How Long Do Inquiries Stay On My Credit Report

All credit inquiries are listed on your credit report for two years. After that, they should fall off naturally. On the plus side, an inquiry only affects your credit score for one year. Once that period is up, your score should rebound a few points.

Again, its no big deal if you just have a few hard inquiries listed on your credit report. But if you have a long list of them, you might want to try getting one or more of the inquiries removed.

This is especially true if you dont remember authorizing the inquiry. To dispute a hard credit inquiry, you must contact each credit bureau that lists it.

Sample Letter To Get Hard Inquiries Removed From Your Credit Report

If youâre going to dispute an error on your credit report, itâs best to write a letter to the credit reporting agencies. Though many bureaus have online forms, they often include forced arbitration forms, which will prevent you from filing a lawsuit over the dispute, something you may ultimately need to do.

Writing a letter may feel overwhelming. However, the Consumer Financial Protection Bureau and the Federal Trade Commission both provide a sample cover letter and a template of the information that the dispute letter needs to include. Your letter should contain the following info:

Information that identifies you:

-

The number from the account

-

You should number each item that you want corrected

-

The dates that the dispute occurred

-

Explain each inaccuracy

-

The company that has the information in dispute

Finally, make sure you include a summary or list of the documents you submitted to support your claim.

Avoid Unnecessary Applications Prior To Applying For Home Or Auto Loan

While a single hard inquiry on your credit report can cause a small, short-term decline in your credit score, it shouldnt have a major negative impact, especially if you have good credit. Having several hard inquiries for different types of credit in a short time, however, could cause a more significant dip in scores and cause lenders to worry that you are having financial difficulty or that you could become overextended.

If youre seeking a loan for a big purchase like a home or a car, first get a copy of your and review it. Avoid applying for new credit until you apply for your mortgage or auto loan. And consider signing up for free credit monitoringit will help you stay on top of your credit situation and can also help alert you to signs of fraud or identity theft, including unauthorized hard inquiries.

Also Check: Does Unemployment Affect Credit Score

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Recommended Reading: How To Check My Credit Score Without Ssn

How To Dispute A Hard Inquiry On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youve checked your credit reports, you may have noticed youre not the only one taking a peek.

-

Utilities use them to decide whether to charge you a deposit.

-

Companies may check your credit standing so they can market products to you.

-

Potential landlords and employers may look to see how reliable you are.

Inquiries stay on your report for two years, but not all of them affect your score. Heres what you need to know about when and how to remove a hard inquiry from your credit report.

Don’t Miss: How To Build Credit Score Quickly

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can raise your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

Also Check: How To Raise My Credit Score 100 Points

How To Remove Hard Inquiries From Your Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible. This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

Written byAttorney Todd Carney.

Navigating your credit score can be confusing, since there are many personal finance factors to deal with. One issue is âhard inquiries.â A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible.

This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

Identify Inaccurate And Unauthorized Hard Inquiries

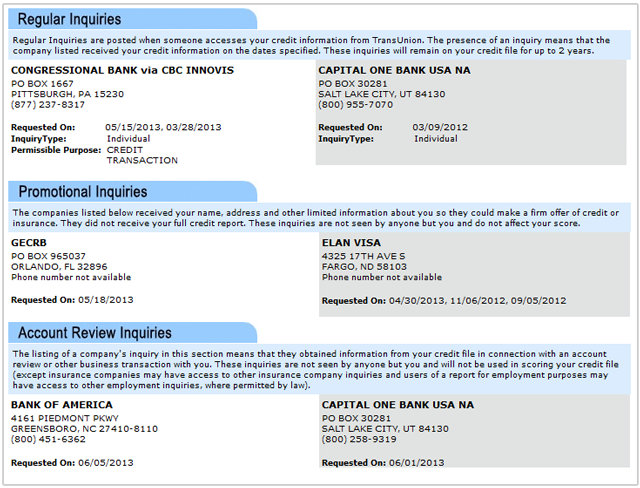

Look for a section on your credit report entitled âInquiriesâ or âCredit Inquiries to the File.â Information in this section may be organized into two sections: credit related inquiries and non-credit related inquiries . Soft inquiries donât have any affect on your credit score and so, in general, arenât really cause for concern.

If, however, you notice any recent hard inquiries that you didnât authorize or that are related to a loan or credit card you didnât apply for then you should immediately act to have them removed. Note that if the hard inquiry is legitimate because you did apply for a loan or credit card, the credit bureau wonât remove it. It will stay on your file for three years or possibly even longer.

Don’t Miss: Does Credit Journey Affect Credit Score

How To Remove Credit Inquiries

Sadly, they can also be a major pain in the derrière. Getting a black spot on your report, such as an unpaid collection or even just an unwanted hard inquiry, can be worse than getting the pirates black spot of death from Long John Silver.

I have good news for you: the tools and mechanisms to remove negative marks from your credit history have become easier than ever. What was once a tedious process done entirely by mail can be done online within minutes though dont rule out snail mail just yet.

Today, I want to assist you in getting those unwanted credit requests off your report pronto.

How Long Do Hard Inquiries Stay On Your Credit Report

Hard inquiries stay on your credit report for two years. Each time a hard inquiry is made, it is recorded by each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. And each time a hard inquiry is logged, it can potentially impact your credit score.

You May Like: How To Save Credit Report On Experian

Does Avoiding Hard Inquiries Raise Your Credit Score

Yes, having hard inquiries removed from your report will boost your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

How Many Points Does A Hard Inquiry Deduct From Your Credit Score

As Canadaâs credit bureaus donât reveal the exact algorithms they use to calculate your credit score, itâs impossible to say exactly how much a hard inquiry will cause your credit score to decrease. Obviously, the higher your credit score, the better you are positioned to weather a few negative hits.

Also Check: How Bad Is A Judgement On Your Credit Report

Review Your Credit Reports For Free

Your first step in reviewing hard inquiries is to pull your own credit reports. But dont worry, you wont be dinged for checking your credit because as a consumer you are entitled to a free report annually from each of the credit bureaus.

The three credit agencies are Equifax, Experian and TransUnion. But you can also visit MyFICO for obtaining your reports and your credit score. Its tempting to not look at your credit too often, but trust me, knowledge is power! Youre not only evaluating your current score, but youre confirming if the hard inquiries listed are legitimate.

How Long Do Collections Stay On Credit Report

How long does an unpaid collection remain on a credit report? In most cases, an unpaid bill can remain on your credit report for up to seven years. An unpaid bill, often referred to as derogatory or negative information, can be reported by your original creditor and collection agency if the bill is associated with it.

Also Check: Can Inquiries Be Removed From Credit Report

Dispute An Unauthorized Or Inaccurate Hard Inquiry

Remember, if you did request the credit inquiry because you were applying for a loan, then you cant dispute it with the agencies.

But if something looks suspicious, then lets take action.

If you find you could have a case of identity theft youre dealing with, then you will need to file a police report.

You would need the information from your police report to help you dispute the unauthorized inquiry.

If you think this is a case of a mistake in reporting, then you can work directly with each bureau.

File A Dispute with Each Credit Bureau

Since you receive three different credit reports, youll need to dispute the inquiry with each corresponding bureau.

Hard Vs Soft Inquiries

First, lets define which inquiries count. There are two kinds, known as soft and hard inquiries.

Soft inquiries, as their name suggests, do not disturb your credit score. This includes a person checking their own credit report. Along those same lines are inquiries pulled by insurance companies or employers.

Employers use credit reports when deciding whether to hire or promote a person. So, with no credit being granted or extended, the inquiry is soft and there is no scoring damage. Landlords can go either way hard or soft. Many landlords use a service that generates a soft pull to get them the information they need to decide if a person is likely to pay their rent and be a responsible tenant.

Also included in the soft category are those pulls for preapproved offers of credit. None of these count against your score. The key differentiator is whether the inquiry is for the purpose of deciding whether to extend or increase credit.

Hard inquiries can be generally defined as those that are made in order to extend new or additional credit. FICO says that on average a consumer will see a 5-10 point drop in their scores for each hard inquiry .

Fat files those with decades of information in them will drop less and for a shorter period of time than for someone with a short history . Its important to know that a hard inquiry counts, whether any credit is ultimately extended or not. Its the intent that matters.

Recommended Reading: How To Read A Credit Report

How Do Credit Inquiries Affect Your Credit Score

Hard inquiries count as minor negative entries and account for 10 percent of your credit score. Although the exact effect on your credit score will vary depending on your credit history and current standing, you can typically expect to see a one to five point drop in your overall credit score.

Although the exact hit to your credit score will vary, you can expect to see drops in your score when these inquiries start to add up. Occasionally lenders will either pull your credit by mistake, pull your credit multiple times or pull your credit without your knowledge whatsoever.

Combining Multiple Inquiries For Credit Cards

The shopping around logic that combines multiple inquiries for auto, mortgage, and student loans is not designed to work for credit cards.

With installment loans, even though you may be approved for the loan, you still have the option of choosing whether or not you want to accept the loan and take delivery of the money. You will probably not open all the accounts, so multiple inquiries can be collapsed into one.

Sometimes, however, if you apply for multiple credit cards with the same issuer in a short period of time, you may only end up with one inquiry on some or all of your credit reports. This is not because the issuer is combining the inquiries and only pulling your credit once. Instead, the credit bureaus see that you have multiple inquiries that look exactly the same because theyre from the same issuer on the same day. Since the credit bureaus want to avoid duplicate information and the inquiries look identical, they may only count one of them.

Recommended Reading: How Does Marriage Affect Credit Score

Why You Should Avoid Too Many Inquiries

For those new to the credit world, it can be quite enticing to accept every offer and apply for every card imaginable. This is a bad idea for several reasons, not the least of which is the impact to ones credit score. Multiple inquiries send up red flags to creditors, in part because it can signal that someone is about to go on a spending spree that they may or may not be able to afford. Multiple inquiries can have a drastic negative impact on a score, especially for those with thin credit files.

There are exceptions when it comes to multiple inquiries. If you are in the market for a mortgage or a student or car loan, you will probably want to do some comparison shopping. The credit bureaus and scoring elves understand this and will count these multiple shopping inquiries as only a single one if they are done in a short period of time . After all, chances are you will only be getting one mortgage or car loan at a time.

I mentioned that landlords can use either a hard or soft inquiry. If the landlord doesnt use a service, the inquiry may be a hard one. If you have multiple landlord inquiries, be prepared to explain why in case they are interpreted as turn-downs from other property owners.

See related: How can I get a closed card account removed from my credit report?

Disputing Inaccurate Hard Inquiries Yourself

It’s important to check your credit reports regularly for accuracy. If, while doing this, you’ve noticed a hard inquiry on your credit report that you believe is the result of identity theft, you can file a dispute with each of the three national credit reporting agencies and petition to have them update the inaccurate information.

The first step is to review your Experian credit report through our Dispute Center and verify your information. Next, confirm that the inquiry was not a result of identity theft.

There may be situations where you don’t recognize the name of a company that checked your credit or you don’t remember applying for a loan with a company you do recognize. Here are a few scenarios when inquiries you don’t recognize may be legitimate:

If you don’t recognize the company name that performed the hard inquiry, contact the company for more information. When you check your credit report through the Experian Dispute Center, the hard inquiry will be accompanied by the company name and typically the mailing address and a phone number.

If you have verified that the hard inquiry is due to identity theft, then the dispute would be handled over the phone with Experian specialists. You can visit our Dispute Center to find out support options. There is no charge to use this service.

Also Check: Is Credit Rating Linked To Address