Why Check Your Reports

One important reason to regularly check your reports is to verify the information in them is accurate. If you find something you think is inaccurate, it may be a good idea to contact your lender directly to get more details, since they report the account to the credit reporting agencies. You can also start a dispute with TransUnion, and well investigate. Knowing what is on your credit reports also may help you make good decisions to maintain your credit health.

Credit monitoring products can make it easier for you to stay on top of your reports and credit health. For example, with TransUnion Credit Monitoring you can:

- Refresh your TransUnion score & report daily

- Get alerts whenever there are critical changes to your TransUnion, Experian or Equifax reports

- Learn how you can improve your credit health with hands-on, interactive tools

- Protect your credit health & identity with Credit Lock Plus and $1MM ID Theft Insurance

How Do I Get My Free Tri Merge Credit Report

How do I get my free tri merge credit report? You cant order a copy of your tri-merge credit report. This report is only offered to lenders. However, you can order copies of your individual reports maintained by ExperianTM, Equifax® and TransUnion®. You can even do this for free at www.AnnualCreditReport.com.

How do I get my free military credit report? If you are an active duty military member or a member of the National Guard, you can sign up for free credit monitoring services from Equifax, with access to your Equifax credit report.

Who Order tri-merge credit report? Merged credit reports are also known as tri-merge reports or three-bureau reports. Theyre generally created by third-party mortgage reporting companies that gather your information from the major consumer credit bureausExperian, TransUnion and Equifax.

How do I check my combined credit score? First, find your credit report at AnnualCreditReport.com, where you can get a free copy from the three credit bureausExperian, Equifax and TransUnion. Then, look at what your report says.

Where To Get A Tri Merge Credit Report

Where To Get A Tri Merge Credit Report written by Mike Marko

Are you a property manager looking to get a tri merge credit report to help you evaluate potential tenants?

The tri merge credit report is a useful tool for property managers to help them when screening rental applicants. It can help you better understand their financial situation. It acts as your crystal ball so you have an idea about how they may pay the rent in the future whether they may be late or miss payments.

So where do you get a tri merge credit report? Well cover that and more in todays article.

You May Like: Credit Score Itin Number

Who Uses A Tri

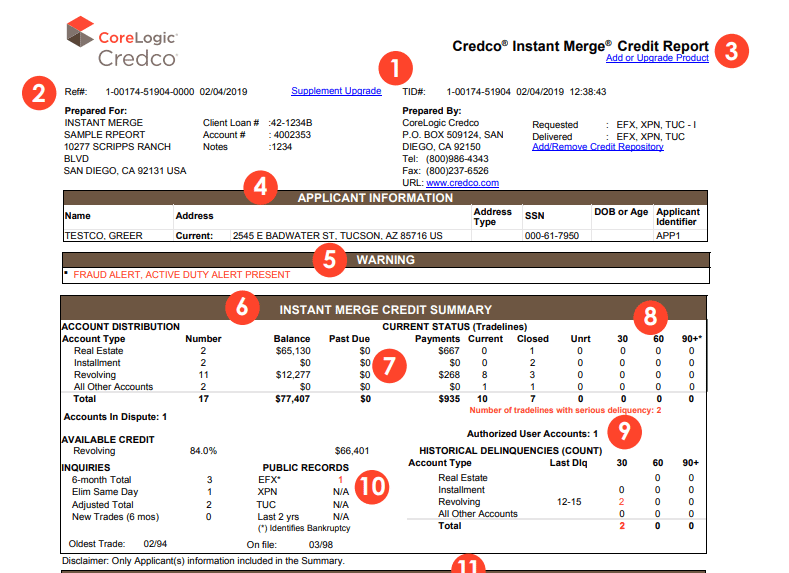

When I was a mortgage lender we only used a tri-merge credit report. Mortgage lenders have always used the tri-merge report to evaluate potential borrowers that are looking to secure a home loan. The report gives you all three credit reporting bureaus reports merged into one simplified report that is easier to read and evaluate someones credit.

When you apply for a mortgage loan the lenders will look at all of your credit. Not just one bureau. Applying for a mortgage is different than applying for a consumer loan where they will usually only need to pull one report from one bureau. When you apply for a credit card or consumer loan, lenders will typically pull from only one bureau because the loan amount is so much smaller.

A mortgage banker or lender will purchase a special credit report called a Residential Mortgage Credit Report, which includes all of the credit information available on you from all three credit bureaus. Each borrower, such as a spouse, must have a Tri-Merge credit report when applying for a home mortgage.

How Does A Tri

Lenders each have their own . Some have more tolerance for risk than do others. Lenders will use the information contained on your credit reports, along with your FICO® credit score, to determine if they are comfortable lending you mortgage money.

A clean report and a high credit score will qualify you for mortgage loans at lower interest rates. If your report is spotty, with late payments and high credit card balances, you can still qualify for a mortgage loan. But you might have to accept a higher interest rate.

Get your free credit report and score.

Create a Rocket Account to see where your credit stands.

Don’t Miss: Does Titlemax Report To Credit Bureau

How Can A Consumer Get Their Own Tri

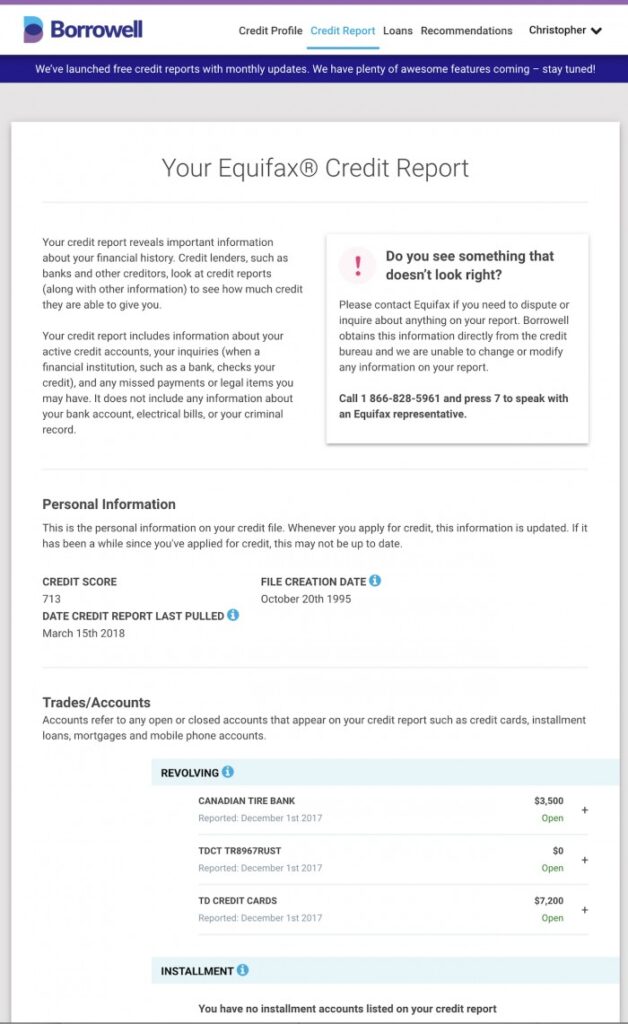

Persons can get their own tri-merge credit reports, although it is not typical nor necessarily cost-effective to get the more detailed RMCR for personal use. Persons can obtain a standard tri-merge general report by requesting one at the nationally recognized annualcreditreport.com once a year.

Outside of this free report, it is generally recommended to get tri-merge reports from an online credit monitoring agency. These monitoring agencies frequently offer an initial report for free to help entice users to sign up for regular credit monitoring. Check with each agency to see what one-time and recurring costs are before obtaining a . Users will also want to review whether the credit reports offered are truly tri merge or whether only 1 or 2 of the primary reporting agencies are represented in the data.

Additionally, many companies that are the victims of data monitoring will offer complimentary credit monitoring services for those customers who have been affected. If this same agency offers tri-merge credit reports then users may be able to get these reports at no cost as well.

What is a tri-merge credit report? In essence, a tri-merge report is a compiled report from the three credit reporting agencies . Tri-merge reports typically improve readability on what can otherwise be a large amount of data for lenders to process. Tri-merge reports are available to anyone that can access a credit report, but are most commonly used by mortgage lenders.

Re: Where Can I Buy A Tri

I thought there might be some companies that would sell to a consumer. Have written to a few of them via their websites but have not heard back yet.

Thank for your reply, TTR.

wrote:

I thought there might be some companies that would sell to a consumer. Have written to a few of them via their websites but have not heard back yet.

Thank for your reply, TTR.

Lenders get their trimerge reports from a credit business services company. Those comapnies do not sell any services directly to consumers. The only way to get that report is to have a mortgage originator pull your credit.

Also Check: Does Self Lender Do A Hard Inquiry

What Is The Best Way To Get Your Credit Report

You can request your information individually from Experian, Equifax and Transunion. According to federal law, you can obtain all three reports every 12 months at no cost.

You can get your tri-merge from the free annual credit report, which is the only federally acknowledged site. Dont be confused by the many companies that advertise this free service, but really want to sign you up for a monitoring or similar paid services.

You can pull your credit reports whenever you want to without risk of harming your score but remember you have to pay if you wish to review your tri-merge more than once per year.

Another way to review your report is to obtain a copy from your mortgage lender. In Orem and throughout northern Utah, Intercap Lending helps Utah home buyers navigate the potentially confusing process of applying and qualifying for a home loan. Contact us today to get your credit report and qualification process started.

Can You Buy A Tri

Unfortunately, securing a copy of your tri-merge credit report can be easier said than done.

Since these reports are designed with the sole purpose of assisting mortgage lenders in their underwriting process, most mortgage credit reporting companies wont share them with the individuals applying for home loans.

However, you may be able to get a copy from the loan officer on your case after you apply.

Though you arent automatically guaranteed one before a decision is made.

If your mortgage application is denied, you do have the right to obtain a copy of the credit report that contributed to your rejection.

However, you arent necessarily entitled to the full tri-merge credit report in any case.

Recommended Reading: Suncoast Credit Union Credit Card Approval Odds

Why Do You Have More Than One Credit Score

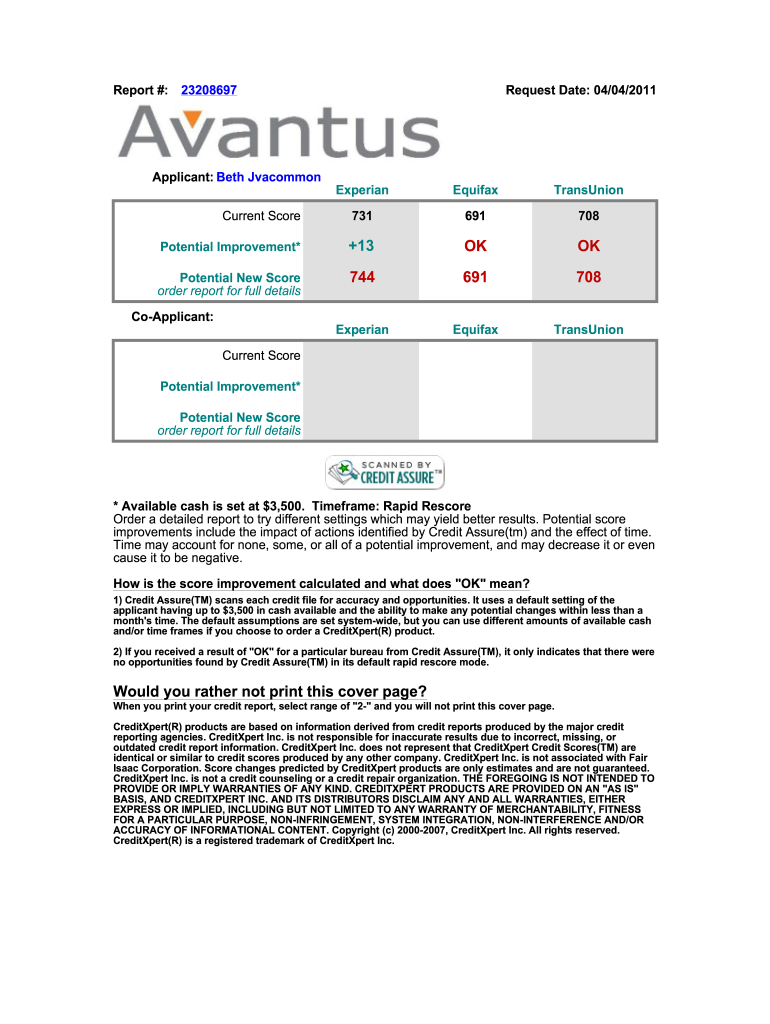

Don’t be surprised if you check your credit scores, or see them on a copy of your merged report, and notice that they aren’t all the same. Not only is this common, but it’s to be expected.

Credit scores are based entirely on the information in your credit report, and they can vary depending on both the scoring model used to calculate it and the credit report that’s being analyzed. For example, Experian gives you a free FICO® Score 8 credit score, but one of your lenders or card issuers might give you a VantageScore 3.0 credit score. Even when both scores are analyzing your Experian credit report, the differences in the scoring algorithms will likely result in different outcomes.

When the same model is used, the resulting scores can still differ based on which credit bureau provided the report. Much of the information in your credit report is provided by data furnishers, such as lenders and collection agencies. But these furnishers don’t have to send information to all three bureaus, and some may choose to only report your account to one or two of the bureaus.

These differences in your credit reports can result in varying credit scores. It’s also why some lenders may want to review a merged credit report before agreeing to give you a loan.

Where Do Mortgage Lenders Get Tri

Tri-merge credit reports can come from a couple of different sources.

In many cases, mortgage lenders like Freddie Mac or Fannie Mae, purchase applicants credit reports directly from the three major credit bureaus.

There are also numerous mortgage credit reporting companies whose operations are dedicated to compiling tri-merge credit reports for mortgage lenders.

In either case, these reports simplify things for mortgage companies.

They do this by presenting them with a comprehensive report, one that is easy to read and tailored to mortgage-related risk factors.

Also Check: Remove Payday Loans From Credit Report

When Are Credit Reports Used In The Mortgage Process

A lender will typically pull and review your credit reports once youve completed your mortgage application. Morse advises against having your reports pulled by the lender when youre just starting the home-buying process, because its considered a hard credit inquiry, which can hurt your credit scores.

Instead, he recommends using a lender whos willing to first talk about your budget and ensure youre financially ready to move forward. That way you can be certain a hard inquiry will be worth it.

Can Someone With No Credit Get A Mortgage Loan

Theres no history for them to go on. Thankfully, you dont need a traditional credit profile to get mortgage-approved. The FHA mortgage is available to first-time home buyers with thin credit or no credit whatsoever. Most mortgage lenders are approved by the Federal Housing Administration to offer these loans.

Read Also: Can You Use Klarna At Walmart

How To Complete Any Sample Tri Merge Credit Report Online:

PDF editor permits you to help make changes to your Sample Tri Merge Credit Report from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

How Does Your Credit Report Affect Your Mortgage Application

Your mortgage lender will consider several metrics when determining if you qualify for a mortgage, and if so, how much the company is willing to lend you.

One of those factors is your FICO score. FICO stands for Fair Isaac Corporation, the company who developed this rating system. Your score which can range from 300 to 850 is based on your debt, your payment history and other relevant factors that assess your creditworthiness.

In addition to your FICO score, your mortgage lender will consider the amount of your monthly debt payments as well as your income. As for your credit data, the underwriter will also carefully analyze your history for making timely payments.

Read Also: Realpage Consumer Report

What Is A Tri Merge Credit Report

Disclaimer: This article is not legal advice. Any legal information is not the same as legal advice, where an attorney applies the law to your specific circumstances, so you should consult an attorney if youd like advice on your interpretation of this information or its accuracy. You may not rely on this article as legal advice, nor as an endorsement of any particular legal understanding.

Are some credit reports better than others? Thats a tough question to ask, because the answer really depends on what you need. For the average consumer, a single or reporting agency can give them the most important details needed to manage their credit at low or no cost.

When seeking a credit report as a lender, there is often a demand to get the big picture in credit reports by seeking an all-in-one or all-inclusive report, sometimes referred to as a tri-merge report. This report is created by compiling data from the Big 3 in credit.

Why Do Mortgage Lenders Look At Your Tri

When you apply to get a mortgage, you are asking lenders to take a big risk. They are lending you hundreds of thousands of dollars, hoping that youll pay them back on time each month. Yes, they make a profit thanks to the interest they charge on these loans. But if you stop paying your loans, that profit disappears.

Lenders look at your credit reports, including your tri-merge report, to make sure you have a history of paying your bills on time and managing your credit responsibly. Theyre more comfortable lending to people with a good financial history.

Your tri-merge report also helps lenders set the interest rate on your loan. If your credit history is spotty, but not bad enough to result in a rejection, your lender will charge you a higher interest rate. This results in a higher monthly payment that acts as a financial safety net for lenders who are taking a risk on you.

Recommended Reading: Sync/ppc On Credit Report

Where Did The Idea For Husqvarna Come From

Husqvarna is based on a tradition that dates back to 1689, when the Swedish King Karl XI ordered the construction of a factory on the banks of the Huskvarna River, for production of muskets. The location was logical, since water power was harnessed from the Huskvarna River to create the water-powered plant.

What Is Tri Bureau Credit Monitoring

Tri-Bureau Report & Monitoring A Tri-Bureau Credit Report and 24 / 7 Credit Monitoring. Score Tracker -Monitors your credit score on a monthly basis and provides factors on why your score may have changed. CyberGuard Monitors the Internet and alerts you if your information is being traded or sold online illegally.

Also Check: What Credit Score Do You Need For Chase Sapphire Reserve

More Than Just A Scoretm

At Certified Credit, we deliver more than just a score. We provide industry-leading information and analytics with the expertise and technology you can rely on to fuel your business.

- Client Acquisition & Retention

- Tenant Screening

“Certified Credit is superior to other providers -with longevity that I count on when doing business.”

– Top Tier Mortgage Lender

Why Are My Scores Different

Not all credit companies report to all three bureaus. Many companies only report to one or two of the three bureaus which creates different credit scores on each report. When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference.

Just pulling one report is not a complete view of someones credit history. This gives the mortgage lender or bank a complete history of how you have used credit in the past.

Recommended Reading: Does Qvc Report To Credit Bureaus

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.

Also Check: How Long Do Inquiries Stay On Chexsystems