Treatment Of Hard Inquiries

FICO and VantageScore also vary slightly in the way they treat hard inquiries. With FICO, multiple hard inquiries within a 45-day period are treated as a single inquiry.

VantageScore treats multiple hard inquiries as a single inquiry if they occur within a 14-day window.

This is called deduplication, and it’s useful if you’re comparing rates across several lenders, such as when mortgage shopping.

What Are Fico 10 And Fico 10t

FICO 10 and FICO 10T are new credit scoring models announced in 2020. FICO says the FICO Credit Score 10 Suite is designed to be its most predictive scoring model yet, giving lenders a more precise picture of someones credit risk. FICO 10 and FICO 10T still follow the same basic FICO algorithm that focuses on payment history, credit utilization, credit age, credit mix, and credit inquiries. What makes FICO 10T different is the use of trended data.

Trended data looks at a persons credit patterns for the previous 24 months or longer. It takes into account things such as whether you carry a balance on your credit cards from month to month or always pay in full, and whether youve consolidated debts at any point during that time period.

The company expects FICO 10 and FICO 10T to eventually overtake FICO 8 as the most popular scoring models.

Which Vantagescore Version Matters Most

Your VantageScore 3.0 credit score matters the most. Although VantageScore isnt used by most lenders, its likely youve checked their score because most major credit-checking services partner with them and not FICO.

Fortunately, most of those credit-checking services provide you with a VantageScore 3.0, which is more used than their latest model, VantageScore 4.0.

Recommended Reading: Do Hard Inquiries Affect Your Credit Score

Fico Score Vs Credit Score: Know The Differences

If youre wondering about your FICO score and your credit score, you might be thinking to yourself that theyre the same thing. While this isnt wrong, its not exactly right either.

Think of your credit score as a general kind of credit report that computers analyze to determine your score. On the other hand, FICO is a specific brand for credit scores that a lender may use when they need to see your creditworthiness.

Either way, this will always be a three-digit credit score thats used to measure how well you are managing your finances. While there are various kinds of credit scores that a lender can use to determine the risk of giving you money, FICO is the most well-known kind.

Even so, some lenders will choose to create their scoring model understanding the difference between credit scores and FICO scores will help you maintain the right kind of finance.

What Is Capital One Creditwise

Capital One CreditWise is a free tool that allows you to check and monitor your credit score. The tool also allows you to discover key factors that impact your score and receive email alerts when something on your account changes. You can even monitor your Social Security number and track the dark web.

All of your data is encrypted with 256-bit Transport Layer Security , and you can access CreditWise online or via their app for iOS and Android devices.

You dont need to be a Capital One customer to utilize their CreditWise benefits. However, you do need to be at least 18 years old with a valid Social Security number they can use to verify your identity and access your TransUnion credit profile.

Once your account is set up, you can access your credit score by logging into your account and visiting the credit summary on the home page. There, youll also find factors that contribute to your score, such as on-time payments and credit line ages.

Don’t Miss: How To Raise Credit Score Quickly

What Is The Difference Between Fico Score And Credit Score

Whether youre seeking approval for a loan application, attempting to lease an apartment, or engaging in one of the countless other activities you need a credit score for, you may have heard the term FICO score before. Theyre two well-known little words that can pack a mighty punch to the gut when they stand between you and your dreams. But whats the difference between your FICO score and credit score?

Technically, FICO is a specific brand of available credit scores. It may differ from other scores in the way its calculation is determined, but for all intents and purposes, it is a credit score. It establishes your overall creditworthiness and the likelihood of you making on-time payments.

As the most common credit-scoring system used by major credit agencies in the U.S., its important to understand exactly what FICO is, what each score category means, how it works, and more. This post provides an in-depth look at everything you need to know about FICO scores and how they compare to other types of credit scores lenders might use to either approve or reject your applications.

What Is The Difference Between Fico Vs Vantage Scores

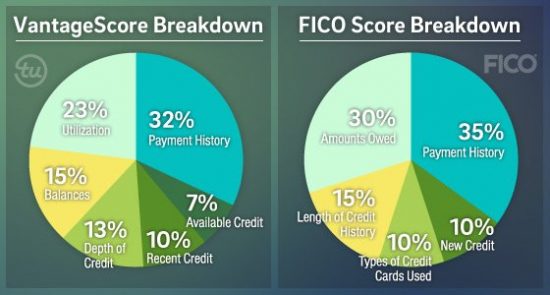

One way the two main credit score models differ is through the method each uses to pull your credit history.

A FICO credit score is determined by a snapshot of all the available credit history data when your score was generated. A VantageScore focuses more on your credit history and informs lenders of your credit behavior.

Both types of credit scores use a variety of similar factors to create your credit score. However, the defining difference is how much these factors influence your score. While both scores look at your credit history to examine your credit usages, balances, payment history, and inquiries, each score is influenced differently by each factor.

Don’t Miss: Can You Self Report To Credit Bureaus

Types Of Credit Scores: Vantagescore Vs Fico Score Vs Credit Score

Understanding your credit score can be hard. And to make things even more confusing, you may have heard that there are different types of credit scores.

No matter what credit score model you use, its important to understand what your score means and how it is calculated. Use this guide to learn the difference between credit score, FICO Score, and VantageScore.

If It Doesn’t Say Fico Score It’s Probably Not A Fico Score

“62% of consumers who received a non-FICO credit score mistakenly believed they received a FICO® Score.” BAV Consulting Survey3

There’s simply no substitute for FICO Scores. Remember, before the creation of FICO Scores there was no industry-standard to make sure access to credit was more fair and accurate. When you want to know where your credit stands, it just makes sense to get the scores your lenders will use.

A note of caution: some sites may try to sell a credit score and pass it off as a FICO Score. If it doesn’t clearly say FICO Score, it’s probably not a FICO Score.

Also Check: What Happens When Credit Score Dropped During Underwriting

Why Are Fico And Other Credit Scores Important

When you apply for a loan, such as a mortgage or auto loan, the lender examines your credit score to assess risk and determine how likely youll be able to repay your loan. Credit scores allow lenders to quickly make decisions based on data that is both impartial and consistent, and reduces their chance of losing money to unreliable borrowers.

Borrowers with good credit scores are rewarded with access to loans and favorable interest rates. Borrowers with bad credit scores are often unable to get a loan or receive loans with high interest rates.

Which Score Do Lenders Use

Although lenders and credit companies use both the FICO score and the VantageScore, FICO remains the clear winner for now. Ninety percent of lenders still use FICO scores, according to FICO. VantageScore, however, is gaining traction with seven out of 10 financial institutions, six out of 10 credit card issuers, four of the top 10 auto lenders and four of the top five mortgage lenders using its scoring model, according to information on the Experian website.

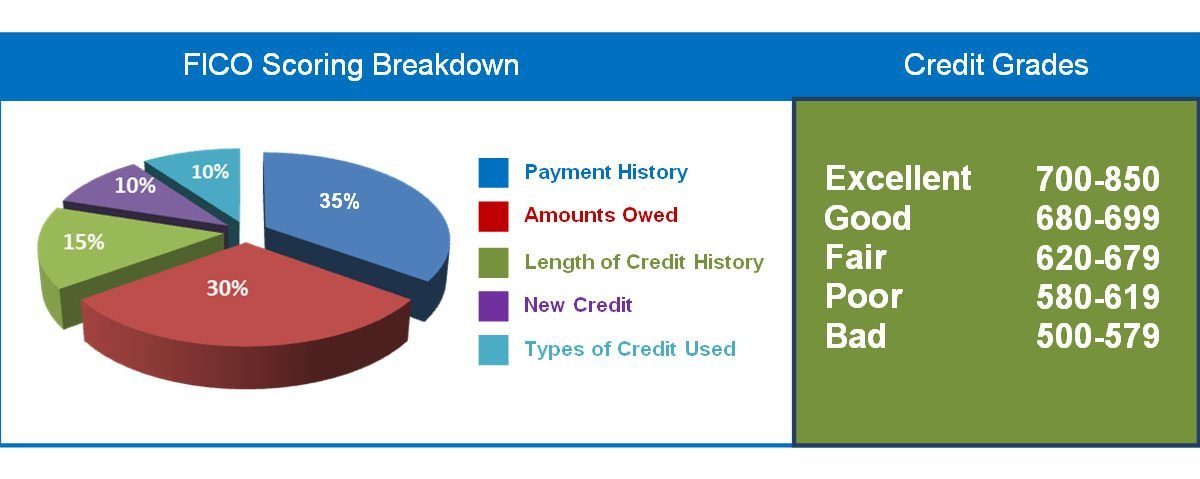

Although both scoring systems currently score borrowers on a scale from 300 to 850, the categories differ. See where you fall on each scale and determine if you have a good credit score.

Read Also: What Does R9 Mean On Credit Report

How Can I Build My Credit Score

The best way to have healthy credit is to practice good financial habits. Your score will fluctuate, but small changes shouldnt significantly impact your overall creditworthiness if you consistently make good choices like following a budget and keeping your debt-to-income ratio within reasonable limits.

Today, sites like Annualcreditreport.com offer the ability to check all three bureau scores, plus your FICO® Score, and may even create a separate aggregate or average score. Some credit cards or financial services offer free credit monitoring as well.

Learn The Differences Between Vantagescore And Fico And Why You May Have More Than One Credit Score

You may already be familiar with the importance of credit. After all, your credit score can help lenders decide whether to approve your credit application, what interest rate to offer, how to determine your credit limit and more.

But did you know that there are different types of credit scores? Read on to learn some credit score basics, why there are different types of credit scores, how VantageScore® and FICO® differ, and more.

Don’t Miss: Does Car Insurance Check Credit Report

What Is My Real Credit Score

Companies can choose which score to purchase and use when reviewing applications and managing customers’ accounts, which is one reason there’s competition in the credit scoring world. With this in mind, there isn’t a single, “real” credit score.

For example, when you’re shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 8, another a FICO® Auto Score 2, and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Generally, you won’t know which of your three credit reports or which credit score a lender will use. However, because credit scores all rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

Which Fico Version Matters Most

Your FICO Score 8 credit score matters the most. Although there are other versions, including FICO 9 and the newly released FICO 10 Suite, most lenders still use FICO Score 8 to make lending decisions.

However, there are other industry-specific versions of your FICO score that may be used. Those include:

- FICO Score 2, 4, and 5: Used in mortgage lending

- FICO Auto Score 2, 4, 5, and 8: Used in auto lending

- FICO Bankcard Score 2, 4, 5, and 8: Used in credit card issuing

Note that FICO Auto Score 8 and Bankcard Score 8 use your FICO Score 8 credit score as a base for further industry-specific calculationsbut they are not the same thing.

Also Check: Is 570 A Good Credit Score

How Are Fico Scores Calculated

FICO scores will be calculated based on details provided in consumer credit reports. The company will also apply a specific formula to the data in the credit report to generate a score, where the following factors are used in the calculation:

- Your payment history: This category will account for 35% of your FICO credit score. To get a high score here, you must make payments on time because late payments will result in a lower credit score.

- This refers to the available credit being used at any one time and is measured in percentage. It accounts for 30% of your FICO credit score

- This will measure the average length of time that you have been using your credit, where having an older credit age can produce better results. Credit age accounts for 15% of FICO calculations.

- This refers to the kind of credit you use, such as revolving credit or installment loans. The credit mix is responsible for 10% of your FICO credit score.

- After a hard credit check, a new inquiry will be registered on your credit report. This accounts for 10% of your FICO score calculation.

However, its best to keep in mind that FICO will generate many versions of your credit scores which are meant to serve different kinds of lending situations. It wouldnt be hard to get 30 kinds of FICO credit scores because they will each serve a different purpose.

Can I Repair My Credit When I Have Too Much Debt

If you are struggling with debt, its crucial to get that under control before focusing on your credit score. Debt relief methods like debt consolidation and settlement can help you reorganize and pay down your debt faster. As your debt decreases, your creditworthiness will improve. Then you can focus on building your credit score through healthy habits to achieve your financial goals.

Read Also: What Can A 700 Credit Score Get You

Vantagescore Vs Fico Score Conversion

There is no official method of converting a VantageScore to a FICO score. Because each scoring uses different criteria and methods of pulling data, its nearly impossible to convert. However, keeping both scores in mind can give you a much more well-rounded understanding of your credit health.

For example, a consumer might have a VantageScore of 623, then check their FICO score and see that its 721. On the FICO model, the score is squarely in the good credit range.. However, it is right at the cutoff that separates fair from poor credit on the VantageScore scale.

What does this mean? The two scores are different enough that its not wise to compare them directly. Take each individual score for what it tells you. For example, when it comes to credit utilization, the VantageScore is an indicator of your most recent credit habits while the FICO score is more of a snapshot of your utilization rate at the current moment. Knowing what each score emphasizes helps you make moves to improve your scores over time.

Key Differences Between A Fico Score And Credit Score

FICO is short for Fair Isaac Corporation, the first company to offer a credit-risk score. Its the most widely used type. FICO uses a formula to measure and assign your creditworthiness. In order of importance, its based on these factors:

- Payment history

- New credit

Using these criteria, credit users are assigned a number in the FICO score range between 300 and 850, with a higher score indicating better credit. FICO also has a variety of scores based on loan types, such as a FICO Mortgage score, FICO Auto Score and more. Its possible to have dozens of different types of different FICO scores, each with a different number.

In addition, the FICO credit score changes in 2020 with the UltraFICO score. This new score is good news for people who are just starting to build a credit history or those who are looking to repair their credit. It is based on the same number scale but also uses deposit account activity to calculate a score.

Another type of credit score is your VantageScore, which was created in 2006 by the three major credit bureaus: Equifax, Experian, and TransUnion. A VantageScore uses the same range, but it is generated with just one month of credit history, making it better for new credit users. VantageScore also uses a different formula to calculate a persons score. In order of importance, its based on:

- Near prime: 601-660

- Subprime: 300-600

You May Like: Is 688 A Good Credit Score

What’s The Difference Between Fico And Vantagescore

| Public company founded in 1956 | LLC jointly founded by three major credit bureaus in 2006 | |

| Scoring criteria | At least six months of history for at least one account | No minimum credit history length one account required |

| Weighting | Clear percentage allocations for five main categories | “Level of influence” descriptions for five categories |

| Treatment of hard inquiries | Multiple inquiries treated as a single inquiry if within 45-day period | Multiple inquiries treated as a single inquiry if within 14-day period |

| Score range | 300-850 |

How To Get Your Credit Score

In the past, the only way to receive your credit score was by purchasing it from FICO or through one of the major credit bureaus. Now, there are a number of free apps and websites that allow you to see your credit score for free.

Most online bank sites have an option to view your credit score for free. You can also sign up for tools like CreditWise from Capital One or Experian, to keep track of your scores and see how to improve them.

When you visit some websites to get your free report, you will be offered the opportunity to purchase your credit score. This score is typically your VantageScore, but as most lenders use FICO, it may not be worth your money to pay for your score from that vendor.

There are also a lot of banks, lenders and credit card companies that offer free FICO scores to their customers through the FICO® Score Open Access Program. Over 200 financial institutions and 100 financial counseling agencies participate in this program.

To learn more about credit scores, check out our Understanding Your Credit Reports and Scores course. Or, if youre looking to improve your credit score, check out our service.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

Most Recent

Don’t Miss: Does Getting Married Affect Your Credit Score