Fewer Consumers Had Subprime Credit In 2020

One effect of the 2020 average FICO® Score increase was the reduction in the number of consumers with subprime credit. This designation is typically given to those with scores between 580 and 669, but for the purposes of this analysis, we include all consumers with scores under 670.

Since 2019, the portion of consumers with a subprime score has decreased from 33.8% to 30.9%a nearly 3 percentage point drop. This improvement is significant and is three times as large as the improvement between 2018 and 2019, when the ratio decreased by less than 1 percentage point.

Among people included in the subprime category, the average FICO® Score rose from 578 to 583 in 2020. This 5-point increase is aligned with the national growth, but illustrates the depth of change occurring throughout the country.

Typically, subprime designations are used by lenders to identify consumers who may have a harder time paying back their debt in full and on time. While some lenders work with subprime borrowers, others may not, and having a score in the subprime range could restrict some borrowers from obtaining credit.

The fact that the 2020 improvement in credit scores touched customers in lower credit ranges is especially impactful, as these people may have had severely restrained access to credit. An improved credit score in their situation could open previously closed doors to credit opportunities.

Canadian Credit Reporting Agencies

There are two agencies in Canada that create credit reports: Equifax and TransUnion. All major banks, credit unions, credit card companies, finance companies and many other lenders and collectors report specific information to Equifax and TransUnion so that these agencies can create credit reports. Information is reported according to specific rules and can only be shared with lenders and creditors who follow strict policies. A creditor can only access your credit report with your permission, and no one else is allowed to see your credit report without your permission.

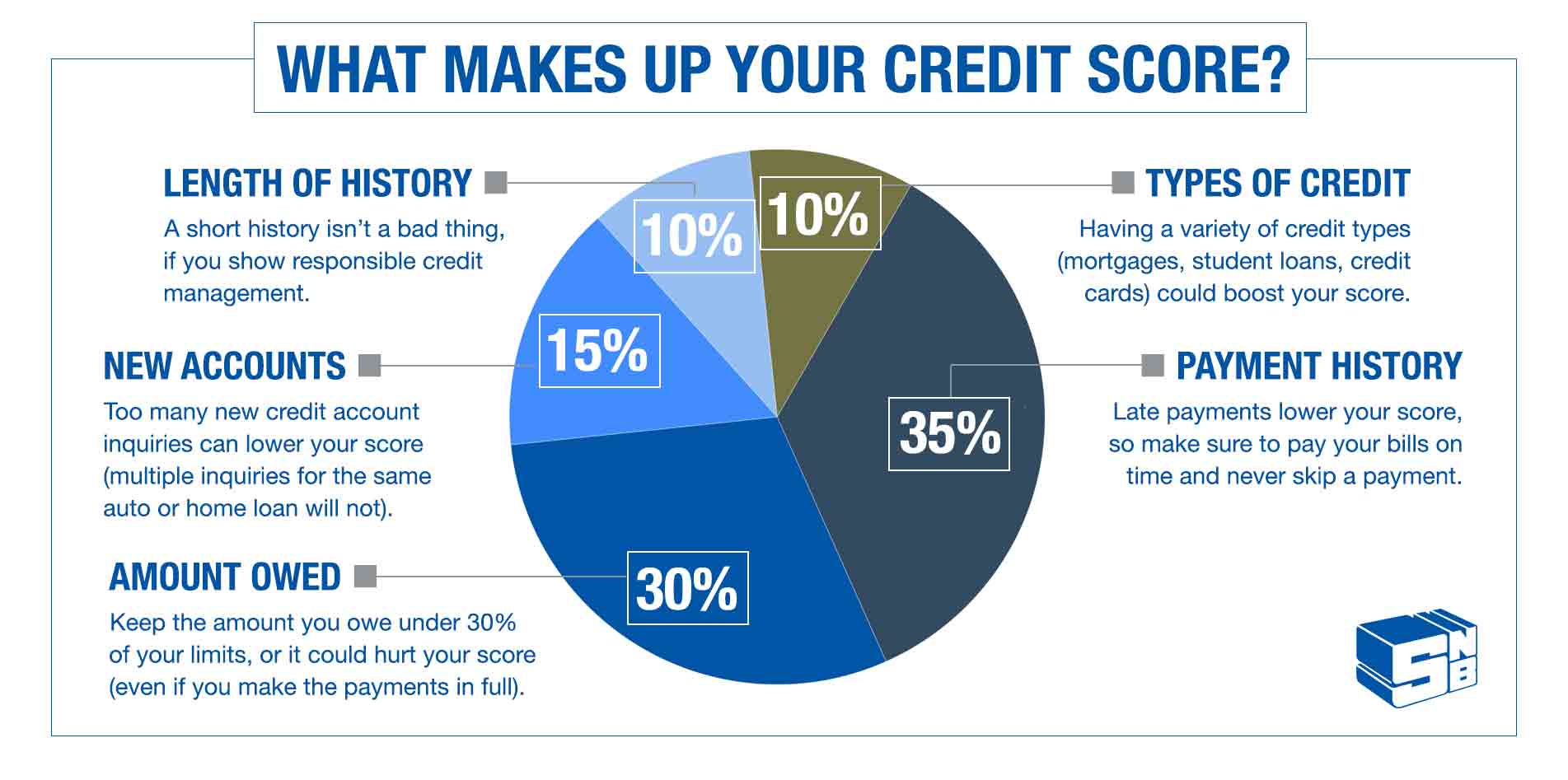

Only Use The Credit You Really Need

Just because you have three credit cards, that doesnt mean its wise for you to max them out every month, even if youre making the monthly payments on time. The credit bureaus frown on individuals using too much of their available credit although they do like to see a diversity of credit accountsmortgages, auto loans, credit cards, installment accountsmanaged responsibly. Solution: Go easy on the credit. Make a determined effort to not use more than 10% of your total available credit. Your credit score will thank you.

Read Also: Is Carmax Pre Approval A Hard Inquiry

How Does A Credit Score Work In South Africa

A credit score is a summary number based on your credit report, which contains information about the debt youve had, how youve paid it back, as well as your age and employment status.

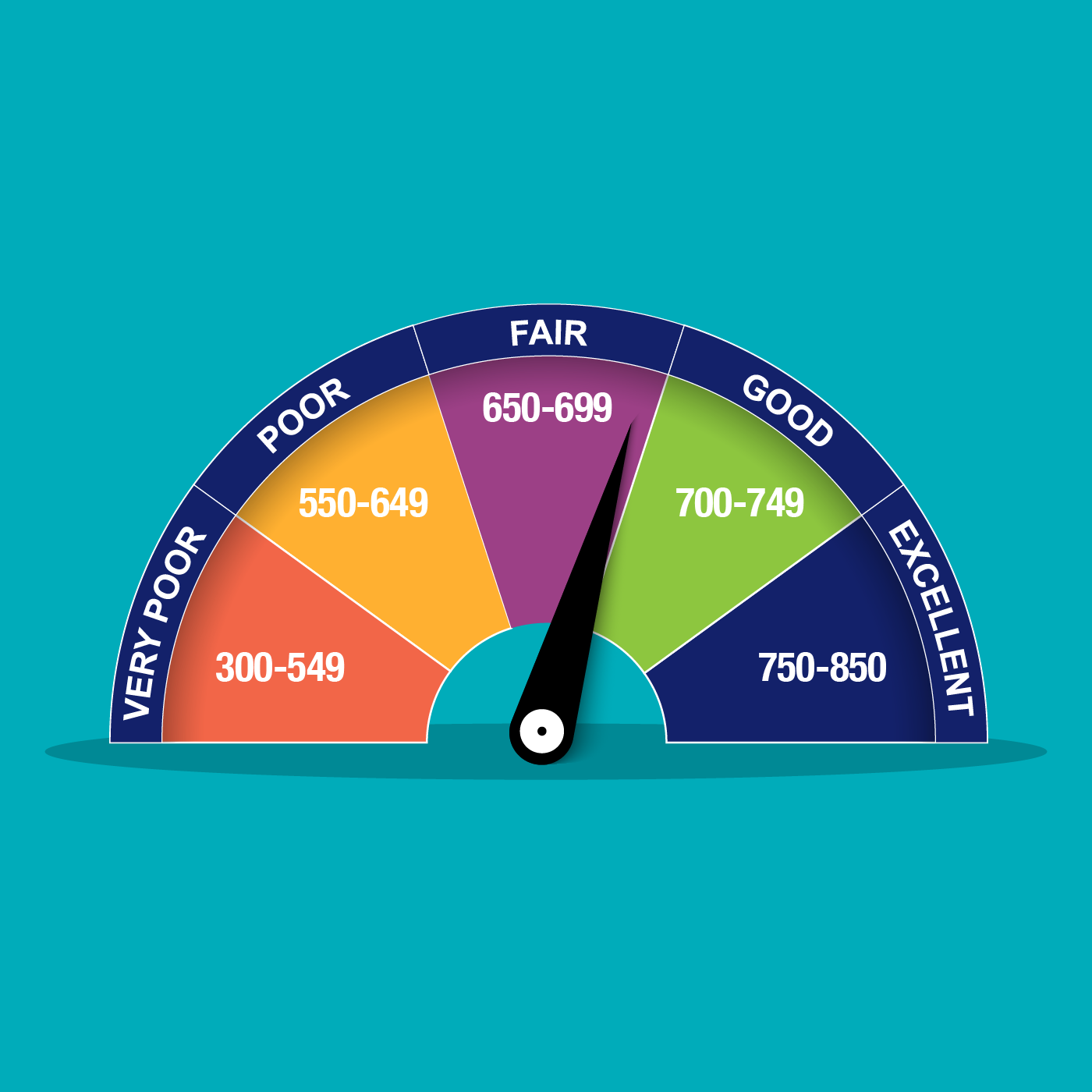

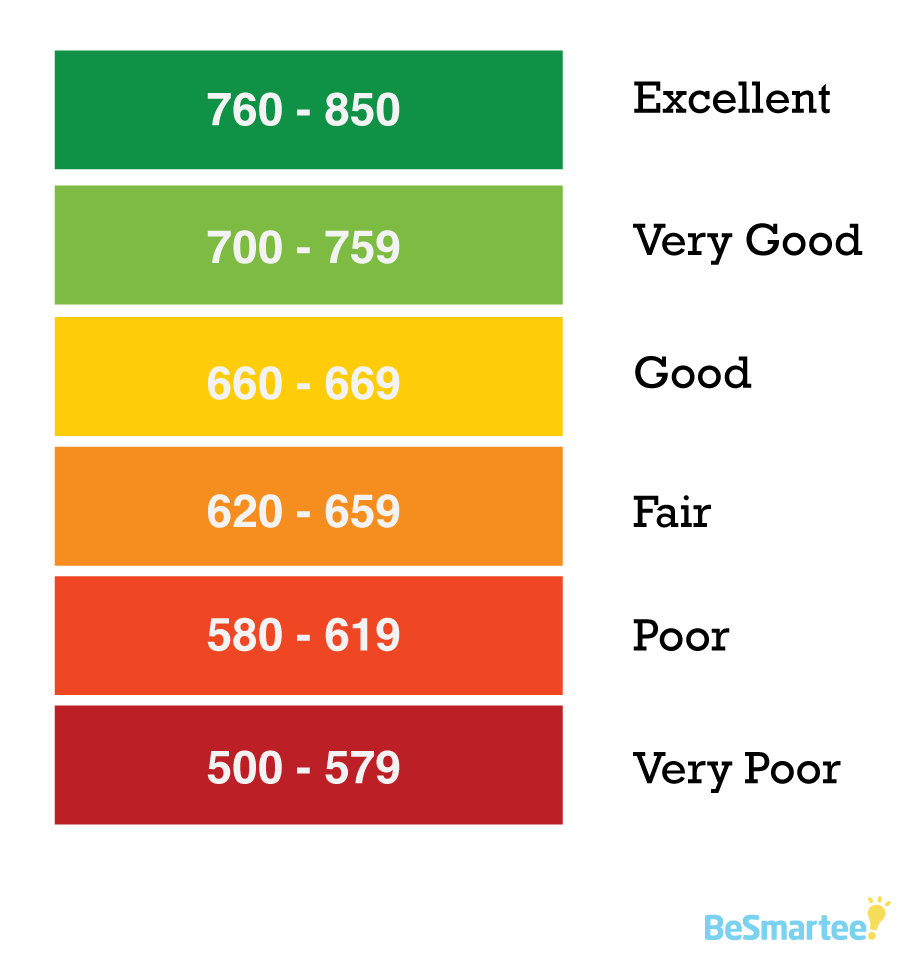

Most credit bureaus rate your credit score between 300 and 850:

- A low score is generally considered to be between 300 and 579

- A fair score is between 580 and 669

- A good score is anything above 700

The higher your credit score is, the healthier your credit is, which means youre more likely to be approved for a credit application and youre also more likely to get a preferential interest rate at which to pay it back.

Its worth noting that credit providers will also look at other factors. like your debt to income ratio so even if you have a good credit score, a high level of debt can negatively affect your credit risk.

How do you ensure you have a healthy credit history?

Everything You Need To Know About Credit Ratings

During uncertain times, you may need to make financial decisions you havent planned for. Whether its something small like opening a clothing account, or something big, like moving into a new home, your credit score could affect the outcome of these decisions.

If your credit rating is poor, your application is likely to be turned down, or you may even be charged extra interest.

So, what exactly is a credit rating? Credit rating is one of those financial terms which is often bandied about but is not always well understood.

Essentially, your credit rating is an estimate of your ability to repay money youve borrowed based on your previous payment history.

Although we tend to use the terms rating and score somewhat interchangeably, historically, credit ratings applied to businesses and governments, while credit scores applied to individuals.

In recent years, this strict definition has relaxed. One of the reasons is that although South Africans were entitled by law to one free credit report each year from any of the credit bureaus, most people didnt bother to do a This could be because they were unaware, it was too complicated to request a report, or too difficult to understand.

It also offers additional information such as your monthly credit commitments and a breakdown of transactions that affect the score. You can also track your rating over time.

The good news is that there are some things you can do to improve your credit rating:

Also Check: Aoc’s Credit Score

What About The Average Credit Score By Province

The average Canadian credit score does fluctuate by province. The province or territory with the highest number of people with credit scores above 750 is Quebec. The province or territory with the highest number of people with credit scores below 520 is Nunavut.

Since the health of your credit is tied to the overall health of your finances, it makes sense that there is at the very least a small correlation between the province you live in and your credit score. Certain provinces or territories offer Canadians more financial opportunities or more financial hurdles, all of which can have an effect on your credit score. Some of these opportunities or hurdles could be:

- Job opportunities

- Cost of housing

- Insolvency

Based on a study by Borrowell , weve compiled the average credit score of some of the major cities by province.

| Ontario | |

| Yukon | Whitehorse 619 |

Moreover, of the eight cities, two belonged to Quebec, two belonged to British Columbia, three belonged to Ontario and one belonged to Newfoundland and Labrador. The other 12 cities all fell within the fair credit score range. Overall, the city credit scores averaged around the average Canadian score of 650 which reinforces the fact that the provinces average credit score has a small correlation to your credit score and can be an indicator of the financial hurdles you face in one province over another.

Debt Levels Could Also Affect Credit Scores

| Province |

Check Your Credit Report For Errors

We talked about how your credit score is based on the information in your credit report. And that information is submitted to the credit bureaus by lenders. Well, lenders arent robots. Theyre real-life human beings, and humans make mistakes.

If you want to increase your credit score, the first thing you should do is request a copy of your credit report to make sure there are no errors or inaccuracies. There could be something on there damaging your credit score that isnt even your fault.

You May Like: Navy Credit Union Auto Loan

Auto Debt Growth Stayed Steady

- 62% of U.S. adults have an auto loan.

- The average FICO® Score for someone with an auto loan balance in 2020 was 712.

- The percentage of consumers’ auto loan accounts 30 or more DPD decreased by 22% in 2020.

Auto debt is the second most popular type of credit, and more than half of the nation’s adults have an auto account listed in their credit reports. Average consumer auto debt experienced one of the more modest increases in 2020, growing by only 2%the same increase as last year.

The percentage of consumers’ auto loans 30 or more DPD went down by 22% in 2020. This decrease is a reversal from 2019, when this figure increased by 1%. Unlike other debt types, auto loans did not see any sweeping government guidance aimed at providing consumer debt relief during the pandemic. Any decisions to modify repayment of auto loanswhere and when it occurredresulted at the discretion of individual creditors. Additionally, accommodations for mortgage and student loan payments may have also contributed to consumers’ ability to make their auto payments on time.

Why Would Your Credit Score Be Lower Than Expected

- If you have a significant amount of available credit, even if unused, banks could be concerned that you have the potential to get into a large amount of debt if used all at once.

- If your credit record is shorter than six years prior, then there hasn’t been sufficient time to calculate your total credit score, making it seem like you’re a higher risk.

- Likewise, if you have very few credit accounts in your name, then there’s an insufficient credit history to rate you.

- Any unanticipated missed, or late payments could count against you.

- Any account balances that are close to the credit limit indicate an over-reliance on credit to make ends meet.

You May Like: How To Get Evictions Off Your Credit

How Credit Scores Work

A credit score can significantly affect your financial life. It plays a key role in a lender’s decision to offer you credit. People with credit scores below 640, for example, are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage in order to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or above is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO score range is often used.

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit you take out.

A persons credit score may also determine the size of an initial deposit required to obtain a smartphone, cable service or utilities, or to rent an apartment. And lenders frequently review borrowers’ scores, especially when deciding whether to change an interest rate or credit limit on a credit card.

What Is A Credit Score?

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See which loan offers you might be eligible for with your .

Read Also: Do Evictions Go On Credit Report

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, the best way to help improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows that you can responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Who Calculates Your Credit Score

Your credit score is calculated by a credit bureau. There are four main credit bureaus in South Africa: Experian, TransUnion, Compuscan and XDS. At ClearScore, we show you your Experian credit score, which ranges from 0 to 705.Each credit bureau is sent information by lenders about the credit you have and how you manage it. Other information, such as court judgments against you or whether you are undergoing debt review, are also sent to the credit bureaus and form part of your credit report.

You May Like: Pre Approval Hurt Credit Score

Surveillance Process Adopted By Rating Agency

Rating agency believes it is of vital importance to monitor pool performance so that it is in line with the outstanding rating. Surveillance is necessary because the receivables from the pool of assets are used to service investors payouts. The investors recourse is thus limited to these receivable, and to credit enhancements, if any provided by the originator.

Additionally, complex structures have been introduced recent times in the securitization market, with issuances incorporating staggered payouts mechanisms, floating rate instruments and trigger based structures. These complexities require close monitoring by the trustee and the rating agency to ensures that the instruments adhere to the originally stipulated and appropriate action is initiated at the right time in case of any deviation.

Rating agency has set up a dedicated surveillance team to monitor the performance of rated pools. Transaction is monitored on a monthly basis and the key parameter is tracked. This is done on the basis of monthly servicer reports provided by servicer/trustees. The reports are checked for accuracy and performance analysed. Thereafter, the team interacts with the concerned parties to understand the reasons behind the trends, and the likely steps have been or need to be undertaken to arrest adverse fluctuations in the pools performance.

Key monitorables of rating agency surveillance process:

Recommended Reading: Removing Hard Inquiries Increase Credit Score

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Read Also: How To Report To Credit Bureau As Landlord

Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.

How To Improve Your Credit Rating

Check your credit rating and profile on DirectAxis Pulse to make sure there are no mistakes reported. Ensure there are no late payments incorrectly listed and that the amount on each credit account is accurate.

You should also check to see that there are no unfamiliar accounts or unpaid debts. If fraudsters get hold of your ID number or other personal information, they can use this to open accounts in your name. The trail of unpaid bills they leave then gets reflected in your credit score.

Don’t Miss: Opp Loans Credit Score

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

You May Like: 688 Credit Score Credit Card

Very Good Credit: 740 To 799

- In this range, youre still a very attractive borrower to the vast majority of lenders. Your interest rates will probably be favorable as long as youre not stretching your income to make the purchase in question.

- An estimated 2% of borrowers in this credit score range will become delinquent on their loans.

How To Fix A Bad Credit Rating

If there are no mistakes or illegal transactions, you can still improve your credit rating, but it will take more time.

First consider whether youre paying your debts on time. Even a payment that is only a few days late can affect your status.

While keeping your creditors informed if you are having difficulties wont improve your rating, negotiating a payment schedule is a positive step. Over time, as you settle the outstanding balances, this positively impact your credit status.

Its important to remember that any overdue account will negatively affect your credit rating. Paying it off or closing it doesnt make your payment history go away, and information about your payment history can stay on your record for two years and more.

Your credit rating is based on information found in your credit report, including your payment history, what is owed, activity, how long youve serviced an account, judgements and defaults, and enquiries about your creditworthiness.

Bear this in mind when thinking about your financial priorities. A poor decision made under stress during a difficult time today could have long-term implications on whether you can access credit and other financial services in the future. Knowing your is an important part of keeping tabs on your financial health.

Read Also: What Collection Agency Does Usaa Use