How To Improve Your Credit Score

Five main factors compose your credit score:

One: Payment history.

This is the most significant aspect of your score, accounting for 35 percent of the calculation. Missed or late payments on your monthly balances or outstanding credit card debt can be detrimental, especially if this behavior persists, so always pay on time. Doing so helps you avoid interest or additional penalties.

One way to ensure that you donât miss a payment due date is by setting up automatic payments or enabling notifications.

You can also add rent and utility payments to your credit report. These types of bills do not typically show up on your report, but you can submit a request to add them. If you have a healthy payment history, this can boost your score.

Two: Credit utilization.

Experts recommend keeping your utilization rate below 30 percent to avoid any problems.

Three: Length of your credit history.

How long youâve had your credit accounts makes up 15 percent of your score. This includes both new and old accounts. Banks and other lenders look at this section of your score to see if youâre able to manage credit over time in a responsible manner.

Itâs better to keep accounts open instead of closing them since youâll lose the activity associated with it, good or bad, and your credit score could drop.

Four: New credit.

Five: Credit mixes.

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.

Avoid Taking Out New Debt Frequently

The longer you manage your credit responsibly, the better it reflects in your credit score. It’s also important to avoid opening new accounts frequently.

That’s because FICO® considers the average age of your accounts. If you’ve had one credit card for 10 years, for instance, and another for five years, the average age of those accounts is 7.5 years. When you open a third credit card, though, it drops that average age to five years.

If you open credit accounts frequently, it will push your average account age down, which could hurt your credit score instead of helping it.

Also, virtually every time you apply for creditwhether you’re approved or notlenders will run a hard inquiry on one or more of your credit reports. Each of these inquiries typically drops your FICO® Score by fewer than five points, and that impact is usually temporary.

But if you apply for multiple credit card accounts in a short period of time, it could cause lenders to view you as a riskier borrower. As a result, multiple inquiries in a short period can have a compounding negative impact on your credit score.

The bottom line here: Avoid opening new accounts unless you absolutely need them.

Also Check: Factual Data Inquiry

How Credit Scores Work

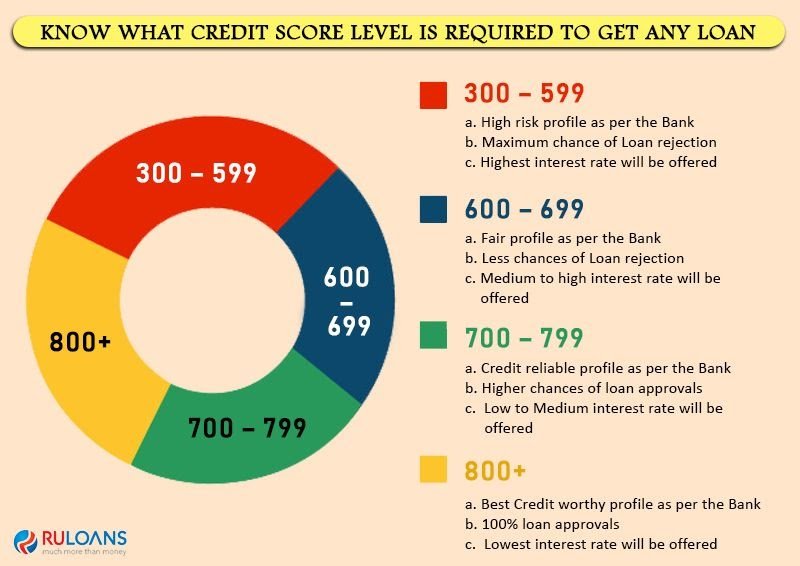

A credit score can significantly affect your financial life. It plays a key role in a lenderâs decision to offer you credit. People with credit scores below 640, for example, are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage in order to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or above is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO score range is often used.

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit you take out.

A persons credit score may also determine the size of an initial deposit required to obtain a smartphone, cable service or utilities, or to rent an apartment. And lenders frequently review borrowersâ scores, especially when deciding whether to change an interest rate or credit limit on a credit card.

What Is A Credit Score?

Reduce Your Credit Card Balances

How much debt you have is a factor in your credit score. But for the most part, the “Amounts Owed” section deals with your , which is the percentage of your available credit on credit cards and other revolving credit accounts that you’re using at a given time.

For example, a $2,500 balance on a card with a $5,000 credit limit gives you a 50% utilization rate on that card. Generally, it’s best to keep your utilization under 30% for each card and across all your credit card accounts for top credit scores, try to get utilization down into single digits.

A high utilization rate signals that you’re relying too heavily on credit and could have a difficult time making your monthly payments. So work on paying down your credit card balances and keep them low relative to their credit limits.

Recommended Reading: What Credit Score Does Comenity Bank Use

Pay On Time Every Time

Your payment history is the most important factor in determining your credit score. Making on-time payments every month is crucial to getting your credit score above 700. If you have some late payments on your credit report, it may make it more difficult to build your credit score. But over time, new positive information can outweigh old negative information.

In addition to paying all your current and future bills on time, make it a goal to get caught up on past-due debts so you can stop them from damaging your credit further.

Why Do I Want A Score Above 700

A good credit score ranges from 670 to 739, according to FICO®, the scoring model used most by lenders. That means working toward a can make your life easier and help improve your finances.

Having a good credit score is important for several reasons. Lenders look at your credit score to determine how likely you are to pay back your debts on time. The higher your score, the more favorable the offers you are likely to receive from lenders, including higher dollar amounts at lower interest rates on loans, higher and lower on those cards, and access to more financing options.

A good credit score can make a significant difference in the long run because lower rates can spell big savings. That’s especially the case on longer-term loans, such as auto and mortgage loans, where even a small difference in interest rate can save you thousands of dollars over the loan term.

Building good credit can also help you qualify for lower auto and homeowners insurance rates and can make it easier to secure a housing lease or even certain jobs. As such, it’s a good idea to work to improve your credit even if you’re not planning a major purchase.

Also Check: Chase Sapphire Preferred Card Credit Score Needed

Avoid Paying Interest To Improve Your Credit Score

One thing that is important to note is that you should never feel the need to pay interest to improve your credit score.

One of the benefits of a high credit score is saving money on interest payments, so paying unnecessary interest to achieve a high score is self-defeating.

The good news is that just opening the account will be enough to get a bump in your score, so long as the lender reports the loan to FICO.

If you have the money to make a purchase in full, you can finance it to get the new type of loan listed in your credit history, then pay it in full once the loan has appeared on your credit report. This lets you avoid interest while reaping the benefits of an improved score.

Don’t Close Old Credit Cards

The length of your credit history is another factor that goes into your credit score calculation. Credit scoring models like to see a long history of managing credit accounts, especially with low balances.

Keeping old credit cards open, even ones you use rarely, can also help your credit score by increasing your amount of available credit. As long as you keep balances low, that extra available credit will help reduce your credit utilization and improve your scores. If you’re not paying high annual fees on those older card accounts, keep them open and use them occasionally so the card issuer doesn’t close your account due to inactivity.

Also Check: Ntwk Credit Card

Dont Wait Until The Due Date To Pay

Did you know that most credit card issuers only update account information with the credit bureaus once a month? If you wait until your due date to pay, your credit report could show a high balance and utilization on your credit card until the next monthly update.

Remember, high utilization can be bad for credit scores.

Pay before the statement closing date on your account, however, and you should bypass this potential issue.

Check Your Credit Score Regularly

Habitually checking your credit score is a reliable way to pinpoint financial weaknesses so you can create a solid plan to combat them. Plus, it allows you check for statement errors. To correct any inaccuracies, send a dispute letter to either the credit reporting company or the information provider.

Note that checking your credit reports will not harm your credit score. Doing this is a soft inquiry the information is only for you as long as you request this information from an authorized credit reporting agency. The Fair Credit Report Act requires reporting companies, including Equifax, Experian and TransUnion to provide free credit reports every 12 months.

Related: Best Rewards Credit Cards

Recommended Reading: How To Unlock Transunion Credit

Length Of Credit History

The longer you’ve been using credit and the longer your average age of accounts the better it tends to be for your score. Remember, credit scores are meant to estimate your risk as a customer, and a longer history gives more data to estimate with.

Avoid closing credit cards unless there’s a pressing reason, like a high annual fee. You can also look into doing a product switch to a more suitable card from the same issuer.

A 700 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

A credit score is a number that lenders use to help assess how risky you might be as a borrower. Credit scores are based on credit reports, which contain information about your credit history. Generally, a good credit score can signal to lenders that youre more likely to pay back money you borrow.

Having good credit can be a game-changer. It can mean youre more likely to be approved when you apply for a credit card or loan. Good credit can also help you qualify for lower interest rates and better loan terms.

Its not quite as simple as that though. You dont have just one credit score. Heres why. Scores can be calculated using different scoring models, like the ones created by FICO and VantageScore. These credit-scoring models use several factors to generate your scores, drawing on data from different sources, namely the three main consumer credit bureaus . So there are actually many different versions of your credit scores.

With so many different credit scores out there, what counts as a good credit score can vary. What one model or lender defines as good could be different from what other models or lenders define as good.

Heres what you need to know about building and maintaining a good credit score and, if youre aiming higher, how you can eventually take that score from good to excellent.

Don’t Miss: Does Affirm Report To Credit Agencies

Jon Saved Thousands By Increasing His Credit Score Above 700

We interviewed Jon on August 10, 2018 he earns $72,000 a year as a executive chef, is 36 years old and resides in Las Vegas, Nev. He lives with his husband of 11 years, and they have no children, but do have three cats.

Member Since: 7/16/2014

Check your credit report

If you havent checked your credit report lately , request a copy from one of the three credit bureaus . By law, each bureau is required to provide you with a copy of your credit report once a year at no charge, at your request. Check your credit report for any inaccuracies or outdated information if you find anything, immediately file a dispute with the bureau and the creditor.

Percentage of members and non members who found inaccuracies on their credit report from 2015-2018

| Found Inaccuracies on Credit Report | Members |

|---|---|

| 16.5% | 35% |

Make payments on time

Consistently making your payments on time is the single best way to improve your credit score. If you slip up, though, dont worry while youll likely still have to pay a late fee, payments that are a few days late will rarely make their way onto your credit report.

Anything at or beyond 30 days, however, almost definitely will. If youre having trouble making your payments, contact your creditor to discuss your options. You may be able to work out a payment plan that wont negatively impact your score.

Reduce your debt

Average credit score by credit utilization

Pay Down Your Credit Card Balances

If youre trying to decide which debt to conquer first, start with credit card debt. Not only will you save money, since credit cards typically have higher interest rates than other debt, but youll also improve your credit score.

Thats because your , which is the percentage of open credit youre using, drops when you pay down lines of credit. Credit utilization is the second most important credit factor, accounting for 30% of your score.

Paying down car loans and student loans is great for your finances. But reducing your loan balance wont decrease your credit utilization ratio. That means you wont get the same credit-boosting effects that you would from lowering your credit card balances.

If you cant pay off your full balance, aim to get your credit usage below 30% of your credit limit.

Read Also: Comenity Bank Shopping Cart Trick

How To Build Up Your Credit Score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO Score® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High , or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.7 credit card accounts.

Seek a solid credit mix. No one should take on debt they don’t need, but prudent borrowingin the form of revolving credit and installment loanscan promote good credit scores.

Qualifying For A Mortgage And Buying A Home Is Much Easier

Back in early 2021, you needed a credit score of 680 to qualify for a CHMC insured mortgage. The CHMC insures mortgages where the lender puts down less than twenty percent of the asking price. Without this insurance, most Canadians would not be able to buy a home.

The requirement for this insurance now is a credit score of 600 and a downpayment of five percent. This five percent can come from your savings, the RRSP Home Buyers Plan, relatives, you name it. If you are self-employed, your high credit score will help you get mortgage default insurance from CHMC alternative mortgage lenders, which helps self-employed borrowers with good credit buy a home.

If you are not in the market to buy a new home, your credit score will help when renting an apartment. The rental marketplace in Canada is very competitive. Landlords can do on a potential renter and having a great credit score can give you a leg up over other potential renters.

Don’t Miss: Remove Hard Inquiries In 24 Hours