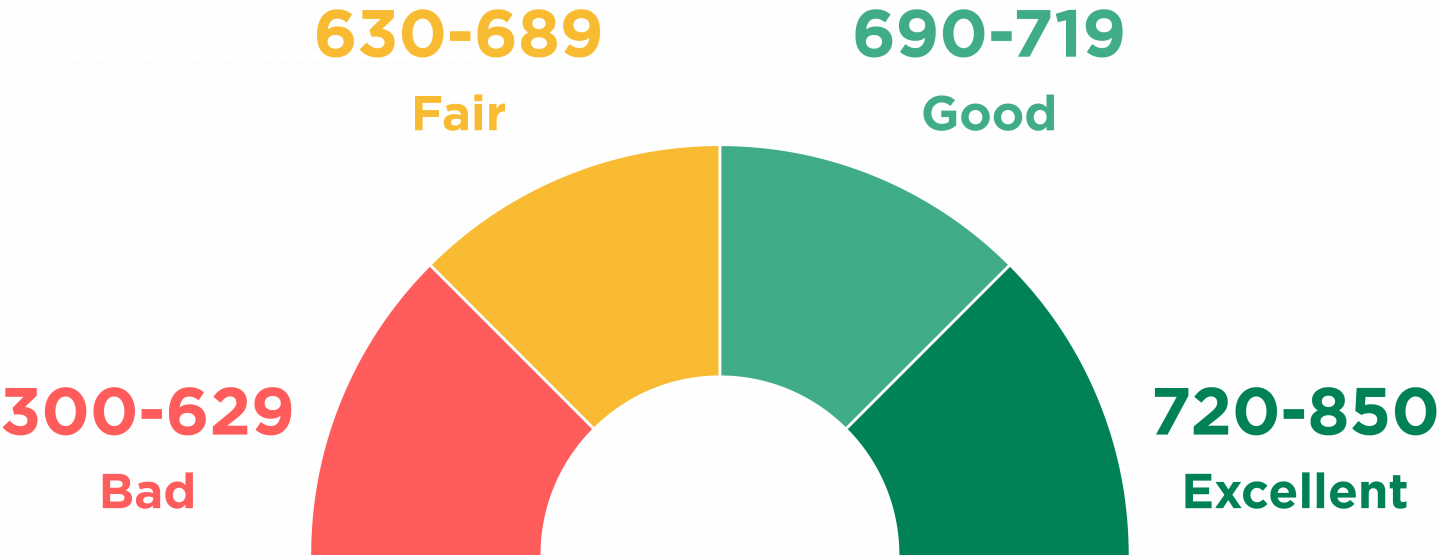

Bad credit can make a real impact when shopping for a new credit card. There are , but they dont have as many perks or benefits as the best credit cards available to those with higher credit scores. Interest rates on these cards can be extremely high as high as 29 percent compared to the current average of around 17 percent. If you have a strong credit score, youll have plenty of solid credit card options available to you with lower interest rates and good cardholder perks .

Read Also: Do Lenders See A Different Credit Report

The Biggest Reasons Your Credit Score Is Low

Debt can lead to a low credit score, but its not just the debt itself that causes the lower score. Remember, your credit score is determined by those five factors listed above.

Poor credit happens when you:

- Have accounts sent to collections

- Hold large balances on your accounts

- Open multiple new lines of credit in a short amount of time

These actions are also consistent with having debt, which is why its easy to make the correlation that debt causes low scores. But you can still find yourself taking actions that drop your credit score without racking up debt at the same time.

Your credit score may be low even if you dont have debt if you:

- Generate lots of hard inquiries on your credit

- Often forget to pay your bills on time

- Charge right up to the limit on your credit before paying off the balance

Payment history makes up 35% of your credit score, so regularly failing to pay on time can cause it to drop even if thats the only mistake you make.

FICO and credit reporting agencies dont detail exactly why your score is low.

What they can tell you is why it isnt higher. So if you want to find out what is holding your score down, check out the reason codes on your credit report or score.

Reason codes say things like, 18: Total of balances on accounts never late is too high compared to loan amounts.

Best Retail Cards For A Low Credit Score

The Fingerhut Advantage Credit Account lets shoppers charge purchases from the online merchant. When you apply for this account, you also automatically apply for the Fingerhut Fresh Start Installment Loan, and Fingerhut will then inform you which one was approved, if either. The Advantage Credit Account reports your transactions to the three credit bureaus, allowing you to build a new credit history.

| Yes | 9.0/10 |

The grace period before payment is due is at least 24 days after the close of the billing cycle. There is no annual account fee and your maximum liability is $50 if your account number is stolen or used without authorization.

Fingerhut periodically offers promotions that allow you to defer your account payments, although interest will continue to accrue on your balance.

Recommended Reading: How Long Bankruptcies On Credit Report

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

A Short Credit History Or None At All

Even though age is not considered in the FICO score, the length of your credit history is. A young person will typically have a lower credit score than an older one, even when all other factors are the same. Another 15% of your FICO score is based on the length of your credit history, including the amount of time since the various accounts were opened and used.

Don’t Miss: How Long Does A Delinquency Stay On Your Credit Report

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

What Credit Score Do I Need For A Mortgage In Manchester

When it comes to applying for any sort of finance, you will be asked to provide an up-to-date credit report. A credit report is essentially a summary of your finances and how you manage your money. It will be summarised by a score out of 1000 your credit score.As a mortgage broker in Manchester, we see different credit scores every day some averaging low, some averaging high. Depending on an applicants financial situation, credit scores can differ from person to person. In a room of ten people, it would be very unlikely to find two people with the exact same credit score.Credit scores range from 0-1000. Sites such as Experian, Equifax and TransUnion will give you a general guide as to what is classed as a poor, fair, good, very good and excellent credit score. These are based on averages over a period of time however, therefore, one lenders impression of a good credit score could be completely different to another.

Also Check: What Is The Difference Between Fico Score And Credit Score

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Is Working With A Credit Repair Company A Good Way To Fix A Low Credit Score

Working with a may not be worth the cost. Credit repair companies typically charge you a fee to “help” you with steps you can do on your own for free. Working with a credit repair company will also not help you raise a low credit score more quickly.

If you want to raise low credit scores, make it a priority to pay your bills on time and pay down your balances. Checking your credit reports for mistakes or evidence of identity theft is also important, as they can cause your credit score to be lower than it should be. You can check your credit reports for free once a year.

Over time, paying your bills on time and monitoring your credit reports will likely help your low credit scores rise.

Want to instantly increase your credit score? Experian Boost helps by giving you credit for the utility and mobile phone bills you’re already paying. Until now, those payments did not positively impact your scores.

This service is completely free and can boost your credit scores fast by using your own positive payment history. It can also help those with poor or limited credit situations. Other services such as credit repair may cost you up to thousands and only help remove inaccuracies from your credit report.

Read Also: Does Checking Credit Karma Lower Your Score

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Get A Cell Phone On Contract With No Security Deposit

Another drawback of having a bad credit score is that cell phone service providers may not give you a contract. Instead, youll have to choose one of those pay-as-you-go plans that have more expensive phones. At a minimum, you might have to pay extra on your contract until you’ve established yourself with the provider. People with good credit avoid paying a security deposit and may receive a discounted purchase price on the latest phones by signing a contract.

Read Also: Does Afterpay Show On Credit Report

The Us Department Of Education

Direct Subsidized Loans are offered to undergraduates demonstrating financial need. Your school will decide how much you can borrow based upon your FAFSA, but the amount cannot exceed your financial need.

The U.S. Department of Education pays the interest on the loan during the following periods:

- While you are enrolled in school at least half-time.

- The six-month grace period following the date you graduate or otherwise leave school.

- During a period of deferment in which your loan payments are postponed for an acceptable reason.

Direct Unsubsidized Loans are available to both undergraduates and graduates. They are not based on financial need.

Your school determines the loan amount according to the cost of attendance and whatever other financial aid you will receive. Borrowers are responsible for loan interest repayments during all periods.

You may postpone loan interest payments during periods of attendance, the grace period, or period of deferment, but doing so will add the interest to the principal amount of the loan.

Take Out A Personal Loan

A personal loan from a bank or credit union can help you consolidate other debts and pay them off, but they also come with interest and lender fees that need to be paid. If your credit score is low and your debt-to-income ratio abysmal, you may be stuck with a high interest rate or refused a loan altogether. The average interest rate for personal loans ranged from 3% to 36% in August 2022.

Recommended Reading: What Is Considered An Average Credit Score

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

How Often Does Your Credit Score Change

Changes to your credit score depend entirely on how often your credit report is updated. While they are mostly updated frequently, there is sometimes a lag between when you perform an action and when it is reported by the lender to the credit reporting body they subscribe to. It’s only when the credit reporting body has the updated information that it will impact your credit score.

Information that’s added or deleted can affect your credit score. And newer information tends to have more of an impact than much older information. In general, your credit score wont change that much over time if your use of credit doesnt change. But it’s important to note that each time your score is calculated it’s taking into consideration the information that is on your credit report at that time. So, as the information on your credit report changes, your credit score can also change.

You May Like: Does Conns Report To Credit Bureau

How Many Credit Reports Do Actually You Have

Since there are three credit reporting agencies – as well as two different types of credit reporting – you could potentially have up to six credit reports one of each type with each credit reporting bureau.

Most lenders will only use one credit reporting bureau to access your credit report – because getting a copy of your credit report costs money. You can access your own credit report for free once a year, but lenders need to pay to access this information. Hence why they only look at one or maybe two of your credit reports, but only with one credit reporting bureau.

Can I Get A Home Loan With A Low Credit Score

As exemplified by the home loan providers reviewed in this article, your low credit score doesnt necessarily disqualify you from this type of loan.

Remember, it is a collateralized loan secured by your home. Lenders know that, as a last resort, they can foreclose on your home and resell it to recoup their loans.

Some of the best home loan sources are peer-to-peer marketplaces, such as LendingTree, where up to five lenders may offer mortgages, home equity loans, home refinance loans, and reverse mortgages to a borrower. If you prefer dealing directly with a bank, Wells Fargo, Citi, and Bank of America offer low-credit-score home loans with little or no down payments and closing costs rolled into the loan.

Home equity lines of credit may be the most versatile home loans because you can use and reuse the same credit line without applying for a separate loan each time. Another time-tested way to get money from your home is to perform a cash-out refinancing.

You can extract some or all of the equity youve built over time by paying down your mortgage principal. On a cash-out refi, you convert your home equity into cash by taking out a new mortgage for a larger amount than the existing loan.

Your new loan repays your old one plus puts cash in your pocket. Some lenders charge reduced closing fees for refinancing versus the fees for first mortgages.

Don’t Miss: Will Paying Off Credit Cards Increase My Score