What Information Is Used To Calculate My Credit Score And What Factors Will Lower My Score

If you have tried looking on the consumer reporting agencies websites, you have seen they provide VERY little information as to how your credit score is calculated. They believe this information is proprietary and therefore their secret. They do, however, provide a list of the main factors which affect your credit score:

1. Payment HistoryEquifax says: Pay all of your bills on time. Paying late, or having your account sent to a collection agency has a negative impact on your credit score.TransUnion says: A good record of on-time payments will help boost your credit score.

2. DelinquenciesEquifax lists: Serious delinquency Serious delinquency, and public record or collection field Time since delinquency is too recent or unknown Level of delinquency on accounts is too high Number of accounts with delinquency is too highTransUnion lists: Severity and frequency of derogatory credit information such as bankruptcies, charge-offs, and collections

3. Balance-to-Limit RatioEquifax says: Try not to run your balances up to your credit limit. Keeping your account balances below 75% of your available credit may also help your score.TransUnion says: Balances above 50 percent of your credit limits will harm your credit. Aim for balances under 30 percent.

Ok, so avoid maxing out your credit because if you dont really need more credit youll be able to get it, and if you do really need it then you are more of a risk.

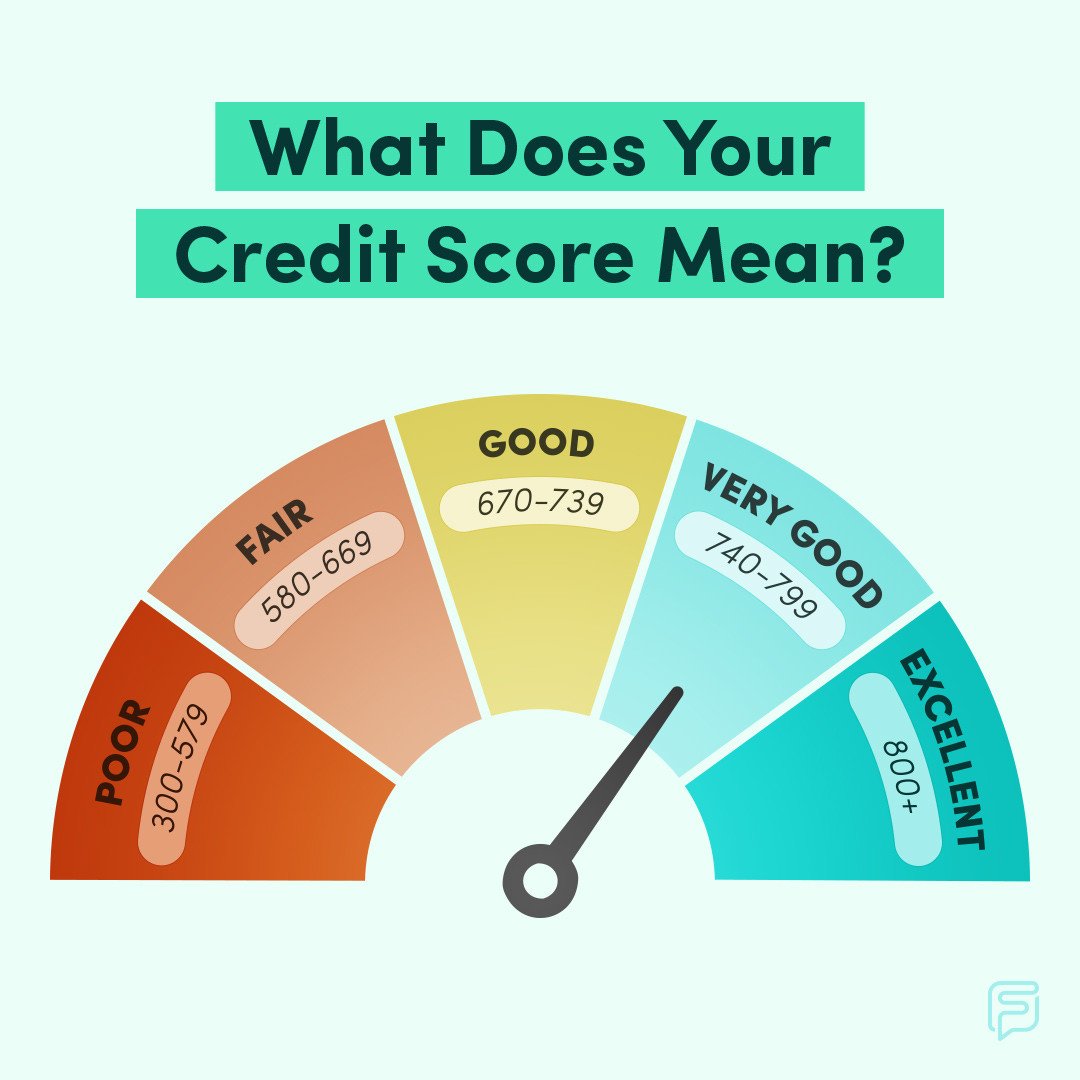

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Read Also: How Can I Check My Credit Score With Itin

How Can I Fix A Bad Credit Rating

You may be able to improve your bad credit rating by practicing responsible lending habits such as making payments on time. It could be worth consolidating debts to make your payments easier, which may improve your credit score in the long run.

There are also credit repair services that offer guidance and counseling to help improve your credit score. Keep in mind that credit repair services charge money and it may not be worth it depending on your circumstances.

Keep Credit Inquiries To A Minimum

People with excellent credit also keep their credit inquiries to a minimum just two in as many years, on average. When we apply for credit whether its for a new credit card, a mortgage, or an auto loan and a lender issues a credit check, it will appear on our and may influence our credit score. This is referred to as a hard inquiry.

Too many hard inquiries may raise red flags for lenders, according to Experian, because they signal a high volume of new accounts in a short period of time, which may mean youre having trouble paying bills or are at risk of overspending. Hard inquiries remain on a credit report for up to two years.

Also Check: Syncb/ppc Closed Account

Recommended Reading: How To Report To A Credit Bureau Landlord

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

What Is A Good Credit Score: Key Takeaways

- The higher the credit score you have, the better, but a good credit score is in the high 600s or above.

- Different lenders/landlords will set their own parameters for what they accept for a credit score based on the circumstances.

- Many lenders require a credit score of at least 620 to qualify for a conventional loan.

- Youll typically need a credit score of at least 500 to buy a car.

- The FICO score ranges from 300 to 850.

Recommended Reading: Tri-merge

Why Credit Scores & Credit Score Ranges Matter

If youre applying for credit, the range and category your FICO Score or VantageScore falls within could affect you in the following ways:

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

Prioritizing Good Credit Can Only Benefit You In The Long Run

Its never too early to start prioritizing good credit. A high credit score opens the door to endless opportunities, so start building your credit today. And if you need a way to check your credit score and keep an eye on your finances, you can use the Mint app, which is free and easy to access on the go.

With an overview of the answer to what is good credit? covered, you can move on to the next chapter in the series, which covers how to build credit.

Recommended Reading: How To Fix A Repossession On Your Credit

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Improve Your Creditworthiness By Adopting The Strategies Used By Those With High Credit Scores

Without even knowing it you might be doing things that are damaging your credit score, which affects your ability to get credit and the interest rate you pay when you do get credit. A 2014 survey by Credit.com found that consumers sometimes dont understand which actions will and will not help them improve their credit scores.

To take the right steps to boost your score, you need to start by understanding the basics of credit scores. The FICO credit score is the most widely used score in lending decisions and ranges from 300 to 850. A FICO score of 750 to 850 is considered excellent, and those with a score in that range have access to the lowest rates and best loan terms, according to myFICO.com, the consumer division of FICO. A score of 700 to 749 is good, and those with a score in this range will likely be approved for loans but might pay a slightly higher interest rate. A score of 650 to 699 is considered fair, and those with a score in this range will pay higher rates and could even be declined for loans and credit, according to myFico.com.

You can get a free VantageScore 3.0 and a credit score from Experian through . provides a free VantageScore and a TransUnion credit score with its credit report card. And Quizzle offers a free VantageScore 3.0 from Equifax. Or you could pay $19.95 per FICO score from each of the three bureaus at myFICO.com.

Recommended Reading: Check Credit Score With Itin

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Don’t Miss: When Does Wells Fargo Report To Credit Bureaus

Why Good Credit Scores Matter

While credit scores help determine your availability of credit and the rate youll pay to access it, what it really measures is your statistically proven likelihood of defaulting on the money you borrow. The greater the risk, the lower your score and the more youll pay to access credit if you can access any credit at all.

In August 2021, the average interest rate on a subprime credit card or a card for customers with subprime credit was 25.88%, while the APR on a low-interest card was 12.96%.

If you carry an average balance of $3,000 month to month on an average subprime credit card, expect to pay about $64 in interest charges. Compare that to $32 in interest charges for an average low-interest credit card, and youre paying twice as much in interest. Low-interest credit cards are typically only available to people with excellent credit scores, and this example demonstrates the importance of building good credit.

Also Check: How To Get Credit Report Without Social Security Number

Buying A Home In Canada Why A Good Credit Score Matters

Its a fact that for most people, buying a home requires a good credit score. In Canada, home valuations are rising across the country, and in desirable markets you could be looking at a home cost in the high six figures, and its rising rapidly. Without a briefcase full of cash, youll need a loan to help make that mortgage work, and that also means having a good credit score to buy a house in Canada.

But when you work with lenders and try to secure financing for that purchase, youll be scrutinized for your financial standing, and one of the most crucial qualifiers is that all-important credit score. Sure, youll need to prove your income and have the down payment ready, but youll be financing a majority of that purchase, and your credit score will dictate the loan youre able to get, as well as that percentage rate that can save you money over the long run.

Read Also: Suncoast Credit Union Credit Card Approval Odds

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That’s why it’s important to research credit cards before you apply.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .