Whats The Best Credit Utilization Percentage

You may have seen experts say you should keep your credit utilization under 30%. And while that advice is okay, its not perfect.

Lower utilization is generally better, with the slight exception that 1% is better than 0%. But each credit-scoring formula may treat utilization a little bit differently, and the resulting impact can vary from credit file to credit file based on various other factors at play.

Consider this: FICOs High Score Achievers which refers to anyone with credit scores of 800 or higher have an average credit utilization of around 4%, with 10% utilization marking about the highest a high-achieving account tends to go.

Younger accountholders with scores above 800 tend to have a slightly higher maximum per-card utilization of around 12% and an overall average utilization of 5%.

Those with FICO scores between 750799, on the other hand, have an average high credit utilization of 25% or 13% , with total averages of about 10% and 6%, respectively.

While 25% is considerably higher than 12%, a credit score of 750 is still considered very good, and shouldnt leave you struggling to secure solid loan rates or appealing credit card offers.

VantageScore takes a slightly different approach and actually supports the idea that anything below 30% should do the trick. But that recommendation comes with an important addendum:

What’s A Good Credit Card Balance

The absolute best balance is $0, but unless you never use your credit card, it will be impossible to maintain a zero balance on your credit card. You’d essentially have to pay off your credit card balance the same day you make purchases, or at least before the account statement closing date to obtain such a lofty goal.

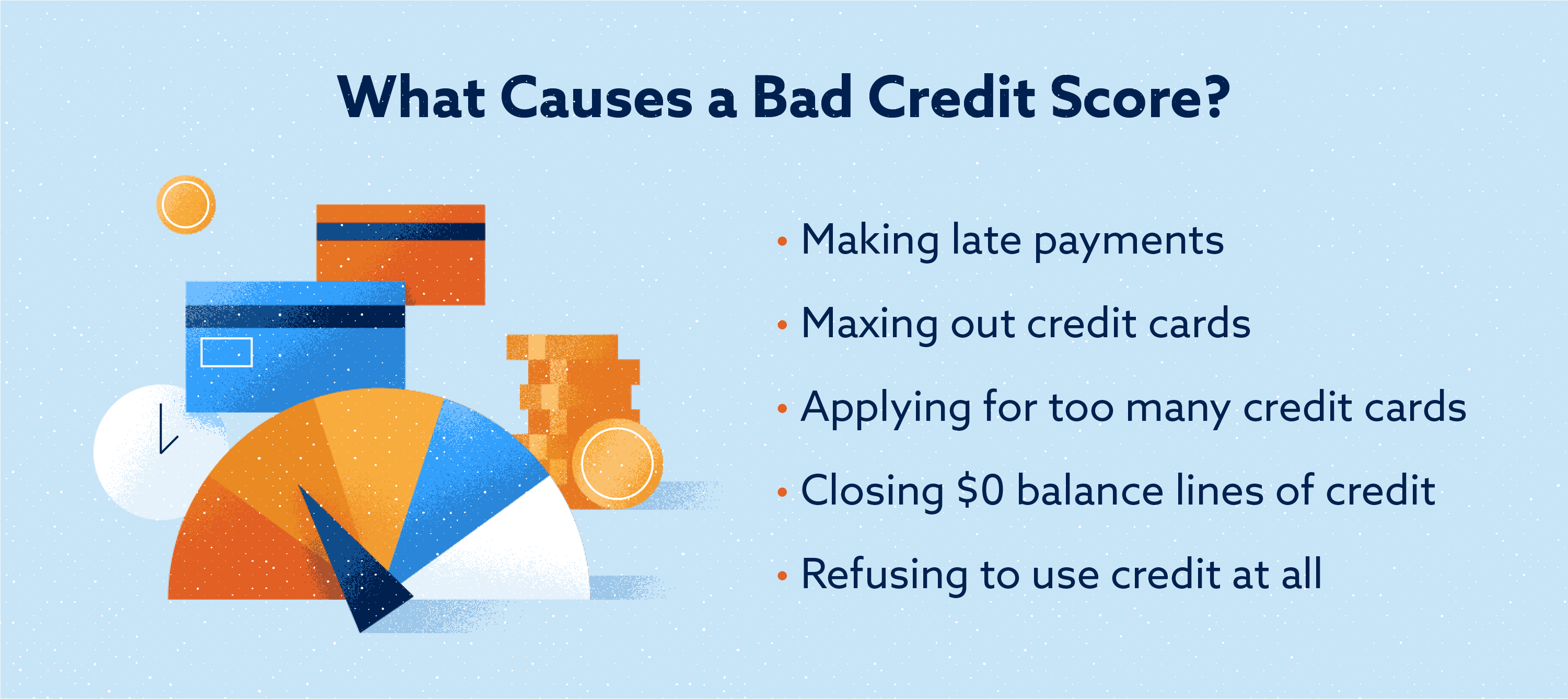

If you want to improve and maintain a good credit score, its more reasonable to keep your balance at or below 30% of your credit limit. For example, that means your credit card balance should always be below $300 on a credit card with a $1,000 limit. Once your balance starts to exceed the 30% threshold, youll notice your . If you habitually max out your credit cards, your credit score could drop significantly.

How Is The Credit Score Of Your Credit Card Determined

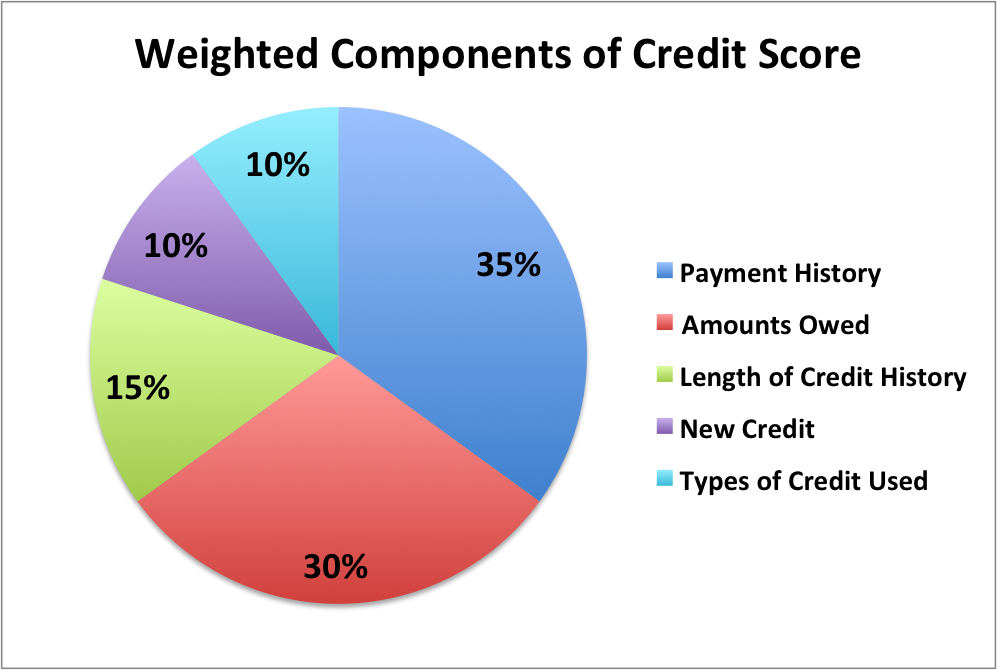

The credit scores are calculated roughly based on the below five factors of which few factors have considerably high weightage than the others.

History of your payments– This is the biggest score factor as it carries weightage of about 35%. Credit cards stand as the biggest variable while considering your credit payments which are done from the debts you hold. Carrying multiple credit cards can be a problem when you have to maintain the payments every month for each of the cards. And late payments can lead to reporting to the credit bureaus eventually lowering your credit score.

Debt to credit ratio– This measures the ratio of the outstanding debts of the credit cards to the available credit, hence also referred to as credit utilisation. The ratio carries a weightage of 30% where your scores are affected if it exceeds the 30% limit. Multiple credit cards can help you to increase your available credit score to the outstanding debt, but it should not exceed the 30% limit.

Average age of the credit card- This can be a factor for those having new multiple credit cards as the age of the credit card adds 15% weightage to your credit score. People having long credit card history of about 11 years or 25 years hold an excellent credit card score. A short credit card history can decrease your credit score and adding new credit cards can drag down the average age of your credit cards.

Also Check: Does Affirm Show Up On Credit Karma

How Credit Card Interest Works

If you carry a balance on your credit card, the card company will multiply it each day by a daily interest rate and add that to what you owe. The daily rate is your annual interest rate divided by 365.

For example, if your card has an APR of 16%, the daily rate would be 0.044%. If you had an outstanding balance of $500 on Day One, you would incur $0.22 in interest that day, for a total of $500.22 on Day Two. That process continues until the end of the month. If you had a balance of $500 at the beginning of the month and added no other charges, you would end up with a balance of $506.60, including interest.

Paying Your Rent On Time Can Boost Your Credit Rating

Do you always pay your rent on time? If so, there are free schemes that private renters and social housing tenants can use to boost their credit ratings.

Typically you’ll need to be signed up to these schemes for at least six weeks for your rent payments to actually start appearing on your credit file, but the longer you stay signed up for, the bigger the impact paying your rent on time should have on your file.

Some users of these schemes have reported seeing significant improvements in their credit reference agency credit scores, including one person who reported a 250-point jump over four months. It’s hard though to say what the average improvement to a person’s score with a credit reference agency is as it’ll depend on your personal circumstances.

It’s worth noting that the only way you’ll potentially reap the benefits of this is if you always pay your rent on time. Miss a payment and it’ll show up in your file and could be off-putting to lenders if/when you apply for a credit product.

There are three free options to choose from one which your landlord has to sign up to and two that you can sign up to yourself.

Scheme that your landlord can sign up to:

Schemes that you can sign up to:

As lenders sometimes check two credit reference agencies when deciding which borrowers to accept, you might find it’s worth paying so that your rent payments are reported to more than one agency.

Also Check: Tri Merge Credit Report Mortgage

Am I Liable For Fraudulent Charges If Someone Steals My Credit Card

A thief can use a stolen credit card to rack up unauthorized purchases in your name. If you report the theft after theyâve already used your credit card, you may be liable for the fraudulent charges to a maximum of $50, by federal law however, there are no liability charges if you report the card stolen before itâs used.

Here are the FTCâs guidelines on fraud liability:

A stolen credit card will only impact your credit score negatively if you fail to report the unauthorized charges, and then donât pay your credit card bill. You are always responsible for paying off your credit cards, unless you report the fraudulent charges and are able to prove they were unauthorized.

Your Credit Limit And Balance Information

Many credit cards have a preset credit limit, which is the maximum amount of credit your credit card issuer has made available to you. Using all your available credit makes you look like a risky borrower and your credit score will suffer because of it.

Many credit card issuers also report a “high balance” which is the highest balance ever charged on your credit card. So, even if you max out your credit card and pay it off, your credit report can still show that high balance. It’s best to keep your credit card balance below 30 percent of your credit limit so you don’t look like an irresponsible borrower.

Don’t Miss: Do Klarna Report To Credit Bureaus

How Good Credit Habits Can Help Your Score

Its a good idea to try to practice good credit habits year round, but especially if youre looking to take control of your credit score. Consider making these habits part of your regular financial wellness routine:

- Pay your bill on time

- Pay in full when possible

- Keep track of credit balances

- Avoid maxing-out credit accounts

- Monitor your credit report

How Many Cards To Carry

The number of credit cards you have and how you use them can have a direct impact on your credit score. If you’re a novice credit card user, focus on building a credit history with one or two cards and paying off your balance in full each month. Adding credit cards for specific purposes such as a good rewards program or for obtaining better travel-related benefits can also make sense, provided they are added gradually over time rather than all at once.

If you’ve used credit cards for several years, it may make sense to add a card if it has a significantly lower interest rate that could save you money if you plan on carrying new balances, assuming you feel you can qualify for better terms. You may also want to transfer a balance to a new card that offers a promotional 0% APR for new cardholders. However, you still need to focus on keeping your debt-to-credit ratio below 30%.

Recommended Reading: Ccb Ppc Credit Report

Keeping Your Credit Cards For A Long Time

The longer you’ve had your credit cards open, the better it is for your credit score, especially if you have a positive payment history with those credit cards. Keep your oldest credit cards around and use them periodically to help out your credit score, but also make sure you check out the latest credit card deals from time to time. If you have a good credit score, there’s a chance you can qualify for a credit card with better terms and rewards than the one you’ve had since you were a young adult.

The key to making sure your credit cards don’t hurt your credit score is to keep them open and active, in good standing, and with low balances.

Dos And Donts Of Closing A Credit Card

There are good reasons for closing a credit card. Whether the temptation of using credit is leading you to constantly overspend and rack up interest, you have so many cards that youâre losing track and missing payments, or you want to get rid of a card with a low limit and higher than normal interest rates, cancelling can be the right move.

If you plan on cancelling one of your credit cards, consider the following doâs and donâts to minimize the impact on your credit score.

Recommended Reading: Does Prosper Report To Credit Bureaus

Stability Counts Use Consistent Details Between Applications Don’t Overchurn

Homeowners rather than renters, and those who are employed, rather than self-employed, tend to be more readily accepted for credit.

Some lenders may factor in having a fixed line rather than a mobile number on application forms, though it’s unlikely it’ll affect your score, so don’t go paying to have one installed if you don’t already have one. Having the same employer, bank and address for a while all help too.

Keep personal details the same between applications. It’s crucial to be consistent, even over long periods, when you fill in applications. If you have a number of job titles or phone numbers, try to use the same one on every form. If you use different ones, you might be flagged up by fraud scoring.

Lenders can’t reject you just for this, but they should tell you if National Hunter has been a contributing reason why they declined you for credit.

Check Your Credit Report Annually Or Before Any Major Application

Your credit reference reports, held at Equifax, Experian and TransUnion, contain enormous amounts of data on you. Errors happen and can kill applications, so it’s important to check them regularly and to go through line by line to check nothing’s wrong.

If possible, check your report at all three agencies as different lenders use different agencies and don’t assume the info will be identical on each.

Following the introduction of the General Data Protection Regulation in May 2018, it’s now always free to check your credit report. See our full Check Credit Files For Free guide, which also includes info on what to check.

Recommended Reading: Is 694 A Good Fico Score

Youre Using Credit As A Crutch

If you frequently charge more than you can afford to pay off each month, its likely that you would benefit from tracking your spending and using a monthly budget. This can help stop you from leaning on your credit and ultimately paying high interest on every purchase that ultimately makes everything your charge to your card more expensive.

Your best bet is figuring out how to spend less than you earn each month. That way, you can stop racking up more debt and focus on paying off the debt you already have.

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

Also Check: How To Get Repo Off Credit

Mistakes On Your Report

Mistakes on credit reports can and do happen, and these can have a negative effect on your credit report.

Some of the most common errors include incorrect names and addresses, but other details such as whether youâre on the electoral roll, your debt levels and account status can have mistakes as well.

If your name or address have errors or if you have used different names/addresses for different accounts, some of your accounts may not appear on your credit report. This may mean you lose out on any positive effects that these accounts may have on your credit score. Make sure you look at the âaccountsâ section of your credit report to check all of your accounts are there and thereâs nothing you donât recognise. If you want to change something that’s not right on your ClearScore credit report , you can raise a dispute.

If you want a cheat sheet of things to check on your credit report, read our guide here.

Don’t ‘spend’ Your Applications Too Often

Every time you apply for a credit product , it adds a footprint to your file for a year.

Too many, especially in a short space of time, can trigger rejections as it makes it look like you’re desperate for credit. Therefore, space out applications if you can and don’t do them frivolously.

In fact it’s almost worth thinking about applications as ‘spending’. Is it really worth spending an application on what you’re doing, or could you save it for something else?

So if you fancy a cashback credit card and have no other credit you need to apply for in the next six months or so, great, spend your application. But if you’re just about to apply for a mortgage, wait until after you’ve done that. Prioritising is important.

For the same reason, if you apply for a cheap credit card and don’t get the credit limit you need, don’t automatically apply for another one. Read the Low Credit Limit guide for more information.

Recommended Reading: Can A Repossession Be Removed From Credit Report

Banks Score You Based On Products They’d Like To Sell You In The Future

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in the future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know.

How Is My Credit Score Impacted

The number of cards you have will affect your credit score, as each credit card will appear on your credit report. If you apply for too many credit cards in a short period of time, your credit score will be impacted negatively and lenders may see you as a risky lender.

That being said, showing that you have good credit utilisation can help to boost your credit score. Lenders are encouraged by evidence that you can manage your money without maxing out the available credit limit.

Read Also: Comenity Shopping Cart Trick

Myth: Having Many Credit Cards Will Hurt Your Credit Score

I have more than a dozen credit cards open. This strikes many of my friends and family members as off-the-wall, and the most common comment I get is, Arent you worried about what all of those cards will do to your credit score?

Related: Yes, I have 19 credit cards heres why

In reality, Im not worried about what they do to my score. Instead, I am enjoying the boost they have on my score.

For this series, its essential to understand the different factors that contribute to your FICO score, the one most frequently used to determine your creditworthiness for any new line of credit:

- Payment history

- New credit

- Types of credit used

However, not all factors are created equal, and these five are weighted based on how important they are to your score:

When it comes to opening a large number of credit cards, its the two most important factors that come into play: payment history and amounts owed.

Related: How credit scores work

Instantly Boost Your Score

Each company may consider different information when working out your score and use a different formula. For example, your credit report held by each of the main credit reference agencies may contain different information. Firms also differ in how many points are awarded for each piece of relevant information, depending on the formula used and any lending policies. Scores are often expressed using different ranges, meaning they wonât usually be directly comparable.

The Experian Credit Score is completely free and gives you an indication of how companies may view your credit report. Itâs represented as a number from 0-999, where 999 is the best possible score, and is based on the information in your Experian Credit Report. You can check it without paying a penny, and itâll be updated every 30 days if you log in.

Don’t Miss: Bestbuy/cbna