How Do Affirm Monthly Payments Work

Affirm is basically a loan financing company. They allow online shoppers to purchase goods & services from online vendors and retail shops on credit. The credit can be paid off by the buyer through fixed monthly payments over time.

The company also charges no service or prepayment fee, or any other hidden charges.

Prove You Had A Hardship

If you made your payment late because of a true hardship, you may get Affirm to reverse the late payment on your credit report.

Before you use this route, make sure you truly had a hardship and arent making it up. You must prove the hardship with as many details as possible. Again, Affirm isnt required to honor your request, so be courteous and provide as many details as possible.

Typically, major emergencies or unique situations qualify you for a hardship, but again, its on a case-by-case basis.

Dealing with a Late Payment on your Credit Report

If you arent successful in getting your Affirm late payment removed from your credit report, it could sit there for 7 years, but it wont affect you forever.

Moving forward, adopt good payment habits and ensure you dont get in over your head again. As time passes, the late payment wont affect your score as much even though it will sit on your credit report.

In the meantime, try these habits:

Always Read The Fine Print

The process isn’t always so easy, as Consumer Reports detailed. Dana Marineau, VP and financial advocate at Credit Karma, tells CNBC Make It that consumers should review their budgets before adding another expense and sleep on a big purchase before pulling the trigger.

“If you agree to take out a loan, you’re borrowing money that you will one day have to pay back,” says Marineau. “Ask yourself if you can afford to take on more debt before signing yourself up for a payment plan that could negatively impact your bottom line.”

In some ways these options may be better than a credit card because the payments are fixed. But the potential downfall is that you might not have the same rights if something goes wrong.Lauren SaundersNational Consumer Law Center

Always read the fine print, particularly as it relates to fees and interest, Lauren Saunders, associate director of the National Consumer Law Center, tells CNBC Make It. These terms vary depending on the retailer and the loan provider it uses.

“It’s important to know not just what the monthly payment is, but what the interest rate and any other fees and charges are, and compare it to other options,” says Saunders. Make sure you know what the consequences will be if you miss a payment and plan ahead for the worst-case scenario.

“In some ways these options may be better than a credit card because the payments are fixed,” says Saunders. “But the potential downfall is that you might not have the same rights if something goes wrong.”

Also Check: How To Get Public Records Off Your Credit Report

Does Affirm Hurt Credit Score

975 Views

Affirm will perform a soft credit check. This wont affect your credit score or show up on your credit report. There is no minimum credit score to use Affirm. Loan approval depends on your credit score, your payment history with Affirm, how long youve had an Affirm account and the merchants available interest rate.

Just so, Does Afterpay build credit?

Afterpay will not help you build your credit history because it does not report its loans to the credit bureaus. While this is helpful to get approved, its lack of reporting of your positive payment history will not help your credit either.

Is Klarna legit? Is Klarna safe? Putting aside the issue of taking on unnecessary additional debt, Klarna is safe in the way it takes payments and stores customers details.

Similarly, Does PayPal credit affect credit score?

Yes, applying for PayPal Credit affects your credit score. PayPal is partnered with a bank called Synchrony Bank, which will review your application and then complete an audit. This hard check will appear on your credit report for 2 years and could lower your credit score by a few points.

What Does The Affirm Loan Cover

Your Affirm payments will be applied to the cost of your device and accessories, as well as your initial Cricket service charge. Subsequent monthly service charges for wireless plans and features cannot be paid through Affirm. Instead, they must be paid directly to Cricket by credit or debit card, Cricket Refill Cards, Service Payment Cards, Apple Pay, Google Pay, Samsung Pay, or cash. Read more about bill pay methods.

If you fail to pay Cricket for your monthly service plan, you may experience an interruption in service.

Cricket Protect and Cricket Protect Plus device coverage can not be purchased using Affirm. If you have Cricket Protect in your shopping cart and select Affirm at checkout, Protect will automatically be removed from your cart. You can add Cricket Protect or Cricket Protect Plus within seven days after activation using My Account.

Affirm cannot be used to sign up for Cricket Auto Pay.

You May Like: Removing Hard Inquiries Increase Credit Score

Affirm Vs Afterpay: Credit Requirements

Affirm performs a soft credit inquiry when you create an account to prequalify you for future purchases. This soft inquiry does not affect your credit score and will not show on your credit report. However, when you do make a purchase, your credit score could be affected if Affirm does a hard credit inquiry. Additionally, your payment history and credit usage may also be reported to the credit bureaus.

Afterpay does not check a customer’s credit to open an account or at the time of purchase. If you are late with a payment, Afterpay also does not report late or missed payments to the credit bureaus. This makes Afterpay an attractive financing option for people with troubled credit or who don’t have enough credit history to get approved by other lenders.

Affirm Vs Afterpay: Interest And Fees

The interest rates on Affirm loans vary based on the merchant you are purchasing from. Some merchants offer a 0% interest promotion, while others may charge a higher rate. All of the financing information will be presented during your transaction so that you can make a decision before finalizing your purchase. You’ll never pay more than what you agree to upfront.

If you are going to be late with a payment, you can log into your account online or through the Affirm app to reschedule your payment. Although Affirm does not charge late fees, if you make a partial payment or have a late payment, it could affect your credit score or your ability to get approved for another loan.

Afterpay does not charge interest or fees as long as you make all of your scheduled pay-in-four loan payments. You are charged a $10 fee if your payment is late. If your account is not brought current within seven days, you’ll be charged another $7 fee.

You May Like: Chase Sapphire Preferred Card Credit Score Needed

Is There A Credit Limit

Affirm does not have a set . Instead, the company decides your eligibility and loan limit on a case-by-case basis, considering factors like your credit score, past payment history on Affirm loans, and your ability to pay. This means that you may be able to be approved for more than one loan at a time, depending on your situation.

You can boost your odds of approval for future Affirm loans by paying off your current Affirm loans on time and working to increase your credit score.

How To Use Affirm In Stores

If you’d like to use Affirm in-store, you can do so with an Affirm virtual card. When you’re approved for buy now, pay later with Affirm, you can choose to have the amount loaded onto a virtual Visa card that works just like a credit or debit card for making purchases. To use your card in-store, you can access it from the Affirm app or link it to .

Recommended Reading: How Long Does A Dismissed Bankruptcy Stay On Credit

Does Affirm Charge Interest

Affirm charges interest ranging from 0% to 30% APR.

Affirm can offer many loans at 0% interest because it negotiates how loans work individually with each merchant. Some merchants may be more inclined to offer 0% loans just to get people to buy their product. However, you may still need to meet certain requirements to get that interest-free loan.

You can make extra payments or pay off your loan at any time. If you do so, you’ll save money because interest will accrue more slowly on a smaller balance.

Trying To Build Credit Don’t Count On Some Silicon Valley Lenders For Help

Like many of her peers, 20-year-old Vanessa Montes de Oca doesn’t have a credit card. In her case, it’s not for lack of interest or even lack of trying.

She’s already been rejected for several credit cards, which she chalks up to her lack of credit history. She’s also part of the under 21 pack, which makes it much tougher for her to get a card in her own name thanks to a 2009 federal law.

Still, the fashion design student likes to shop. And companies like Affirm, PayPal and Klarna are happy to help her do so, positioning themselves as a sort-of digital alternative to credit cards for the Millennial crowd.

What these Silicon Valley financiers don’t advertise, however, is that they won’t help you build conventional credit. When you make on-time payments on a regular credit card, it’s beneficial to your credit score. “It’s like the sun rising in the East and setting in the West,” says credit expert John Ulzheimer. That’s not the case with these companies, whose policies are all over the lot and aren’t made sufficiently clear.

When Montes de Oca first learned about Affirm, she was checking out at her favorite online clothing retailer UNIF and it appeared as a payment option. She never used to be able to buy too much at once. “It’s a little more on the expensive side,” she says of the store.

Part of what’s incentivized her to do so: She thought it would help her credit score.

Also Check: What Bureau Does Comenity Bank Pull

Affirm Funding Valuation & Revenue

According to Crunchbase, Affirm has raised a total of $1.5 billion across 9 rounds of venture capital funding. Notable investors in the company include the likes of Spark Capital, Wellington Management, Founders Fund, Lightspeed Venture Partners, Khosla Ventures, Andreessen Horowtiz, and many others.

The company raised its latest round of funding in September 2020, which netted them $500 million in the process. Unfortunately, no valuation figures were shared publicly. Its prior Series F round, announced in April 2019, catapulted the companys valuation to $2.9 billion.

The firm is set to target a valuation of $10 billion during its IPO. Affirm is going public by the end of 2020. For reference: Affirms European counterpart Klarna gathered a valuation of $10.6 billion during its most recent funding round.

For the fiscal year 2020 , Affirm generated $509.5 million in revenue while posting a net loss of $112.6 million over the same timeframe. In the year prior, the FinTech generated $264.4 million in revenue while loosing $120.5 million.

One noticeable bit about Affirms income statement is that about 30 percent of the companys revenue can be attributed to Peloton, the bike producer taking the world by storm. This consequently poses a major risk for Affirm going forward while giving Peloton some leverage in future negotiations.

How Do Returns & Refunds Work With Affirm

All returns and refunds are subject to the merchantâs return and refund policies. If you want to return an item or get a refund, you will have to reach out to the store, not Affirm.

If you and the merchant agree to a return or refund, then Affirm will go ahead and process the request. If a refund or cancellation is for the entire amount of the loan you borrowed, you might still be on the hook to pay a credit/cost of borrowing charge.

Recommended Reading: Increase Credit Score By 50 Points

Why You Should Stay Away From Affirm

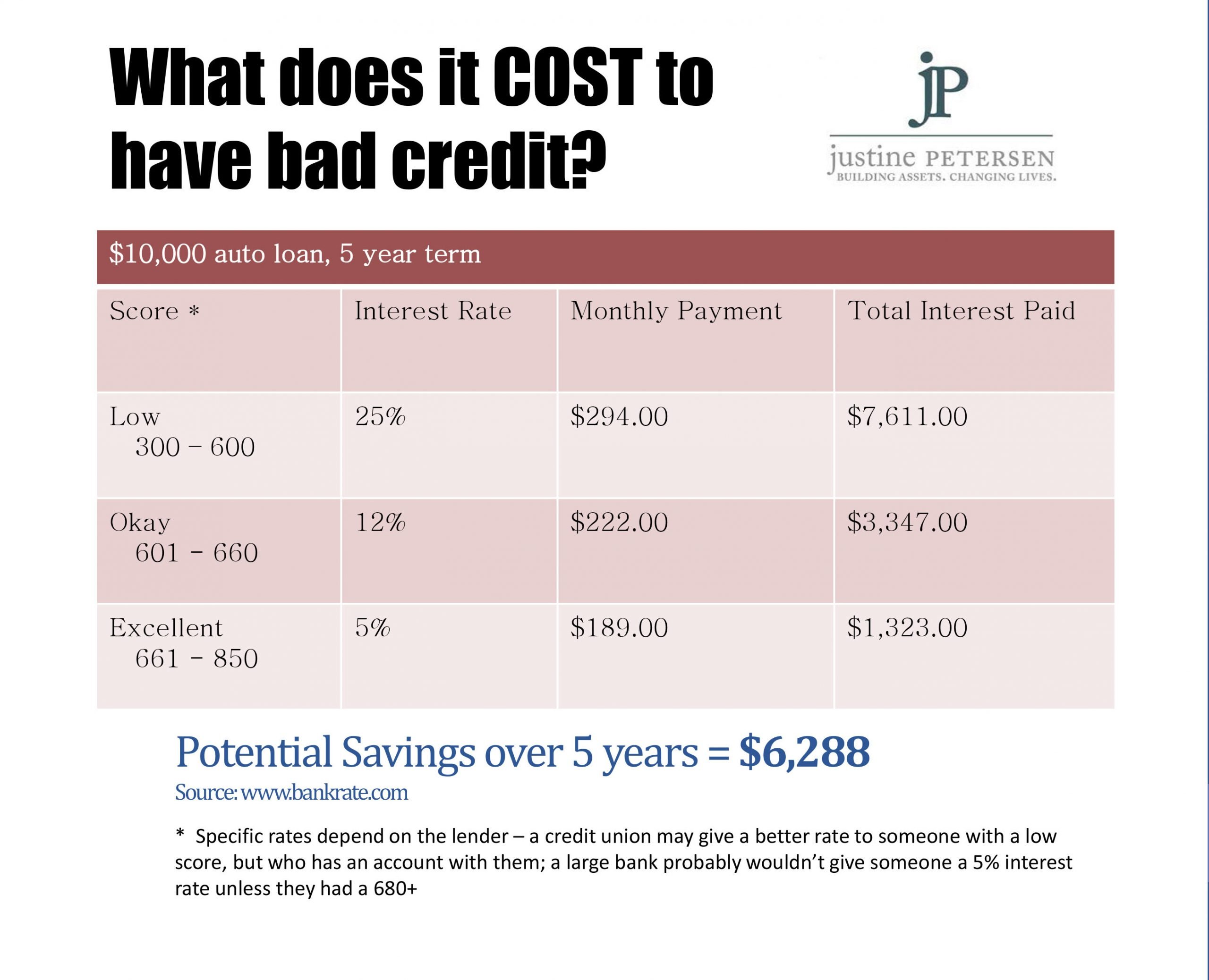

Lets talk about a few of the reasons why we dislike digital installment plans. To start, interest rates can be high. Like, really high. To give you some perspective, the average credit card interest rate is at 15.91% right now, while Affirms rates can get up to 30%!1,2 Thats almost twice as much!

And dont forget, the longer you take to pay off that loan, the more the interest you pay. And speaking of interest, if you return an item, you wont be refunded the interest you paid Affirm.

Lets talk about what happens if you miss a payment. Well, as we said, Affirm wont charge you late fees. But customer reviews on Better Business Bureau say the late payment still damages your credit scorewhich can be a worse slap in the face than a fee. And though were anti-credit score, were also anti being sneaky about how your processes work. Also, customers say getting a refund from Affirm after they return an item is often a nightmare.

Bottom line: Affirm is in the debt business. And debt preys on your desire for the good life. Right now. And listen, were all about the good lifebut you should get there the right way . And guess what? This right way is worth it. Cut out this middleman and pay for the good life with actual money!

This have it now, pay for it slowly and painfully mindset has got to end.

How Experian Boost Works

Experian Boost is free to use and there are no existing membership requirements to sign up. To receive a boost, individuals create a free Experian account and navigate to the products page.

From there, users will be prompted to connect the bank account they use to pay their bills. For those wary of granting third-party access to their account, Experian explains that its product can access only read-only data from a bank, and doesnt have access to any of the funds. Once an account is connected, the feature scans transactions for on-time utility, cell phone and streaming video plans, including Netflix, HBO, Disney+ and Hulu payments. Experian needs at least three months of payments within a six-month window.

Experian Boost shows users which bills are pulled and when they were paid. The feature only pulls positive payment history, which means it wont report any negative information that could lower your credit score. Users also have the option to exclude any payments they dont want to be added to their file.

Read Also: Paypal Working Capital Phone Number

Also Check: Does Affirm Hurt Your Credit

Can Using Affirm Improve Your Credit Score

Affirm doesn’t specify what credit score you’ll need to qualify. Again, qualification is based on your overall credit history, your history with Affirm, and current economic conditions. But generally, the better your credit, the easier it may be to get approved for a point of sale installment loan.

It is possible for Affirm to improve your credit score if you have a good credit utilization ratio. This means having a lot of credit available to you without using much of it. So in theory, if you used Affirm strategically it could improve your credit score.

Can You Build Credit With Affirm Or Afterpay

When you borrow with Affirm, your positive payment history and credit use may be reported to the . This can help you build credit with the credit bureaus as long as you make all of your payments on time and do not max out your credit.

Afterpay will not help you build your credit history because it does not report its loans to the credit bureaus. While this is helpful to get approved, its lack of reporting of your positive payment history will not help your credit either.

Read Also: What Credit Score Is Needed To Buy A Car At Carmax

Affirm Provides Instant Funding For Online And In

Lindsay VanSomeren is a credit card, banking, and credit expert whose articles provide readers with in-depth research and actionable takeaways that can help consumers make sound decisions about financial products. Her work has appeared on prominent financial sites such as Forbes Advisor and Northwestern Mutual.

Affirm is a buy-now-pay-later company that was launched in 2012 by Paypal co-founder Max Levchin. These days, it seems to be just about everywhere, offering you the option right during the checkout process to split your purchase up into several payments over time.

Business is booming, too. Revenue was up by 55% in Q2 2021 compared to Q2 2020. Affirm is meant to be quick and easy, which means it’s a good idea to ensure you’re not paying for convenience in the form of higher costs.

Do Affirm And Afterpay Require A Credit Check

Affirm requires a soft credit check when opening an account, which does not affect your credit score. When you are ready to make a purchase, Affirm may require a hard credit inquiry to verify your score and provide financing options based on your credit profile.

There are no credit checks required with Afterpay. Afterpay doesn’t even ask for your Social Security number when signing up for its account. Instead, your spending limits will grow based on your on-time payments and responsible use of its platform.

Don’t Miss: Carmax Income Requirements

Do Affirm Loans Help Your Credit

In theory, Affirm loans could help your credit when you make timely payments. That said, one important factor for your credit sore is your credit utilization ratio. What makes your credit score happy is when you have a lot of credit available to you, but you havent used a lot of it. For example, having a couple of credit cards with over $10k in available credit, but a low balance that you regularly pay off each month. That would give you a good credit utilization ratio. On the other hand, if you have a lot of credit extended to you and you have high balances on that credit, that can actually harm your score. On top of that, when you actually pay off your loan with Affirm, you are essentially closing off a line of credit extended to you, which could in theory harm your score.