Why Is It Important To Check Your Credit Report

To be a master of your finances, you should know whats on your credit report. A yearly check and revision can help improve your chance of getting loans and credit card applications approved.

- Spotting incorrect personal information. Details of your current address, employment information and other personal details need to be accurate when applying for credit.

- Checking for incorrect negative information. Negative information may include past due or unpaid debts, collections, charge-offs, bankruptcy, court judgements, repossessions or other black marks that would make your credit history look bad to lenders. Any incorrect information needs to be disputed and fixed so your credit report remains healthy.

- Protecting your identity. Its possible that theres an account listed on your credit report thats not yours that needs to be addressed with the credit reporting agencies as soon as possible so your credit score isnt affected.

- Accessing credit. Lenders are more likely to approve your credit application if you currently have little to no debt, have a history of making payments on time and have had a stable job and address.

Warning About Impostor Websites

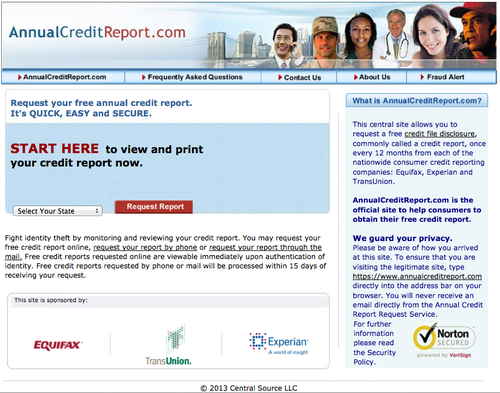

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law: AnnualCreditReport.com. Other websites that claim to offer “free credit reports,””free credit scores,” or “free credit monitoring” are not part of the legally-mandated free annual credit report program.

In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may unwittingly agree to let the company start charging fees to your credit card.

Some “impostor” sites use terms like “free report” in their names others have URLs that purposely misspell Annualcreditreport.com in the hopes that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

Annualcreditreport.com and the nationwide credit reporting companies will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from Annualcreditreport.com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam. Ensure you are on the right website by verifying through the Consumer Financial Protection Bureau .

Can Annualcreditreportcom Be Hacked

While AnnualCreditReport.com takes steps to keep its site secure, hypothetically, your credit report could be accessed if an impersonator had enough of your personal information. Thats what happened in an incident in 2013. Perpetrators were able to illegally access the credit reports of some celebrities using considerable amounts of personal details gathered from other sources, according to TransUnion. As we confirmed at the time, neither AnnualCreditReport.com nor TransUnion was hacked, said David Blumberg, a TransUnion spokesperson.

Keep in mind that even if someone were to obtain your Social Security number, address history, and date of birth, they would also have to successfully answer the identity verification questions. If they dont know who holds your mortgage or the balances on your student loans, for instance, theyd hit a roadblock.

Don’t Miss: Zebit Report To Credit Bureau

How To Get Your Free Credit Report From Credit Karma

Another way to get free credit reports is through , a site that also allows you to keep tabs on your credit score. Credit Karma gives you access to your reports from both TransUnion and Equifax and will even highlight important information to make the reports easier to understand. Your reports can be updated as often as once a week, and you can check them as often as you want.

Team Clark recommends Credit Karma as a free way to monitor your credit. Here is Team Clarks full Credit Karma review.

Why Its Important To Check Your Credit Report

Checking your credit report should be done periodically to screen for reporting errors and unrecognized activity. The first signs of identity theft usually appear on your credit report, and the earlier you spot them, the easier it is to stop the theft. Even if all the information you find is accurate, seeing your credit activity at a glance can give insight into how to manage debt more efficiently and raise your credit score.

Requesting a free credit report should also be an early step in any upcoming plans involving applying for a loan, such as buying a home or car. Pull a copy at least six months before a major purchase because if you do need to work on your credit, dispute errors, etc., it can take several months or longer to address these issues, says Bringle.

As long as youre entitled to a free report, theres no harm in requesting one. A common myth is that getting your own report will hurt your credit scores, says Rod Griffin, senior director of public education and advocacy at Experian. It wont. This is because there are two types of credit checks: hard inquiries and soft inquiries. While the former can temporarily ding your score, the latter which includes requesting your personal credit report will not. Soft inquiries do not affect credit scores or lending decisions, says Griffin.

You May Like: Does Klarna Affect Your Credit Score

How To Get A Free Annual Credit Report From The Government

The Fair Credit Reporting Act entitles all Americans to a free credit report every 12 months. You can make this request via the official government-run website. The credit report contains information from the three major US credit reporting bureaus

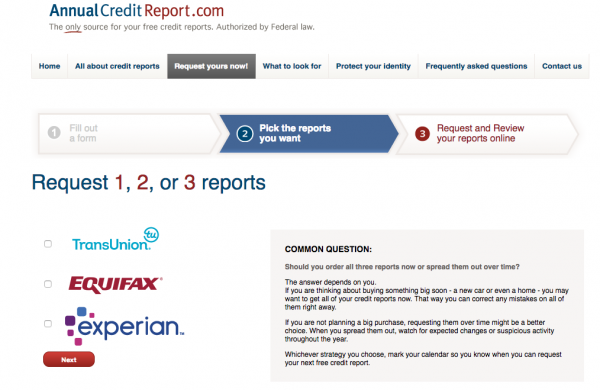

This will take you to a page outlining the three-step process required to request your credit report.

This begins the three-step process.

Is Annualcreditreportcom Safe

To understand the precautions AnnualCreditReport.com takes, its important to have an overview of how the site works. First, you must provide your Social Security number. Youll also need to give AnnualCreditReport.com your first and last name, your current address, and if youve lived there for less than two years, your previous address.

Once you enter that information, the site asks you which credit report youd like to request. You can select one, two, or all three. Perhaps you may want to space out your requests so you are checking on one report every few months.

After making your selection, AnnualCreditReport.com takes additional steps to verify your identity. Youll be asked to review your details to make sure theyre correct. Then youll be asked to answer three security questions. These will vary depending on your situation. For instance, you may be asked what year you took out a car loan, the balance on your mortgagea dollar rangeor to choose a city youve previously lived in from a list. If you answer those questions successfully, youll be able to view your credit report.

Your credit reports wont include your credit scores. Experian, TransUnion, and Equifax can provide those separately, but there are sometimes fees. You can get scores for free from sites such as CreditKarma.com or CreditSesame.com. Many major credit card companies also include free scores monthly as a perk.

Don’t Miss: Does Balance Transfer Affect Credit Score

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

Wallethub: Best For Daily Updates

If its daily updates youre looking for, then give WalletHub a try. It offers free credit scores and reports that are updated daily!

Since it does provide daily updates, you can spot errors, signs of fraud and money-saving opportunities as soon as they appear.

You can even get your report on the go with the WalletHub app.

It also provides detailed credit monitoring and credit improvement, with credit advice tailored to your needs. It offers 24/7 credit monitoring and the site will notify you of important changes.

Its totally free to sign up to the site, with no credit card information required.

Also Check: What Credit Score Do You Need For Amazon Prime Visa

Best For Improving Credit: Creditwise

You can check your TransUnion credit report and credit score through CreditWise, a credit report and credit score tool from Capital One. Credit Wise is available for free, even for those who arent Capital One customers. Sign up is simple and easy. You wont have to enter any credit card information, theres no trial subscription to cancel, and your credit information is updated weekly. You can access Credit Wise online or use the mobile app to keep up with your credit score.

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Recommended Reading: Does Paypal Credit Report To Bureaus

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Beware Of Imposter Sites

The only website you should be using to request a free credit report is annualcreditreport.com.

Unfortunately, some consumers mistakenly visit other websites that show up in online search results. Many of these sites will advertise a free credit report, but later try to upsell you on their paid service or even mislead you into signing up for a subscription.

One example was freecreditreport.com, a website owned by Experian that was forced to settle with the FTC in 2005 for failing to adequately disclose that consumers would be signed up for a $79.95 annual membership. The website still exists and can grant you access to your Experian report for free, but not Equifax or TransUnion. A statement from Experian says freecreditreport.com was created nearly five years before free annual credit reports became required by law and is not represented in any way as a replacement, substitute or alternative to the federally mandated free credit report website.

You May Like: How Do I Unlock My Experian Credit Report

So Which Site Is The Best

The best free credit report site is the one that best suits your needs.

Honestly, Id go with AnnualCreditReport.com because you can check your report from all three of the major credit reporting companies.

The only downside though is that you can only view your report from each company once per year.

If youre looking to take a look at your report more often than that, then Credit Karma and WalletHub are awesome, allowing you to check your report weekly and daily, respectively.

The other sites on the list also offer benefits, from convenience in the case of NerdWallet to credit monitoring in the case of CreditWise from Capital One.

Give these sites a try and ensure that your credit report contains the right information.

Wheres your favorite place to stay up to date with your credit history and score?

Let us know in the comments section below.

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Don’t Miss: How Long Does A Repossession Stay On Your Credit Report

How To Get Your Weekly Free Credit Report

Heres how to access your free credit report every week through April 2021:

- Fill out the form, which asks for your personal information

- Confirm your identity with each credit bureau

- After verification, youll be forwarded to your credit reports

Remember, if you notice a discrepancy or see something that doesnt look right, you can dispute your credit report.

How To Get Your Free Annual Credit Reports From The Major Credit Bureaus

Do you keep track of your credit accounts? When was the last time you checked your ? Well, tracking your accounts and analyzing your credit reports regularly goes a long way in helping you improve your credit score.

Typically, Federal law gives you access to free credit reports once every 12 months from three major Equifax, Experian, and TransUnion.

In this article, well discuss more on credit reports and how you can get your annual credit report from the major credit bureaus. So, keep it here!

To begin with, lets first understand what a credit report is and why it is important.

A credit report is a financial report summarizing your personal credit history. It contains your identifying information such as social security number , name, date of birth, and address, as well as your credit information, including how you settle your debts.

This financial report can affect your borrowing and buying power and even your ability to secure a certain job position or rent a property.

Typically, most lenders scrutinize your credit report anytime you apply for a loan with them to determine whether you qualify for their funding. Some employers also look at your credit report before making a hiring decision.

Having understood what a credit report is, lets now look at how you can get your annual credit reports from the major credit bureaus.

Recommended Reading: Comenitycapital/mprcc

Is Getting A Free Credit Report Safe

A credit report is a useful important document. It helps you obtain a mortgage, a new car, and a student loan. It can impact credit card approvals and maybe even a job application. Getting a free credit report can be safe if you are careful about the particular website from which you get it.

Three major provide credit reports: Equifax, Experian, and TransUnion. These may be the safest routes to obtaining your credit history, which ultimately affects your personal credit score.

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

You May Like: What Is Syncb Ntwk On Credit Report