How Do Credit Scores Influence Car Loans

Your credit score is an invaluable part of your financial status. Knowing what your credit score is and how it impacts your ability to find a car loan is important.

When you apply for a car loan or financing, lenders look at your credit score to assess your financial health. They want to know that you can make your regular car loan payments on-time. A good credit score shows lenders that youâre a responsible borrower who can successfully manage credit products and repayments.

Your credit score will directly impact your chances of getting approved for a car loan. It will also influence what interest rates, financing terms, and other beneficial offers you qualify for. The higher your score, the better your chances of qualifying for the best rates and offers.

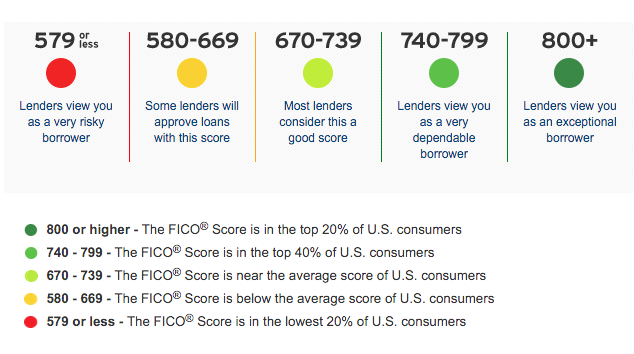

Typically, most lenders will evaluate a consumerâs credit score using the following labels:

-

Excellent â credit scores between 741â900

-

Good – credit scores between 713â740

-

Fair – credit scores between 660â712

-

Below Average- credit scores between 575â659

-

Poor – credit scores between 300â574

If you have a fair credit score between 660 and 712, youâll be approved for many car loan offers. If you have a good or excellent credit score above 712, youâll have higher approval chances, get quicker approvals, and be eligible for more attractive car loan offers.

How Capital One Auto Loans Work

Capital One auto loans are only available at certain dealerships. While this lender does have a wide array of dealers available, there’s no option for other financing for private party purchases, and this could limit your ability to purchase from some independent dealerships. Information on dealers that work with this lender is available on Capital One’s website, and is worth checking out in advance if you want to work with a certain dealership or find a specific vehicle.

Loan terms range from 24 to 84 months and loans are available in the contiguous 48 states.

Other requirements include:

- A minimum income between $1,500 and $1,800 a month, depending on credit

- A minimum financing amount of $4,000

- Used vehicles must be model year 2011 or newer and have less than 120,000 miles. However, Capital One states that financing may be available for vehicles model year 2009 or newer and with 150,000 miles.

A Capital One auto loan might be for you if you have a nonprime or subprime credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates.

Capital One works with borrowers with credit scores as low as 500. Auto loan interest rates at Capital One tend to start lower than the typical interest rates, and could help people in this credit category get lower interest rates, too.

Average Credit Score To Finance A Car

An average new car buyer has a credit score of around 722. For used car buyers, the average hovers around 655. If your score is lower, remember that these are averages and that drivers with lower scores have secured great loans on their vehicles. In general, a higher credit score means youll be offered lower-interest financing deals. If youre currently working on lowering your score, keep in mind that lenders will evaluate your score according to FICO or VantageScore rating systems:

- Super Prime 901 to 990

- Prime Plus 801 to 900

- Prime 701 to 800

- Non Prime 601 to 700

- High Risk 501 to 600

- Bad 300 to 500

Also Check: Comenitycapital Mprc

How Does Your Credit Score Impact Your Loan Costs

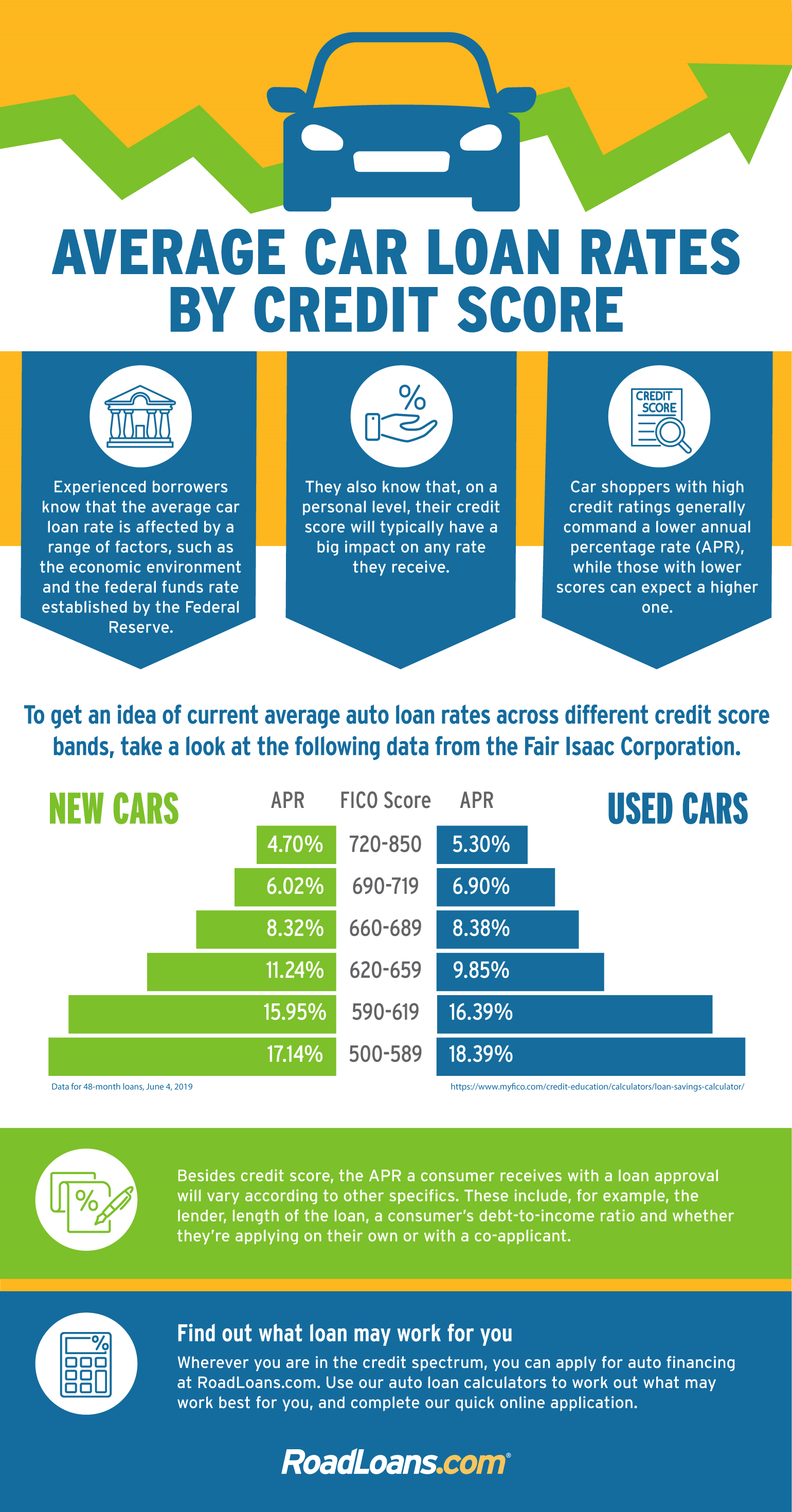

Your auto loan credit score has a big impact on how much you pay for a loan. Take a look at this chart of the average car loan interest rate by credit score for the second quarter of 2022, according to Experian:

| Average APR for new cars | Average APR for used cars | |

|---|---|---|

| Super prime | 2.34% | |

| Deep subprime | 14.59% | 20.58% |

The difference between 20.58% and 3.66% might not seem that huge at first, but lets look at how that affects how much interest you pay over the life of the loan. If you buy a car for $25,000, make a $5,000 down payment and pay it off over five years, youll pay $1,916 in interest by the time that car is paid off with good credit.

However, with bad credit, youll end up paying a staggering $12,181 in interest by the time you paid it offover half as much as the car itself costs.

Shopping Around For A Car Loan Can Help

Perhaps the most important suggestion I can give you, especially if you have so-so credit, is to shop around for your next car loan. You may be surprised at the dramatic difference in offers you get.

Many people make the mistake of accepting the first loan offer they get . It’s also a smart idea to get a pre-approval from your bank as well as from a couple of other lenders. Online lenders and credit unions tend to be excellent sources for low-cost loan options. Not only are you likely to find the cheapest rate this way, but you’ll then have a pre-approval letter to take to the dealership with you.

The best part is that applying for a few auto loans won’t hurt your credit. The FICO credit scoring formula specifically allows for rate shopping. All inquiries for an auto loan or mortgage that occur within a 45-day period are treated as a single inquiry for scoring purposes. In other words, whether you apply for one car loan or 10, it will have the exact same impact on your credit score.

Recommended Reading: Credit Score Needed For Care Credit

Buy A Car Now Or Work On Your Credit

The bottom line is that there is no set minimum FICO® Score to get a car loan. There’s actually a good chance that you can get approved for an auto loan no matter how bad your credit is.

Having said that, subprime and deep-subprime auto loans can be extremely expensive, so just because you can get a car loan with bad credit doesn’t necessarily mean you should. The savings from a moderate score increase can be substantial, so it could be a smarter idea to wait for a bit and work on rebuilding your credit before buying your next car.

How A Credit Score Is Calculated

In the United States, the three major credit reporting bureausExperian, Equifax, and TransUnionkeep track of your borrowing in regularly updated credit reports. Your credit score is essentially a snapshot of these reports, a way for lenders to quickly and consistently consider how well youve handled your loans in the past.

There are a number of factors that go into calculating a credit score. The major factors are your payment history, the amount that you owe compared to your credit limit, how long youve been using credit, how many new credit accounts you have, and your credit mix .

To find out your score, you can check with the credit bureaus or use a third-party provider like or Credit Sesame. Many banks and credit card companies will give you access to your credit score as well.

There are several different credit scoring systems, and even within the same system, scores can vary depending on which bureaus credit report is used. Fair Isaac Corp.s generic FICO scores are the most widely known, but auto lenders also use industry-specific FICO scores, as well as VantageScores.

Also Check: Does Zebit Build Credit

Whats The Minimum Credit Score Needed To Buy A Car At Carmax

Carmax hasnt set a universal minimum credit score requirement for car loans. Its not the only company that operates with no such restrictions, too. There are no universally accepted industry standards that stipulate the minimum credit score individuals need to qualify for a car loan. Each auto lender can come up with its own policies for evaluating your creditworthiness.

Does the lack of minimum credit score requirements mean that anyone can qualify for a Carmax Auto Finance Loan? Well, not exactly.

Even though Carmax doesnt have a minimum credit score requirement, your credit score will determine whether you qualify for a loan and the terms you get if you do. The credit score needed to buy a car at Carmax goes through an evaluation. The car retailer evaluates your eligibility for financing based on four factors:

- Your credit history

- How much you can afford to pay upfront as a downpayment

- The car you want .

The better you perform on these four merits, the higher your chances of qualifying for approval, friendly loan terms, and a better interest rate.

If wondering should you get a Carmax pre approval the answer is yes. But since todays discussion is all about credit scores, were only interested in one of these four factors: your credit history. In a nutshell, the higher that you rank on the credit score tiers, the better the deal youll get.

Heres an in-depth look at how CAF financing works for buyers in the various credit tiers:

How To Improve Your Chances Of Getting Approved

Use these tips to qualify for lower rates and get approved for your next car loan:Make payments on time. Pay your bills on time to avoid late fees and bad marks on your credit report. Any late payments you make will drag down your score.

- Mix up your credit types. Take out a variety of credit types if possible to diversify your debt portfolio.

- Try not to apply for too much credit. Avoid applying for too much credit since doing so will result in hard inquiries on your file .

- Avoid new debt. Avoid taking out new loans or credit cards wherever possible since these debts are seen as immature and can bring down your credit score.

- Correct errors in your credit report. Correct mistakes or errors on your credit report with one of Canadas major credit bureaus to make sure you get the right score.

- Consolidate debt.Consolidate your debt into one easy payment to qualify for lower rates and make sure you have a good handle on the money you owe.

Recommended Reading: When Does Wells Fargo Report To The Credit Bureau

Shop Around To Get The Best Auto Loan

Like anything else, you should weigh your options to find the right deal if you need to finance your car purchase. Look for lenders who finance vehicles for people with similar credit scores to yours, and also see what financing the dealer may offer.

When shopping around for the best loan, you may incur multiple hard inquiries as each lender will want to check your credit themselves to establish what you qualify for. Typically, multiple inquiries in a short period of time could cause your score to decrease slightly. But when it comes to car loans, as long as the inquiries all happen within a short periodusually around 14 daysthey are counted as one when calculating your credit score. This perk allows you to engage with multiple lenders, giving you the ability to see which one offers you the best dealwithout taking a big hit to your credit.

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Also Check: Does Drivetime Report To Credit Bureaus

Bring Documents Showing Financial Stability

If your credit score is low, potential lenders are less likely to see you as a risk if they can see you have stability in other areas of your financial life. Bringing documentation like your most recent pay stubs and proof of address to show lenders how long you have lived at your current address and worked at your employer could help you seem more reliable.

Car Loan Options With Bad Credit

You can pursue the following options to get a car loan with bad credit:

- Secure your loan with an asset. You may be able to get financing if you use an asset such as your home, jewellery or a vehicle youve paid off to secure your repayments. This should bring your interest rates down and help you get approved.

- Get a cosigner. It may be possible to get a friend or family member with good credit to cosign your car loan with you. Just be aware that the person you ask will be on the hook to make your repayments if you default on your loan.

- Apply for a bad credit car loan. Some lenders specialize in offering bad credit car loans to people who cant meet the eligibility requirements for traditional loans. The issue with these loans is that they often come with extremely high interest rates.

You May Like: Does Affirm Help Your Credit Score

How Does Your Credit Score Affect Car Finance

Your credit score reflects your credit history and can affect:

- whether youre approved for car finance

- what options are available to you if you are approved, and

- the interest rates youre offered.

The higher your credit score is, the better your chances of approval and with lower interest rates. This is because a high credit score indicates that you are good with money and are therefore a low-risk, reliable borrower.

If you have bad credit, on the other hand, your finance options may be more limited. And If youve never taken out a or a loan before, you may struggle to get accepted for car finance. This is because youll probably have whats called a thin credit history which means lenders are unable to see how good you are at managing your debts.

How To Build Your Car Credit

Its important to check your credit score before you start shopping, so you know your baseline. The best way to improve your credit in preparation for an auto loan is to pay your current car loan on time, every month. But here are other ways to improve your credit score in addition to or instead of that if you dont currently have a car loan:

- Pay all bills on time

- Reduce your credit card debt

- Keep your credit accounts open

- Dont apply for other types of credit for six months before applying for a car loan

There are two main credit score models that can produce your credit score:

FICO Score. Your FICO Score, developed by Fair Isaac Corporation, is the most commonly used credit score method by far. It heavily weighs your payment history and how much debt you have compared to your credit limits. It takes about six months of credit history to develop a FICO Score.

VantageScore. The three major credit bureaus developed the VantageScore with the aim to more accurately reflect consumer behavior and risk. Your total credit usage and credit mix are the most important factors in your VantageScore. It takes only about a month of credit history to develop this credit score. Heres specific guidance on how to get a car loan with no credit.

Don’t Miss: What Credit Card Can I Get With A Score Of 570

Budget For A Higher Interest Rate

Experts recommend that you keep your total transportation costs to less than 10% of your budget. If you have a low credit score, you will pay more in interest, so you should aim for a less expensive car and/or have a high down payment.

Experian reports that successful auto loan applicants with subprime credit scores financed lower average amounts approximately $29,000 to $35,000 compared to those with higher credit scores who had larger loans roughly $34,000 to $39,000.

For example, if you can afford a $450 payment for a 72-month term, heres how much you should finance, based on the average auto loan APR for your credit score. Note that the credit bands are different based on the data source.

| Prime |

Do Auto Lenders Use The Same Credit Score As Other Lenders

There are a wide variety of credit scores to help meet different lenders needs. Because auto lenders place more importance on certain credit information, such as your history of making car payments, the credit score one auto lender sees may be slightly different from the score pulled by other lenders. Some of the credit score models specific to auto loan decisions include:

- FICO® Auto Score 2

- FICO® Auto Score 5

- FICO® Auto Score 8

There shouldnt be a huge difference between the score you may see for free from your bank or credit card issuer, but if youre really curious to see your FICO® Auto Score, youll have to pay a fee of $29.95 a month to myFICOs FICO® Advanced service.

Read Also: Thd/cbna On Credit Report