You Cant Order All 3 Fico Scores

In the past, you could order all three Fico scores on your own, one from each of the three major credit reporting agencies.

This was clearly the best way to determine your creditworthiness, as you would see the same thing as lenders .

But the general public can no longer order an Experian Fico score, meaning you only have access to Fico scores from Equifax and TransUnion.

This is essentially worthless to some degree, as you wont know whats going on with your Experian Fico score.

You can still see your Experian Fico score if a lender pulls it, but by then itll be too late, assuming there are any problems.

Funnily enough, Fico calls on consumers to check all three of their Fico scores before applying for loans, but now this is impossible.

So what are we consumers to do?

Is Fico Score The Same As Credit Score

FICOScorescoresFICO Scorescores

. Beside this, what is a good FICO credit score?

FICO®Scores are used by many lenders, and often range from 300 to 850. A FICO®Score of 670 or above is considered a good credit score, while a score of 800 or above is considered exceptional.

Similarly, is FICO and TransUnion the same? TransUnion is one of the major credit bureaus in the US. FICO on the other hand is not a credit bureau. Unlike a credit bureau which provides potential lenders with your detailed credit history, FICO provides a score based on data from the big credit bureaus that shows lenders how creditworthy you are right now.

Regarding this, is FICO The most important credit score?

So there you have it: A FICO score is just one brand of . The reason you’ve heard about it is because it’s the most widely used. It was created by the Fair Isaac Corporation back in 1989. While there are other scores, 90% of top lenders use one of FICO’s scores in their lending decisions.

Why is my FICO score different on different sites?

When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference. So, make sure the credit scores you are comparing are actual FICO Scores. The FICO scores should be accessed at the same time.

Hard And Soft Credit Checks

The majority of Canadian lenders use the FICO Score, including major banks. Consumers arent able to access their FICO Score without going through a major bank. Youve got a soft and hard credit checkoption and your FICO Score is known as a hard credit check. The hard check is where a business runs a credit check but the lender isnt allowed to share this report with you. They can talk about the information they see and provide you with insights however.

A hard check may be necessary, but it does come with risks to you as it can impact your credit score negatively. If you do many hard inquiries in a short amount of time, lenders may end up deeming you as risky. A soft check doesnt impact your credit score however.

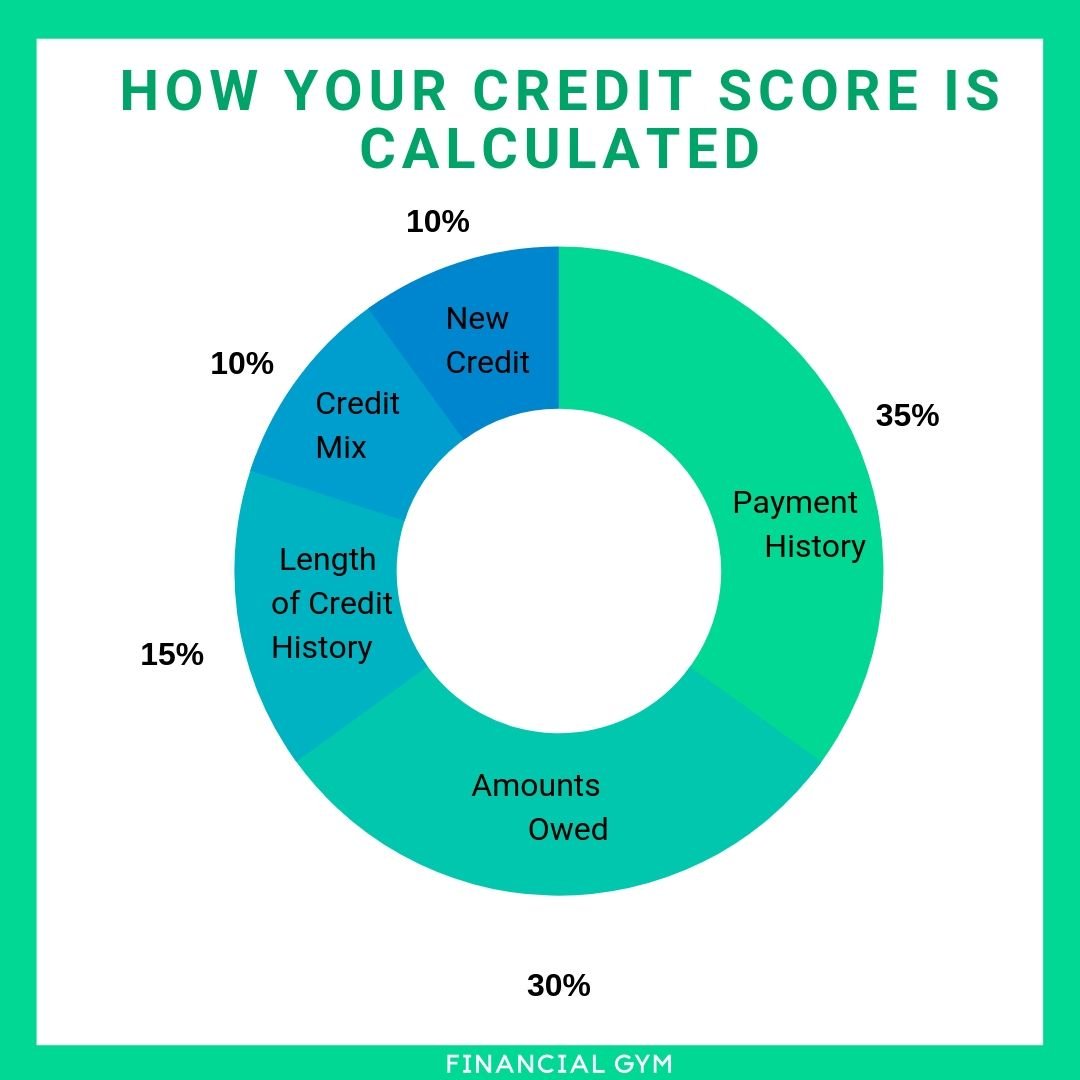

What youre going to find is that your hard credit check will give you the true FICO Score where a soft check is less likely to do the same. You may have a lot better credit than a soft check credit score provides. Credit lenders use the FICO Score, which gives a more concise score than a soft credit check. The FICO Score and the percentages that a lender sees is as followed:

Payment history : 35%Length of credit history: 15%New credit: about 10%Types of credit used: about 10%

Don’t Miss: Can A Closed Account Be Reopened

Top 3 Reasons You Should Choose Fico Scores Over Non

“For years, there has been a lot of confusion among consumers over which credit scores matter. While there are many types of credit scores, FICO Scores matter the most because the majority of lenders use these scores to decide whether to approve loan applicants and at what interest rates.” The Wall Street Journal1

So why choose FICO Scores over other scores? Here are just a few reasons:

2.You can make more informed financial decisions. With FICO Scores, you’re better prepared to know when to apply for credit because you’re viewing the scores used by 90% of the top lenders.

Remember, non-FICO credit scores can differ by as much as 100 points. Other credit scores may vary from your FICO Score by several points. This variance could cause you to overestimate your likelihood of getting approved. According to a recent Consumers Union report, “score discrepancies can give consumers the false hope that they qualify for credit or low-interest rates when they do not. Consumers can face higher interest rates than expected, or be denied credit.”2

On the flip side, non-FICO credit scores can lead you to underestimate your creditworthiness, keeping you from purchasing a much-needed family car or refinancing a mortgage that could save you thousands in interest.

How Can I Access My Credit Score

To access your credit score for a fee, you can contact the credit reporting agencies. There are also websites that offer a free Vantage Score. A Vantage Score is not the same as a FICO® Credit Score, and there are differences in how they are calculated. Some banks and credit card companies also provide credit scores to their eligible customers. Wells Fargo now provides access to FICO Credit Scores to eligible customers through Wells Fargo Online®. When comparing scores, be sure to understand what kind of credit score you are looking at , what score version it is, and when it was last updated. For more information, view: understanding the difference between credit scores.

Also Check: How To Remove A Repo From Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Two Types Of Credit Scoring Models

While there are a number of credit scoring models utilized to determine a persons credit worthiness, there are essentially two distinct types of scoring models that can be validated statistically.

These models will either use a statistical or judgmental scoring analysis. In each case, the end credit score result can vary as well.

A statistical scoring model utilizes multiple factors from one or a number of credit reporting agencies, correlates them and then assigns weights to each factor. The model does not consider the individual judgments or experiences of any credit officials.

A judgmental scoring model considers an individual or organizational financial statement, payment history, bank references and even the credit officials own previous experience in handling its products and services. By including these elements in someones credit history, a subjective judgment is given more weight in determining the credit score rating scale.

11 Minute Read

You May Like: Does Carmax Do Credit Checks

What Factors Contribute To The Fico Credit Score

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

Who Creates Credit Scores

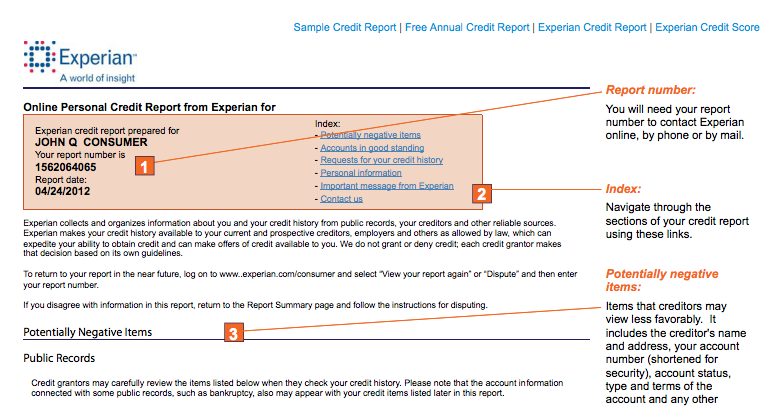

Those credit reports are a collection of all the information lenders and other creditors provide the bureaus on a monthly basis, about how much credit you’re using as well as your payment behavior and payment history.

Because many scoring models are in use, the same borrower might have different credit scores across different scoring models.

Read Also: Credit Score With Itin Number

Fico Scores Are The Most Widely Used Credit Scoring Model

A Tea Reader: Living Life One Cup at a Time

FICO is perhaps the most recognizable name in . The Fair Isaac Corporation , which developed the FICO algorithm, says its scores are used by 90% of top U.S. lenders in 90% of lending decisions. There are currently several types of FICO scores available. The most widely used model is FICO 8, though the company has also created FICO 9 and FICO 10 Suite, which consists of FICO 10 and FICO 10T. There are also older versions of the score that are still used in specific lending scenarios, such as for mortgages and car loans.

What Are Fico Scores

FICO® Scores are the most widely used credit scores and are used in over 90% of U.S. lending decisions. Your FICO® Scores are based on the data generated from your credit reports at the three major credit bureaus, Experian®, TransUnion® and Equifax®. Each of your FICO® Scores is a three-digit number summarizing your credit risk, that predicts how likely you are to pay back your credit obligations as agreed.

Recommended Reading: Syncb Zulily Credit Card

Vantagescore And Fico Create Multiple Credit Scores

VantageScore and FICO® create software that can analyze a credit report to generate a credit score. And the consumer risk scores that VantageScore and FICO® create have the same goal: to predict the likelihood that a person will fall at least 90 days behind on a bill within the next 24 months.

The VantageScore models and the base FICO® models are generic credit scores, meaning they’re created for use by a wide range of creditors, such as private student loan companies, online lenders and card issuers. FICO® also creates industry-specific auto and bankcard scores, which are built on the same criteria as the base FICO® scores but tailored for auto lenders and card issuers.

As with other types of software, VantageScore and FICO® occasionally update their scoring models to ensure they remain predictive as consumer behavior changes, and to incorporate new technology, information and industry practices.

The first VantageScore model, version 1.0, was launched in 2006 the company released the latest version, 4.0, in 2017. The FICO® base scoring model dates back to 1989, but the latest versions are the FICO® Score 8 and FICO® Score 9 . Creditors can choose which model to use and may test out different models to figure out which one is best at helping them determine risk with their particular customer base.

Types Of Credit Scores: Vantagescore Vs Fico Score Vs Credit Score

Understanding your credit score can be hard. And to make things even more confusing, you may have heard that there are different types of credit scores.

No matter what credit score model you use, its important to understand what your score means and how it is calculated. Use this guide to learn the difference between credit score, FICO Score, and VantageScore.

Don’t Miss: Does Paypal Bill Me Later Report To Credit Bureau

What Is A Vantagescore

VantageScore was created by the three major credit reporting agenciesExperian, Equifax, and TransUnion. It uses similar scoring methods to FICO but yields slightly different results.

Featured Topics

One of the primary goals of VantageScore is to provide a model that is used the same way by all three credit bureaus. That would limit some of the disparity between your three major credit scores. In contrast, FICO models provide a slightly different calculation for each credit bureau, which can create more differences in your scores.

Is 629 A Good Credit Score To Buy A House

If your credit score is a 629 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. … With a 629 score, you may potentially be eligible for several different types of mortgage programs.

Don’t Miss: How Long Does Defaulted Student Loan Stay On Caivrs

What Is A Credit Score

A credit score is a numerical representation of financial health, telling lenders at a glance how responsible you are with credit and debt. Generally speaking, a higher credit score suggests that you borrow and pay back what you owe on time. A lower credit score, on the other hand, may hint that you struggle with managing debt obligations.

So where do credit scores come from? Theyre generated by companies like Equifax, Experian, and TransUnion based on information thats included in your credit reports. A is a collection of information about your financial life, including:

- Your identity

- Existing credit accounts

- Public records, including judgments, liens, or bankruptcy filings

- Inquiries about you from individuals or organizations that have requested a copy of your credit file

Dont Miss: What Is Leasingdesk

Why Are Your Fico Scores Important

FICO® scores are widely used by many types of creditors, including lenders, credit card issuers and insurance providers to gauge your credit risk that is, how likely you are to repay the money loaned to you.

The higher your credit scores, the more likely youll end up with better rates and terms on your loan. With lower scores, if youre approved, it may be with worse credit terms than if you had higher scores.

In the case of insurance companies, lower scores could lead to higher premiums.

Knowing your scores may help you determine the likelihood of your application getting approved and whether the creditor is likely to offer you favorable terms. In some cases, a lender may even have a threshold that your scores must meet or pass to get approved.

You can try to check the lenders website or ask a representative to find out whether there is a threshold to be approved and which scoring model the company uses. But some companies may not share this information.

Recommended Reading: Usaa Credit Card Credit Score

Why Its Important To Keep Track Of Your Credit Score

When it comes down to it, regularly checking your credit score is key to overall financial health and ensures you know where you stand when applying for new lines of credit.

Additionally, any sudden movements in your credit score may indicate inaccurate reporting or potential fraud, allowing you to catch a potential mistake on your credit report and reverse it.

Learn more about where to access your credit score for free by reading Bankrates guide.

Length Of Credit History: 15 Percent

The length of your credit history accounts for 15 percent of your FICO® Score and considers the age of your credit accounts, the activity level of these accounts and more. Note, FICO also factors in the average age of your accounts and the age of the oldest account you own.

Knowing this, its important to think twice before closing accountssuch as canceling a credit card you no longer find a use for. Keeping a semi-dormant credit card account open, for example, and making small purchases each month can strengthen your FICO®Score.

Recommended Reading: Syncb Ppc Closed

How Is A Fico Score Calculated

The company applies a proprietary formula to the data in your credit reports to produce a score.

Often, the three credit bureaus that create your credit reports Equifax, Experian and TransUnion have slightly different data from one another. So your score may vary depending on which bureau’s data was used.

Why Is My Fico Score Different Than Other Scores Ive Seen

There are many different types of credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, but different lenders may use different versions of FICO® Scores and some lenders may use different versions of FICO® Scores for different credit products, as discussed more fully here.

Additionally, FICO® Scores are based on credit report data from a particular consumer reporting agency, so differences in your credit reports between credit reporting agencies may create differences in your FICO® Scores. The FICO® Score being made available to you through this service is the score provided by TransUnion. Scores provided by Experian and/or Equifax will likely vary due to differences in the customers credit reports with those credit reporting agencies. When reviewing a score, take note of the score date, consumer reporting agency that provided the credit report for the score, and score type.

Also Check: How Long Does A Repossession Stay On Your Credit Report