Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

Is A 700 Credit Score Good

A 700 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Also Check: How Often Can You Request A Credit Report

Good Range Credit Scores By Income

People who make at least $50K per year are significantly more likely to have a credit score of 700 or above. And people who make between $75K and $100K per year are in the ideal range for a score that begins with a 7 or an 8. But it’s important to note that it is possible to have a score of 700 or above even if you earn less money, or to have a much lower score even if you make a lot more money. It all depends on spending within your means.

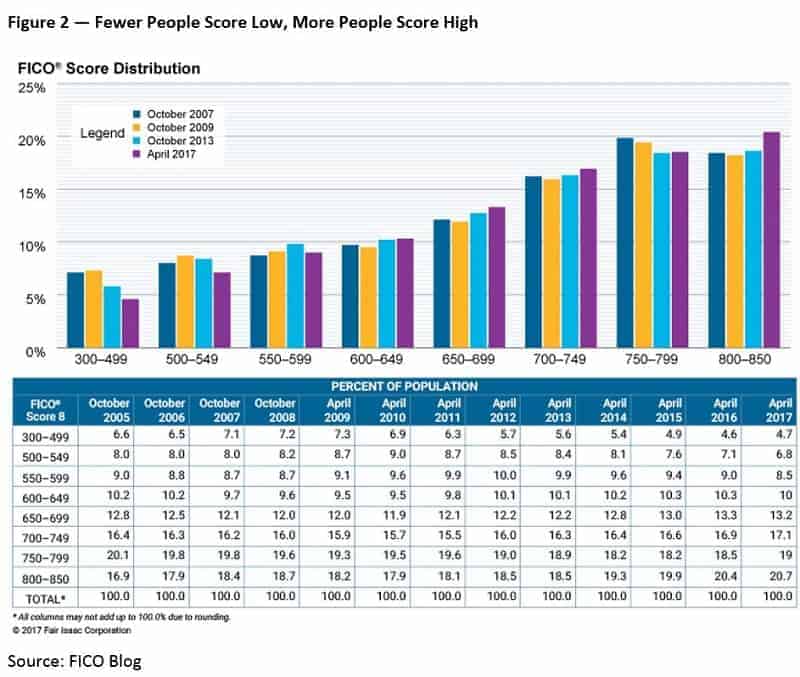

Forty percent of consumers have credit scores that are lower than 696.

Can I Buy A House With A 760 Credit Score

According to FICO® credit bureau data, the best credit score to buy a house is 760 and higher, which tends to unlock the best mortgage rate. However, to qualify for a home loan, you’ll need at least the minimum credit score to buy a house, which ranges from about 500 680, depending on the mortgage program.

Recommended Reading: Does Your Credit Score Start At 0

Lower Your Credit Utilization Rate

Your credit utilization rate is the percentage of your available credit that youre using. For example, if you have a single credit card with a limit of $1,000 and you owe $500, you have a credit utilization rate of 50%.

Generally speaking, the lower your credit utilization rate, the better for your scores. A good rule of thumb is to keep your credit utilization rate below 30% and even lower than that, if possible. A 50% rate is an example of a high credit utilization rate that could negatively affect your credit.

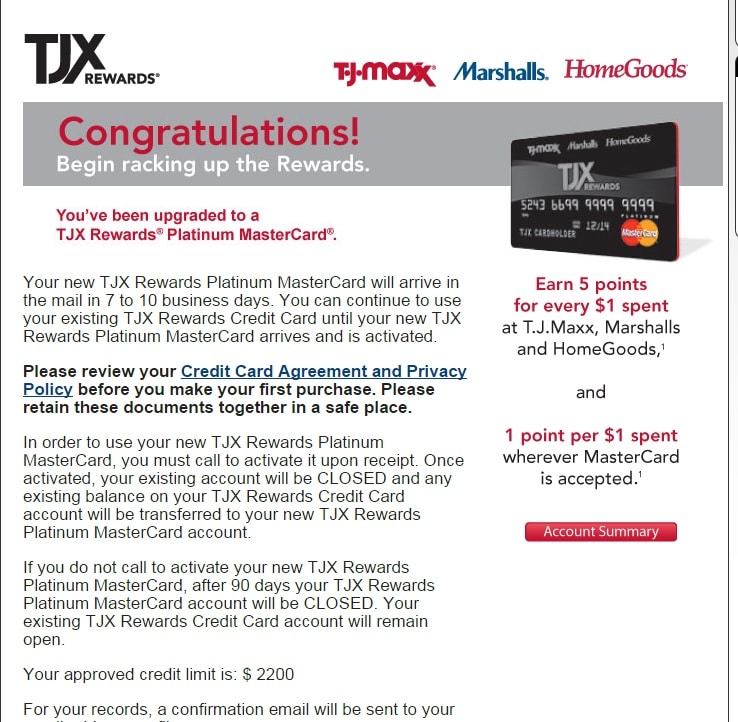

You can decrease your credit utilization rate by paying off debt . You can also lower your credit utilization rate by increasing the amount of credit available to you. One way to do that is by reaching out to your lender to ask for a higher credit limit or opening a new loan or credit line though you probably wont want to open too many too often, as that could have a negative impact on your credit as well.

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Don’t Miss: How To Remove Authorized Hard Inquiries From Credit Report

Is A 735 Credit Rating Good

A 735 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Can I Get A Car Loan With A 698 Credit Score

There’s no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair range may limit your options to loans with higher rates and less favorable terms. Building your credit over time is a good way to potentially get access to better terms, but that’s not an overnight process.

Recommended Reading: What Does Frozen Credit Report Mean

Why Would A Home Not Qualify For An Fha Loan

Homes Must Be Primarily Residential It is possible to purchase a mixed-use property using an FHA home loan and its’ low down payment requirements, but if the home is not primarily used as a residence and has 50% or more floor space taken up by non-residential use it cannot qualify for an FHA mortgage.

Is 696 Considered A Good Credit Score

A 696 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

You May Like: How To Check Business Credit Score

Credit Score: Is It Good Or Bad

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U.S. FICO® Score, 714, falls within the Good range. Lenders view consumers with scores in the good range as “acceptable” borrowers, and may offer them a variety of credit products, though not necessarily at the lowest-available interest rates.

21% of U.S. consumers’ FICO® Scores are in the Good range.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

Length Of Credit History

The longer you have been using credit, and the longer your average age of accounts, the better it is generally for your score. Remember, credit scores are designed to estimate your risk as a customer, and a long history provides more data to base that estimate on.Unless there is a pressing reason, like a high annual fee, avoid closing credit cards. You can also look into doing a product switch to a more suitable card from the same issuer. On the credit scorecard for account age, a grade “B” means that the average account is less than 9 years old.

Recommended Reading: How To Get Free Credit Report

Mortgage Rates For Fair Credit

The average credit score it takes to buy a house can vary widely depending on where youre looking. With that said, it can be more challenging to get a mortgage with good terms if your credit is in the fair range.

There are several types of mortgages out there, some of which are meant specifically for those who may not qualify for a conventional loan. These loans, which are made by private lenders but are backed by the government, may allow a smaller down payment than youd need with a conventional loan.

Common types of government-backed loans include

These options can be easier to get than a conventional loan, but they arent for everyone. If you have fair credit and plan to apply for a conventional loan, you may find it difficult to qualify without having to pay high interest rates and fees.

Its important to shop around to understand your options and what competitive rates look like in your area. As with auto loans, you have a window of time when multiple inquiries are only counted as one for your credit scores. While that shopping window can be longer, keeping multiple inquiries to a period of 14 days is the safest bet.

How To Increase Your Credit Score Before Buying A House

If you’re planning on buying a house, you’ll need to make sure your credit score is as high as possible. A good credit score will help you get a lower interest rate on your mortgage, which will save you money in the long run.

1. Check your credit report for errors and dispute any inaccuracies.

2. Pay all of your bills on time, including your credit card bills and utility bills.

3. Keep your credit card balances low.

4. If you have any outstanding debt,

If you want to get a loan, your credit score needs to be good. If your credit score is not good, you can do things to make it better. Rocket Mortgage is not a financial advisor, so it’s a good idea to talk to credit repair ease who knows about this stuff to help you improve your credit score.

You May Like: Is 755 A Good Credit Score

Whats A Good Credit Score Range

A good credit-score range depends on where a score comes from, who calculates the credit score and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine . That means that what FICO, VantageScore or anyone else considers good may not be the same.

However, there are some general guidelines for how being within a score range can impact your choices:

- A poor to fair score means you may find it difficult to qualify for many credit cards or loans. You might need to start with a secured credit card or credit-builder loan to build or rebuild your credit. And if you do qualify for an account, you may have to pay high fees and interest rates if you don’t pay your balance in full each month.

- A fair to good score means you may be able to qualify for more options, but you wonât necessarily receive the best rates or terms. You also might find you can qualify for a traditional unsecured but have a harder time qualifying for a premium card.

- A very good or excellent score means you may be able to qualify for the best products with the lowest advertised rates. While creditors consider other factors too when determining your eligibility and rates, your credit score probably wonât be holding you back.

Whatâs a Good FICO Credit Score Range?

FICO scores that range between 670 and 739 qualify as good scores. Scores in that range are near or slightly above the U.S. average. In total, FICO breaks its scores into five categories:

What Counts Towards Your 696 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 696 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Recommended Reading: Do Insurance Quotes Affect Your Credit Score

How To Turn A 696 Credit Score Into An 850 Credit Score

There are two types of 696 credit score. On the one hand, theres a 696 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 696 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Maintaining A Good Credit History

The average American consumer has a good FICO® score. With some time and effort, you can increase your score into the Very Good range or even the Exceptional range . Moving in that direction will require an understanding of the behaviors that help grow your score and those that hinder growth.

Late and missed payments are among the most significant negative influences on your credit score. Lenders want borrowers who pay their bills on time, and those who have missed payments in the past are more likely to default on debt than those who pay promptly. If you have a history of making late payments , you can improve your credit score significantly by kicking that habit. More than one-third of your score is influenced by the presence of late or missed payments.

Usage rate, or utilization rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | |

|---|---|

| $20,000 | 24% |

40% of Individuals with a 696 credit score have credit portfolios that include auto loans and 29% have a mortgage loan.

Also Check: Is 680 A Bad Credit Score

Heres How To Improve A 696 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Can You Get A Personal Loan With A Credit Score Of 696

Most lenders will approve you for a personal loan with a 696 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

Don’t Miss: How To Remove Charge Off Credit Report

How To Read Your Cibil Report Or Credit Report

The credit report is a detailed document that highlights your entire credit history and record. It includes your personal information, contact information, employment history, credit limit on various credit cards, credit balances, and dates on which you opened various accounts. Various parties or organisations view this credit report.

Some common parties who may view your credit report are as follows:

- Lenders like banks and non-banking financial companies

Given that it is a comprehensive document with multiple sections, it is important for you to know how to read your credit report. This will help you understand your report better and even check if it does justice to your credit history.