Will I Definitely Be Accepted

Although using a smart search tool will give you a good idea of which products you stand the best chance of obtaining, its not a dead cert that youll be accepted when you go on to apply for a product.

Thats because lenders use a combination of whats in your credit files and what you put on the application form when making a decision.

Also, lenders sometimes change their criteria at short notice, which might affect your eligibility.

Nevertheless, a smart search lets you make a much more educated guess about where youll be accepted.

How Do I Fix A Hard Search On My Report

You canât remove a hard search from your report. Youâll need to wait 12 months for it to disappear, although the older it gets, the less weight it’ll have. You should minimise the number of hard searches on your credit file, especially if you know you want to apply for something important soon, such as a mortgage. That’s why it’s important to use soft search eligibility checkers before you apply for any form of credit. The best way to improve your chances of being accepted for credit is to keep an eye on your credit file.

How Smart Search Tools Work

A smart search tool helps you check your eligibility before you actually apply for a credit product.

If you use such a tool youll typically be asked to enter a few details, such as your name, date of birth and address and employment details.

This information is then transmitted to a credit reference agency to carry out a credit soft search.

The soft search returns a credit score, which is then used to show you the deals that you have the greatest chance of being accepted for, filtering out the ones youre unlikely to be accepted for.

Smart search tools vary, but you may, for example, be shown a score out of 10 indicating the likelihood that youll be accepted for a particular deal.

Read Also: Is 812 A Good Credit Score

Some Of The Providers We Search

We search more than 16 providers for credit cards and loans, some of the big ones are listed below. Unfortunately we don’t cover the whole market yet, but we’re working hard to add new providers all the time.

MoneySavingExpert.com Limited is an appointed representative of Moneysupermarket.com Financial Group Limited, which is authorised and regulated by the Financial Conduct Authority . Moneysupermarket.com Financial Group Limited, registered in England No. 3157344. Registered Office: Moneysupermarket House, St. David’s Park, Ewloe, CH5 3UZ.

How this site works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

MoneySavingExpert.com is part of the MoneySupermarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-bindingMSE Editorial Code.

Ways To Help Manage Hard Credit Inquiries

When you know what can trigger hard inquiries, you may be able to better manage their impact.

Here are some other tips to help you manage hard inquiries on your credit:

The Capital One CreditWise tool is another easy way to monitor your credit. With CreditWise, you can stay on top of your VantageScore® 3.0 credit score and TransUnion credit report for freeâeven if youâre not a Capital One customer. With the CreditWise Simulator, you can even explore the potential impact of your financial decisions before you make them.

Recommended Reading: How Long To Credit Inquiries Stay On Report

Why Do Hard Credit Checks Affect My Credit Rating

Too many credit checks can imply to lenders that a borrower might be seeking multiple credit products and could be taking on too much debt. It may signal that this person could be in financial difficulty, which is a negative signal to lenders.

If a borrower has too much debt then they are less likely to be able to afford to pay anyone back, leaving the lender at a higher risk of losses.

Sometimes having several searches within a few days could indicate you have been a victim of fraud. Someone that steals your personal details may be applying for finance in your name this can usually show up through the footprints on your credit report.

A service like Credit Angels allows you easy visibility of these searches, so you can quickly see if this has happened.

How Long Do Inquiries Stay On My Credit Report In Australia

There are many factors apart from credit inquiries that can affect your credit score including your previous payment history, outstanding debt, and bankruptcies. Even defaults can affect your credit score severely.

In fact, credit inquiries that stay on your credit report can only impact up to 10 percent of your total credit score. Whereas, payment history can affect over 35 percent of your total credit score. As a result, it is just as essential to understand how your credit score is calculated.

Multiple hard checks in a short period of time can affect your credit score by over 5-10 points. Although when these hard inquiries are dropped off eventually after a year or two, your credit report gets updated and your score goes back to what it was before all the inquiries.

On an average, hard inquiries can stay on your credit report in Australia for over two years. In case you see any discrepancies in your credit file or find any inquiries that should have never existed there in the first place, you can claim against them with the credit bureau and get the inquiry taken off of your file, if your claim is proven to be true.

Read Also: Is 809 A Good Credit Score

How Long Do Inquiries Stay On Your Credit

Most credit reporting is voluntary. For example, credit card issuers arent legally required to share customer information with the credit bureaus. The credit bureaus arent required to include credit card accounts on credit reports, either. Account information is reported and included in credit reports because it helps the companies involved boost their bottom lines.

Inquiries are different. The credit bureaus are required by law to disclose when they give anyone access to your credit information. According to the Fair Credit Reporting Act , most inquiries must stay on your credit report for at least 12 months. Employment inquiries have to remain on your credit report for 24 months.

Typically, the credit reporting agencies opt to keep inquiries on your credit reports for two years. Yet FICO only considers hard inquiries that occurred in the last year. Once a hard inquiry is older than a year, it has zero influence on your FICO Score.

VantageScore once again is more lenient where inquiries are concerned. If a hard inquiry lowers your VantageScore credit score, it will generally rebound in three to four months .

How Fraud Can Affect Your Credit Rating

When lenders search your credit reference file, they may find a warning against your name if someone has used your financial or personal details in a fraudulent way. For example, there may be a warning if someone has used your name to apply for credit or forged your signature.

There might also be a warning against your name if you have done something fraudulent.

To be able to see this warning, the lender must be a member of CIFAS. This is a fraud prevention service used by financial companies and public authorities to share information about fraudulent activity. CIFAS is not a credit reference agency. The information it provides is only used to prevent fraud and not to make lending decisions.

If there is a warning against your name, it means that the lender needs to carry out further checks before agreeing your application. This may include asking you to provide extra evidence of your identity to confirm who you are. Although this may delay your application and cause you inconvenience, it is done to ensure that you don’t end up being chased for money you don’t owe.

You May Like: What Credit Score Do You Need For Home Depot Card

How Does A Hard Inquiry Affect Your Credit Score

A single hard inquiry can shave up to 5 points off your FICO score. However, with the most-used FICO model, all inquiries within a 45-day period are considered as one inquiry when you are rate shopping, such as for mortgage, student and auto loans. Older FICO models and VantageScore, FICO’s competitor, also group inquiries for rate shopping, but into a 14-day period. A VantageScore spokesman said a hard inquiry can shave up to 10 points off a VantageScore.

Most lenders or card issuers will pull a credit report from just one of the three major credit bureaus Equifax, Experian or TransUnion. So the inquiry will show up on only one of your credit reports. The exception is for a mortgage, when all three credit bureaus are usually checked.

It is smart to limit hard inquiries. Before you apply for credit, check to be as certain as you can that you are likely to be approved so you don’t lose score points without getting the approval you seek. Avoid applying for credit on impulse. Consider whether a discount or bonus you are hoping to receive is worth the potential ding to your credit score. If you have excellent credit, a few points may not be a big deal. However, if you have borderline credit quality, think twice.

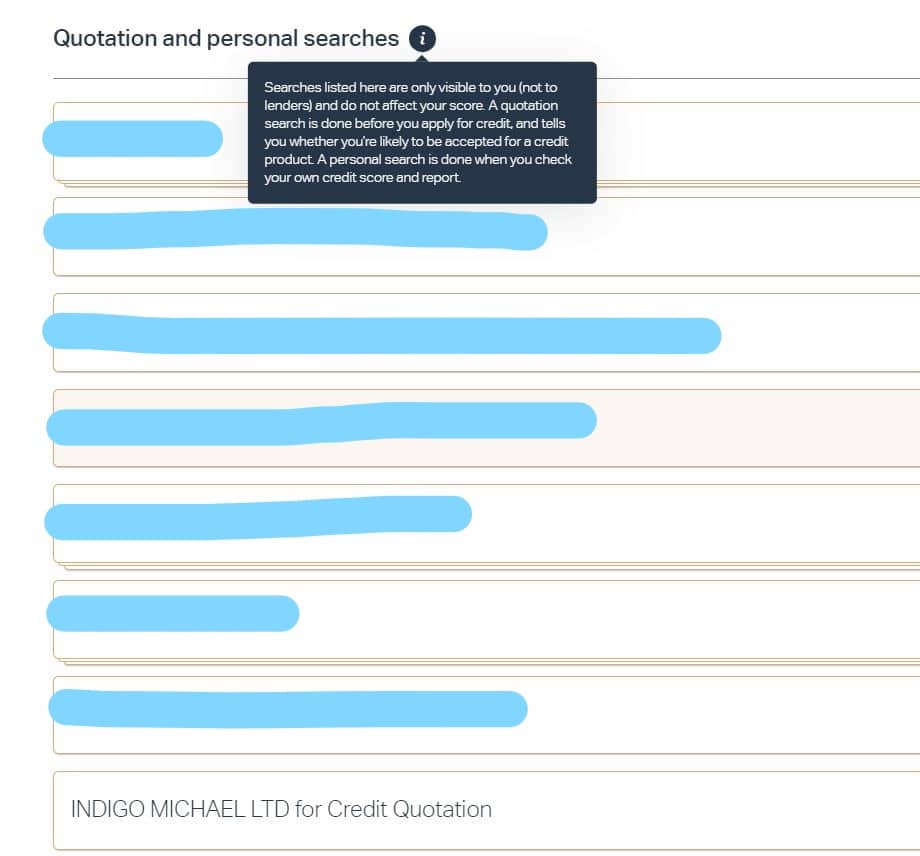

Checking Your Search History

Your ClearScore credit report will always show when someone has checked your report.

Checking over your searches history may be helpful if youâre wanting to carefully plan any credit applications. This will help you avoid applying multiple times in a short period . Checking your searches history can also help you identify early signs of identity fraud in the event that someone is trying to take out credit in your name.

Read Also: Is 584 A Good Credit Score

How To Get A Soft Credit Check

A soft credit check, also known as a soft inquiry, is a type of credit check that does not affect your credit score. Soft inquiries are typically used by lenders when they are trying to pre-approve you for a loan or credit card. They can also be used by landlords to check your credit history before approving you for an apartment. So, if youre wondering how to get a soft credit check, read on.

Why Do Lenders Need To Check My Credit Report

Lenders use your report to try and figure out how much of a risk you are to lend to before they make a decision.

If youâve paid everything back on time and all of your personal details are correct and up-to-date, itâs likely you have a good credit rating and arenât very risky to lend to.

If youâve missed payments in the past and have lots of debt, you may have a poor credit rating and could be seen as riskier to lend to. If this sounds like you, itâs particularly important to try and avoid getting any more marks on your report, so look out for those eligibility checkers. Think ninja!

Don’t Miss: How To Increase Your Credit Score Quickly

Who Can Run A Soft Credit Check

Not just anybody can run a credit check on you. Under the Fair Credit Reporting Act, an individual or business must prove that they have a permissible purpose for checking your credit. 4

A company can run your credit if theyre genuinely checking whether you qualify for their services or have a legitimate need to conduct a background check on you. However, they cant check your credit if theyre not considering a business relationship with you at all.

With that said, companies dont need to ask your permission before running soft credit checks. 5 For example, creditors may pull your report to preapprove you for a new credit card without getting your consent.

The following are all examples of people or organizations that can conduct a soft pull:

- Landlords and property management companies

What Are Hard And Soft Credit Score Inquiries

There are two types of lenders and others can make on your credit score: a “hard inquiry” and a “soft inquiry.” The difference between the two is that a soft inquiry won’t affect your score, but a hard inquiry can shave off some points.

Here’s what hard and soft inquiries are all about: why there’s a difference, and who makes them.

Recommended Reading: How To Raise Experian Credit Score

Should You Worry About Inquiries

In general, hard inquiries only play a minor role in your score and fear of a hard inquiry shouldn’t keep you from applying for credit when you need to open a new account.

Soft inquiries are even less worrisome because you could have dozens, or even hundreds, of soft inquiries in your credit reportsand they still won’t impact your credit scores.

What Does A Soft Credit Check Show

A soft credit check is a type of credit check that does not impact your credit score. Soft credit checks are typically used when you are checking your own credit score or when you are applying for a job. If you are applying for a loan, the lender will most likely do a hard credit check, which can impact your credit score.

Read Also: How Bad Is A 500 Credit Score

Why Do Credit Checks Impact Your Credit Score

It is only hard credit checks that potentially can impact your credit score. This is because when you take out credit it reduces the amount you can afford. This signals to lenders that you could be in financial difficulty and that you may be relying on borrowing money.

Hard checks are normal, and most people will take out finance or a loan at some point in their life. It is the amount of times that a hard check is done on your credit report that you need to be careful with. A hard check will stay on your file for 12 months, but if you keep the hard checks to a minimum then a hard check could affect your score less.

The Differences Between Soft And Hard Credit Checks

The difference you really need to know about is that soft searches arent visible to companies, but hard searches definitely are. No matter how many soft searches are made on your credit report, it wont damage your credit score.

Hard credit searches do show up to companies and can count against you by lowering your credit score. Lenders get nervous if they think that you apply for credit too often. This can suggest that youre desperate for credit. Lots of hard searches on your credit report will make you look like a high-risk borrower and can damage your credit score. A lower credit score can limit the kinds of credit that you can apply for.

Heres a quick summary of those differences:

Also Check: How Do You Check Your Business Credit Score

Impact On Credit Score

Soft inquiries do not affect your . While soft inquiries do appear on your credit report, only you can see them.

Hard inquiries lower your credit score by a few points, though that shouldnt be a big deal in the long run. However, too many hard inquiries in a short period of time may give lenders the impression that youre a high-risk customer.

Dont Miss: Does Zzounds Report To Credit Bureau

Can You See Soft Inquiries On Your Credit Report

You can view the soft inquiries on your credit reports. If you want to get copies of your credit report, you can request one free copy from each major credit bureau every 12 months on AnnualCreditReport.com. You can also check your Experian credit report monthly for free on Experian.com.

Keep in mind that your three reports could have different inquiries, as an inquiry is only added to the credit report that was checked. For example, if you check your Experian credit report, the soft inquiry won’t be added to your Equifax or TransUnion credit reports.

Recommended Reading: How To Remove Paid Medical Collections From Credit Report

How Multiple Credit Inquiries Affect Your Credit Score

Do you panic whenever a lender or landlord proposes pulling your credit report? If so, a lot of that anxiety may be overblown.

Too many credit inquiries in a short enough period of time will make a dent in your credit score, but this shouldnt deter you from rate shopping for the best offers.

Its ironic that so much attention gets focused on credit inquiries because they are such a tiny part of the FICO score, said Craig Watts, public affairs manager for the Fair Isaac Corporation .

We generalize by saying that typically no more than 10% of a FICO scores weight is determined by a persons taking on new credit, Watts said. But for most people, inquiries have little to no influence on their FICO scores.

To put that 10% into perspective, payment history, i.e. whether or not youve been paying your bills on time, makes up 35% of your credit score.

So, a credit inquiry is just a small nick in your credit report, but not all inquiries are created equal.

Can I Avoid Hard Credit Checks

To minimise the number of hard searches on your report, youâll need to make as few credit applications as possible. But you can ensure the applications you do make have a higher chance of acceptance, by only applying for credit youâre eligible for.

You can check your eligibility rating for credit cards and personal loans when you compare them with Experian. Itâs free and only a soft search will be recorded on your report, meaning your score wonât be affected unless you actually apply.

Recommended Reading: Is 500 A Good Credit Score