Is Credit Score The Same As Fico Score

To put it another way, your FICO® scores are simply one sort of available to you. This is due to the fact that FICO® is a firm that develops specialized scoring models that are used to calculate your credit ratings. Other companies, on the other hand, utilize different scoring methodologies to establish your credit scores.

Which Credit Score Matters Most

While FICO Score 8 is one of the most widely used FICO Scores, creditors can choose from a variety of credit-scoring models and versions. When youâre looking for a new credit card or loan, for example, the score that matters most is the one the creditor will use to evaluate your application.

You might not know which model the creditor will use, but itâs helpful to know that credit scores are generally calculated using information from your . So you should focus on using credit responsibly over time. A long credit history filled with consistent on-time payments and a low credit utilization ratio could help you build and maintain good credit.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

Fico Scores Vs Credit Scores American Express

Basically, credit score and fico® score are all referring to the same thing. Fico scores are one kind of credit score. While the terms fico score and credit score are often used interchangeably, they are not the same thing. Vantagescore may look at the same factors that the other popular fico scoring .

Don’t Miss: What Credit Score Is Needed To Rent An Apartment 2020

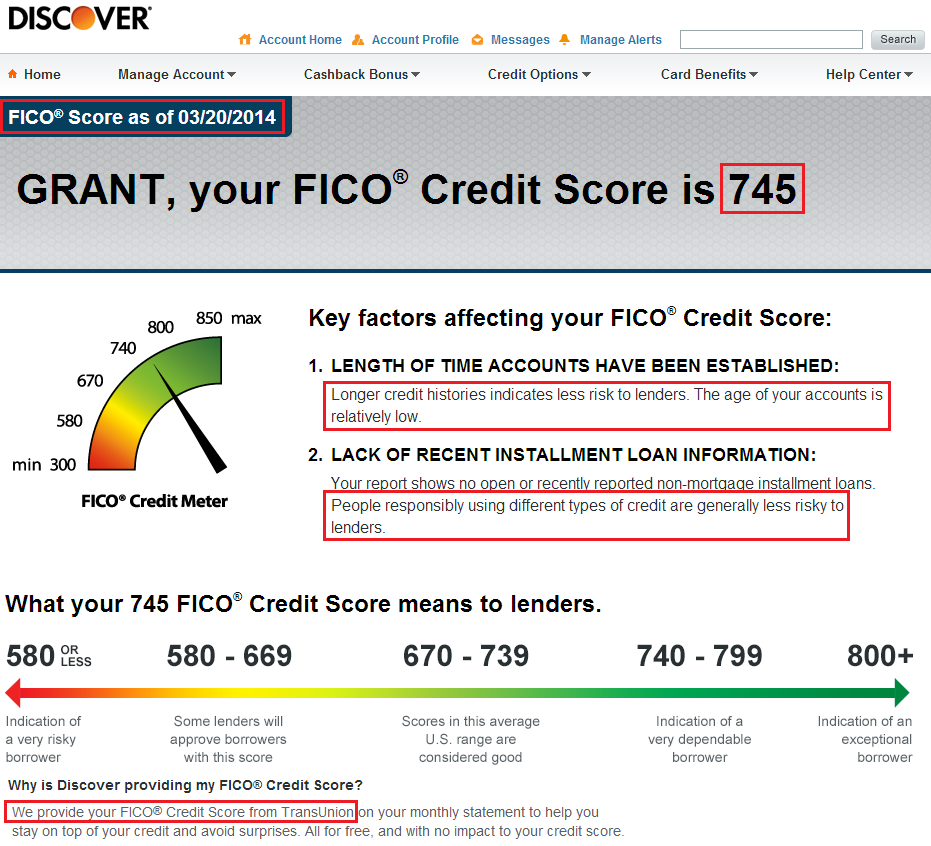

Why Is Fico Score Lower Than Transunion

This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your credit report is pulled from since they don’t all receive the same information about your credit accounts.

Why Do Fico Scores Fluctuate

There are many reasons why your score may change. FICO® Scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a particular consumer reporting agency at that time.

So, as the information in your credit file at that bureau changes, your FICO® Scores can also change. Review your key score factors, which help explain what factors from your credit report most affected a score. Comparing key score factors from the two different time periods can help identify causes for changes in FICO® Scores. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

Your credit report

Read Also: What Is An Acceptable Credit Score

Lets Learn About: Fico Scores

FICO® Scores represent how risky a borrower is when they want to borrow funds from a lender.

FICO® Scores typically consider five components of a persons credit history.

Most lenders use FICO® Scores, but there are other credit scores that are calculated differently from FICO® Scores.

Whether youre new to credit or have been borrowing money for years, youve probably seen the term FICO® Credit Score, yet you may not be sure of what it means. Understanding the basics of your score and how it impacts your credit may help you better understand lender decisions, and help you make wiser choices when it comes to managing your credit and setting useful financial goals. Heres what you need to know about FICO® Scores.1

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Also Check: How To Pull My Credit Report

What Is Fico 9

FICO 9 was introduced in 2016 and is available to both lenders and consumers. While not as widely used as FICO 8, this scoring model has some features that could help certain consumers improve their credit scores.

Here are the most noteworthy aspects of FICO 9:

- Third-party collection accounts that have been paid in full no longer have a negative impact for credit scoring.

- Unpaid medical collection accounts have less of a negative impact compared with other types of unpaid collection accounts.

- Rental history can now be factored into FICO 9 credit scores, which may help people with limited credit history.

FICO 9 credit scores are available to consumers for free through lenders that participate in the FICO Score Open Access program. Your credit card company, for example, may offer free FICO 9 credit scores as one of its customer benefits. Otherwise, youll need to purchase your scores from FICO.

Rent payments arent factored into FICO 9 scores automatically. Your landlord has to report your payment history to one or all three of the major credit bureaus for your rent payments to be included.

What Is A Fico Score Fico Score Vs Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A FICO score is a three-digit number, typically on a 300-850 range, that tells lenders how likely a consumer is to repay borrowed money based on their credit history.

Recommended Reading: How To Bring Up Credit Score

What You Need To Know

After reading the information above, it should now be clear that you dont have just one credit score. You have many. Between the many different FICO and VantageScore versions, there are actually hundreds of different credit scores that lenders may use to evaluate youthousands if you count custom-made models.

When you learn that there are so many different credit score possibilities, its natural to have a few questions.

Why Are Your Fico Scores Important

FICO® scores are widely used by many types of creditors, including lenders, credit card issuers and insurance providers to gauge your credit risk that is, how likely you are to repay the money loaned to you.

The higher your credit scores, the more likely youll end up with better rates and terms on your loan. With lower scores, if youre approved, it may be with worse credit terms than if you had higher scores.

In the case of insurance companies, lower scores could lead to higher premiums.

Knowing your scores may help you determine the likelihood of your application getting approved and whether the creditor is likely to offer you favorable terms. In some cases, a lender may even have a threshold that your scores must meet or pass to get approved.

You can try to check the lenders website or ask a representative to find out whether there is a threshold to be approved and which scoring model the company uses. But some companies may not share this information.

Read Also: How Long Can Collections Stay On Credit Report In Florida

What Is A Fico Score And Why Is It Important

Discover how experts are combatting inflation with Gold with this free report.

Inside Your Report:

- Top Strategies to Hedge Inflation

- Benefits of diversifying with gold and precious metal

- 2022 IRS Loopholes

- Why experts are turning to Gold

Whenever you apply for a loan or line of credit in the U.S., the lender almost certainly pulls your . And before they look at anything else on that report, they look at your FICO score.

While not the only type of credit score, FICO scores are by far the most commonly used. As you aim to improve your credit, it helps to understand exactly how FICO scores work and how to boost yours.

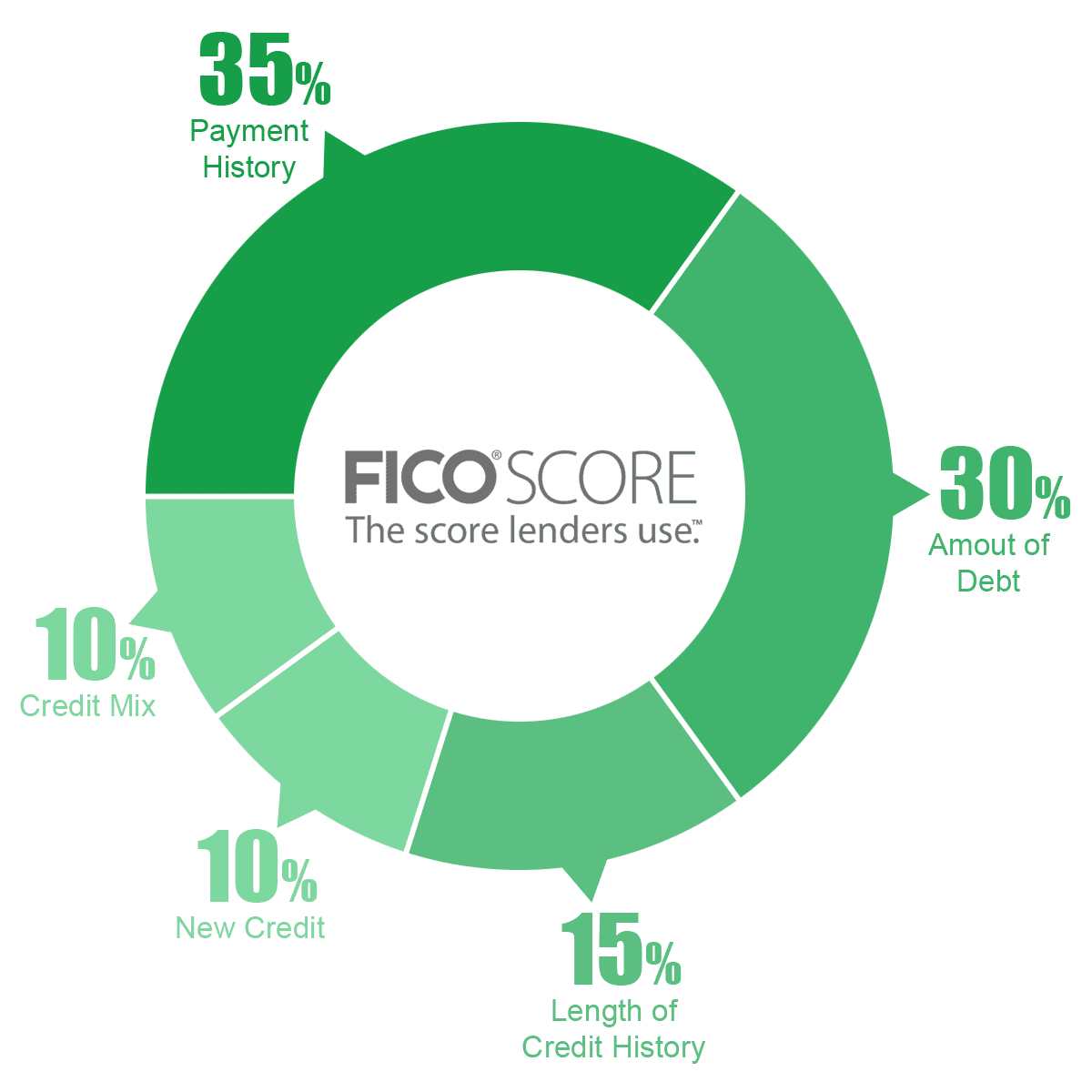

What Factors Contribute To The Fico Credit Score

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

You May Like: How Long Does It Take To Increase Credit Score

When Does A Late Payment Report As Delinquent

If you are less than 30 days late, you may incur late fees on your account, but it will not show on your credit report. Once a payment is at least 30 days past due, it is reported delinquent and can damage your credit score. Credit-reporting agencies track how many times in the past seven years accounts are reported 30, 60, or 90 days late. To limit damage to your score, work to bring your account current as soon as you can and make all further payments on time.

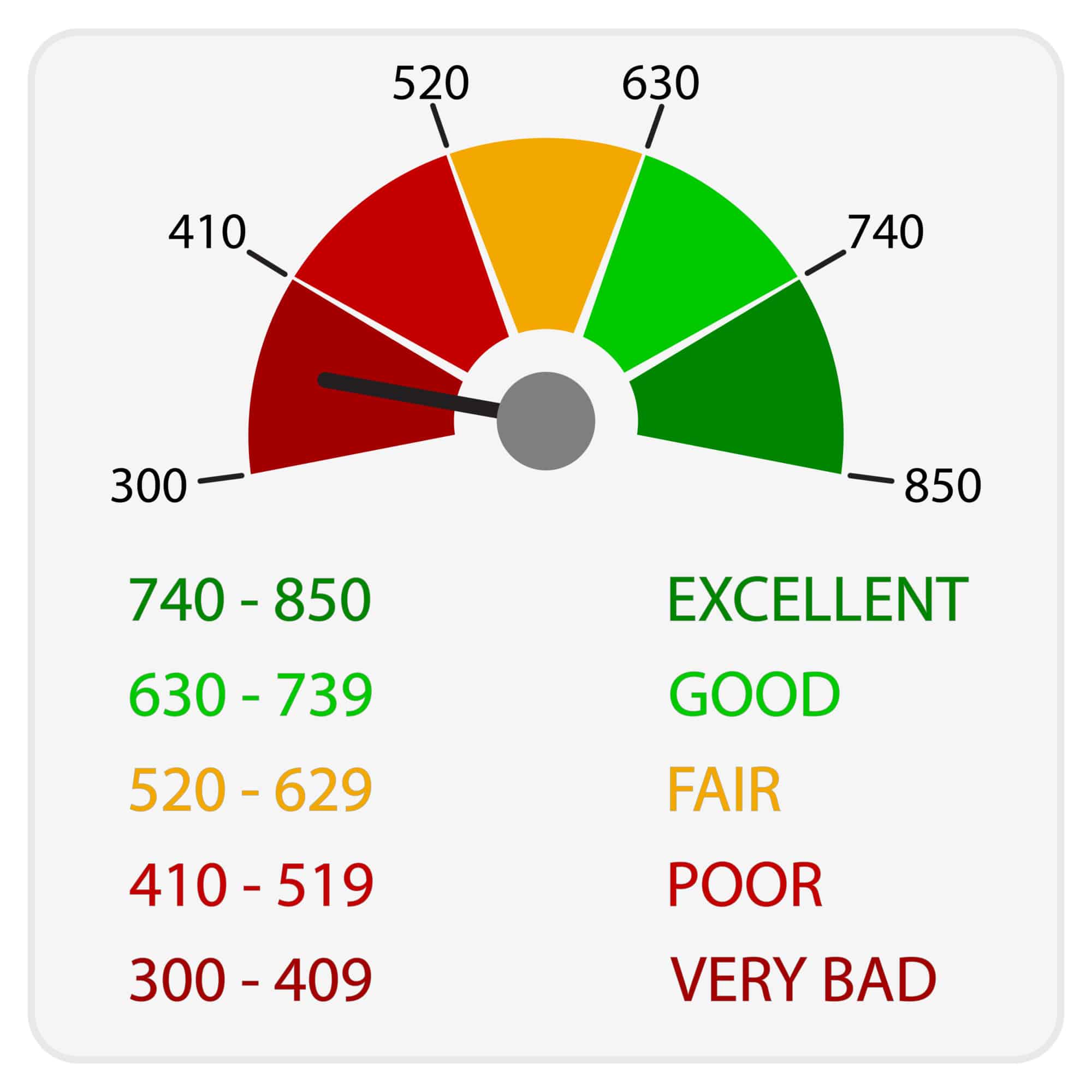

What Is A Good Credit Score

Most credit scores have a 300-850 score range. The higher the score, the lower the risk to lenders. A “good” credit score is considered to be in the 670-739 score range.

| < 580 | Poor | This credit score is well below the average score of U.S. consumers and demonstrates to lenders that the borrower may be a risk. |

| 580-669 | Fair | This credit score is below the average score of U.S. consumers, though many lenders will approve loans with this score. |

| 670-739 | Good | This credit score is near or slightly above the average of U.S. consumers and most lenders consider this a good score. |

| 740-799 | Very Good | This credit score is above the average of U.S. consumers and demonstrates to lenders that the borrower is very dependable. |

| 800+ | Exceptional | This credit score is well above the average score of U.S. consumers and clearly demonstrates to lenders that the borrower is an exceptionally low risk. |

While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.

Recommended Reading: How To Raise Credit Score By 200 Points

What Is A Good Fico Score

Borrowers with higher scores have higher approval odds and greater access to competitive rates. What is considered a good FICO Score depends on the lender or creditor evaluating a consumers credit profile. That said, lenders typically view FICO scores above 670 as good while the official FICO scale classifies scores between 670 and 740 as Good.

Fico Credit Score Range

FICO credit scores range from 300 to 850, and are classified into five categories that represent a consumers likelihood of repaying debts and the amount of risk he poses to lenders. These are the five FICO credit score ranges:

- Poor . A score under 580 is well below average and classified as Poor under the FICO scoring model. Consumers with scores in this range are considered risky borrowers.

- Fair . Still below average, scores between 580 and 669 are considered Fair on the FICO scale. Borrowers with a FICO Score in this range may be approved by many lendersthough they likely wont be offered favorable terms.

- Good . FICO scores in the Good range are at or above the national average. Because of this, most lenders are willing to extend funds to borrowers in this category.

- Very Good . A Very Good FICO Score is in the range of 740 to 799. Because this level of score is above average, it indicates to lenders that the consumer is low risk and likely to pay off their loan on time.

- Exceptional . Consumers with a FICO Score of 800 or above are considered Exceptional. Not only are these borrowers most likely to get approved, but they also have access to the most competitive rates and other loan terms.

Read Also: How To Remove Repo From Credit Report

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

What Impacts Your Fico Credit Scores

FICO® Scores are calculated based on these five categories of information from the consumers credit report:

The importance of these categories may vary for different credit profiles.

Also Check: How To Report A Death To Credit Bureaus

What To Look For When Checking Your Fico Score

Monitoring and checking your credit report regularly is a helpful way to keep track of your finances and keep an eye out on fraud. When checking your credit score and report, you’ll want to check for any errors that could potentially make you seem like an undesirable borrower. With so much information listed on your credit report, it can be overwhelming to figure out what you should focus on. Below are some things you should look for when checking your credit score.

What Is Fico 8

FICO 8 is still the most widely used FICO credit score today. If you apply for a credit card or personal loan, odds are that the lender will check your FICO 8 scores from one or more of the major credit bureaus.

FICO 8 is unique in its treatment of factors such as , late payments, and small-balance collection accounts. Here are some key things to note about FICO 8:

- This scoring model is more sensitive to higher credit utilization .

- Isolated late payments on your credit report may not count against you as much as having multiple late payments.

- Small-balance collection accounts in which the original balance was less than $100 are ignored for credit scoring purposes.

Its also worth pointing out that there are different versions of FICO 8. With FICO Bankcard Score 8, which is used when you apply for a credit card, the focus is on how youve handled credit cards in the past. FICO Auto Score 8, on the other hand, doesnt emphasize credit card activity and history as heavily.

Regardless of which FICO credit scoring model is involved, the same rules apply for maintaining a good score. These include paying bills on time, maintaining a low credit utilization ratio, and applying for new credit sparingly.

Don’t Miss: Does Credit Karma Affect Credit Score

What Is A Credit Bureau

A credit bureau, also known as a consumer-reporting agency, collects and stores individual credit information and sells it for a fee to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

Your score history

Read Our Frequently Asked Questions:

- Your FICO® Score is refreshed quarterly and may not have been available during our last score refresh process.

- Your account with 1st United is new – It may take a month or two for us to populate your score on your statement.

- The FICO® Score we have on file for you is more than 90 days old.

Don’t Miss: Does Rent Show Up On Credit Report