Can I Check My Rental History

You can check your rental history report for free once a year, thanks to the Fair Credit Reporting Act. To get your rental history, go online to find a list of rental history report providers. From there, you can reach out to the rental history report agency of your choice and ask them for a copy of the report.

Will An Eviction Hurt My Credit Score

by Maurie Backman | Updated July 21, 2021 – First published on Sept. 2, 2020

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

It pays to avoid an eviction for more reasons than one.

Evictions have been in the news a lot lately due to the COVID-19 crisis. Earlier in the year, the federal government and many individual states put eviction bans in place to protect struggling renters. But unfortunately, as those bans expire and unemployment benefits and other assistance dries up, millions of Americans are at risk of becoming homeless. Specifically, a frightening 19 to 23 million renters are at risk of eviction by September 30, according to The Aspen Institute.

But evictions were a problem well before the COVID-19 pandemic. Between 2000 and 2016, roughly 1 out of every 40 renter households was the subject of an eviction.

If you’re evicted, it will clearly impact your living situation for the worse. But what about your ?

What Are Legitimate Reasons You Can Get Evicted

While rules on what actions qualify for an eviction vary by state, there are several common reasons for eviction:

- Failure to pay rent on time

- Substantial damage to the property

- Behavior that endangers health and safety

- Violation of lease terms

- Illegal behavior on the premises

- Holding over or remaining in the property after your lease has expired

It is important to note that eviction is a legal process. You typically have to be notified in writing, which many landlords do by posting a notice on a tenants front door. State attorneys say tenants should not ignore these notices, and they should appear at all court dates to argue their side.

Recommended Reading: What Collection Agency Does Verizon Use

Does An Eviction Show Up On Your Credit Report

While positive rental payment history may be included in your Experian credit report, your report will not show eviction information. Eviction records can be found via a , which can be obtained through a tenant screening company or through Experian RentBureau.

Your landlord or apartment complex may also file a civil suit and win a judgment against you for the unpaid debt. Judgments are not part of a credit report, but they are a matter of public record and may be included in other kinds of consumer reports, so they could affect personal and business decisions.

Although your credit report will not show an eviction, it could include a collection account for any unpaid rent and fees, if the apartment complex felt that you owed them money and sold the past-due debt to a collection agency. The collection account should show the name of the original creditor who sold them the debt.

Collection accounts remain on your credit report for seven years from the original missed payment date that led up to the collection status. Collection accounts are considered derogatory and can have a substantial impact on credit scores, especially if left unpaid.

Although a paid collection account is still considered negative, some newer credit scoring models don’t include paid collection accounts in the score calculation, so paying off an outstanding collection account could help improve certain credit scores.

Can You Repair The Damage Or Remove The Information From Your Credit Report

If a landlord has turned over any unpaid money due to a collection agency, paying off what you owe can help. As stated above, once the balance is paid off, some of the newer credit-scoring models will remove it from your credit reports. Plus, it just looks better to future lenders to see that you have rectified the debt.

Going forward, the best way to repair any credit damage from an eviction is to tune up your financial health. By paying your bills on time and keeping your debt low, your scores will eventually start to improve.

While damaging information can stay on your credit report for seven years, debts carry less weight the older they get as more positive information is added to your credit reports. You may choose to seek help from a nonprofit , which can help you organize a budget to start repairing your credit health.

Read Also: Capital One Authorized User Credit Score

How Badly Does An Eviction Impact Your Credit

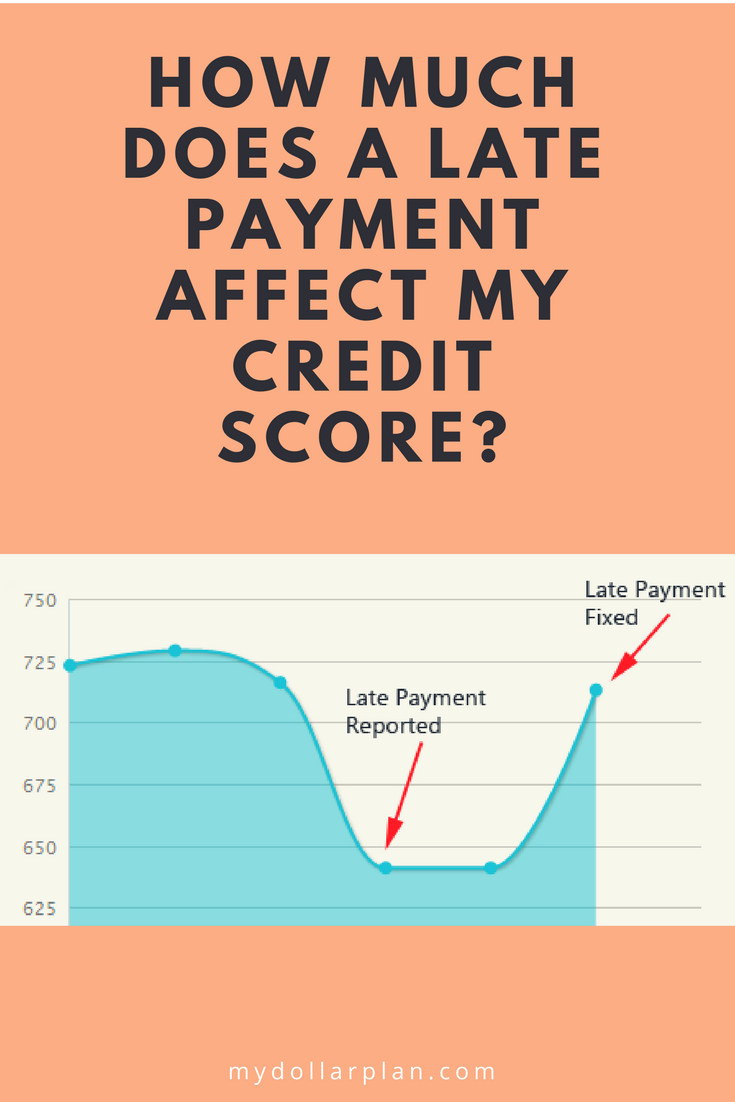

How an eviction impacts your credit score depends on how your landlord handles it. If they sell the past due debt to a collection agency, it will show as a charge-off and an account in collection. A charge-off can cost you anywhere from 80 to 150 points,depending on where your credit score began.

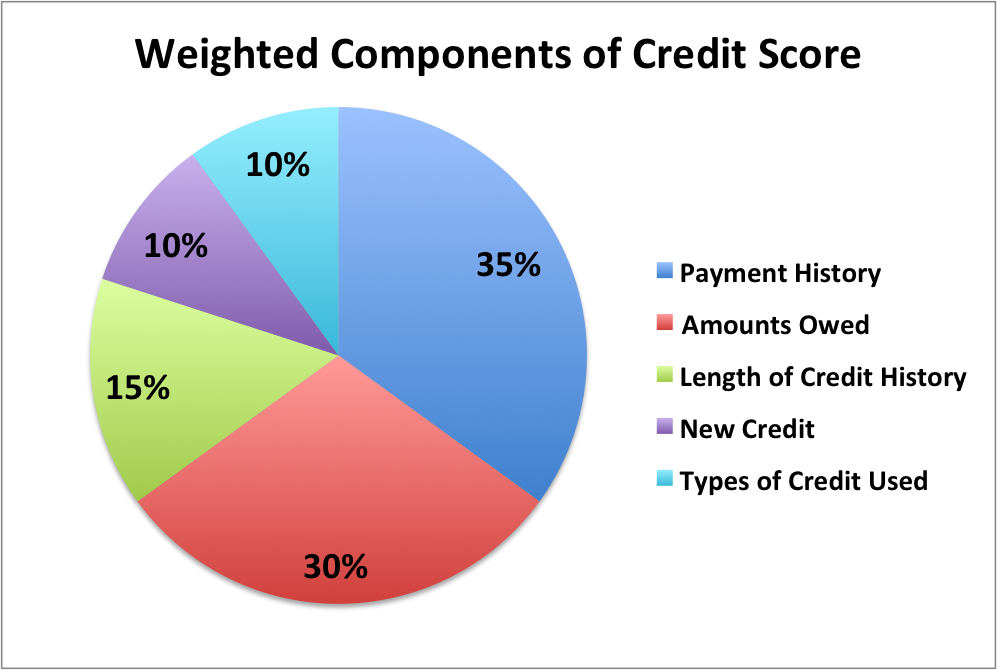

If they report the past due payments, it will appear in your payment history. Your payment history makes up 35% of your overall credit score, so negative items there could cause it drop significantly.

If youâre lucky, they might not report it or sell the debt, but if they obtain a judgment it could appear in the public records section. Thereâs no way to know for sure how many overall points an eviction will deduct, but it will severelyhurt your score.

Access To Credit In The Future

It will most likely be difficult to find housing with an eviction on your rental history and credit history. You may also have limited access to credit in the future.

Even if the landlord doesnt check your credit report, or you were evicted but didnt owe any money, many landlords use a tenant screening company when considering rental applications.

Don’t Miss: Report A Death To Credit Agencies

Can You Dispute An Eviction

If you have an eviction listed on a tenant screening report that you believe is inaccurate, contact the tenant screening company directly to dispute the information.

To check if there are any collection accounts for eviction-related debt appearing on your Experian credit report, you can request your free Experian credit report online.

If you have a collection account on your Experian credit report that you believe is incorrect, you can dispute that information quickly and easily through the online Dispute Center.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Also Check: Do Landlords Report To Credit Bureaus

Can I Get An Apartment With A 600 Credit Score

Usually, the minimum FICO credit score to rent an apartment falls somewhere between 620 and 650. However, some landlords may be open to scores of 600 or lower, while others may consider 700 to be the lowest qualifying score. Most landlords use FICO credit scores to determine if an applicant qualifies for an apartment.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Read Also: How To Check Credit Score With Itin Number

How Does An Eviction Impact Your Future Housing Prospects

Unfortunately, an eviction will almost undoubtedly hurt your ability to secure housing in the future.

Many landlords perform credit checks on prospective tenants. So, if your credit report contains debts owed through collection agencies or civil judgments, that will raise a big red flag on your application.

Even if a landlord cant tell that the collection debt is rent-related, theyll still question your ability or propensity to pay the rent on time each month.

Youll also have trouble getting approved for a mortgage, credit card, or personal loan during those seven years because your credit score will take a huge hit.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

You May Like: How Long Does A Repossession Stay On Your Credit Report

Protect Your Credit And Your Reputation As A Tenant

When facing an eviction, finding a new place to live is just one challenge. While an eviction may not directly hurt your credit, it could lead to problems down the line. To learn more about your legal rights, how to approach your landlord, or how to respond to an eviction, ask a lawyer.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.

Where Can You Go For Help

Because eviction laws differ from state to state, its best to research the relevant laws where you live. If youre not sure where to start or think your landlord is mishandling the eviction process, look up your local Legal Aid chapter.

If you qualify under your chapters low-income guidelines, you can receive free legal assistance. Theyre likely to have specific expertise with eviction defense.

You can also try negotiating directly with your landlord. If you just need a bit more time to come up with your rent money, consider telling them about your financial situation.

Most landlords want to avoid lengthy and potentially expensive court proceedings. So if youve been a good tenant but are in a rough spot with your money, it cant hurt to try being open and working out an agreement.

Read Also: How To Get Credit Report Without Ssn

How Long Does An Eviction Stay On Your Record And Affect Your Credit

No one wants to go through an eviction. Not the landlord, and especially not the tenant. As a tenant, being removed from a rental property can have serious consequences. Evictions negatively impact public records and rental history and can affect your credit.

When a tenant fails to pay rent or meet the requirements of the rental agreement, the landlord gives notice, which provides the tenant a chance to make things right. However, if the tenant still doesnt follow the contract, the landlord will file suit in court, and an eviction judgment is likely to be handed down.

Evictions can stay on your public record for up to seven years. And your credit reports will show the financial effects of eviction for the same period. The eviction will fall off of your public record and eviction-related financial debts will drop off your credit reports after those seven years. Still, during that time, the failure to pay can affect credit scores. The eviction will make it difficult for another landlord to offer you a rental agreement.

So, it makes sense to do all you can to avoid an eviction. Another thing to consider is filing for a complete rental history background check and receiving a free credit report to see if eviction-related debts are listed.

How Apartment Rentals Check Your Credit

Landlords can check credit in several different ways some are considered hard pulls while others are considered soft pulls. You can always ask the landlord what type of credit check theyre going to do. If you want to make sure the landlord isnt doing a hard credit check, you can offer to provide your own credit report, which results in a soft pull.

Many tenant screening reports are different than the credit checks a loan company or credit card provider may perform. These reports may be more in-depth than other credit reports, offering criminal searches, eviction reports, and income information. TransUnion, Equifax, and Experian, the three major U.S. credit bureaus, all offer specialized screening reports for landlords, Realtors®, and property managers. While Experian states its service is only a soft credit check, the other two bureaus dont specify.

Landlords may also obtain credit reports from third party services, who then pull reports from the credit bureaus. Whether these reports represent a soft or a hard inquiry depends on the service used.

Also Check: Does Usaa Report Authorized Users

Can You Get An Apartment With 700 Credit Score

Landlords utilize credit scores to see if renters will be able to pay rent on time. Credit scores range from 300 to 850, and a credit score of 700 or above is generally considered good. With proof of income, a valid photo ID, and a good credit score, a renter should be able to apply for an apartment without difficulty.

How To Avoid An Eviction

Evictions are a relatively lengthy process. The exact laws vary by state, but there are several legal steps involved. And, as mentioned earlier, your landlord is required to give you notice before having you removed from your home.

Generally, tenants wind up getting evicted because they’re either behind on rent or because they violate another term of their lease . If money problems are causing you to become delinquent on rent, thereby putting you at risk of eviction, it pays to talk to your landlord about the hardship you’re facing and see if he or she is willing to work something out. Your landlord might agree to let you postpone some rent payments, or pay just a portion of your rent until your income situation improves.

One thing you should know is that the eviction bans that were put in place earlier in the year expired in late July and have not been extended. As such, don’t assume that your landlord doesn’t have the right to begin the process of evicting you. The good news, again, is that eviction isn’t an instant process, and your landlord is required to give you notice, which means you may have time to work out a deal.

Finally, if you’re struggling to pay your rent, it pays to see if you qualify for rental assistance. You can use the Rent Assistance tool to find programs you may be eligible for.

Don’t Miss: How Do I Unlock My Experian Credit Report

What Happens If You Move Out Before Eviction Hearing

4.8/5move out beforecourtIfcourtoutmoving outquestion here

The tenant may simply move out before the court date. The landlord may dismiss the case. If the tenant owes missing rent or money for rental house damages, the landlord may ask the court to convert the case to a regular civil case.

Beside above, what happens when you go to eviction court? Court Eviction ProcessThe landlord prepares an official notice to the tenant. The court will contact the tenant and the landlord for a hearing date, and both parties attend to present their information. The court makes a decision on the eviction and in most cases, the landlord wins the unlawful retainer lawsuit.

Moreover, can you get evicted if you move out?

If you don’t vacate the property after receiving the initial notice, the landlord may file papers with your local court to have you evicted. Note that you should respond to any legal summons even if you‘ve already moved out of the property.

Do pending evictions show up on background checks?

The answer is yes. And in order to determine tenant liability, the vast majority of landlords these days pull rental background checks on new applicants.

7 Steps for Fighting and Beating a Bad Landlord