What Credit Score Does Car Dealers Use

The FICO credit score. The FICO credit scoring model is the most commonly used credit scoring model by auto lenders and car dealerships, and is also the oldest and first-ever credit scoring model. It’s estimated that 90% of auto lenders use the current FICO Score 8 model when making lending decisions.

Why Is Experian Credit Score Important

Your Experian credit score basically is an indicator of your loan repayment capability and is, in fact, the first thing that lenders check when you submit a credit card/loan application. Hence, if you want to stand a chance of getting a loan or a credit card from a financial institution at attractive repayment terms or borrowing rates, you must ensure that your Experian credit score is in a range that lenders consider ideal . If your Experian credit score is lower than that, you may get a loan or credit card at unfavourable repayment terms. If your credit score is even lower , chances are that your credit card/loan application will get rejected.

Monitor Your Credit Report And Score

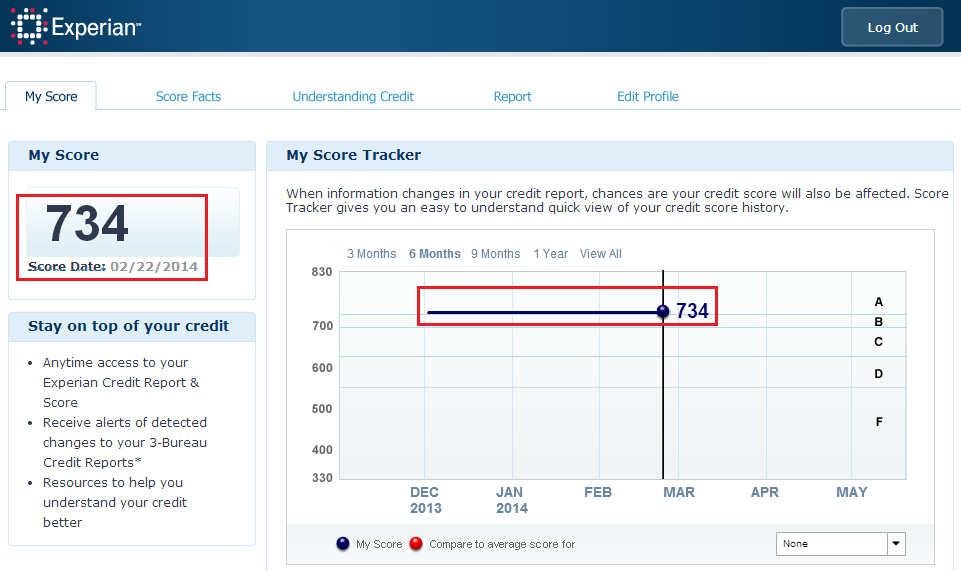

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Don’t Miss: How To Obtain A Free Credit Report

Who Experian Boost May Be Best Suited For

Experian Boost may be best for an individual who has been making on-time cell phone, utility and/or service payments for some time but has never opened a credit card or another type of loan account.

Experian Boost doesnt work for everyone, though. The free feature is best suited for individuals who pay their telecom, utility or service bills through an eligible account. If the feature doesnt work for you, you can try other methods to boost your credit scores.

Nevertheless, with how fast it is to set up an account with Experian and start the process, it might provide an easy way to raise your credit score by a few points.

The Perfect Credit Score May Vary

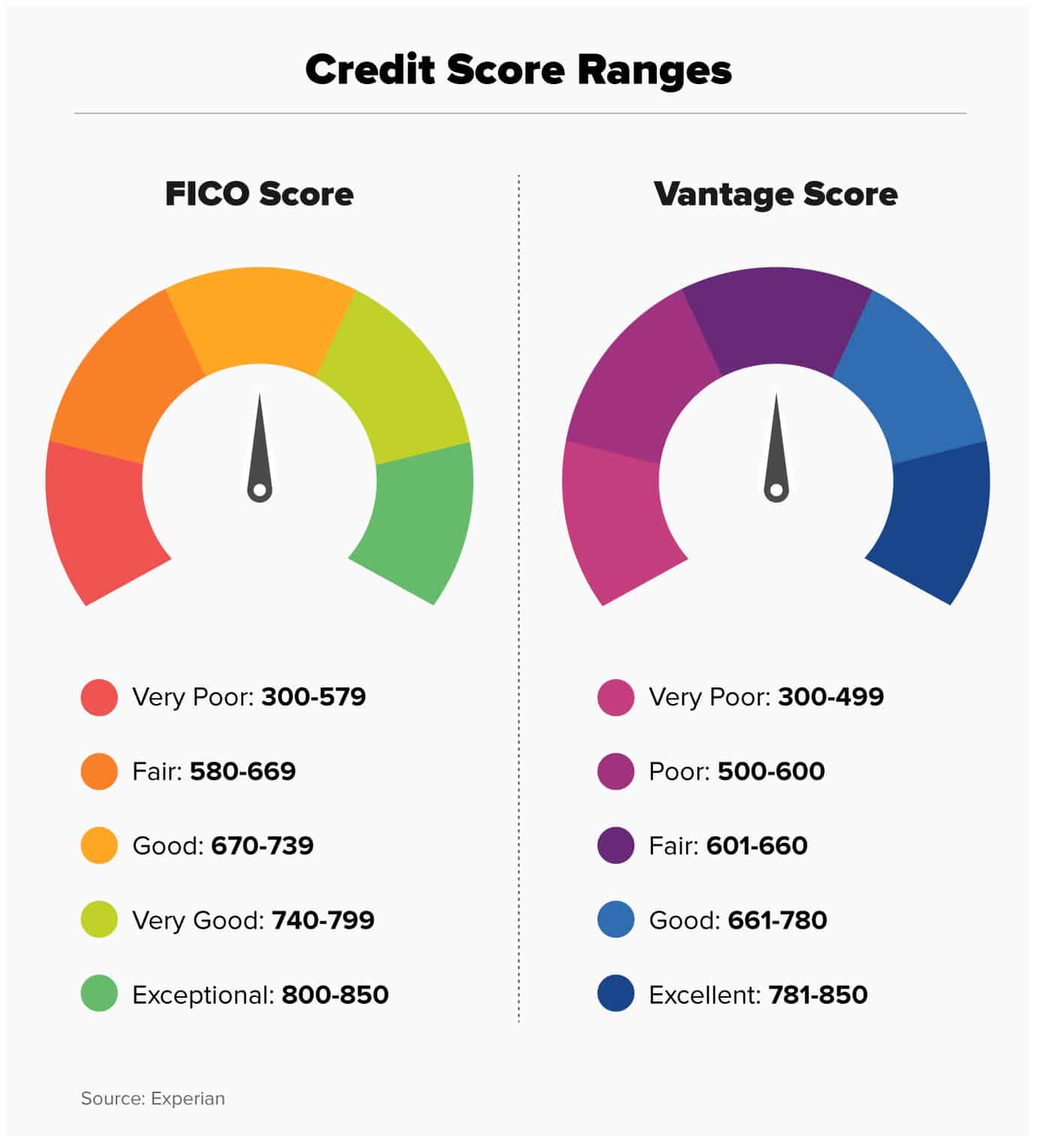

Ask most people what constitutes a perfect credit score, and you’ll likely hear 850. That’s correct with respect to the generic FICO® Score used in most lending decisions, but it’s not always the right answer to the question.

The generic FICO® Score has a score range of 300 to 850, so a perfect score on that scale is, of course, 850. The same is true of the most recent scoring models from FICO competitor VantageScore®: Its VantageScore 3.0 and 4.0 models also use a 300 to 850 scale. So while FICO and VantageScore use different mathematical formulas to measure your creditworthiness , 850 is a perfect score on both companies’ generic scores.

But many, many scoring models exist, with different score ranges and measures of perfection that differ with their numerical scales. For instance, the first two versions of the VantageScore model, VantageScore 1.0 and 2.0, use a scale of 501 to 990, so 990 is their perfect ideal.

FICO also offers specialized industry scores, the FICO Auto Score and the FICO Bankcard Score . Each score is calculated differently, but both share a score range of 250 to 900, so perfection for each is a score of 900.

Recommended Reading: How Do You Unlock Experian Credit Report

Why Is It Important To Check Your Experian Credit Score

As checking your Experian credit score is a free process, it is important to do so on a regular basis. That way you can track your score and see how it changes over time, especially if you are trying to improve your score.

As checking your Experian credit score is a free process, it is important to do so on a regular basis. That way you can track your score and see how it changes over time, especially if you are trying to improve your score.

What Exactly Is A Credit Score

A credit score is a three-digit number used by lenders to determine whether you qualify for credit, such as a loan or credit card. Your credit score is based on your credit report, which is a record of your credit history and how youâve managed your finances in the past. This allows lenders to assess your level of risk when you apply for credit.

Read Also: Is 781 A Good Credit Score

Experian Vs Credit Karma: Whats The Difference

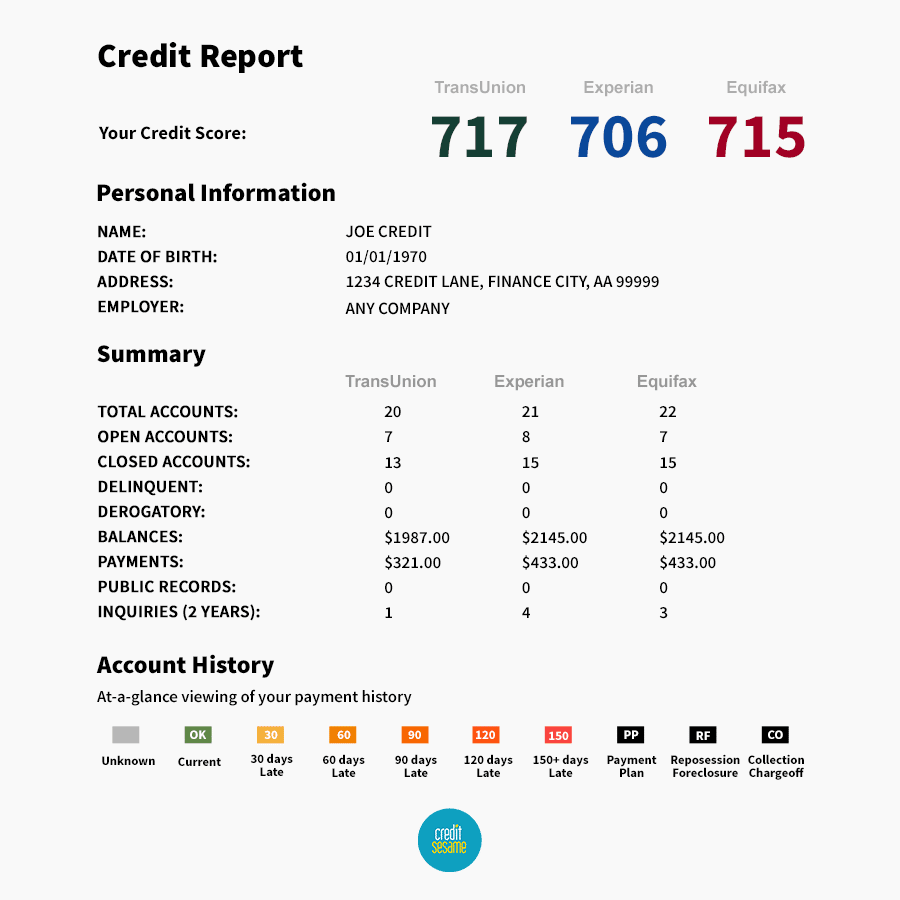

Experian is one of the three major credit bureaus, along with Equifax and TransUnion. These companies compile information about your credit into reports that are used to generate your credit scores.

Instead, we work with Equifax and TransUnion to provide you with your free credit reports and free credit scores, which are based on the VantageScore 3.0 credit score model. We also offer recommendations for credit cards, personal loans, auto loans and mortgages.

What Is A Good Credit Score

Quick Answer

A credit score is a three-digit number that is calculated from information on a credit report and generally ranges between 300 and 850. A good credit score is 670 to 739 on the FICO® Score range, while a credit score of 661 to 780 is good on the VantageScore® range.

In this article:

A credit score ranges from 300 to 850 and is a numerical rating that measures a person’s likelihood to repay a debt. A higher credit score signals that a borrower is lower risk and more likely to make on-time payments. Credit scores are often used to help determine the likelihood someone will pay what they owe on debts such as loans, mortgages, credit cards, rent and utilities. Lenders may use credit scores to evaluate loan qualification, credit limit and interest rate.

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750. In 2021, the average FICO® Score in the U.S. reached 714an increase of four points from the previous year. Higher scores can make creditors more confident that you will repay your future debts as agreed. But creditors may also set their own definitions for what they consider to be good or bad credit scores when evaluating consumers for loans and credit cards.

Don’t Miss: How Do You Get Your Credit Report

Understand The Benefits Of A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 36% of people with FICO® Scores of 680.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Fico Vs Experian Vs Equifax: An Overview

Three major compile information about consumers’ borrowing habits and use that information to create detailed credit reports for lenders. Another organization, Fair Isaac Corporation , developed a proprietary algorithm that scores borrowers numerically from 300 to 850 on their creditworthiness. Some lenders make credit decisions strictly based on a borrower’s FICO score, while others examine the data contained in one or more of the borrower’s credit bureau reports.

When seeking a loan, it is helpful for borrowers to know their FICO score, as well as what is on their credit bureaus reports, such as those from Experian, Equifax, and TransUnion. A borrower who appears stronger under a particular scoring or reporting model should seek out lenders that use that model. Given the crucial role a good credit score and credit reports play in securing a loan, one of the best credit monitoring services could be a worthy investment to ensure this information stays safe.

You May Like: What Is A Fair Credit Score To Buy A House

Create A Budget Calendar

The tricky part of managing biweekly paychecks is ensuring you’re always on track to cover your expenses. To see what you’re working with, add all of your fixed bills to a calendar. This will help you visualize when your bills fall and allocate your income accordingly.

If the majority of your fixed expenses fall at the same time, such as at the beginning or the end of the month, consider seeing whether the payee allows you to choose when payments are due. Adjusting even a couple of your payment due dates can make a big impact when it comes to spreading out your expenses.

Alternatively, you can allocate a portion of your funds in each of your paychecks to go toward expenses, even those that aren’t due for multiple pay periods. An app like You Need a Budget can help you direct a portion of your pay to future goals. Another benefit of this approach is that you’ll get ahead of your bills, and you won’t find that you have drastically more or less spending money in certain pay periods than in others. That can make it easier to get into a sustainable spending-saving routine.

How Important Is It To Check My Experian Cir On A Regular Basis

Checking your Experian credit report on a regular basis is important for two reasons:

- It helps you make an informed credit decision regarding big purchases, such as buying a car or a home. A high Experian credit score increases your chances of getting a loan approved at a low-interest rate.

- It helps you spot errors in advance on the credit report, if any. You can then raise a dispute with the credit bureau and get them rectified. If inaccurate information goes unchecked, it can harm your credit score and interfere with future loan approvals.

Also Check: Why Is My Credit Karma Score Lower Than Fico

Where Can I Check My Business Credit Score

The best way to understand your business credit reports and scores is to see them for yourself. Heres where to go to access your score and report:

Experian: Visit Experians website to access your Experian business credit report or sign up for Business Credit Advantage credit monitoring.

Credit monitoring can also help you stay on top of your businesss credit. Experians Business Credit Advantage provides access to your current business credit file, sends alerts when any changes occur, and even offers tips for improving your companys credit standing.

How Can You Get Your Experian Credit Scores

If youd still like to access your Experian credit score, you can find it for free in several places.

Experians free CreditWorks Basic service updates your credit score every 30 days. Experian also operates freecreditscore.com, another place where you get your free Experian FICO score once a month.

Some banks and credit card issuers, like Discover, also offer complimentary Experian-based FICO® credit scores.

And if youre willing to pay, Experian and FICO both offer premium services through which you can access your credit scores on a more regular basis. These services offer other benefits, too, such as access to your credit reports and credit- and identity-theft monitoring and support. But we believe strongly that you should never have to pay to access your credit scores or credit reports.

Also Check: Does Closing An Account Hurt Your Credit Score

How Will The Experian Credit Score Affect My Loan Applications

The higher your Experian credit score, the better are your chances of getting a loan. If your Experian credit score is above 750, you stand a decent chance of getting a loan at favourable interest rates. On the other hand, the lower your credit score, the lower are your chances of getting a loan. If your Experian credit score falls below a certain threshold , your loan applications are likely to get rejected.

How To Get Your Experian Credit Score For Free

The largest credit reference agency offers new customers a free 30-day trial of its , which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

You can access your Experian credit score through a free Experian account. This is designed to help people shop around to see how they can save money by comparing credit deals based on their financial profile.

Once you’ve signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you won’t be able to see your credit report.

To be able to access both your Experian credit report and score for free, you can sign up to the Money Saving Expert Credit Club.

You can also see how likely you are to be accepted for the market-leading cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you won’t receive alerts about any changes to your report.

Recommended Reading: Does Credit Karma Hurt Your Score

How To Check Experian Credit Score Online

Note: As per the RBI directive, you can get a free credit report from Experian every year. However, for every successive credit report requested in the same calendar, youâll be charged a fee of â¹399.

- Step 1. Go to Experian official website.

- Step 2. Enter your name as on your PAN card, mobile number, and email. An OTP will be sent to your mobile.

- Step 3. Youâll be directed to another page where youâll need to enter your date of birth, PAN card number, gender, and address. Tick the declaration box and click on the âGet Reportâ button.

- Step 4. You will then be taken to the payment page where youâll have to pay a fee of â¹399 to access your Experian CIR and credit score.

Make Payments On Time

If you pay your account in full and on time, lenders will see you as a responsible borrower and hence would want to work with you. Furthermore, it will prove that their investment will yield a return. You should also contact your creditor if youre 30 days or more late. However, this means that the creditor might want to report you to credit bureaus. If thats the case, you can ask the creditor to reconsider reporting your late payment if you can make it up.

Read Also: How To Boost My Credit Score 100 Points Fast

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

How To Lift A Freeze

You can lift a freeze on your credit report online, or by contacting each credit bureau by mail or phone. The online options may be the easiest and fastest.

To unfreeze your TransUnion or Equifax credit reports, youâll log in to each account and choose to temporarily or permanently lift the freeze. With a temporary thaw, you select the start and end dates for the thaw.

Experian takes a different approach. You can manage your Experian credit report through the Security Freeze Center without creating or logging in to an account. Instead, youâll use your personal information and the PIN you were emailed when you froze your Experian credit report to temporarily or permanently remove a credit freeze.

If you donât remember your PIN, you can retrieve your PIN by verifying your identity through the Security Freeze Center. Or, you can verify your identity as part of the thaw request rather than using a PIN.

Additionally, Experian lets you create one-time-use codes you can use to give a single creditor access to your Experian credit file. It could be a good way to let a creditor check your report without having to thaw it entirely. Be sure to ask the creditor before relying on these codes, however, since some creditors might not have systems in place to use them.

You May Like: Why Is A Credit Report Important