Over 1000 Five Star Reviews

I was very pleased that they were able to fund me money when I really needed it for the holidays. They made it easy and quick for me to do.

Jackie

The staff at Wise Loan is awesome! Olga is very professional with a very strong work ethic and is always willing to go the extra mile.Martha V

Its quick. Theres no hidden fees. No penalty for paying it off early. Its easy to apply for online and get funding in no time!Jaymi M

Jaymi M

Use A Secured Or Guaranteed Credit Card

Establishing a history of responsible credit usage is one of the best ways to raise and maintain your credit score. However, if youre unable to qualify for a major credit card or dont want to risk racking up more debt, a secured or guaranteed credit card is your best option. You can qualify for these cards without any prior credit history, but you will need to post a certain amount of money as collateral. While this amount is usually equal to the cards limit, these are not prepaid cards. When you use a secured or guaranteed card, your activity will be reported to credit bureaus so you can build your score, just like with any other credit card.

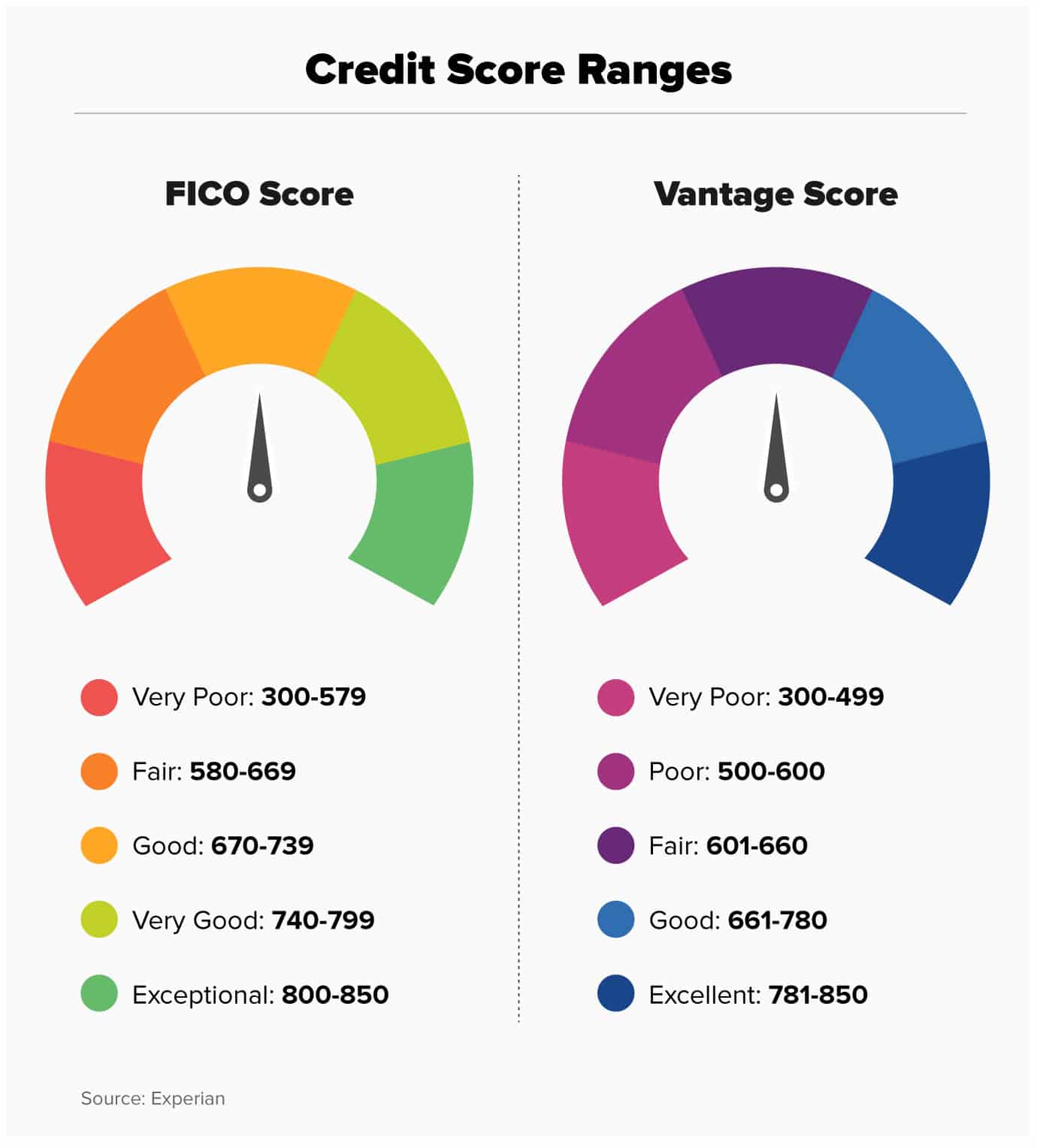

What Is A Good Or Bad Credit Score

Based on the FICO Score range of 300 to 850, a bad credit score is classified as 300-57 while anything from 580-669 is fair. This is known as subprime, which is the term used to describe borrowers they believe will have a hard time repaying back a loan. While getting a bad score can be disheartening, you can repair your bad credit for your financial future.

You May Like: Does Cosigning Affect Credit Score

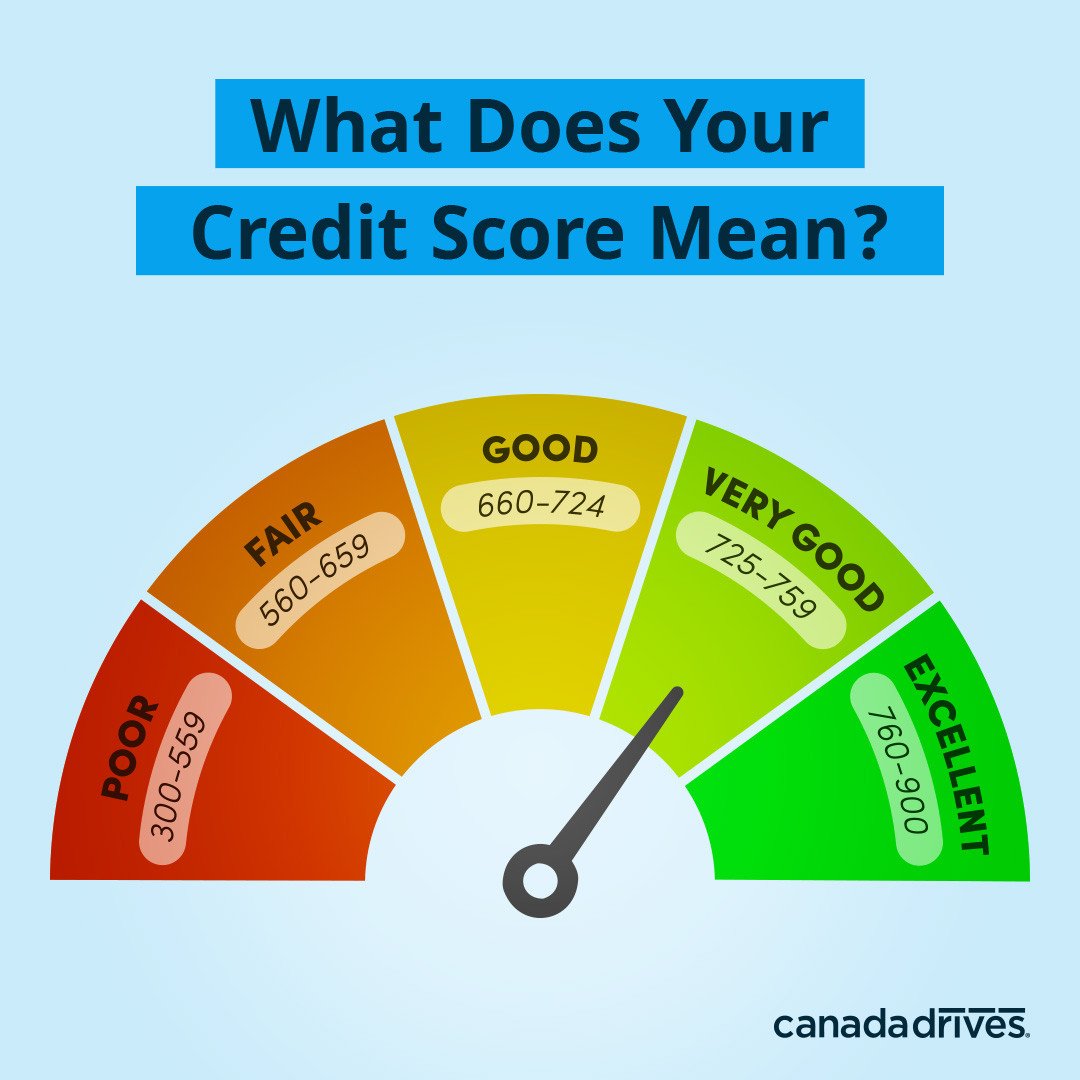

Whats Considered A Bad Credit Score

The average credit score in Canada is around 753, but what exactly constitutes a good score or a bad score? Having a bad credit score, of course, is not a good thing, because youll end up struggling to accomplish various financial tasks. Those with very bad scores will have a hard time getting an apartment, getting loans, mortgages, opening bank accounts, and so on.

On the other hand, those with good credit scores would be able to open credit cards, bank accounts, apply for huge loans and mortgages, and so on. But what exactly is a bad credit score and what can you do to improve yours? Keep reading and learn more about it below.

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

Recommended Reading: How To Boost Credit Score In 30 Days

What Causes A Bad Credit Score

There are various factors that make up your credit score, all of them unique to you and as an accumulation of your financial habits. Typically, bad credit scores are due to factors such as:

Poor Payment History

Your payment history is the biggest factor that impacts your credit score, making up around 35% of your score.Missing one bill payment can decrease your credit score by as much as 150 points, according to Borrowell internal data. A single late payment could prevent you from qualifying for prime credit cards, low-interest loans, and attractive mortgage rates.

Lenders look at your credit score when qualifying you for products. Late payments will impact your credit score and raise red flags to lenders. In order to keep your credit score healthy and maintain your financial reputation, itâs important that you stay on top of your bill payments.

The key takeaway is that the longer a bill goes unpaid, the more potential damage it can have on your credit score.

High Credit Utilization Rate

Credit utilization is another important factor that affects your credit score. Your credit utilization rate determines around 30% of your overall score. Simply put, your credit utilization rate is how much credit you have used up compared to the total amount of credit available to you.You should always aim to keep your credit utilization rate below 30%.

Here is a four-step process you can take immediately to calculate your credit utilization rate:

How Is Your Credit Score Determined

Two common credit scoring systems determine your credit score by using a collection of data gathered by credit collection agencies. You may have heard the term FICO and VantageScore tossed around when speaking about credit reports. Though the two scores are similar, they are compiled by different agencies and feature a slightly contrasting scoring method. Both scoring systems range from 300850, with 850 being the highest credit score possible. FICO scores are gathered by the Fair Isaac Corporation using information from the three most common credit data collection agencies Experian, Equifax, and Transunion. VantageScores utilize internal financial data gathered by these collection agencies themselves. You can access your VantageScore through services provided by Turbo and Mint.

A bad score is never determined by the credit reporting agencies themselves. These agencies simply gather information from financial institutes that lend you money. Their systems collect important data from your credit card companies, banks, and public records to build a report readable by you and your potential lenders. The lenders themselves make the call on what is considered a good or bad credit score depending on your inquiry. The data is used to determine how likely and how quickly youll be able to pay back the requested loan.

You May Like: How To Get Medical Bills Off My Credit Report

Problems Getting A Rental Unit Or An Insurance Policy

Its common for landlords and insurance companies to check your credit to assess how likely you are to make your payments on time or file an insurance claim. Some landlords and property management agencies impose a minimum credit score requirement for renting an apartment, so a low credit score can make it harder to get your applications approved. Youll also probably pay more on your insurance premiums.

What Is A 730 Credit Score

What is a 730 ? This is a question that many people are asking these days. A 730 credit score is considered to be in the excellent range, and it will allow you to get the best interest rates on mortgages, car loans, and other types of loans. In this blog post, we will discuss what goes into determining your credit score, and we will also provide some tips for improving your credit rating.

Also Check: What Impacts Your Credit Score

How To Improve Your Score

Making timely payments in full is key in establishing, or improving, a good score. And since details about your payment history, including late or missed payments, are considered public record and can stay on your credit report for years, you should aim to pay as much of their monthly balance as you can, on time, every time.

The snowball method, in which you pay off the smallest of your debts first, then move on to the next largest, is a popular way to do that. Redd Horrorcks, a self-employed voice actress, using this method, paid $39,000 in credit card debt in five years.

Aside from paying in full and on time, look to reduce your credit utilization rate, too, which is the ratio of how much you’ve spent on your credit card versus the card’s limit. “The smaller that percentage is,”according to Bankrate, “the better it is for your credit rating.”

“Even if you pay balances in full every month, you still could have a higher utilization ratio than you’d expect. That’s because some issuers use the balance on your statement as the one reported to the bureau.” The ideal utilization rate is less than 30 percent of your available credit.

Then, he says, choose one or two go-to cards for most of your purchases: “That way, you’re not polluting your credit report with a lot of balances.”

Ways To Help Improve Bad Credit Scores

With time, credit scores can improve. In general, you can help yourself by committing to responsible credit use and good financial habits. Here are some strategies that might help:

You May Like: How To Remove Collections From Your Credit Report

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

What Affects Your Credit Score

There are manyin fact, hundredsof credit scores that lenders use to help make lending decisions. Several factors affect those credit scores. But in almost all credit scores, the two factors that affect your credit scores the most are your payment history and credit utilization rate.

- Payment history: With the FICO credit scoring models, your bill payment history makes up 35% of your credit score. Consistently making payments on time helps your score, while missing payments will hurt it. Furthermore, the longer your payment is late, the more your score will suffer. And recent late payments have a greater effect than those that happened further in the past.

- Amounts owed: FICO scores consider how much of your available revolving credit you’re using at any given time, also called your credit utilization ratio, for 30% of your score. Your is based on the amount you owe on revolving credit such as credit cards compared with the total amount of credit that you’ve been extended. To calculate your ratio, divide all your revolving credit balances by your total credit limits on those accounts. The more you owe relative to your total credit limit, the more it could lower your credit score. In general, always try to maintain a ratio of 30% or less to avoid hurting your score. For top credit scores, keep your utilization under 6%.

There are three other factors that affect your credit score to a lesser degree.

Read Also: How To Build Your Credit Score

Manage Your Credit Balances And Request Higher Credit Limits

The proportion of your available credit that youre using also affects your credit score. Increasing your credit limit can help your credit scoreas long as your spending doesnt increase as wellbecause the scoring models reward consumers with lower utilization rates.

Alternatively, you can transfer balances or adjust your budget to ensure that none of your cards has a utilization rate above 30%. Bear in mind that in addition to your overall utilization rate across all of your accounts, the utilization rate for each account also affects your credit score. 6

Ideally, your credit utilization rate will be under 10%. 7 If thats not attainable, make sure to keep your utilization rate under 30%.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Don’t Miss: Are There Any Real Free Credit Report Sites

How A Bad Credit Score Can Impact You

Bad credit scores can hurt you financially in multiple ways, including:

Higher interest rates. In general, having a lower credit score means lenders will charge higher interest rates to compensate for the risk. If youre approved for a loan with a high interest rate, this can significantly increase your borrowing costs.

Not meeting a lenders credit score requirements. If your score is too low, you might not meet a lenders minimum credit score requirements. For example, lenders typically dont approve borrowers who have a FICO score below 580 unless they have a co-signer. Also, some lenders only approve borrowers who have excellent credit scores.

Renting an apartment. When you try to rent an apartment, the landlord may charge you a higher deposit amount. In addition, some landlords might require that you pay the first and last months rent upfront.

Applying for a mortgage. Bad credit often results in a higher down payment amount to qualify for a mortgage loan. For example, a Federal Housing Administration loan allows you to put down 3.5% if your credit score is at least 580. If its below that threshold, you can still qualify, but your down payment amount increases to 10%.

Auto insurance rates. Some auto insurance companies will charge you higher insurance rates if you have bad credit.

Utility accounts. When you apply for a new utility account, a utility company will review your credit. If you have bad credit, you might have to pay a refundable deposit.

Loans And Credit Cards

While it may seem somewhat counterintuitive, getting a small loan and then paying it off can actually boost your credit score in a short amount of time. This is because paying off a loan in a timely manner will show that you know how to handle your debt and how to pay it off. Of course, when doing this, you shouldnt try to get a huge loan.

Instead, try to get a small and manageable loan that you know you can pay off in a certain period of time. If you dont want to get a loan, getting a credit card can help with this as well. Buying things with your credit card and then paying off the debt will improve your credit score in a similar way.

Whatever the case, as long as you manage your debt and pay everything off on time, your credit score should start to increase in no time.

Read Also: When Disputing Credit Report What Reason

Lexington Law Credit Repair Can Help

Watch on

A credit repair service can remove negative items from your credit reports. Lexington Laws past clients have seen an average of 10.2 negative items removed from their credit reports within four months. Its definitely worth it if youve got some things on your report dragging your score down.

- Most results of any credit repair law firm

- Clients saw more than 7 million negative items removed from their credit reports in 2020

- More than 221 million challenges and disputes sent for clients since 2004

| Yes | 7.0/10 |

A secured credit card works the same as an unsecured card the only difference is that it requires a deposit to secure your line of credit.

Remember, nothing is permanent. Our credit scores are being recalculated all the time. With a little help, you can quickly improve yours. And whether youre carrying a secured or unsecured credit card, paying your monthly bill on time is one of the most important factors when it comes to determining your credit score.

Pay Attention To Revolving Debt

Remember credit utilization? Its generally a good idea to use no more than 30% of your total available credit. The CFPB says that paying off credit card balances in full each month helps to keep the ratio low and strengthen a credit score.

Credit utilization involves credit card and other revolving debts, not installment loans like mortgages or student loans.

Read Also: How Long Does A Black Mark Stay On Credit Report