Missed And Late Payments May Impact Your Score

Your credit report will show whether you missed or made a late payment. Repayment history information shows if you have made your repayments on time. There is a 14 day grace period on repayments. CommBank calculates grace days as calendar days, regardless of weekends or holidays. So if youre late making a payment after the grace period, it may be recorded on your credit report.

How late and missed payments impact your credit score is determined by each credit reporting body.

Keep in mind that any payments past their due date will be charged a late fee.

Read Also:

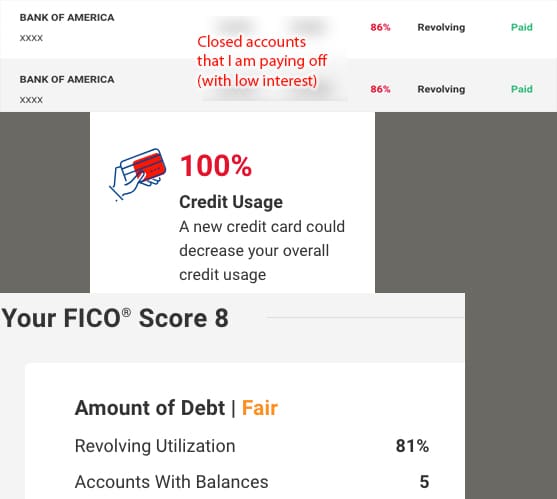

How Long Do Closed Accounts Stay On My Credit Report

When you close an account, it may not be removed from your credit report immediately. This is true whether the closed account is a credit card or an installment loan. Closed accounts stay on your report for different amounts of time depending on whether they had positive or negative history. An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Should I Try To Get Rid Of Closed Accounts On My Credit Report

Don’t try to remove a paid-off mortgage, car loan, credit card or other accounts from your credit report if they show a positive payment record. That good record will continue to help your credit scores.

If you have negative marks on the account, however, you want it off as soon as possible. You can use AnnualCreditReport.com to get free reports from the bureaus every 12 months to verify negative information has been removed as required by law. If a negative mark is lingering, you can file a dispute.

Many credit scoring models now exclude paid-up collections accounts. But because some lenders still use older scoring models, you may want to try removing collections from your reports.

Don’t Miss: Is 742 A Good Credit Score

What Happens When An Account Is Closed

When you pay off or close an account its not available for purchases or payments.

An account can be closed for many reasons such as paying off the amount borrowed or closing an unwanted line.

Once the account is closed, its then settled and will appear on your credit report as such.

When an account is closed with a balance, the creditor will still report the status and account details to the credit bureaus on a monthly basis.

The information that is reported is the balance, monthly payment history, and the date of your last payment.

Why Should You Settle An Account

Its important to remember that having unpaid debts will affect your credit score in a negative way. Creditors will consider you a high-risk borrower, which means these lenders will assume that youre less likely to pay back the amount you borrow from them. Theres a good chance youll end up with a higher interest rate when you obtain the loan too. Lenders use this additional interest to account for the perceived risk of lending to you.

Settled accounts may harm your credit history but their effects are much less averse when compared to listing an unpaid debt on your credit report. Creditors will look at credit reports with settled debts more favorably than those with unpaid debts. Settling an account may lower your credit score in the short term but its negative effect will lessen as time goes by.

Settling an account, paying it in full and closing it may help your credit score. Your payment history on that particular account will still appear on your credit report, which lenders can use as a reference to determine your ability to pay back debts.

Don’t Miss: What Number Is Considered A Good Credit Score

How Long Does My Repayment History Last

When assessing a credit application, we may look at how youve made repayments over the past 24 months.

If youve missed a few payments in the past, your credit history wont be permanently impacted because repayment history information is only on your credit report for 24 months.

Each time you make your required minimum repayment, this will have a positive impact on your credit report. Your credit score may be improved by getting back on track with your minimum repayments.

How Long Will Derogatory Credit Last

Derogatory credit can follow you around for a long time. Some types of derogatory informationlike a bankruptcycan remain on your credit report for up to 10 years.

Most other derogatory informationlate payments and debt collection accountswill only remain on your credit report for seven years. Typically, these items will automatically fall off your credit report once theyre past the credit reporting time limit.

Only accurate, timely, and complete information can be included on your credit report. You can dispute an error or outdated derogatory item with the credit bureaus to have it removed from your credit report.

In some cases, having negative information removed can increase your credit score, but it depends on the rest of the information on your credit report.

Dont Miss: Klarna And Credit Score

Don’t Miss: How High Can Your Credit Score Be

What Happens When An Account Goes Into Collections

Step by step, heres what happens when you have an account go into collection:

Virtually any type of unpaid debt can be sent to collection, including:

Can A Collection Agency Report An Old Debt As New

You may have heard of another date pertaining to collection accounts: the date of last activity .

You might have heard it said that you should never make payments on a collection because that action would change the DLA on the account. If the DLA changes, so the advice goes, this resets the clock on the seven-year period after which the collection will fall off your credit.

In reality, debt collectors cannot change the DLAonly the can do that. Furthermore, the DLA does not affect the timeline of your collection account.

The seven-year period begins at the DOFD, not the DLA, and not the open date of the collection. The collection agencies are not legally allowed to change the DOFD, so there should be no legitimate way for them to restart the seven-year timeline. Yet there are many cases in which consumers report that their collection accounts are suddenly being updated as new accounts, even if they are several years old. What is going on in these situations?

This shady practice is the collection agency re-aging the debt.

Its illegal to re-age a collection account by incorrectly changing the DOFD.

When a debt collector acquires an account, they sometimes improperly update the DOFD to be the same as the date that the new collection account was opened. If you make a payment on the collection, they may replace the DOFD with the DLA, which is the date that you made the payment. This explains why the seven-year clock seems to restart in these situations.

Read Also: Does Getting Married Affect Your Credit Score

How Long Can A Card Be Inactive Before The Account Is Closed

How long your card can be inactive will vary, depending on the card issuer, as well as your own account and purchase history. The window of time could be six months, one year, or several years. You can prevent an account from being closed due to inactivity by regularly making small purchases or setting up recurring payments for a bill.

Wait For The Closed Account To Drop Off Your Credit Report

If nothing else works, you only have to wait it out because closed accounts wont stay on your credit report forever.

How long does a closed account stay on your credit report? Closed accounts with negative records, such as late payments, will remain on your credit report for 7 years. It will negatively affect your credit score and these are the ones that will benefit you to get deleted.

Meanwhile, accounts that were in good standing when you closed them will be on your report for 10 years. This is favorable to you because positive information on your credit report will have positive effects on your credit rating. And logically, you will want to keep these on your credit record.

So it is important that you know the difference and act accordingly.

Don’t Miss: What Is The Highest Credit Score You Can Receive

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Dispute Any Inconsistencies To A Credit Bureau

The first step to closing a settled account on your credit report is to dispute it.

You must study the loan or account closely and see if there is any inaccurate information.

If there is, then you can dispute inaccurate information.

This information can include personal details like your name and address to inconsistencies in repayments.

For example, you have kept track of making payments and when comparing your data to the records on the account it appears that they didnt receive or track a payment.

This is something you should dispute.

To dispute, you must contact one of the three credit bureaus.

Equifax, Experian, and TransUnion allow anyone to file a dispute online or by mail.

When filing your dispute you must provide your name, number of the account you are disputing, why youre disputing it, and supporting information and documents to prove that the dispute is valid and accurate.

After providing the credit bureau with your dispute and supporting information they must look into it.

They have a timeline of 30 days to begin the investigation process.

If the credit bureau finds anything, they will inform you in writing through the mail.

If the settled account was faulty, it will then be removed from your account.

The only way it will appear again is if the creditor proves it was accurate.

This is a great way to not have the account affect your score negatively but in most cases, it will still remain on your report.

Read Also: Is 653 A Good Credit Score

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Lenders are required to investigate and respond to all disputes.

Remember to include as much documentation as possible to support your claim. Including a copy of your report marking the error is also helpful.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Do I Get Closure Notice

Your credit card issuer is not likely to tell you if it plans to close your account. However, if youve signed up with a , you may receive an alert. If that happens, call your issuer right away to see how to get your card reinstated. The issuer may restore your account with the previous terms, or it may request that you reapply for the card. If you lost points because of the closure, ask if those can be reinstated as wellalthough the issuer has no obligation to do so. If your card is restored with a lower credit limit, wait six months and then ask for an increase.

Recommended Reading: Does Uplift Report To Credit Bureaus

Pay Your Bills On Time

You can improve your credit score significantly over time by improving your payment history. Its the most important factor in determining your credit rating, accounting for 35% of the score. Pay your bills on time every month and dont miss any payments. One missed payment can already have a drastic impact on your credit score that you wont be able to recover quickly.

When you pay your bills on time, creditors and lenders see it as a sign that youll pay your debt, so theyre more likely to approve your loan application or give you a new line of credit.

What Does Closed Mean On Credit Report

Asked by: Prof. Halie Schuster IV

What does account closed mean on a credit report? If you have closed credit card accounts, your credit report will indicate whether the account was closed by you or by the account issuer. The account issuer might close one because of default, late payments or inactivity.

a closed account can still affect your scorethe account in question defaulted and was closed as a resulthelp improve your scores over timehave an outstanding loan thats a year25 related questions found

You May Like: When Does Bank Of America Report To Credit Bureaus

How To Get Rid Of Closed Accounts On Credit Report

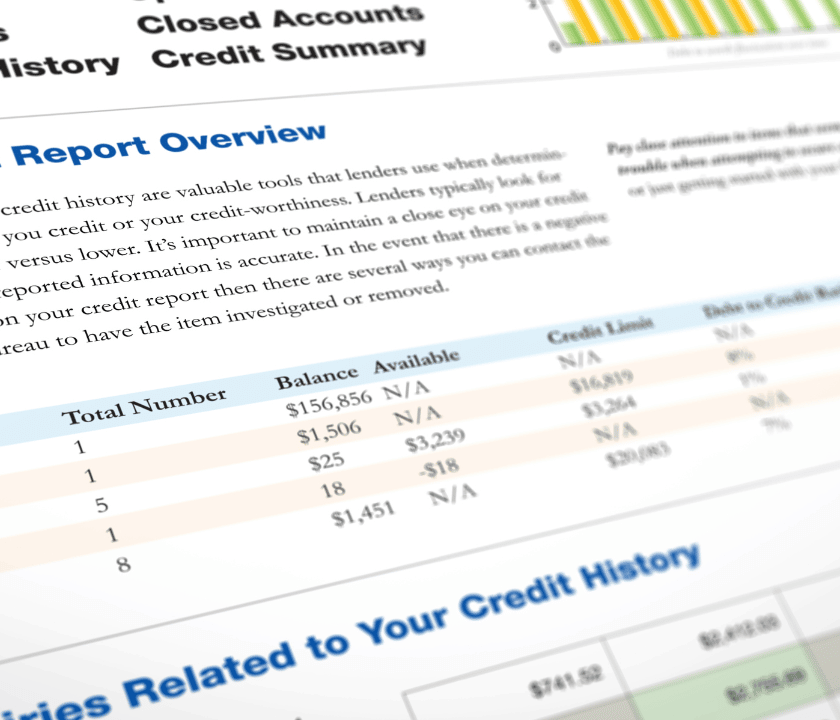

Your credit report is a crucial record of your credit worthiness, and contains your credit score which is a quantitative measure by which you will be assessed by many financial institutions. As such, why wouldnt you want to have a clean report? After all, credit agencies look at your credit report and score to determine whether you qualify for a loan or a credit line.

Your credit report contains details about all your credit accounts, including payment history. When you have closed accounts, they will show up on your credit history between 7 and 10 years.

Closed accounts can continue to affect your credit score. Should you have them removed? How to get rid of closed accounts on a credit report?

How To Remove Negative Items From Your Credit Report

Amarilis YeraNorma RodríguezAndrea AgostiniTaína CuevasAmarilis Yera26 min read

Your is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Also Check: What Most Impacts Your Credit Score

Rebuilding Your Credit Rating

Since the charged-off account will still show up on your credit report, it will continue to impair your credit score. But the good news is that as charge-offs and other negative information ages, its overall impact can lessen.

In the meantime, you can work on rebuilding a positive credit history by doing things like paying your bills on time, keeping your low, and limiting how often you apply for new credit.

What Should I Do If My Student Loans Fell Off My Credit Report

Theres no statute of limitations for federal student loan debt. So even if your loans no longer show in your credit history, you still owe your loans. They didnt go away. And that means the U.S. Department of Education can still garnish your wages, take your tax refund, and offset your Social Security Benefits.

In addition, your defaulted federal student loans will remain on the CAIVRS database, and that will stop you from getting a federally backed mortgage and qualifying for new Federal Student Aid.

You can avoid these consequences by getting out of default by:

You May Like: When Does Affirm Report To Credit Bureaus

Recommended Reading: How To Get Inquiries Off Credit Report