How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Rbc Royal Bank Mortgage Pre

RBC offers both mortgage pre-qualification and pre-approval. The former is quick and convenient: done through the phone or online, you are required to provide financial information such as income and debt. The lender will then give an estimate of how much they are willing to lend with no obligation.

With a mortgage pre-approval, the lender will actually verify your credit and information although the actual rate or mortgage may differ if you do decide to accept, the lender is obligated to lend to you if you do get pre-approved and meet the conditions. You can apply for anRBC mortgage pre-approvalby filling out their online application form. An RBC mortgage specialist will then take over the rest of the process and let you know what documentation you will need to provide. Typically, if pre-approved you will be able to lock-in a mortgage rate for 120 days.

Case Study: Making Multiple Pre

Lets say you applied for a pre-approval with your bank.

Over the next few months, you start shopping around for a property but the particular suburb youre looking at is a tightly-held real estate market.

It ends up taking you more than 6 months to find the perfect home in a price range that suits your budget.

Because pre-approvals only last for 3 months, you would have had to reapply for a pre-approval.

During this time, you also signed up for a new mobile phone plan after your old plan expired.

Youve essentially added three enquiries to your credit file over a space of 6 months:

- Your mobile phone contract.

- Two mortgage enquiries.

This could spell the end of your home loan application if you were to apply for your second pre-approval with a different bank.

However, if youre applying with the same bank, this shouldnt be an issue.

Thats because they would already have your details on file and the most youd need to provide is a couple of current payslips and a bank statement showing your savings.

Recommended Reading: Does Walmart Do Klarna

Question: Does A Pre Approval Affect Credit Score

Requests for Pre-approved offers will not affect your credit score unless you follow up and request a credit score. Pre-approval means that the lender has identified you as a good potential customer based on the information on your credit report, but it is not a guarantee that you will receive the loan.

What Are The Benefits Of Getting Pre

Home loan pre-approval has numerous advantages. These include:

- You know how much you can borrow, meaning you can search for properties accordingly

- You have 3-6 months until your pre-approval expires, with the possibility of an extension, so thereâs no rush to settle on a property

- Vendors may look favourably on buyers with pre-approval as they can usually settle more quickly

- It doesnât cost anything.

Are you seeking home loan pre-approval? Our friendly Home Loan Specialists are here to answer your questions. Book an appointment at a time that suits you.

You May Like: Does Qvc Report To Credit Bureaus

How Is My Credit Score Determined

Your credit score demonstrates to lenders how risky of a borrower you are. Your score will gradually rise over time if you pay your bills and debts on time. However, it will drop significantly if you miss a payment.

Other factors that harm your credit score include:

- Applying for too many loans and receiving multiple âhard credit checksâ

- Not having a credit history

In Canada, there are multiplefree services to check your credit score.

Applying For Conditional Or Pre

Before you apply for pre-approval you should:

Check your credit score

Ensure all details on your credit report are correct

If necessary, take steps to improve your credit score by demonstrating positive credit behaviour

Research and compare lenders and/or discuss options with a mortgage broker

Discuss your options and possible borrowing power with your chosen lender

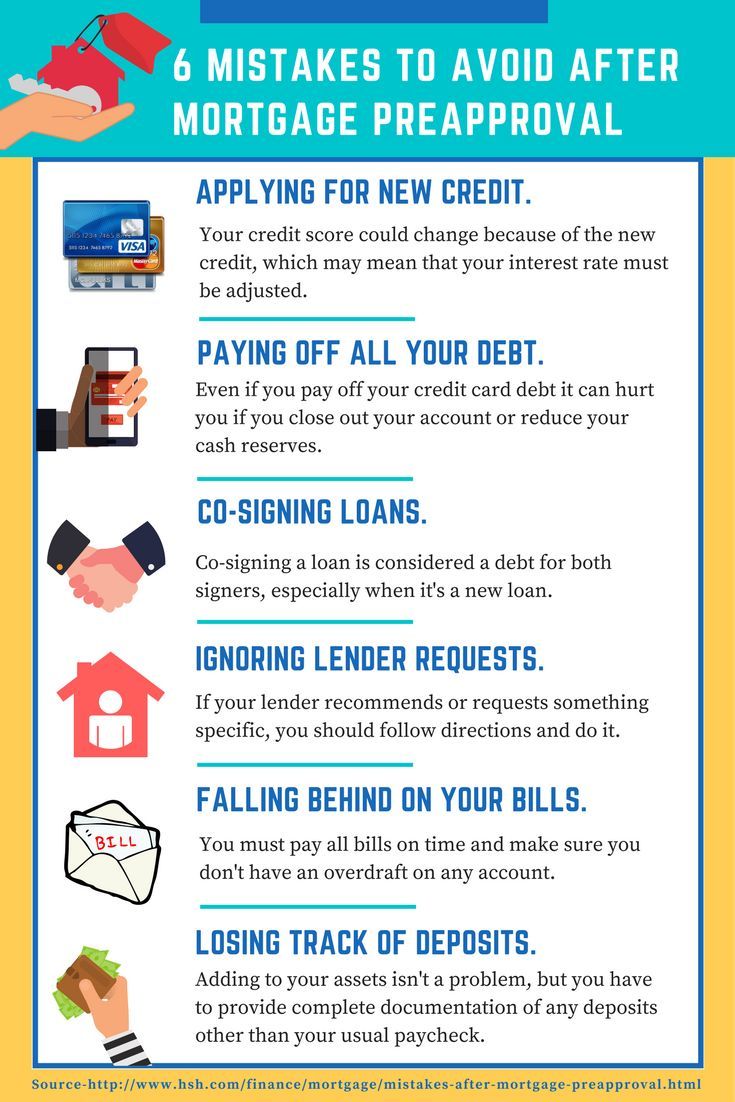

A home loan conditional or pre-approval application can often be completed in your own time through an online application process. The information and supporting documentation used in your application is generally the same as that of a formal home loan application, which saves you time later down the track. With the ease of online applications, it may be tempting to apply multiple times, but remember that with multiple applications for credit, even home loan pre-approvals can hurt your credit score.

Find a suitable lender and stick with them to ensure you are given the best rate and a competitive deal on your home loan. With just one conditional approval or pre-approval in your tool box, all thats left is to find the perfect property, or in the case of the latter, make the offer. Good luck!

Mortgage House

At Mortgage House, were no strangers to the property buyers journey. Its a long one. If youre thinking of applying for a home loan, you can Apply Online today to get started!

You May Like: What Does Public Record Mean On Your Credit Report

How To Improve Your Credit Score

To boost your credit score for an upcoming mortgage approval, first check your credit report to learn whats comprising your score. All consumers get access to a free annual credit report at AnnualCreditReport.com.

If youve never reviewed a credit report, it can feel overwhelming. There are public resources that can help you, or you can ask for help in our chat. Well consider the factors that impact your credit score and discuss ways to make improvement, like opening a secured credit card account or shifting balances between charge cards.

Here are the best habits to improve your credit score:

- Pay your bills on time Payment history accounts for 35% of your FICO credit score

- Lower your credit utilization Increase your debt payments temporarily or request a credit limit increase

- Avoid new credit lines Hard credit inquiries are performed for a new line of credit and can affect your credit score for the next six months

- Dont close old accounts Keep old credit lines open and catch up on old payments or delinquencies

- Be patient It can take up to 6 months to make big changes in your credit score, so do the work and wait it out

What’s The Difference Between Pre

A pre-approval uses verified information to approve you, as a buyer, for a mortgage loan. A pre-qualification doesn’t.

A pre-qualification uses estimates, not verified information. It’s a non-verified estimate of how much a home buyer can qualify for and gives the home buyer an estimate of the interest rate they will be paying on their mortgage.

A pre-approval is the process where a lender verifies your information and approves you for a mortgage. After completing a pre-approval, you receive a formal document that confirms the mortgage size and interest rate you can obtain from your lender.

|

Pre-qualification |

|

|

Provides an early estimate of mortgage affordability |

Provides written commitment of mortgage affordability |

|

Quoted based on self-attested estimates |

Quoted based on accurate and verified information |

|

Answer questions about your financial situation |

Submit documents proving your financial situation |

|

Self-reported credit score |

Hard credit inquiry |

Banks, credit unions, and other lending institutions take precautions before lending money. Lenders pull credit reports to assess an individual’s present and historical financial behavior. These assessments divide into categories known as soft inquiries and hard inquiries.

Learn more about the difference between pre-qualification and pre-approval.

You May Like: Does Removing Hard Inquiries Increase Credit Score

When To Get A Preapproval

The best time to get a mortgage preapproval is before you start looking for a home. If you dont, and you find a home you love, itll likely be too late to start the preapproval process if you want a chance to make an offer. As soon as you know youre serious about buying a home that includes getting your finances in home-buying shape you should apply for a preapproval.

If youre following mortgage rates, you can to determine the right time to strike on your mortgage with our daily rate trends.

Understanding The Differences Between Pre

When you see âpre-qualifiedâ or âpre-approvedâ on a credit card offer you get in the mail, it typically means your credit score and other financial information matched at least some of the initial eligibility criteria needed to become a cardholder. Understanding the distinction between the two terms can get tricky because companies can use them differently.

Here are a few things to keep in mind if you have questions about pre-qualified and pre-approved credit card offers.

Read Also: Mortgage Tri Merge Credit Report

Should I Apply For Multiple Conditional Or Pre

When looking for the right financial product and the interest rate the advice is always to shop around, but when you apply for home loan pre-approvals the opposite is true. Applying for multiple conditional or pre-approvals can have a negative impact on your credit score.

Research is still important, but it should be done well before you formally apply for a conditional approval. A conditional approval should not form part of your research and comparison, rather you should only apply for a home loan conditional or pre-approval once you have decided on a suitable lender.

You can also ask your lender to make recommendations before they make a credit enquiry. This will help you to decide on the best lender without affecting your credit score. A mortgage broker is also helpful when it comes to finding the right lender. They can assess your situation and give you an idea of your borrowing capacity with lenders without making formal enquiries.

You May Like: Raising Credit Score By 50 Points

Does A Preapproval Letter Expire

Once you have your preapproval letter, you may be wondering how long it lasts. Your income, credit history, interest rate think about all the different ways your finances can change after you get your letter. For this reason, a mortgage preapproval typically lasts for 60 to 90 days.

Once it expires, youll need to connect with your lender again with your updated paperwork and apply for a new preapproval letter. The good news is, this typically doesnt take too much time since they have most of your information on file. But bear in mind that re-applying requires another hard inquiry on your credit rating, and your credit score can be further impacted.

- Insights & Articles

- 6 Minute Read

Unless you are planning to pay all cash, pre-approval is an important step in the process of buying a home no matter what type of financing you choose.

You may have heard that applying for a credit card can reduce your credit score, and you might wonder if applying for pre-approval would do the same. Its wise to protect your credit score when youre considering a big purchase. But there is good news. The impact of pre-approval is small, and its well worth the benefits when youre serious about buying a home.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Don’t Miss: How Long For Collections To Fall Off Credit Report

Should I Still Apply If Im Not Pre

If you request a pre-approved offer online but youre not provided with an offer, it means theres something in your credit history or other information youve provided on the pre-approval request is keeping you from meeting the qualifications for pre-approval. You may want to address any issues before applying for the credit card. If there are errors on your credit report that are keeping you from being pre-qualified for a credit card, you can dispute them with the credit bureau.

Learn More About The Benefits Of Prequalification And Preapproval

As you look for a home, you may be asked to get prequalified or preapproved. Before you start, its important to understand the difference.

When you want to talk to a lender to establish a general range of home prices, you can get prequalified, which is simply a lenders estimate of what you could potentially borrow.

This can be completed easily and conveniently online, in person, or over the phone in just a few minutes with basic information like your income and expected down payment.

When you want to give yourself a competitive edge over other buyers in the market, you can get preapproved. Having a preapproval lets sellers know that you already qualify for the home financing which greatly increases your chance of having your offer selected.

Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay stubs, bank statements and tax returns.

The lender will then use these documents to determine exactly how much you can be preapproved to borrow.

Once youre preapproved, youll have 90 days to find a home you love. Then you can lock your rate and complete your application.

Whether you choose to get prequalified or preapproved, you will have a better sense of whats in your price range and can hunt for a house with confidence.

Don’t Miss: What Credit Score Do I Need For Ashley Furniture

Your Credit Score Remains The Same Even If You Getpre

Experts will advise you to get a pre-approval from several lenders for good reasons: it will not hurt your credit score and you could get the most competitive rate. The best time to get a pre-approval is before you start looking for homes or submitting an offer. Although lenders will pull out your credit history and make a hard inquiry, it will not affect your credit score because youre just shopping for a more beneficial mortgage interest rate. Hard inquiries could hurt your credit only if they are a result of your trying to open multiple credit cards in a short time. Credit scoring company, FICO even recommends homebuyers to get a pre-approval from multiple lenders within 30 days to secure a better rate.

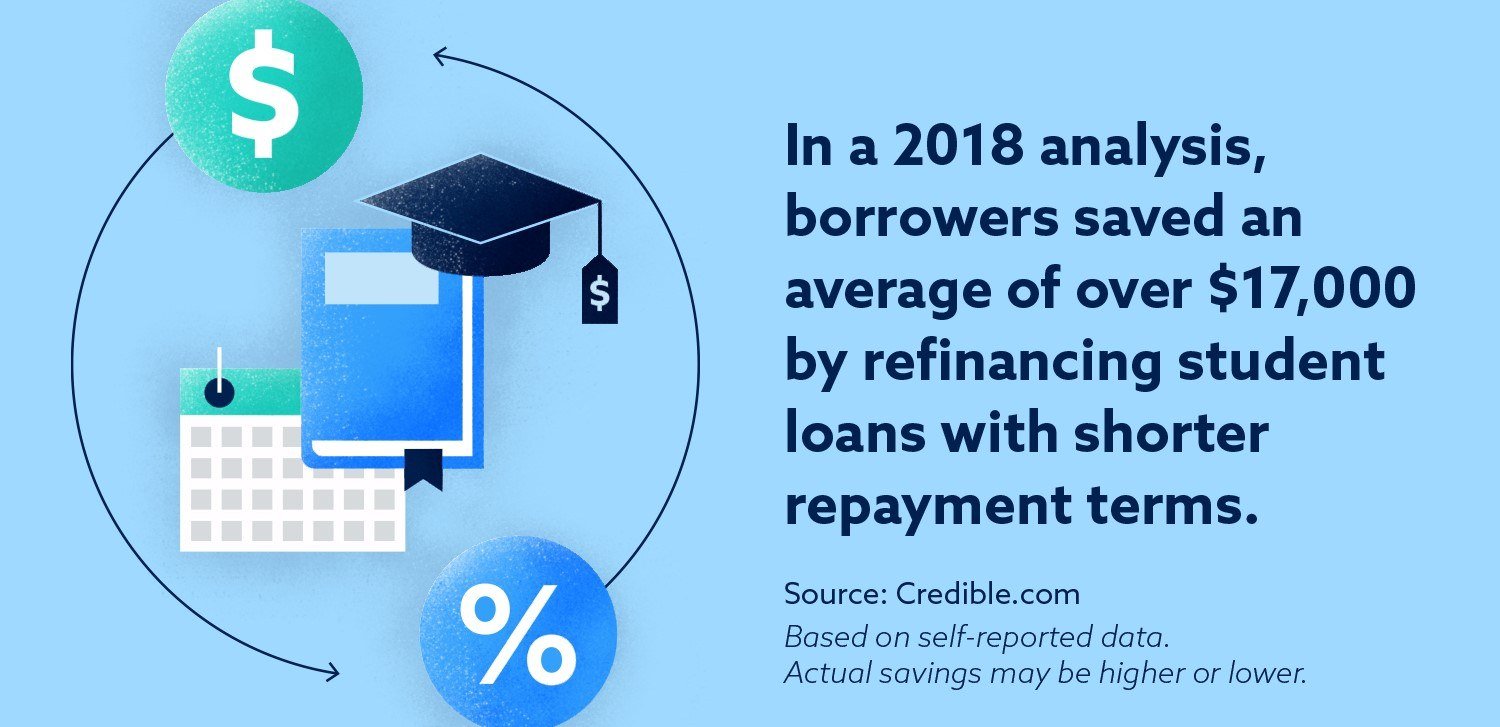

On average, you could save hundreds of dollars in interestif you could compare pre-approvals from at least five mortgage lenders.

How Can I Improve My Chances Of Being Pre

If you dont prequalify for a credit card, you can take steps to improve your credit score so that you can may be eligible for pre-approval offers down the road. Its important to pay your bills on time each month. Missed and late payments can bring your credit score down and hurt your chances of prequalifying for a credit card. Using too much of your available credit can also lower your score, so its a good idea to keep your balances low.

Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.

Also Check: How To Get A Repo Off Your Credit Report

When Should You Seek Prequalification

Theres no time like the present to seek prequalification, according to Majour Bey, a sales manager at AnnieMac Home Mortgage in Netcong, N.J.

Its 100% free and by talking to a mortgage professional early, they can calm your nerves about things you thought would be a big deal, Bey said. Seeking prequalification early, and from several lenders, can help you better prepare for your mortgage application and help you comparison-shop for your best rates.

Applying To More Than One Bank

If you seek another pre-approval from the bank that issued your last one, it shouldnt be a problem. However if you go to another bank, this second lender may wonder if you have been denied by your previous financial institution and become wary about offering you pre-approval.

If your score is not as good as you would like it to be, find out how to improve your credit score.

Ready to buy or refi?

You May Like: Is Mrs Bpo Legit

Why Preapproval And Prequalifications Won’t Hurt Your Credit

Whether you’ve applied for prequalification through a card issuer’s website or you received a prescreened offer in the mail stating that you have been selected to apply for a certain credit card, neither of these situations hurt your credit score. Issuers only do a soft inquiry, or “soft pull” of your credit report during the preapproval process. It’s not a full look just a glance to see if you seem like an ideal card member.

Once you apply for the card you want, the lender or issuer will have your permission to do a hard inquiry, or “hard pull” of your full credit report from one of the three main credit bureaus .

A hard inquiry can temporarily ding your credit score a few points, regardless of whether you’re approved or denied for the credit card or loan. This is why it’s recommended you only apply for a new credit product every six months or so. And if you do get denied, know there are many steps you can take to improve your credit score.

Can You Be Denied A Loan After Pre

Yes, you can still be denied a loan after pre-approval. Pre-approval for an auto loan is more of an invitation to apply than it is a guarantee that you will be approved once you actually apply. The good news is that a pre-approval suggests that you are likely to be approved for the loan based on your meeting the minimum criteria. However, you still have to apply for the loan, and the lender will have to perform a hard inquiry at which point they may not approve your application.

One of the main reasons why an auto loan may be rejected after pre-approval is because the individuals credit situation has changed. For instance, the individuals credit score may be lower when they apply for the loan then it was when the lender initially received their credit history information. If you are self-reporting credit and income information to get a pre-approval, then any mistakes you make in entering the correct information can also impact denial once you submit the actual loan application and the lender performs the hard inquiry.

To minimize your chances of being rejected for the auto loan after pre-approval, you will want to check your credit score from one or two of the major credit bureaus. If your credit score falls within the range that the lender is looking for, you have a good chance of getting final approval once you have applied. Its important to note that you may also be approved for auto loans that you were not pre-approved or prequalified for.

Also Check: Affirm Credit Score Needed