How Do I Run A Credit Check Without Hurting My Credit

Some places may charge you to check or monitor your credit. But you donât have to pay to use . You can use it to access your TransUnion credit report and weekly VantageScore 3.0 credit score for free anytimeâwithout negatively impacting your score.

You can even see the potential impacts of financial decisions on your credit score before you make them, with the CreditWise Simulator.

What Other Free Tools Does Credit Karma Offer

Free credit reportsOn Credit Karma, you can check your free credit reports from Equifax and TransUnion. And as with your credit scores, you can check your free credit reports as often as you like.

Free credit monitoringCredit Karmas free credit-monitoring service can alert you to important changes on your Equifax and TransUnion credit reports. Along with checking your credit scores regularly, this feature sends you an alert so you can sniff out any suspicious activity.

Mobile appThe allows you to check your credit scores on the go. The app also features tools ranging from the newRelief Roadmap to opt-in push notifications that help alert you to potential changes on your Equifax or TransUnion credit reports.

Free Business Credit Score Services

- Get a summary of your Dun & Bradstreet, Experian and Equifax business credit report

- Receive business credit grades for each score, plus your personal Experian credit score

- Tools to help you build business credit

What’s missing: You don’t receive your full business credit reports and scores with the free version. But you can upgrade to a paid version, starting at $29.99 per month for Nav Business Manager, to receive your full report and score with Dun & Bradstreet, Experian and Equifax, plus the ability to dispute errors on business credit reports and more. Compare Nav business credit products. There are alternative paid options to view your actual score, which we break down below.

Don’t Miss: Does Amex Gold Report To Credit Bureaus

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services will notify you after certain updates have been made to your credit report and credit score, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if youve been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services. Some institutions may offer it for free under certain conditions.

What’s The Difference Between A Credit Score And A Credit Report

Your credit score is different from your . A credit report is a more holistic view of your credit that shows detailed information about your credit activity and current credit situation. Credit reports detail personal information , credit accounts , public records and inquiries into your credit. The three main credit bureaus who issue reports are Experian, Equifax and TransUnion.

“Your credit scores are a proxy for the health of your credit reports,” says Ulzheimer. “So if you’re not going to take the time to pull and review all three of your credit reports, then at the very least you should check your credit scores.”

Update April 20, 2020: You can now receive 3 free credit reports each week for the next year

Also Check: What Happens When You Report Fraud On Your Credit Card

How Do I Check My Credit Score For Free

You have a legal right to access your credit report for free from any credit reference agency. These statutory reports offer a snapshot of your credit history and dont include a credit score.

But the three main credit reference agencies all offer more comprehensive services for a monthly fee.

These provide unlimited access to your credit report, plus extra features, such as a score and alerts when major changes are made to your report.

However, it’s now possible to access both your credit report and score without having to pay for a subscription.

Your Credit Score And What It Means

If you are able to achieve a high credit score, this could possibly result in a greater chance of having your next loan approved, greater borrowing capacity or access to lower rates on a loan or credit card. Keep in mind lenders typically have their own criteria when it comes to assessing applications and the rates they may offer.

Read Also: Can You Self Report To Credit Bureaus

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

You May Like: How Long Does Bankruptcy Show On Credit Report

How To Check Your Business Credit Score

While there are dozens of free credit score and free credit report resources available for consumers, it gets tricky when you look for business versions. There are select free business credit score resources available, but you may not get the full picture compared to a service that requires you to pay.

To make things easier for busy business owners, we’ve rounded up the popular free credit report resources and summarized what they offer. We’ve also included some of the other services that cost money but can be worth the money if you’re looking for a comprehensive view of your business’s financial standing.

How Does Clearscore Work

At ClearScore, weâre on a mission to help you get on in life by making finance clearer, calmer and easier to understand. We give 17 million people across the world free access to their credit score and report using Experian, a credit bureau with a score range of 0 to 705. We also know taking out credit can be confusing. Thatâs why we personalise our offers, making credit decisions a little easier for you. Itâs worth knowing thatwe sometimes make money when you apply for a card or loan with us. We order your offers based on how relevant they are for you, never on how much weâre paid. With ClearScore there are no time-limited trials or hidden costs. Your score and report are free, forever.

Read Also: How Do You Boost Your Credit Score

How Long Does A Credit Card Refund Take

Unfortunately, there are no legal rules for how long a credit card refund can take. While most credit card refunds take 4 or 5 business days, it could actually take 2 to 90 days for a refund to show up on your credit card account. If more than 90 days go by without word from your credit card company, contact them and ask whether your refund is being withheld or disputed.

You can also contact the merchant youre trying to get a refund from to see if theyve forgotten to process your refund or if theres some technical issue. If your refund is being disputed by your merchant, you can request a chargeback with your credit card company.

Not Sure If Your Purchase Is Eligible For A Refund

Before you return a credit card purchase for a refund, read your merchant and credit card companys policies carefully so you dont waste your time. Who knows? There may be something youre missing. If the refund is due to fraud, theft or an error made by the merchant or card provider, make sure to contact them immediately for a solution.

Rating of 5/5 based on 1 vote.

Don’t Miss: Is 778 A Good Credit Score

A Better Score Means Better Deals

Your credit score is a number that reflects your financial history on your credit report. This is what banks and lenders often use to help them decide whether or not to lend to you. A high credit score may mean you are eligible for more products at lower rates – and we can help you improve your score.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Also Check: Is 627 A Good Credit Score

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Don’t Miss: How To Obtain A Free Credit Report

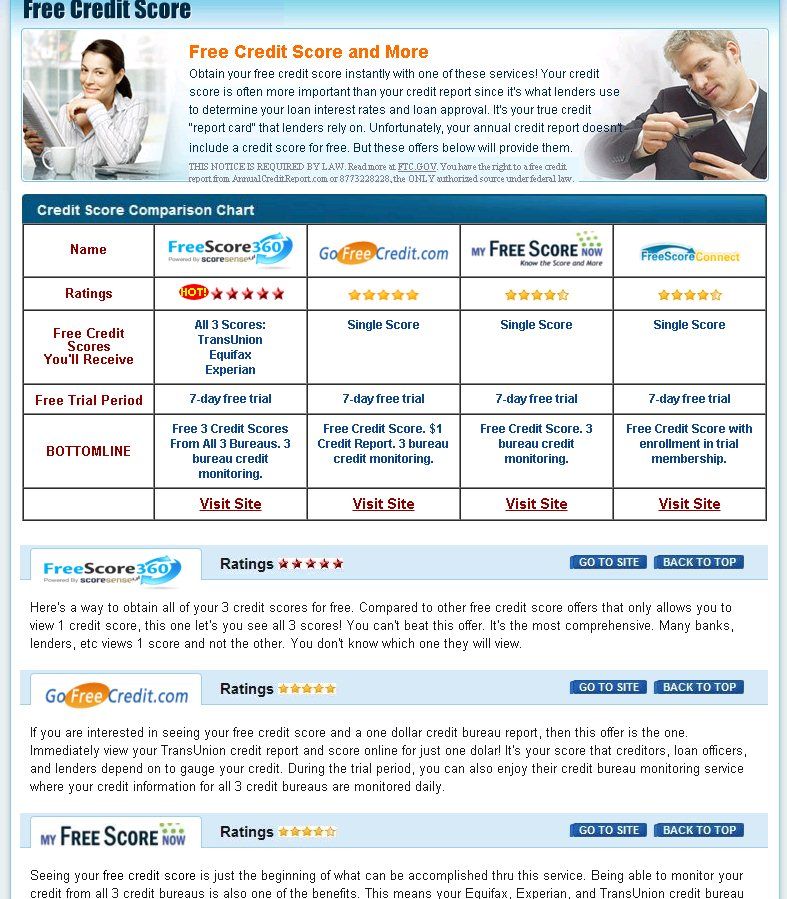

Free Credit Scoring Website

One of the best ways to check your credit score for free is by visiting a free credit scoring website. These websites typically offer access to your credit report, score and/or credit monitoring and are updated anywhere from weekly to monthly. Theres no fee to sign up for basic credit score updates. However, some websites offer more advanced services for a monthly fee.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Read Also: How To Remove Closed Accounts From Credit Report

How Is A Business Credit Score Calculated

A business credit score considers many of the same factors as a personal credit score, such as payment history and amount of debt used. However business credit scores use different scoring models.

For two main types of business credit scores, Dun & Bradstreet PAYDEX Score and Experian Intelliscore Plus, scores range from 1 to 100, and the closer to 100, the better. Consumer FICO scores, on the other hand, are ranked 300 to 850, with 800 and above being consider excellent credit.

Business credit scoring models weigh different factors when calculating scores, but you can anticipate that your payment history, age of accounts and amount of debt will be considered. If you carry a balance on The Blue Business® Plus Credit Card from American Express, that will be factored into your business credit score. And if you miss a payment on your Ink Business Cash® Credit Card, that can negatively impact your score.

Can You Repair Your Credit Score

Your credit score isnt fixed it reflects your credit situation only at the time a check takes place.

One slip-up can reduce your score. In order to avoid this, its important to always pay your bills and make loan repayments on time and not overextend yourself financially.

If you see something in your credit score report that looks questionable, get in touch with the credit provider to get it checked or corrected. Outdated information can result in you being refused a loan or line of credit.

And if you think you have been a victim of identity theft, contact the police and credit providers fraud department so they can investigate this for you.

Recommended Reading: What Credit Score Do Dealerships Use

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report Is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

You May Like: Does One Main Report To Credit Bureaus

Vantagescore 30 Credit Score Ranges

vary by scoring model, and lenders can view ranges in different ways. VantageScore 3.0 credit scores range from 300 to 850. Think of them in terms of four basic categorizations: Excellent, Good, Fair and Poor. Heres how they break down.

Excellent :You may qualify for the best financial products available, and youll likely have several options when it comes to choosing repayment periods or other terms. But excellent credit scores arent the only factor in a lending decision a lender could still deny your application for another reason.

Good :Youre less likely to have an application denied based solely on your credit scores, compared to having scores in the fair or poor range, and youre more likely to be offered a low interest rate and favorable terms.

Fair :You may have several options when it comes to getting approved for a financial product, but you might not qualify for the best terms.

Poor :You may find it difficult to get approved for many loans or unsecured credit cards. And if youre approved, you might not qualify for the best terms or lowest interest rate.