Automatic Credit Line Increase

In some circumstances, American Express might boost your credit line without provocation. The issuer keeps close tabs on your account and might extend a higher limit just for using your card responsibly. There is no designated timeline for this process and it wont happen for every cardholder but you should watch your account just in case.

How To Choose Which American Express Credit Card Is Right For You

1. Consider current financial situation

Amex cards range in features, benefits and annual fees, which can make it tricky to pick the right one for you. Before you select a card, think about your current financial situation, and to also “reverse engineer” what you need.

- Are you in need of cash back to save on your monthly expenses?

- Do you need to earn travel rewards to save on a future vacation?

2. Eliminate cards

What Is A Credit Score

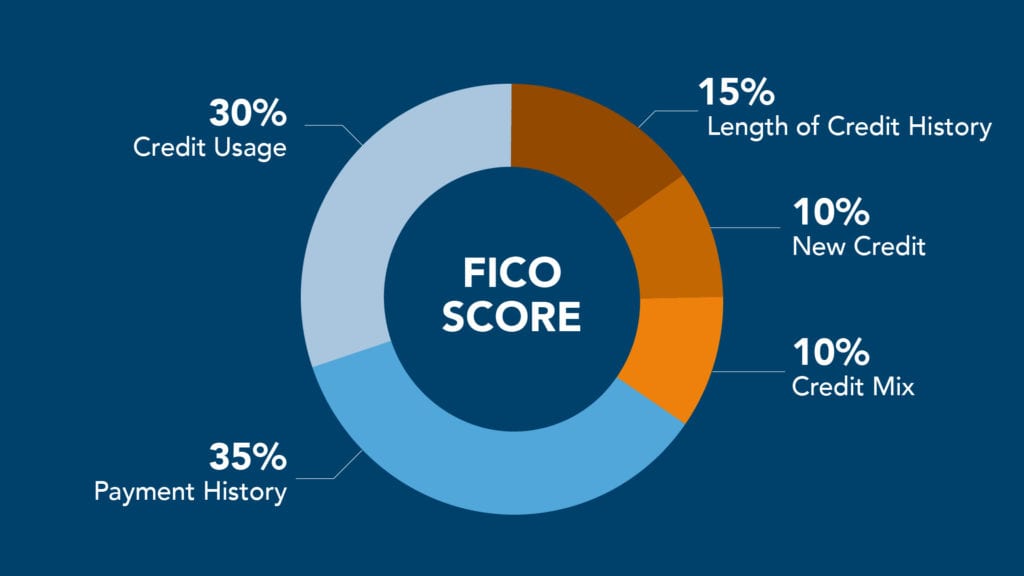

Your credit score can help you get approved for attractive borrowing rates and repayment terms when you apply for most loans including mortgages, auto loans, personal loans and credit cards. , the oldest and most widely used credit score brand, range between 300 and 850. Higher scores help banks and lenders to predict the risk of a borrowers default on a loan or credit card.

Those with good to excellent credit scoresdefined by FICO as a score of 670 and higherrepresent a lower potential risk of default to a lender.

Higher credit scores can mean access to credit cards with lower interest rates as well as greater rewards and other perks. For example, a premium American Express travel card loaded with features and benefits is typically only available to those with excellent credit.

Those who are still building credit, or have some missteps in their credit history, are more likely to get approved for a card aimed at those who fall into the fair credit or lower range. However, in exchange for accepting lower credit scores these cards may come with fewer benefits as well as higher interest rates on any balances you carry.

Don’t Miss: How Long Can Eviction Stay On Your Credit

Benefits Of The Delta Sky Miles Blue American Express Card

This card rewards you with 10,000 bonus miles if you spend $500 with the card within the first 90 days of opening the account. It also adds two times the miles for each dollar you spend in restaurants, takeout, deliveries, and Delta purchases. You get 1 mile for every dollar spent on all other eligible purchases with the card. You can save $50 on a flight for every 5,000 miles flown with the Pay with Miles program through Delta when booking online and a 20 percent savings as a statement credit for delta in-flight purchases.

Unlimited 1% Cash Back Rewards

The Credit One Bank American Express card offers a simple cash back earning scheme: You earn 1% cash back on all purchases, regardless of where or what you buy, and cash back is automatically applied to your account each statement period as a statement credit. If youre looking for a no-fuss way to reduce your monthly balance, the Credit One Bank American Express card will do the job.

That said, a 1% cash back rate pales in comparison to the rate offered by many of the best cash back cards. Not only will most cash back cards match the Credit One Bank American Express cards cash back rate, some can get you 1.5%-2% back on all purchases or even more on purchases in specific bonus categories.

Even some can match or beat the Credit One Bank American Express cards cash back rate. Consider the Petal® 2 Cash Back, No Fees Visa® Credit Card, which offers 1% cash back on eligible purchases right away and allows you to increase your cash back rate to up to 1.5% back after you make 12 on-time monthly payments, all without paying any fees.

Additionally, automatic redemption as a statement credit, while convenient, means you wont have the option of requesting a check or redeeming your cash back for travel or gift cards.

See related: Best flat rate cash back cards

Recommended Reading: How Do I Report A Tenant To The Credit Bureau

Blue Cash Everyday Card From American Express

$200 back after you spend $2,000 in purchases on your new Card within the first 6 months.

- Earn a $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months.

- Buy Now, Pay Later: Enjoy $0 intro plan fees when you use Plan It® to split up large purchases into monthly installments. Pay $0 plan fees on plans created during the first 15 months after account opening. Plans created after that will have a monthly plan fee up to 1.33% of each purchase amount moved into a plan based on the plan duration, the APR that would otherwise apply to the purchase, and other factors.

- Low intro APR: 0% for 15 months on purchases from the date of account opening, then a variable rate, 13.99% to 23.99%.

- 3% Cash Back at U.S. supermarkets .

- 2% Cash Back at U.S. gas stations and at select U.S. department stores.

- 1% Cash Back on other purchases.

- Cash back is received in the form of Reward Dollars that can be easily redeemed for statement credits.

- No annual fee.

Which Credit Bureaus Banks Check

When you apply for a credit card, the issuer contacts a credit bureau to purchase a copy of your credit report. Included in your report are the categories mentioned above. Knowing which credit reporting agency a card issuer uses to pull reports might help give you a better picture of your approval odds.

You can also use this knowledge to space out your applications in such a way that helps you maintain an optimal credit score, even if you are applying for multiple cards in a shorter timeframe.

Many credit card companies tend to rely on one bureau when they process . The credit bureau they use to buy reports, however, may change depending on the state you live in and the specific card you want.

Here are a few anecdotal data points that have been reported over the years:

- Citi usually pulls credit reports from Equifax or Experian.

- Amex primarily pulls Experian, though sometimes Equifax or TransUnion reports.

- Chase favors Experian, but may also buy Equifax or TransUnion reports.

Lets say you find out that Citi usually pulls from Equifax and Chase primarily uses Experian. You could apply for cards from both issuers in a single day and potentially improve your approval odds for both.

Read Also: R9 Credit Score

How To Check Your Credit Score

Before you apply for a credit card, it makes sense to know where you stand. You can check your score in several different ways:

- Use a free credit score site. Its a good idea to check your score through a reputable site like AnnualCreditReport.com once per year to make sure there arent any errors on your report that could have an adverse impact on your score.

About American Express Credit Guide

What information can I find on MyCredit Guide?

MyCredit Guide provides your VantageScore® credit score by TransUnion®, refreshed weekly upon login. MyCredit Guide also includes a range of information and tools to help you understand your credit score better and plan for the future. Some of the features include:

- Score Factors impacting your score

- Up to 12 months of score history

- Detailed TransUnion credit report

- Email alerts about critical changes to your TransUnion credit report information to help you identify potential fraud

- Score simulator to help you assess the possible impact of financial choices before you make them

How often is the credit score in MyCredit Guide updated?

Your VantageScore credit score is updated weekly, upon login.

What are the “Score Factors” impacting my VantageScore credit score?

The “Score Factors” impacting your VantageScore credit score tell you what information from your TransUnion credit report is impacting the calculation of your score. These are some key factors that could affect your credit score:

- Your history of making payments on time

- How old your credit accounts are

- How much credit you are using

- Recent inquiries for credit

- Recently opened new credit or loan accounts

- How much credit you have available

What is the Credit Score Simulator?

Please note the results of Credit Score Simulator are estimated and dont necessarily show the exact results a given behavior will have on your score.

How accurate is the Credit Score Simulator?

Also Check: Is 524 Bad Credit

Hilton Honors American Express Card

80,000 Hilton Honors Bonus Points after you spend $1,000 in purchases on the Hilton Honors American Express Card in the first 3 months of Card Membership. Plus, you can earn an additional 50,000 Hilton Honors Bonus Points after you spend a total of $5,000 in purchases on the Card in the first 6 months.

- Earn 80,000 Hilton Honors Bonus Points after you spend $1,000 in purchases on the Hilton Honors American Express Card in the first 3 months of Card Membership.

- Plus, you can earn an additional 50,000 Hilton Honors Bonus Points after you spend a total of $5,000 in purchases on the Card in the first 6 months.

- Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with a hotel or resort within the Hilton portfolio.

- Earn 5X Hilton Honors Bonus Points for each dollar of eligible purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- Earn 3X Hilton Honors Bonus Points for all other eligible purchases on your Card.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- Enjoy complimentary Hilton Honors Silver status with your Card. Plus, spend $20,000 on eligible purchases on your Card in a calendar year and you can earn an upgrade to Hilton Honors Gold status through the end of the next calendar year.

- No Annual Fee.

This Is Good News Right

The average credit score hit a record-high 704 last year. But as a consumer analyst and advocate, I worry that credit scores may be improving in part because lenders want to expand their customer bases, not just because Americans are more creditworthy. After all, Im the same guy, yet the 2014 FICO release rates me a whopping 52 points higher than the 2004 model.

Lenders have been asking credit-reporting firms and FICO to figure out a way to help them boost lending without significantly more risk, the Wall Street Journal wrote last October regarding the recently unveiled UltraFICO score. This is the new second-chance program which aims to expand access to credit by examining with their permission the bank accounts of consumers whose credit applications are rejected.

UltraFICO is looking for a lack of overdrafts and an average balance of at least $400 over the past three months. This last piece, in particular, strikes me as a slippery slope. What if that number becomes $1,000? Or $10,000? Id rather see people rewarded for how well they manage their money, not how much money they have.

Experian Boost is another new initiative that pledges to help people with damaged or nonexistent credit. I like this one better than UltraFICO because it focuses on phone and utility payment histories. People can give Experian access to their bank accounts to look for these types of bills, which arent typically included in credit scores because theyre not credit obligations.

Don’t Miss: Check My Credit Score With Itin Number

What To Do If You Get Rejected

Getting rejected for a card you want is never fun. But, there are many reasons Amex might deny your Amex Business Platinum application. For example, you may have opened too many credit lines recently. Or your income-to-spending ratio might indicate too much risk.

I recommend waiting to read the eventual rejection letter youll get in the mail. This letter will provide one or more reasons why Amex rejected your application. You can use the rejection as an opportunity to learn and improve your credit before applying again .

You can also if you believe additional information might lead Amex to reconsider your application. Even if the representative isnt able to approve your application, calling the reconsideration line may provide more insight into why Amex rejected your application.

Things To Remember When Applying For Amex Credit Cards

Im all for doing due diligence before applying for a new Amex card. But keep in mind that Amex has the final say, and sometimes credit card denials can come as an unfortunate shock. In these cases, you can always call up Amex personal credit reconsideration at 877-399-3083. Sometimes theyre just looking for a little more information that could help boost your chances of approval.

You also need to make sure youre adhering to Amexs application rules, including how frequently you can apply for new credit cards. Remember, Amex only allows you to earn the bonus on a specific card once, per person, per lifetime.

And sometimes you might not be eligible for a given cards welcome bonus depending on what credit cards youve applied for and held in the past. Because of this, I recommend you read our full review of each of the below cards before deciding whether or not to apply.

If you do choose to sign up for any of the above cards, best of luck in your application process and may the approval odds be ever in your favor. Weve also covered the minimum credit scores you would need to be approved for Chase credit cards.

Recommended Reading: What Is Coaf Credit Inquiry

Use Your Credit Card Responsibly

Regardless of where you get your credit card, it’s crucial that you develop good credit card habits. For starters, it’s important to pay your bill on time every month to avoid missing a payment, which can hurt your credit score and result in a fee.

Also, make it a goal to pay your balance in full every month, which will ensure you never pay interest. If you can’t pay back what you charge to your card, consider using cash or a debit card to avoid overspending.

Finally, it’s critical that you keep your credit card balance as low as possible. Your credit card balances affect your , which is an important factor in your credit scores. If you’re constantly bumping up against your credit limit, that could be seen as risky behavior by lenders and credit scoring models, even if you pay your bill in full every month. When your balance climbs above 30% of your credit limit you risk credit score harm. There’s no hard-and-fast rule, but the lower, the better.

What Our Research Means For You

The goal of this article is to help you identify the credit report that is most likely to affect your chances of getting a credit card from American Express. Given that Experian is used for almost every American Express application, that is the report you should focus on.

Ideally, anything you do to improve your score with one bureau will improve it at all three. However, focusing on one, especially if there are errors, can make things easier.

Don’t Miss: 641 Credit Score Credit Card

Ask For A Balance Transfer

If you wish to boost the credit line of a specific Amex credit card with the aim of using it more often, you may consider transferring all or part of its balance to another card. While you may transfer the balance to an existing card, you might also have the option of transferring it to a new balance transfer card. These cards come with 0% APR offers on balance transfers for varied time periods.

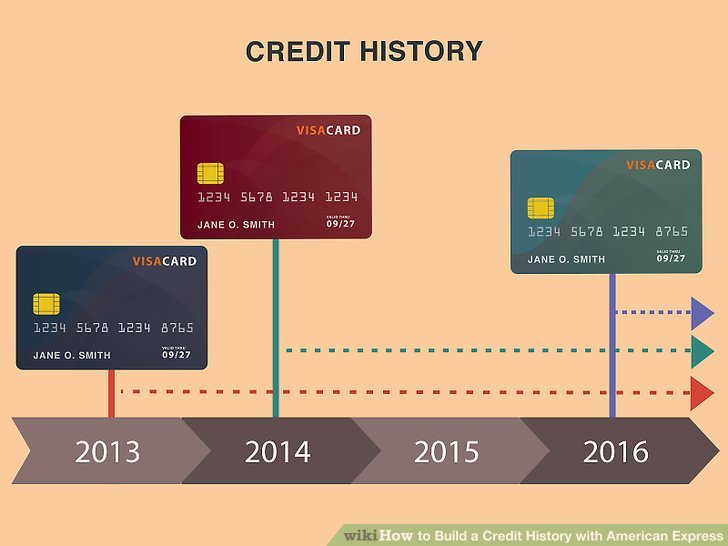

Carrying out a balance transfer to a new card might have a slightly negative short-term effect on your credit score because applications for new credit typically result in hard inquiries. In addition, getting a new card might bring down the average age of your credit accounts, which may also ding your credit score. However, these slight dips are easy to overcome in a short time if you maintain responsible credit habits.

What helps is a new card will add to your overall available credit limit. This may improve your credit score by lowering your credit utilization ratio.

> > More: Balance Transfer vs. Personal Loan

It’s Easy To Be In Control

Sign up for MyCredit Guide at no charge to see your detailed TransUnion credit report, updated weekly upon log in, get alerts, and use the credit score simulator.

Already enrolled to MyCredit Guide? Log In Here

Articles about Credit

Here is how to check your credit score for free and get the most accurate picture of your credit.

Enroll with MyCredit Guide to get a free credit report that you can access at anytime or you can request a copy of your credit report 3 credit bureaus once a year.

Learn about credit score ranges from FICO and VantageScore, and how they classify Excellent, Good, or Poor credit score.

Tips to Improve Your Credit Score

The better your credit score, the better chance you may have to secure a mortgage for a house or get approved for that premium credit card. Watch this short video from American Express to learn how to improve your credit score.

Recommended Reading: 714 Fico Score

Guide To Credit Score And Credit Reports

Learn more about your credit score and how to manage it.

Need an apartment but have bad credit? Though many landlords require a credit check, there are plenty of ways renters with bad or no credit can get an apartment.

FICO Score 8 is currently the most popular of many FICO scoring model versions that businesses use to size up a borrowers risk.

Identity theft protection services can help you safeguard your identity for a fee. While there are ways to protect yourself, many feel that such services are worth the cost.

You cant have a zero credit score but you can have no credit score. Learn why living without a credit score can make some financial goals harder to achieve.

FICO scores are credit scores but not all credit scores are FICO scores. Learn the difference between credit score types to better understand your creditworthiness.

Your FICO score is a three-digit number based on the info in your credit report. Learn what your FICO score is, why it matters, and how its calculated.

Identity theft can be a costly hassle that affects up to 1 in 3 Americans. Here are 7 common identity theft techniques and related tips to help protect you from each.