Missed A Credit Card Payment Learn What A Late Credit Card Payment Is And How It Can Affect Your Finances

Missing a credit card payment can be frustratingâespecially if you had planned to pay on time.

So what counts as a late credit card payment? How will paying late affect your account and finances? And what are Capital Oneâs late payment policies? Read on to find out the answers to these questions and more.

Your Creditor Doesnt Report To All Three Bureaus

This could explain why you see an account on one report, but cant find it on another. John Danaher, president of consumer interactive at TransUnion, suggests consumers check their credit reports from each bureau every six to 12 months.

Ensure the information is accurate and up to date, since information from separate reports can vary, says Danaher.

How Do You Improve Your Credit Score After A Late Payment

Get current on payments and stay current

If youve missed a payment, the best thing you can do for your credit score is to bring the account current and make all future payments on time. If youre struggling financially, you may even be able to work something out with your lender many credit card issuers, for example, offer hardship programs for people dealing with situations like job loss, medical bills and natural disasters.

Follow theSE steps for building good credit

Once youre back on track with timely payments, know that the impact of one late payment will fade over time as you add more positive information to your credit reports. At its core, building good credit is a straightforward process. These steps will keep you on track:

You May Like: Do Closed Accounts Affect Credit Score

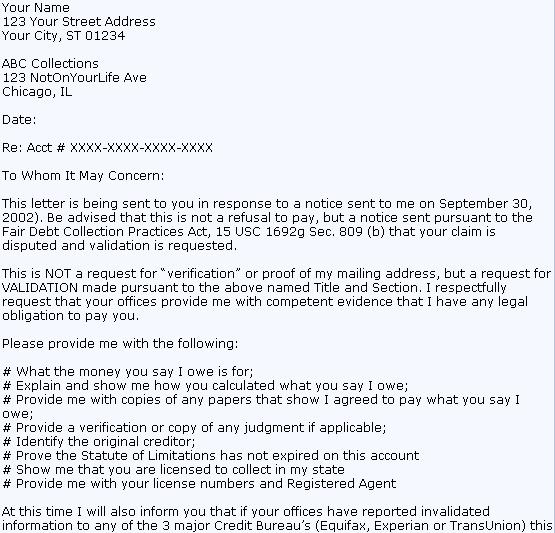

Strategies On Successfully Disputing Your Credit Report

It’s important to remember that disputing your credit report with Capital One means more than just filling out a simple form. Here are some ways to help ensure that your dispute will be successful:

- Get all of the documentation you can. Be sure to include invoices, debit cards, receipts, and any other documentation that can prove that you have done what you agree to in your dispute request.

- Make sure your dispute is clear, concise, and focused on the errors in your credit report.

- Avoid submitting a dispute that has already been investigated. If you have already taken the creditor’s previous step of investigating your dispute, it might make more sense for you to write a new dispute letter and file an entirely new dispute instead of adding another layer of paperwork to the process.

- Speak with a knowledgeable attorney if you can’t decide which dispute form is best for you.

- Be sure to look over your credit report and make sure that you don’t have duplicate disputes being submitted. It’s not a good idea to submit the same disputed information more than once because you will end up sending multiple dispute letters without any results at all.

- Keep copies of all of the paperwork you send in as well as any confirmation receipts from the credit bureaus and your bank or banking institution.

To avoid this hectic encounter, let DoNotPay help you know when Capital One has reported to the credit bureaus, as well as help you with the dispute process more efficiently.

How To Dispute A Capital One Credit Report

In most states, you will not be allowed to dispute your credit report with Capital One directly. Instead, you can submit a dispute form to each of the credit bureaus that currently maintain your report. Here is what you need to do:

If you want to know Capital One reporting date, DoNotPay can help you find out so that you know when your information has been updated to improve your credit score.

Recommended Reading: When Do Credit Card Companies Report To Bureaus

Us Bank Business Cash Rewards World Elite Mastercard

As far as rewards cards go, the U.S. Bank Business Cash Rewards World Elite MasterCard® is a solid pick. Earn up to 3% cash back on eligible gas station, office supply store and cell phone/service provider net purchases. Earn 1% cash back on all other eligible net purchases. Plus theres a 25% annual bonus based on your prior years cash rewards, up to $250.

For business owners looking to maximize cash flow, there is a 0% Intro APR on balance transfers for 12 billing cycles. After that, a variable APR currently 13.99% 22.99%. And the annual fee is $0.

Note:

You May Like: How To Unlock My Experian Credit Report

Who Is Eligible For A Credit Limit Increase With Credit One

Your credit card issuer determines your credit limit when you open a card. After a certain period of time, you may be eligible to increase the limit if youve practiced responsible borrowing. While Credit One Bank doesnt explicitly list requirements for a Credit One credit increase, they do list some general guidelines on their website. To become eligible for a credit limit increase with this issuer, consider the following:

- Make sure to pay your bills early or on time each month.

- Ensure your credit utilization is in a reasonable range.

- Keep an eye on your credit card account and look for signs of fraud.

- Monitor your credit reports for both signs of fraud or identity theft, which you can do for free with all three credit bureaus at AnnualCreditReport.com.

These eligibility requirements arent hard-and-fast rules, but instead a list of recommendations that could lead to a Credit One Bank limit increase.

Read Also: Why Does Credit Score Go Down When You Check It

Chase Reports To Credit Bureaus At The End Of Each Billing Cycle

Chase uses a process called Universal Reporting to report information to the credit bureaus. This means that they report information to all three of the major credit bureaus Equifax, Experian and TransUnion at the same time.

Chase reports information to the credit bureaus at the end of each billing cycle, so if you have a Chase credit card, your account activity will be reported to the credit bureaus every month. This includes both positive and negative information, such as whether you paid your bill on time or if you carried a balance over from month to month.

What Is A Goodwill Letter

A goodwill letter is a request made to your creditor to remove the report of the late payment from your credit report. Negative marks against your credit report can stick around for up to seven years, but these simple requests can help keep your report spotless and your .

These requests are not meant to dispute errors on your credit report rather they are an apology to your credit issuer for missing the payment and a goodwill statement that you will pay your bills on time moving forward.

Of course, a goodwill letter doesn’t necessarily have to be a physical letter. You can also call the number on the back of your credit card to talk to a customer service representative to request the late payment be removed. Just keep in mind that the first person you talk to on the phone may not be able to help you’ll need to politely request to escalate the issuer to a manager or different department that can handle the request. You can also reach out via email, but emails can easily get lost in the shuffle.

You May Like: Why Did My Credit Score Drop 30 Points

What Happens If You Never Pay Your Credit Card

When a credit card account goes 180 days past due, the credit card company must charge off the account. This means the account is permanently closed and written off as a loss. But youâll still be responsible for any debt you owe.

There are a variety of ways that your lender might try to collect the debt. Some of these include using the lenderâs collection department or a third-party debt collector.

But just remember that charge-offs could stay on your credit report for up to seven years. And that could have an effect on your âand how lenders view your applications for other loans or credit cards in the future.

Some card issuers may be willing to work with you if youâre having a hard time making payments. But itâs important to contact your credit card issuer as soon as possible so they know whatâs going on.

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, co-president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

Recommended Reading: Is 725 A Good Credit Score

Filing A Small Claims Lawsuit Against The Creditor

Finally, if the first three steps do not yield results, I often help my clients file a small claims suit.

Heres whats great about this I have seen many judges rule in a consumers favor if they can prove wrongdoing by the creditors.

Research your states civil code to see what violations were committed pertaining to credit reporting. Also check for breach of contract, or unfair business practices.

Small claims court also requires consumers to show monetary damages.Proof of monetary damages could include documentation that a consumer was turned down for credit. It could also be that they received unfavorable financing terms due to the specific late payment.

Something to remember when trying to remove remarks from credit reports via legal actionSimply filing a suit will not make the creditor buckle.

The case has to be strong and well documented. What you may find surprising is, that even in the event the creditor does not show up to court, the judge will still look at the merits of the case and rule accordingly.

I normally recommend hiring an experienced professional or attorney if you are going to go down this path.

This is due to the complexities involved with filing and winning a small claims case to erase your late payment,

I do offer a free consult to determine if legal action is the right course for you.

Getting Approved For A Credit Card

Check credit score requirements before applying for a credit card. Some credit cards only approve people with excellent credit. Others are made especially for people with low or no credit. Here are our favorite credit cards organized by credit score requirements:

- 740 or higher:Best cards for excellent credit

When you’re deciding which credit card to apply for, ask yourself a few questions:

- What rewards would I like to earn? To improve your credit utilization ratio, you’ll need to keep your spending the same. But that doesn’t mean your rewards need to stay the same. If you split your spending 50-50 between your old card and new card, you can earn two different types of rewards instead of just one.

- What other features am I missing in my current cards? Improved credit utilization and rewards are only two benefits of a new card. Do you want a card with rental car insurance? TSA pre-check? Purchase protection? Look into various credit card benefits before settling on a new card.

- How likely is it I’ll be approved? If you’re focused on building your credit score, try to minimize the number of credit cards you apply for. Narrow your search to cards you’re likely to be approved for.If you’re concerned about this last point, don’t worry. You’re not alone. Below, we’ve listed some of the easiest credit cards to get.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Read Also: What Does Written Off Mean On Your Credit Report

Your Statement Closing Date

Now lets talk about how this relates to the date that Capital One reports to the major credit bureaus. As we mentioned, the balance on your statement closing date is what Capital One reports as your balance to the three credit bureaus.

Because your balance on your statement closing date is the last date of your billing cycle, its often the highest your balance is all month. Even if you pay off your full balance before your payment due date, its still the statement closing balance thats reported to the credit bureaus.

The balance on your statement closing date is then used by credit bureaus to calculate your credit utilization. So if youve used a large percentage of your credit limit that month, your credit reports will show a high credit utilization, even if you dont plan to carry a balance.

This timing is especially problematic for people who use their credit card for all of their expenses throughout the month and then pay it off in full. Even though youre using your credit card responsibly, your credit score wont reflect as much.

What If You Cant Pay Your Credit Card For Several Months

Some credit card companies may not report past due accounts that are just a few days late. But you may still receive a late payment fee. And once itâs 30 days past due, late payments may be reported to credit bureaus.

Depending on your issuer and your account terms, the lender may apply a penalty annual percentage rate to your account if itâs been 60 days without a payment.

In general, card issuers report late payments every 30 days. Late payments are only one of several factors that impact credit scores. But usually, the later the payment, the worse it could be for your credit scores.

Card issuers could also send your account to their collection department or a third-party debt collector at any point.

You May Like: How Long Are Credit Inquiries On Your Report

Why Credit Utilization Is Important

The reason lowering your balances can increase your FICO® Score is that your has a big effect on your credit score. Utilization is your revolving debt balances compared to your credit limits, or the amount of your available credit currently being used. It’s calculated for each card and overall.

Let’s say, for example, that you have the following balances and limits on a portfolio of four cards:

| $6,000 | $24,000 |

In this case, your total utilization rate would be 25% — $6,000 divided by $24,000. Your utilization on Card 3, however, is 50%. Your credit score will suffer if any one card is maxed out or nearly maxed out.

But you can have good credit with a utilization ratio of 30% or even more if other factors are strong.

To understand this better, here are the factors that affect your FICO® Score according to their weighting, most to least:

- Payment history: 35%

- Length of credit history: 15%

- New credit accounts : 10%

Utilization is the second-most critical component of your , next to payment history, and its weight is nearly equal.

Catching Missed Payments Early

If you do miss a payment, it’s important that you catch it early. Most issuers only report credit activity approximately every 30 days. This means if you catch the late payment early and rectify your account, the issuer may not report it to the credit agency. While you’ll likely still get hit with a late payment fee and possible penalty APRs, in this case your credit score wouldn’t suffer.

If you do notice a late bill, it’s still worth a call to your issuer to make sure it won’t end up on your account. I know I’ve certainly flubbed on a due date this year because I got due dates mixed up on a new credit card.

Related: How to check your credit score

Also Check: Is 629 A Good Credit Score

Does A Business Card Affect Your Personal Credit Score

A business credit card can impact your personal credit score in a few key ways. Heres how:

New credit inquiry: If a business does not have sufficient credit history to qualify for a business credit card, the card issuer may require the business owner to provide a personal guarantee . In that case, the company will run a hard inquiry on your personal credit, and youll be personally responsible for the companys debts if the business cant pay them. That hard inquiry will likely be reported on your consumer credit report and could briefly ding your credit score. New credit inquiries account for 10% of your FICO score.

Even if you have an LLC or are incorporated, they might want you to put in your Social Security number as a personal guarantee, explains Nathan Grant, Senior Credit Industry Analyst at Credit Card Insider. Its still not going to be reporting the daily charges to your personal credit report, but if your account becomes delinquent, they need to have someone be liable, especially at first when the business has no credit history.

| American Express | Reports in the case of default |

If your business credit card does report activity to the consumer credit bureaus, you should use some standard best practices to be sure your personal credit is protected. For example, aim to keep a low balance on your business card relative to the total limit .