Show Article Sources 1 Free Credit Freezes Are Here Federal Trade Commission

Mike Azzara has covered technology and financial services issues for more than 30 years as a writer, editor, publisher, consultant, and analyst for media brands, startups, and established corporations.

All content is written by freelance authors and commissioned and paid for by American Express.

Related Articles

What Is A Credit Bureau

Three major credit bureaus gather and store our credit information. For example, your report includes any open accounts, payment history, and any delinquencies, collections, repossessions, or bankruptcies. These credit files can also contain addresses, current and past, job history, etc.

Lenders supply much of the information in a credit bureaus file on us. When a lender requests the background on a potential borrower, the credit bureau provides whatever information it has collected.

Three major credit bureaus collect and report your credit information:

Well provide more information below on these credit bureaus and their role in freezing your credit.

Unfreezing Your Credit Is Simple

Online toolsas well as phone and mail-based optionsmake it easy to unfreeze your credit file in a timely, secure manner. Whether you need to temporarily thaw your credit file or permanently unfreeze it, you can work with each bureau to make your report available to external parties when the need arises.

You May Like: How To Remove Freeze Off Credit Report

A Credit Freeze Can Protect You From Identity Theft

Having your identity stolen is no stroll along the beach. Victims of identity theft often suffer for months and even years after it occurs. Clearing your name takes time and effortand sometimes money. It can seem like youre doing time, even though you werent the one who committed the crime.

To prevent your identity from being stolen or further identity theft after your identity has already been stolen, you might consider freezing your credit report, a free service that all three major credit bureaus offer.

Place A Credit Freeze

![How to Freeze Credit Report in 5 Minutes [Easy Online Process]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-freeze-credit-report-in-5-minutes-easy-online-process.jpeg)

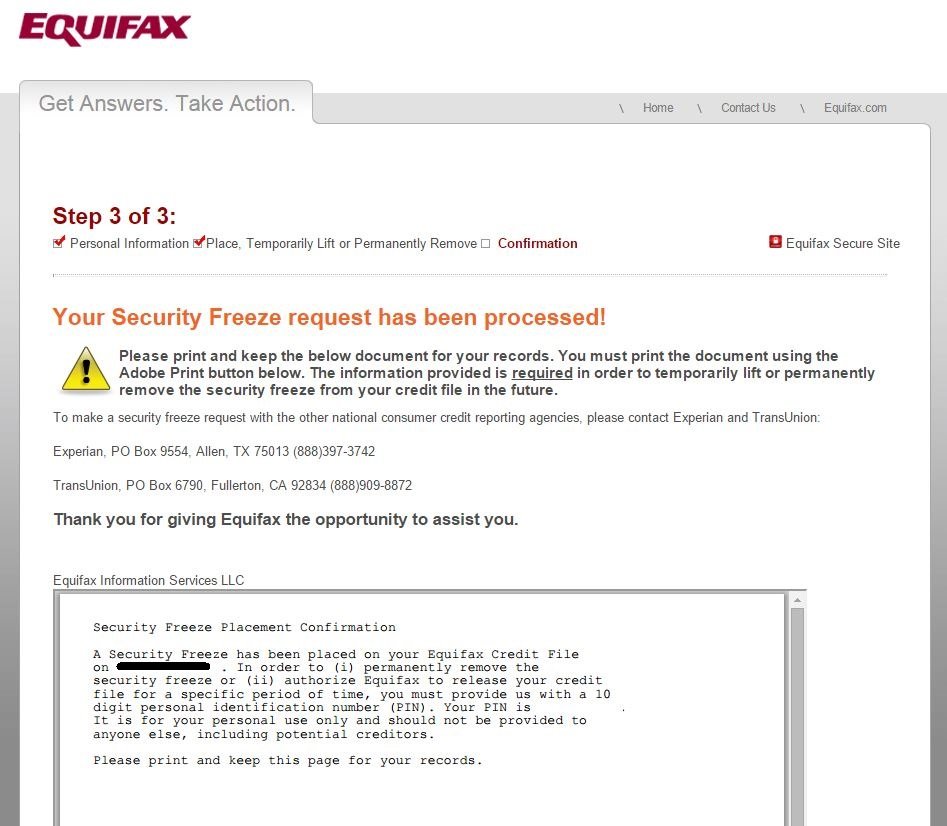

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: What Do Employers Look For In A Credit Report

What Is A Security Freeze

A security freeze is a step you take to prevent credit, loans and services from being opened in your name without your permission. You will need to request a freeze with each of the three credit reporting companies. It is important to know that if you place a security freeze on your credit report, businesses will not be able to obtain a copy of your report in connection with any new applications for credit. Before you apply for new credit, you will need to temporarily lift the security freeze following the procedures from the credit reporting company where you placed the freeze.

Free Security Freezes By Mail

Your letter should include:

- Your full name including middle initial and any suffix

- Your home addresses for the last five years

- Your Social Security number and date of birth

- Two proofs of residence

- Police or DMV report if youre a victim of identity theft

Note: The credit bureaus already have your name and other personal information in their files. You will be providing it to verify your identity.

Don’t Miss: How To Remove Multiple Late Payments From Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can I Still Get My Free Annual Credit Report If My File Is Frozen

Yes. To order your free annual credit reports, see our How to Order Your Free Credit Reports. For Experian and TransUnion reports, use the regular procedures for ordering. For Equifax, order by mail using the form included in How to Order Your Free Credit Reports and also provide the PIN issued to you by Equifax when you freeze your file.

Read Also: Does Chapter 13 Trustee Monitor Credit Report

The Pros And Cons Of Freezing Your Credit

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

In a world where data breaches are increasingly common, many Americans are taking action to protect against credit and identity fraud. Freezing your credit can be an effective way to ward off identity thieves and save yourself a lot of headaches and money down the road.

A temporarily suspends anyone from accessing your credit report, which means neither you nor identity thieves can open new lines or credit or loans in your name. Think of it as locking away a valuable item for safekeeping until you need it again. When that time comes, you can unfreeze your credit report and once again allow lenders access. Freezing and unfreezing your account does not affect your credit score.

To freeze and unfreeze your credit, youll need to contact all three national credit bureaus by phone, online or in writing.

Cons Of Freezing Your Credit:

- It doesnt stop someone from stealing your personal information or hacking into an existing account.

- You have to lift the freeze if you want to open a new line of credit.

- It could slow down any applications that require a credit check.

- You have to keep track of a PIN number.

Now that weve covered the credit freezing basics, lets take a look at some other ways to protect your identity.

Read Also: How Is Your Credit Score Calculated

Drawbacks Of Credit Freezes

Every time you want to view your credit reports yourself or allow a creditor to do so, you must provide your PIN. If you lose track of this number, your creditors will be unable to view your report and will likely deny your application, since they can’t assess your creditworthiness. You can still get the credit freeze lifted, either temporarily or permanently, but you must go back to the credit bureaus and fill out additional paperwork to prove that you are not an identity thief.

In the past, you also had to pay for credit freezes and unthaws. But as of September 21, 2018, the credit bureaus are now required to offer you these for free.

Perhaps the biggest downside to credit freezes is that all of the hassle might not stop identity thieves. While a freeze will most likely prevent them from opening new accounts in your name, it cannot prevent fraud on your existing accounts. If thieves get hold of your credit card number, for example, they can still run up a bunch of charges in your name, credit freeze or no.

Which Fraud Alert Is Right For You

Fraud Alert

Extended Fraud Alert

Active Duty Alert

Place when youre concerned about identity theft. It makes it harder for someone to open a new credit account in your name. Its free and lasts 1 year.

Place when youve had your identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years. Its free and lasts 7 years.

Place when youre on active military duty. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 2 years. Its free and lasts 1 year.

What to do if your information is exposed in a data breach

You May Like: How To Calculate Credit Score Points

Information You Need To Freeze Your Credit At All 3 Bureaus

Its a good idea to gather all the documents you will need before initiating a credit freeze. While all three credit bureaus have slightly different requirements, here is the information you will generally need to provide:

-

Social Security number.

Depending on how you initiate the credit freeze online, by phone, or by mail you might also need:

-

Copy of your passport, drivers license or military ID.

-

Copy of tax documents, bank statements or utility bills.

-

Proof of address, like a utility bill.

Note: If you freeze your credit by phone, be prepared to answer some authentication questions, too.

Once a credit freeze is in place, it secures your credit file until you lift the freeze. You can unfreeze credit temporarily when you want to apply for new credit.

Identity Theft Victim Steps To Take

If you believe your information may have been stolen and used fraudulently, it can be hard to know what to do and where to report it. So, here are a few things to consider if you believe you’re a victim of identity theft:

The FTC advises you to keep a record of the calls you make and the people you speak to, and keep copies of any letters you send or receive. Its also a good idea to keep a written record of other actions you take, such as closing accounts or disputing charges.

Recommended Reading: How To Increase Credit Score To 800

What Does Freezing My Credit Do

What is a credit freeze? When you freeze your credit, the credit reporting bureaus canât give any information to anyone who makes an inquiry about you. Typically, businesses inquire about your credit when you are trying to, for instance, open a new credit card, buy a car or rent an apartment. The credit check helps the business determine if they want to lend or rent to you, and it can help set your rates and lending terms for loans and credit cards.

When you freeze your credit and the business canât get any information about you, it typically stops the process â which means a fraudster will be unable to open an account while using your identity.

What Are The Pros And Cons Of Freezing My Credit

Freezing your credit prevents creditors from checking your report before opening a new account. That stops an identity thief from opening an account in your name. However, it also prevents you from getting new credit until you lift the freeze.

When you apply for new credit like a mortgage, ask which credit bureaus the lender checks, then temporarily stop the freeze on those accounts.

Lifting the freeze is quick and easy, as long as you keep track of your password or PIN. TransUnion says the freeze is usually lifted as soon as you request it but advises allowing an hour for the account to open up.

Creating a freeze doesn’t affect your credit score or any credit lines you already have. If your credit file is locked and someone steals your credit card number, they can make charges on the account, so freezing your credit doesn’t stop all illegal activity.

Also Check: Is 689 A Good Credit Score

Can Anyone See My Credit File If It Is Frozen

When you have a security freeze on your credit file, certain entities still have access to it. Your report can still be released to your existing creditors or to collection agencies acting on their behalf. They can use it to review or collect on your account. Other creditors may also use your information to make offers of credit unless you opt out of receiving such offers. See below for how to opt out of pre-approved credit offers. Government agencies may have access for collecting child support payments or taxes or for investigating Medi-Cal fraud. Government agencies may also have access in response to a court or administrative order, a subpoena, or a search warrant.

The Cons Of Freezing Your Credit

- A credit freeze isnât guaranteed to be 100% effective

- You need to contact each credit reporting agency individually to issue a credit freeze and then subsequently to lift the freeze

- Youâll need to plan ahead when opening a new credit account since youâll need to request a temporary lift of the credit freeze

As you can see from the list of pros and cons, there are tremendous benefits to freezing your credit, while the downside mostly deals with convenience. I think itâs a small price to pay for the security that it offers.

If youâve ever had to dispute anything on your credit report or deal with a fraudulent account, then youâll know that the amount of time it takes to instate a credit freeze is time well spent. The time involved in getting a credit freeze from the major credit bureaus pales in comparison to the hassle of disputing an error on your credit report.

If you are ready to freeze your credit, hereâs what you need to know.

You May Like: What Is A Closed Account On Your Credit Report

How Does A Credit Freeze Compare With A Fraud Alert

If you’ve been a victim of identity theft or suspect your personal information is otherwise being abused by criminals, you can limit most access to your credit reports by requesting security freezes at all three national credit bureaus. Doing so can limit unauthorized credit checks, but can also limit processing of your own legitimate credit applications.

While a to your credit report until you lift it, fraud alerts are temporary. An initial fraud alert remains for one year, while an extended alert remains for seven. And while freezes must be removed before most access is granted, fraud alerts give lenders access to your credit reports and ask that they verify your identity before processing credit applications made under your name.

Compared with the process of lifting and reapplying a credit freeze at all three credit bureaus anytime you need to allow access to your report and scores, a fraud alert offers a more convenient and potentially safer alternative. A fraud alert stays in place while you continue to use your credit as normal, and won’t need to be lifted like a credit freeze would.

Unlike a credit freeze, when you request a fraud alert at any one of the three credit bureaus , alerts are automatically placed at all three bureaus. Removing fraud alerts before they expire will require you to contact each bureau separately.

How Do I Freeze My Credit

The three major credit card companies all give you the option of freezing your credit. When your credit file is frozen, creditors can’t check your report, preventing someone who has your personal information from opening a new credit line in your name.

If you want to apply for new credit or a loan, you can lift the freeze with a PIN or a phone call.

You must freeze your credit individually with each of the three major credit bureaus Equifax, Experian, and TransUnion. They all have a slightly different process. You can apply for a freeze online or by phone. All three have a snail mail option, too, but online is the easiest way to go.

Also Check: Does Debt Consolidation Hurt Credit Score

How To Freeze Your Credit For Free

If you have concerns about account security and identity theft, itâs possible to freeze your credit to keep others from opening new accounts in your name.

Itâs free, but there are a few steps you have to takeâand multiple companies to contact. Hereâs how to freeze your credit, plus other information about credit monitoring and protecting against fraud.

Key Takeaways

- A credit freeze restricts access to your credit reports, which can prevent identity thieves from using your information to open accounts in your name.

- You must request credit freezes separately from each major credit bureau.

- Freezing your credit wonât harm your credit or prevent you from building credit.

- You can unfreeze your creditâtemporarily or permanently.

Unfreeze Your Experian Credit Report

To unfreeze your Experian credit report, log in to your Experian account or create one for free. After you log in, you can navigate to the Help Center, where you can find quick actions to manage your freeze and toggle your freeze status to “Unfrozen.”

You can also call 888-EXPERIAN , or send a request by mail to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

Also Check: What Day Does Wells Fargo Report To Credit Bureaus

Freezing Credit In A Nutshell

Concerned about identity theft or someone stealing your credit card number? Itâs important to take steps to secure your information and identity. Part of that might include freezing your credit.

You can also monitor your credit by regularly reviewing your credit reports. You can get free copies from all three bureaus by visiting AnnualCreditReport.com.

Could It Hurt My Credit Scores

Unfortunately, being a victim of identity theft means your may be negatively impacted. Thieves could open new lines of credit or credit cards in your name — and fail to pay the bills. As debt accumulates and payments are missed, your scores may be negatively affected, because of the payment history associated with the accounts or the increase in your credit utilization. Learn more about what actions can affect credit scores.

After you report the fraud, you can work with collection agencies and banks to get any fraudulent collection accounts, late payments and balances removed from your credit reports. You can also file a dispute with the three nationwide credit bureaus. Visit our dispute page to learn how to file a dispute with Equifax.

Read Also: Does It Hurt Your Credit To Check Your Credit Report