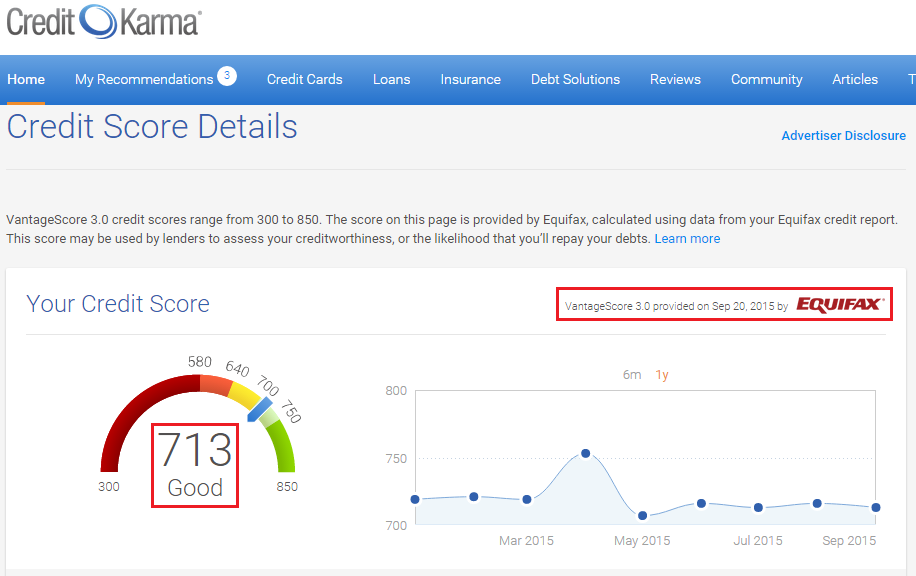

How A 713 Credit Score Can Benefit Your Finances

Having a good credit score means that youll pay less for loans and other types of credit than you would if you had a bad credit score. This is because you can take advantage of the low interest rates and the other financial benefits of a good credit score.

Loans and Credit You Can Get with a 713 Credit Score

| Installment loans | Mortgage | Eligible for all types of mortgages, including FHA-backed mortgages with a 3.5% down payment, conventional mortgages, VA loans, USDA loans, and jumbo mortgages |

| Car loan | Eligible, but youll have to pay a higher interest rate | |

| Private student loan | Usually eligible without a cosigner | |

| Personal loan | ||

| Eligible, though you might not get the best interest rates | ||

| Secured credit card | ||

| Usually eligible without a deposit | ||

| Utilities | Eligible, but you may need to pay a deposit if youve previously had any late payments | |

| Charge cards | Sometimes eligible |

In addition to helping you qualify for better credit card and loan terms, having good credit can help you snag your dream job or apartment. This is because many landlords and employers run credit checks. A high score can also save you money on services like insurance.

However, if you want the very best rates and terms on your loans and credit cards, then there are still some things you can do to further improve your credit score. This is easy to do once you understand how credit scores work and how theyre calculated.

What Counts Towards Your 713 Credit Score

In essence, your credit score tells you whether YOU have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 713 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

How To Read Your Credit Report

Your credit reports contain both personal information and financial information. Your credit reports illustrate who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. A credit report is the report card of your credit life and understanding how to read it can help you take control of your credit and be prepared for any of your future credit needs.

Don’t Miss: When Does Chase Report To Credit Bureaus

Breakdown Of A Credit Score Rating

So far, this article has only discussed two of the credit score groups which you could move into Good credit score group and Excellent credit score group but there are a range of others that you could fall into if you do not manage your debts very well. These are fair, poor and bad.

A fair credit score would fall into the 650 699 range, if you fall into this bracket it means that you have likely missed a small number of payments on a debt. In general, around 15% of people fall into this category. A poor score means that you have missed several payments over an extended period or have missed a payment on multiple occasions. In can also mean you have a lot of debt at present and would be unlikely to be able to repay any further loans, about 20% of people have this rating.

At the bottom of the scale is a bad score, here you are likely to have had a legal judgment registered against you or in a worst-case scenario been declared bankrupt at some point. The main factor driving you credit score is how well you have managed to make repayments and as shown above these drive your credit rating which is especially true in this case. If you are in this bracket you are in the 8% of the borrowing population.

Your Score Falls Within The Range Of Scores From 670 To 739 Which Are Considered Good

The usefulness of a credit score is in the eye of the lender. Get collections off your credit report as noted above. You can get rv loans rates with a 657 credit score so, good luck getting your loan. The total paid amount will be $37179.49. 713 is a good credit score. Your score falls within the range of scores, from 670 to 739, which are considered good. However, your interest rate may be somewhat higher than someone who has very good or excellent credit. Consumers in this range may qualify for better interest rates from lenders. But it doesn’t quite work out that way in practice. The answer is that credit score under 713 is considered a good score and is actually very close to even qualifying the holder as an excellent credit risk. If you are wondering if 713 credit score is good or bad, then you have no need to worry. Someone with a credit score of 713 will probably be able to get a loan with good interest rates and favorable terms. Good score range identified based on 2021 credit karma data.

If i had figured out the statement date/credit reporting date i would have had a normal rate. A 713 fico® score is considered good. is in this range. Whenever possible, it’s a smart thought to set something aside for an upfront installment, especially if your credit is awful. Mortgage, auto, and personal loans are relatively easy to get with a 713 credit score.

Also Check: Which Credit Score Is Used To Buy A Car

How To Get A 713 Credit Score

While theres no sure-fire way to achieve an exact credit score, theres plenty you can do to build and maintain your credit within a range. Most importantly, youll want to practice healthy credit habits.

Even with so many different credit scores out there thanks to different scoring models and different credit bureau data some general principles apply. Most credit scores take into account at least five main credit factors.

Heres a breakdown of each factor and how it can affect your overall credit.

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

Don’t Miss: What Credit Score Do You Need For Best Buy

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

How Do Credit Scores Work

Credit scoring models analyze credit reports from the three major and assign a score to the consumer based on that data.

There are different credit scoring systems available, and each lender will favor one over the other. Some are for general use, while others are tailored to specific lending industries like mortgage and auto loans.

Both FICOand VantageScore provide free credit scores and tools that help identify bad credit and create personal finance plans.

Also Check: Does Requesting Credit Increase Affect Score

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| -53 | 688 |

Given time, you can get your credit score into the top ranges. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down.

Regardless of your circumstances, there are steps that you can take immediately to increase your credit score.

You May Like: Is 654 A Good Credit Score

So Can I Lease A Car With A 713 Credit Score

There are two kind of leasing deals namely the normal deal and the promotional deal. A promotional car lease deal is one offered via auto makers and their merchants temporal period . The arrangements are vigorously promoted and can be seen on car organization sites.

As a rule, these extraordinary arrangements depend on lessened costs, and helped lease-end residual value. Besides, there might be mileage confinements and up-front installment to be required. When you will try to lease a car with 713 credit score, keep in mind that only people with good or excellent score point are entitled to this promotion the reason being that most car companies go on loss because some people do not fulfill the lease agreement most of the time.

Is A 713 Credit Score Good

Asked by: Luisa Murphy

A 713 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Read Also: Do Lawsuits Go On Your Credit Report

Can You Get A Personal Loan With A Credit Score Of 713

Most lenders will approve you for a personal loan with a 713 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

Summary Of Moneys Guide To Credit Scores

A credit score measures your creditworthiness and guides the creditors lending decisions on loan rates, terms, and loan amounts. Credit scoring companies use data from your credit report a detailed record of your borrowing history and behaviors to calculate your credit score. A healthy credit score is founded on good borrowing practices: on-time payments, moderate debt amount, and low credit utilization.

You need a good credit score to qualify for better loan terms and interest rates. A poor credit score does not prohibit you from borrowing money, but its a big obstacle for mortgage or car loan applications. Low credit limits your lender options, raises your interest rates, and can even disqualify your loan application.

- Categories

Also Check: Do Checking Accounts Affect Credit Score

How Do I Check My Credit Score

You can check your credit score for free with the Finder app. It’s a secure way to find your credit score and your credit report so you know exactly where your finances are at. We’ll update it automatically every month, let you know if your score has changed and will give you handy tips to improve it. Getting your credit score through the Finder app also unlocks additional benefits like finding out how likely you are to be approved for a personal loan or credit card.

1. Average credit score in Finder’s member database from June 2018 to February 2021.

Credit Score: Good Or Bad

At a glance

713 is a good credit score. Scores in this range are high enough to get most types of credit, but you might not qualify for the best interest rates. Well explain what financing you can get with a score of 713 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or instantly boost your credit score for FREE with Experian Boost.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Recommended Reading: How To Raise Your Credit Score 50 Points