When It’s Better To Keep The Card

On the flip side, there are certain circumstances when it can be wiser to keep the account open, such as when:

- It’s the oldest account on your credit report

- You don’t have many other open credit accounts, which can result in a thin credit file, making it harder to qualify for future credit

- The only reason you’re canceling it is that you don’t use it very often

How Many Credit Cards Is Too Many

The number of cards you should have depends on your needs, financial circumstances, and how you use them. Remember that different cards suit different purposes, such as repaying debts, spreading purchases, reward schemes or overseas spending.

However, the more credit cards you have:

- the higher the temptation to spend beyond your means

- the harder it is to keep track of repayments and account management

- the higher the risk of fraudulent use

- the higher the risk of losing them or forgetting password or PIN details

When Should You Close A Credit Card

Closing a credit card isnt ever going to help your credit score, so you should think twice before you do it. However, there are a few instances when you should go ahead and cancel a card:

Youre paying an annual fee. If the card charges an annual fee and youre not reaping enough rewards to make the fee worth it, go ahead and close the account.

Youre struggling to stay out of debt. If youre working hard to pay off debt and youre worried about racking up a bigger credit card balance, its better to close accounts than to leave yourself open to temptation. In fact, its possible to close credit cards that still have balances you just have to work out payment plans with your card issuers.

You have too many cards to keep track of. Just one charge that goes unnoticed can spiral into a mess of late fees and calls from collectors. Though there are tools you can use to keep tabs on all your accounts, if you dont trust yourself to stay on top of all your cards, its probably best to get rid of any unnecessary accounts.

Choosing whether to close a credit card is up to you. Often it makes more sense to just leave it open rather than risk any hits to your credit score. But as Griffin pointed out, its always best to base your decisions on what makes the most sense for you financially rather than what might happen to your credit score.

Don’t Miss: What Is The Lowest Credit Score

How Closing A Credit Card Impacts The Overall Age Of Your Credit Card Accounts

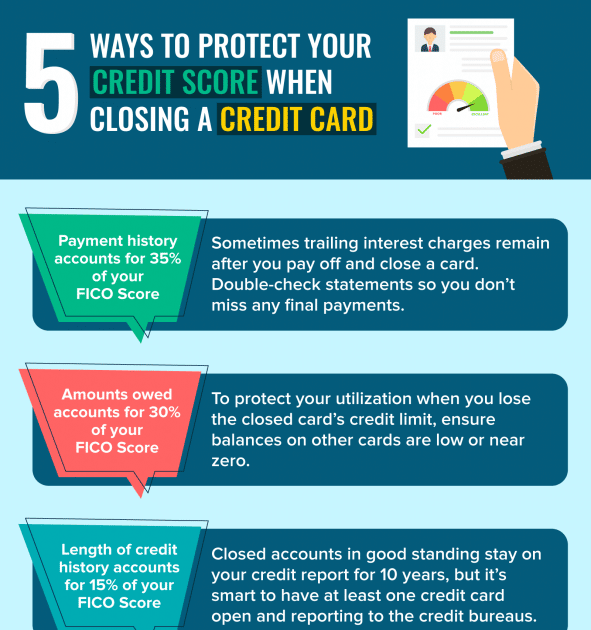

FICO and other credit scoring models consider the length of your credit history when calculating your credit score. The longer youve been using credit responsibly, the more creditworthy you are in the eyes of lenders.

The average age of your accounts counts toward 15% of your FICO Score, and its calculated by adding together the age of all your accounts by the number of accounts. For example:

Card A is 5 years old, Card B is 10 years old and Card C is 2 years old. That comes to an average of = 17 divided by 3 = 5.7 years.

The good news is that closed accounts in good standing stay on your credit reports for 10 years, so your length of credit history wont be negatively affected for a decade unless you decide to open a new credit card account .

Alternatives To Closing A Credit Card

if you do not want to cancel or close your credit card and are looking for alternative ways you can remedy the issues that were leading you to want to cancel the card, here are some tips:

if you were cancelling your credit card because of annual fees, you can call your issuer to consider lowering or waiving the annual fee. some companies may be willing to do this to retain their customers.

if you are worried about overspending if you keep the card, put it somewhere secure or you can even pause your credit card account for a few months.

if you rarely use the credit card you wanted to close, you can keep it open by putting a small monthly subscription to your favourite magazine or OTT. however, make sure you don’t forget the payment due date of your credit card and make payments on time.

Also Check: What Is Considered A Poor Credit Score

It Can Raise Your Credit Utilization Ratio

Your credit utilization can be found by dividing the balance on your cards against the total credit limit on all your cards. For instance, let’s say you’re carrying a balance of $500 across all cards, and the total limit on all your cards is $5,000. Your credit utilization rate would be 10% . If you close a card with a $1,500 credit limit and $0 balance, your credit utilization rate would rise to 14% .

The higher your credit utilization, the riskier you seem to creditors and lenders. That’s because it might be a warning signal that you’re in financial hot water or are having problems keeping up with your bills, so you’re resorting to plastic. So where should your credit utilization hover? The rule of thumb is to aim to keep it under 30%. Credit utilization makes up 30% of your credit score, so it’s important to keep your utilization low if you want to maintain a solid score.

Does Closing A Credit Card Hurt Your Credit

Does canceling a credit card hurt your credit? Youve likely heard that closing a credit card account may damage your . And while it is generally true that cancelling a credit card can impact your score, that isnt always the case. If you pay off all your credit card accounts to $0 before canceling your card, you can avoid a decrease in your credit score.

Typically, leaving your credit card accounts open is the best option, even if youre not using them. However, there are a few valid reasons for deciding to close an account. Its best to close joint credit card accounts during a , for instance, or if your credit card company chares high annual fees.

Read on to learn what they areand to get details on how to cancel a card the right way.

Don’t Miss: How To Dispute Items On Your Credit Report

+ Ways Can Credit Karma Be Hacked

22 October 2022

9+ Ways Does Settling A Debt Hurt Credit. To make debt settlement work, you must stop making payments to your creditors. The main reason is that the amount you owe wont be settled in full. However, that does not mean that you shouldnt do it. If youre currently in a tight spot financially and wondering what the best next step to take is. While a settled status is slightly better than an unpaid status, any payment status other than paid as agreed or paid in full can damage your credit.

03/07/2020 · yes, settling debt will affect your credit score. Once you have a clear understanding of how settling debt will affect your credit score, you can make a decision. To make debt settlement work, you must stop making payments to your creditors. Since 30% of your score depends on just your payment history, its safe to say most of the damage is already done.

How To Close A Credit Card Without Damaging Your Credit Score

if you have made up your mind that you want to close your credit card account, here are a few suggestions that you should keep in mind so you have no issues in future:

- pay off all outstanding balances before closing your credit card.

- redeem all outstanding rewards if you have a rewards credit card.

- if you have any auto-payments set on this credit card, stop it or move it to other available options to avoid missing payments.

- give a heads-up to the customer support of your credit card issuer that you want to close your account and ask them to confirm in writing that the account was closed at your request.

- send a follow-up notice to your credit card issuer to confirm your cancellation in writing. you should also mention your name, phone number, address, credit card account number and other details in the letter.

- once your credit card is closed, destroy it and put the pieces of it in different trash bags to make it harder for a potential thief to find and piece together your credit card details.

Read Also: Does Quadpay Report To Credit Bureaus

How To Safely Close A Credit Card Account

If you decide that canceling your credit card makes sense for you, make sure you do so safely. For your own financial protection, you want to be thorough whenever you close any kind of credit card accounts.

The first step you should take when you want to cancel your credit card is to clear your total statement balance. Make sure you dont have a remaining credit card balance or owe on your annual fee.

After that, make sure you have utilized any rewards left on your card. If you have cash back, frequent flier miles, or other unused benefits, make sure you use them all up or transfer any bonus funds into a checking account.

You dont want to lose out on rewards youve earned just because you close your credit account.

Next, you should contact your credit card company and notify them that youd like to cancel your account. Sometimes, companies require a certified letter explaining that applicants would like to close their accounts. Other times, you can simply call your card company and they can walk you through the process of closing your account.

Then its time to clear up any loose ends. Notify any other respective owners or users of the credit card cancelation. Lastly, you want to destroy your credit card physically. Scammers on the dark web have been known to steal old credit cards and use them for identity theft. Because of this, any credit card expert will tell you to make sure your card is destroyed and thrown away after you cancel your account.

Find Another Way To Handle Mounting Debt

If youre trying to get out of credit card debt and dont want to add new payments, you might be considering negotiating to close the card account with your issuer. But you might also be able to pay off your debt with a balance transfer credit card or personal loan. These options might offer a more manageable way of paying off your debt.

Recommended Reading: How To Win A Dispute On Credit Report

Check Credit Score Impact

Closing a credit card wont immediately affect your length of credit history by lowering your average age of credit. Even after you close a positive account, it may remain on your credit for up to 10 years. Yet closing a credit card could raise your overall credit utilization rate and possibly lower your credit scores.

To mitigate potential credit score damage, you should make a plan to keep your credit utilization rate low even after you close the account. One option is to pay off all your credit cards before you close an account, especially the account youre closing. To ensure the $0 balance is reported to the credit bureaus, its best to pay early a few days before your statement closing date. Of course, if your overall credit utilization is already 0%, closing a card wont change that figure.

Another option is to open another credit card before you close your other account. Lets say you plan to close a credit card with a $15,000 limit. If you open a new account and receive the same limit or a higher one, your utilization shouldnt be impacted negatively. You will, however, have a new hard inquiry, and the new account itself may lower your average age of credit. These actions might result in lower credit scores, at least temporarily, so weigh these factors in making your decision.

Ask For A Product Change

If you are unhappy with your credit card, call your credit issuer and request to swap your credit card for another card offered by the same issuer. If you have a credit card with an annual fee, for example, ask if you can downgrade your card to a no-annual-fee version. You might even be able to swap a cash back credit card for a travel rewards card .

Also Check: Is 524 A Bad Credit Score

What Should I Do If I Have An Unused Credit Card

Should you cancel unused credit cards or keep them? Thereâs no one right answer, and several factors to consider. For example, cancelling a card may:

- Reduce the risk of fraud â an open account you hardly ever check up on may be more vulnerable to fraudsters, who may pretend to be you in order to spend money in your name.

- It can be good to show lenders that you can successfully manage multiple credit accounts, as they may see this as evidence that youâre a reliable borrower. So, cancelling a long-held card could put you at a disadvantage, depending on what the lender is looking for. Whatâs more, cancelling a card may increase your credit utilisation â the proportion you use of your available credit â which can also lower your score. For example, if you have an overall limit of £1,000 and you use £250 of it, your credit utilisation is 25%. But say you cancel a card and your overall credit limit shrinks to £500 â if youâre still using £250 in credit, your credit utilisation will now be 50%.

How Closing A Credit Card Account May Impact Credit Scores

Reading time: 2 minutes

Highlights:

-

Closing a credit card could change your debt to credit utilization ratio, which may impact credit scores

-

Closing a credit card account youve had for a long time may impact the length of your credit history

-

Paid-off credit cards that arent used for a certain period of time may be closed by the lender

Youve paid off your credit card, and youre wondering if you should close the account – and whether that might impact your credit scores, for better or worse. The answer depends on your unique credit situation.

Before you close a credit card account, consider the following:

- Closing a credit card could lower the amount of overall credit you have versus the amount of credit you’re using , which could impact your credit scores. You can calculate your debt to credit utilization ratio by adding all your available credit and all the debt you owe on those accounts. Divide the total debt by the total available credit. Creditors and lenders like to see a lower ratio of how much debt you have compared with how much available credit you have.

- Closing a credit card account youve had for a long time may impact the length of your credit history, which is another factor generally used to calculate credit scores. In general, creditors like to see youve been able to properly handle credit accounts over a period of time.

- If you have a paid-off credit card you haven’t used in a certain period of time, it may be declared inactive and closed by the lender.

Recommended Reading: Will Affirm Affect My Credit Score

How To Cancel A Credit Card

If youve decided that canceling a credit card is your best option, you need to be thorough and deliberate. After paying your balance in full, get specific account closing instructions from the cards customer service department. The operators will likely try to persuade you to keep your account open. Be polite, but firm. And, confirm with the operator that your account will indeed be closed. Then verify the account was actually closed through email and another call.

The bottom line is that closing a credit card account could impact your credit score. The key is balancing responsible credit management and the desire to maintain or improve your credit score. Understanding your specific credit situation, including your spending habits, utilization ratio and low risk cancellations can help you make the right decision.

You are leaving Discover.com

Check Your Credit Before Closing An Account

Closing a credit card account can make sense in certain circumstances, but it’s important to understand that it can adversely affect your credit score. Before your close your account, consider taking a look at your to see where you stand and make sure that closing the account won’t leave you with a credit history that’s too thin or too new. While the negative effects of closing a credit card account are usually temporary, it might be worth keeping a long-standing account open if you’re able to.

You May Like: How To Remove Something From Credit Report

Plan Your Exit Strategy

If youve gone through the list above and you still want to cancel your credit card, its time to plan your exit strategy. You should keep in mind two primary goals during this process protecting your credit score and protecting your rewards. You dont want to see your credit score plummet by just canceling cards, and you dont want to lose any points or miles you may have accumulated.

Upgrade To An Unsecured Card

Instead of closing a secured credit card, ask your credit issuer if they can upgrade you to an unsecured credit card. Some issuers upgrade you automatically after you demonstrate responsible credit use for a specific period of time. If your credit issuer is not able to graduate you to an unsecured card, they may be able to tell you what you can do to earn an upgrade in the future.

Don’t Miss: How Long Do Closed Credit Accounts Stay On Your Report