File A Dispute To Remove It

If you believe the repossession on your credit report is inaccurate or incorrect information, you can file a dispute with the credit bureaus to remove the item. This involves writing a letter and mailing it to the bureaus via certified mail.

If the lender cannot prove that the information is valid or fails to respond within 30 days, the item be removed from the credit report.

We have an entire guide that walks you through how to dispute an error on your credit report.

A Repossession Stays On Your Credit Report For 7 Years

If you are late to pay an account and then bring it current, the late payment will be removed after seven years, but that doesn’t mean the entire account will be removed with it. In that instance, only the delinquencies up to the point the account became current, which have reached the seven-year mark, will be removed. The rest of the account history will remain on the report.

If there are no other delinquencies in the history, the account status will become positive. Positive accounts remain on your credit report for 10 years from the date they are closed, or indefinitely if they are open.

In the case of a repossession, the account was never brought current, so the entire account will be removed seven years from the original delinquency date. The original delinquency date is the date of the first missed payment that led up to the repossession status.

There are other dates in the credit report, as well. Some you might see are the open date of the account, the date the account was closed, the date of the last payment or activity on the account, or the date the account was last updated by the lender. None of these dates have any bearing on when negative information will be removed from the credit report.

Once the seven-year period is reached, Experian will delete the account from your credit report automatically. You don’t need to request that it be removed.

How To Spot A Repossession On Your Credit Report

Repossessions are typically listed under the public records section of your credit report.

For example, on the Experian credit report, they give you a snapshot of your record right at the topin this example, you can see there are zero public records, but if you have a repossession, the information would likely appear here:

If you’re unsure how to read over your credit report and things you should look for, you can check out our guide on how to read your credit report.

Don’t have a copy of your credit report yet? You can get them for free in less than ten minutes:

Note that both voluntary and involuntary repossessions will appear on your credit reportso just know you don’t get a pass if you decide to voluntarily give up your car.

Don’t Miss: Speedy Cash Repayment Plan

Is Voluntary Repossession Better For Your Credit

Repossession has the same impact on your credit score even if you opt for a voluntary repossession. Either way, the lender had to reclaim the car and try to recoup its losses from your loan.

But voluntary repossession has a couple other benefits. You can preserve some dignity by taking control of the process, for example.

And, you could avoid a few additional late or missed payments from making their way onto your credit report.

If you see theres no way to avoid repossession, you may as well surrender the car voluntarily. Usually, though, you can avoid a repo by communicating with the lender.

Getting Back On The Road

If youre ready to put a repossession behind you and get into your next auto loan, start right here with Auto Credit Express. We have a nationwide network of dealerships that work with bad credit lenders.

To begin, fill out our no-obligation, secure, and free car loan request form. Well look for a dealer in your local area that can work with unique credit situations.

Recommended Reading: How To Dispute A Repossession

Can I Still Get A Loan After A Repossession

You can still get a loan after a repossession, but itll be difficult until the repo has come off your credit report. If a lender does agree to issue you a loan, expect them to charge you relatively high interest rates and fees.

Lenders do this to compensate for the extra risk theyre taking in extending your credit when you have a bad credit score or a derogatory mark like a repossession on your credit report.

Why Should You Try To Settle Things Yourself

There are a few good reasons to try options 1 and 2 before hiring an expert in credit repair for repossessions.

Recommended Reading: How To Get Inquiries Off Credit Report

Pay Your Bills On Time All Of Them

Want to know the most heavily weighted portion of your credit score? Its your payment history! That means the best thing you can do to improve your credit score is regularly pay your bills on time.

Not just your credit cards and loans. Every single bill, because most creditors can report your late payments to the credit bureaus as quickly as 30 days after the original due date.

Set up automatic payments if you have to. Making sure you never miss another payment is one of the most important things you can do to help your credit after your car is repossessed.

How Does A Repossession Affect My Credit Score

The number of points that will be taken out from your credit score will vary depending on your individual circumstances, however, this point drop will typically range from 50 to 150 points. Take note that aside from the repossession itself, the missed payments leading to the repossession also play a role in chipping off points from your credit score.

If you plan to apply for mortgage, personal loans, or even credit cards, having a repossession included in your credit report may discourage lenders from giving you the best deals or you may not even be eligible for a loan if the repossession is very recent. This is because a record of repossession somehow gives out the message that you are not a good risk and you may be capable of making timely payments on the loan that you are applying for.

The impact of the repossession will lessen as the years pass, depending on whether you have improved your financial status. If you are able to rebuild your credit score to a good or very good rating, a repossession that is 4 to 5 years old may not affect you that much compared to its impact during the first year of repossession.

If the repossession on your credit report is the only negative entry thats keeping you from reaching a good credit score and getting new lines of credit, you may want to try having it removed from your credit report.

Also Check: Bbb Lending Club

How Many Points Will Be Added When A Repo Is Removed

After a repo is removed, it will take some time for the credit score to be updated as such, but it will essentially gain back the points it lost due to the repo and the associated financial blemishes we already discussed.

Therefore, you can expect your credit score to increase by as much as one-hundred points after a repossession record has been removed from your financial history successfully, and the score gets updated with it.

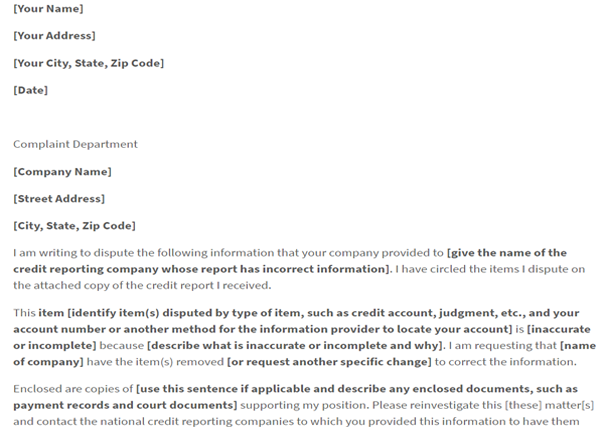

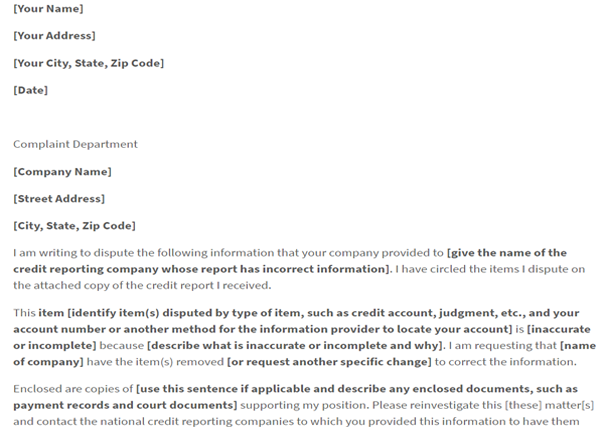

Repossession Dispute Letter Sample

Dear Sir or Madam:

I am writing to dispute the following information in my file. I have circled the repossession I dispute on the attached copy of the report I received.

This repossession is because . I am requesting that the item be removed to correct the information.

Enclosed are copies of supporting my position. Please reinvestigate this matter and the disputed item as soon as possible.

Sincerely,

Enclosures:

You May Like: Zebit Report To Credit Bureau

Contact A Credit Repair Company

As with almost every industry, you can pay professionals to settle the dispute for you. The good news is that you save yourself a lot of hassle, and there are some good credit repair agencies that can help.

The bad news is that it does cost money, often a few hundred dollars. However, this amount is small compared to the problems that a bad credit score can cause you.

How To Remove Negative Items From Your Credit Report

First, it’s important to know your rights when it comes to the information in your credit history.

Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the information disputed is found to be incomplete or erroneous, the bureaus are obligated to remove it from your record.

Some common credit report errors include payments wrongly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number, or identifying information.

Bear in mind that correct information cannot be removed from your credit report. So, if your score is being dragged down by accurate negative information, youll need to repair your credit over time by ensuring you make payments on time and decrease your overall amount of debt.

Here are some tips to help you repair your credit history:

Don’t Miss: Affirm Approval Credit Score

Can Repossessions Be Removed From A Credit Report

In certain cases, repossessions may be withdrawn from your credit report, especially if they are inaccurate or unreasonable. To try to delete one, there are a couple of things you can do:

- Negotiate with your lender when they are repossessed, your lender loses money. And if you pay less than what you owe, paying off your loan is cheaper and more convenient for them.

To see if you can settle your debt and delete it from your credit records, you can try renegotiating with them. Make sure you have it in writing if they agree to this, and that you follow through with the terms you and your lender agreed to.

- File a dispute: You will dispute it with the credit bureaus if you go through your credit reports and find something reported inaccurately about your repossession.

The credit bureaus must inquire if you do this, and will ask the creditor to check the facts concerning your repossession. If the lender does not claim that the debt is correct, fair or substantiated, the repossession from your credit records can be withdrawn by the credit bureaus.

If they have already repossessed your house, your time to negotiate with your lender can be short or already closed. In this case, the choice to consider is to file a dispute.

Ask For Court Validation

Any inaccurate information on your credit report must be removed according to the Fair Credit Reporting Act. If a court cant validate your judgment, its inaccurate information, and the credit bureau must remove it.

To obtain court validation, send a request in writing to the court that entered the judgment. Include your identifying information and the court case number.

Send your letter via certified mail so you can track it. If the court does not or cant validate the case, write to the credit bureaus and ask them to delete the information.

Don’t Miss: How To Report Rent Payments To Credit Bureau For Free

State Laws & Repo Codes

To determine the repo laws for your state or the creditor’s state, you can view the statutes per state. Using this information you can determine what was permissible under the law in repossessing your car and whether it was conducted in an illegal or legal manner. You can also look up state by state repo codes. These repo codes can help you determine what activity is legal in your state like recovery guidelines, deficiency requirements, documents required to transfer ownership of the car, and state motor vehicle provisions.

Remove Repossession From Your Credit Report In 3 Steps

Repossession is when you fail to make payments on a car loan, and the lender takes the vehicle back. There are two types of repossession voluntary and involuntary repossession. Voluntary repossession occurs when you voluntarily return the auto you usually exercise some control in this form of repossession.

Involuntary repossession is when the lender takes the vehicle back, usually without warning you. This type of repossession happens more commonly than the other. Both kinds will negatively impact your credit score.

For example, you may not qualify for a new loan next time.

If youre wondering whether you could have repossession removed from your credit card, the answer is yes. This article will give you tips on how to take out the detail from your credit card.

Below are three ways to remove repossession from your credit card.

Don’t Miss: Navy Fed Car Buying Program

You May Need To Wait Until The Repo Ages Off Your Report

When credit repair isnt an option or its already failed to result in a removal the only real thing to do is wait. The majority of negative credit report items, including defaults and repossessions, should naturally fall off your credit report after seven years .

That said, the negative impact to your credit score from a repo on your credit reports wont necessarily last the full seven years. Credit score models typically give more weight to the more recent items on your credit report, with older items factoring into your credit score calculations less as they age.

The best way to minimize the negative impacts of a repossession on your credit is to ensure the rest of your credit profile looks as good as possible. Defaulted loans fall under the payment history portion of your FICO credit score. Payment history is 35% of your score, and the more positive payment history you can build, the less the repo will drag down that factor.

You should also work on the other major factors of your credit score to help balance out a less-than-stellar payment history. This includes your credit utilization and total debt, credit history length, number of new credit accounts, and the diversity of your credit mix. Keep low balances on your credit cards and avoid opening superfluous credit accounts.

What Happens During A Repossession

During a repossession, your property is rightfully and lawfully seized and sold to repay all or part of your debt or at least it should be. The creditor has to lawfully follow state rules that apply to repossession. Most states require the creditor to notify you of what they will do with your property.

According to the Federal Trade Commission:

Some states impose rules about how your creditor may repossess the vehicle and resell it to reduce or eliminate your debt. Creditors that violate any rules may lose other rights against you, or have to pay you damages.

Also, during the repossession proceedings, if your property is at auction, you may have the right to attend and bid on your property. While this may not be the optimal choice, you may be able to buy back your items and settle your debts.

You may also have the opportunity to buy back your vehicle or other property for the full amount owed before it goes to auction. You would be wise to research repo laws, as they apply to your specific state.

Also Check: How Do You Remove Hard Inquiries Off Your Credit Report

How Does A Repossession Affect Credit

If you have a repossession on your credit report, youll likely see a decrease in your . There are a few different ways that repossession can affect your credit score these include:

- Late payments: The primary cause for repossession is multiple late payments. Late payments are reported to the credit bureaus and this hurts your credit score. Note that late payments stay on your credit report for up to seven years

- Getting sent to collections: If you have a lot of missed payments or you still owe a balance after the item is repossessed and sold, it is common to get sent to collections. Collections agencies report to the credit bureaus and this will negatively impact your credit score

- The repossession itself: When an item is repossessed, this information is passed along to the credit bureaus and will result in a negative mark on your credit report.

Additionally, if you have a co-signer on your loan, their credit score could also be affected.

There is a common misconception that if you opt for a voluntary repossession, it affects your credit less this is not the case. Although there may be some benefits to a voluntary repossession, your credit score is not one of them.