Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Benefits Of Knowing The Maximum Credit Score

As we mentioned before, knowing the maximum credit score is important because it gives you a framework for whats possible and it helps you understand how much improvement you need to make in order to break into that Excellent threshold.

If youre like most of the U.S. population, you have some room for improvement. Lets look at some of the ways you can improve your credit score.

Length Of Credit History

There are two main tips for doing well in this category: dont open too many new accounts at once, and keep your old accounts open.

Opening too many cards at once will lower the average age of your account. With great power comes great responsibility: If you have rapidly opened many new accounts, lenders may worry that you have access to large credit lines of spending power that you havent proven you can manage.

Although it is tempting to close old credit cards you dont use anymore, they can provide valuable leverage in building your average account age.

So long as there isnt an annual fee attached, plan on keeping your accounts open even if you dont plan to make purchases with that card again in the future.

Don’t Miss: What Credit Report Does Comenity Bank Pull

Become An Authorized User

If you dont have a lengthy credit history, ask a family member who has excellent credit to add you as on their oldest credit cards. Your score can increase if the credit card issuer reports information to the credit bureaus for authorized users. However, the downside is that your score can decrease if the primary cardholder misses a payment and its reported on your credit report.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

Read Also: How To Remove Repossession From Credit Report

What To Do If You Have A Bad Credit Score

A subprime loan is a type of loan given out to people, especially borrowers with low credit. Many mortgage lenders reject people that have low credit ratings, because of their potential inability to repay the loan. This is also why the interest rate is relatively higher for such loans.

There is a prime interest rate that is set for prime buyers with a reasonable credit rating, currently the prime interest r ate is 3.25%, but the subprime interest rate is always higher. This is due to the risk of the low-credit borrower to end up defaulting on the loan altogether.

Even if youre not a high-risk borrower on your own fault, there are chances that you default on the subprime home equity loan because of higher interest rates. Heres how you can avoid getting to that stage of default:

- Budget your income to include the potential loan payment.

- Check your credit score and fix errors in your credit history.

- Make timely payments each month to improve your credit rating.

- Shop around for alternative lenders.

- Consider asking someone with strong credit and income to cosign on the loan.

- Set a reminder at least 3-4 days prior to the due date so that you dont forget paying, and if youre short of money, you have time to ask from your friends or family.

Key Characteristics Of Consumers With The Highest Credit Score

Although theres no defined formula for a perfect credit score, heres what the highest credit score consumers have in common:

- Long credit histories. Most people with perfect credit scores have a long credit history. According to a 2019 FICO report, their average oldest credit account was 30 years.

- Perfect payment history. A person who has perfect credit typically has a perfect payment history. This means they have no collections, late payments or other negative information listed on their credit reports.

- Low credit utilization ratio. The majority of people with scores of 850 dont use much of their available credit. According to the same FICO report, their average credit utilization ratio was 4.1%.

- A low number of recent credit inquiries. Although some open new credit accounts, the majority of them dont. When you apply for a new account, it typically requires a hard credit inquiry, which can damage your score between one and five points.

You May Like: Check Credit Score Usaa

Reasons You Need An Excellent Credit Score

Well, its a magic number that lets money lenders know that youre an ideal person to lend money to. If you want to finance a car, buy a house, or open another credit card, the lenders will check your credit score.

If you want to make big purchases without cash , youre gonna need to have a great score .

A good credit score can also be the difference between being able to rent an apartment and even a determining factor in whether you get a job youve applied for.

1. Lower Insurance Rates: Did you know that some insurance companies run a credit check on you when you purchase insurance? It turns out that having a good credit score will save you 15% or more on car insurance thanks, Geico!

2. Buyer Protection: When you use a credit card for your purchases, you get outstanding buyer protection, something using a debit card or cash cant bestow.

3. Help with Renting: If youre looking to rent a place to live, the landlord will run a credit check and might deny you housing because of a poor score. Im a landlord, and I ran a credit check on my tenant.

4. Lower Interest Rates on Houses and Cars: Yes, the better your credit score, the lower your interest rates. It might not seem fair to everyone, but thats the way it is, and I think the best reason to care about your credit score.

While you might read a bunch of articles online filled with tips on increasing your credit score, there are only three things you need to do to improve it.

What Are Inquiries And How Do They Impact Fico Scores

Inquiries may or may not affect FICO® Scores. Credit inquiries are classified as either hard inquiries or soft inquiriesonly hard inquiries have an effect on FICO® Scores.

Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender. FICO® Scores do not take into account any involuntary inquiries made by businesses with which you did not apply for credit, inquiries from employers, or your own requests to see your credit report. Soft inquiries also include inquiries from businesses checking your credit to offer you goods or services and credit checks from businesses with which you already have a credit account. If you are receiving FICO® Scores for free from a business with which you already have a credit account, there is no additional inquiry made on your credit report. FICO® Scores take into account only voluntary inquiries that result from your application for credit. Hard inquiries include credit checks when youve applied for an auto loan, mortgage, credit card or other types of loans. Each of these types of credit checks count as a single inquiry. Inquiries may have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk.

Read Also: Is 766 A Good Credit Score

Introducing The Fico Score 10 Suite The Most Recent Updatedfico Score Version

FICO Score 10 relies on the same design and key ingredients of prior models as well as captures the subtle shifts in consumer credit data that have occurred over the 5+ years since FICO Score 9 launched, such as the increasing use of personal loans, especially for purposes of debt consolidation.

As long as consumers practice good habits like consistently paying bills on time, lowering their debt as much as possible, and applying for credit only when needed, they can achieve and maintain a good FICO Score 10.

FICO Score 10 T builds on FICO Score 10 by also assessing “trended credit bureau data” when determining your score. Scores that don’t use trended data typically use the most recently reported month of data to drive certain components of the score such as the most recently reported balance and/or credit limit on an account.

The trended data allows the credit scoring model to determine what your “trend” is: are your balances trending up, down, or staying the same? Someone whose balances are trending up may be higher risk than someone whose balances are trending down or staying the same.

FICO Score 10 and FICO Score 10 T are currently available to lenders.

Why Does Your Credit Score Matter

Your credit score is kind of like a snapshot of how well youve been managing your debt. If you have a high credit score, lenders will assume that you are less of a risk of defaulting on a loan.

But if your score is low and you have a history of not paying your bills on time, lenders will see you as more of a risk. They may still be willing to lend to you, but youre going to pay a lot more in interest. A low credit score means youll end up paying more for things like your mortgage, personal loans, or auto loans.

A poor credit score can affect your life in other unexpected ways. The Society for Human Resource Management found that 47% of employers take credit scores into consideration when they are making hiring decisions.

And landlords may check your credit score before deciding whether or not to accept you as a tenant. So if your credit score falls in one of the lower ranges, its worth putting in the effort to raise your score.

Also Check: What Is Syncb Ntwk On Credit Report

What’s The Difference Between Base Fico Scores And Industry

Base FICO Scores, such as FICO Score 8, are designed to predict the likelihood of not paying as agreed in the future on any credit obligation, whether it’s a mortgage, credit card, student loan or other credit product.

Industry-specific FICO Scores incorporate the predictive power of base FICO Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking. For example, auto lenders and credit card issuers may use a FICO Auto Score or a FICO Bankcard Score, respectively, instead of base FICO Scores.

FICO Auto Scores and FICO Bankcard Scores have these aspects in common:

- Many lenders may use these scores instead of the base FICO Score.

- It is up to each lender to determine which credit score they will use and what other financial information they will consider in their credit review process.

- The versions range from 250-900 and higher scores continue to equate to lower risk.

Is A Perfect Credit Score Necessary

Believe it or not, a perfect credit score is not necessary in order to get good deals or interest rates on loans. If you have a credit score above 700, you will likely be approved for loans or credit cards with a fair interest rate.

In fact, while it is possible to achieve a perfect score of 850, it is highly unlikely. Less than 1% of consumers have a perfect credit score and those that do dont have it for long since the three companies are constantly re-calculating your score.

Since you cant determine exactly what affects your credit score, there is no need to obsess over obtaining the perfect score.

Read Also: How Long Foreclosure On Credit Report

What Is The Highest Achievable Fico Score

Chip Stapleton is a Series 7 and Series 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP& A.

A FICO score is used by creditors and lenders to determine the overall of any individual consumer. Individuals with higher ratings are considered to have greater creditworthiness. Each score is calculated using a proprietary tool developed by the Fair Issac Corp , and each of the three major credit bureaus in the United StatesExperian, Equifax, and TransUnionrely on Fair Issac’s technology to calculate a FICO score for any borrower.

The Credit Score Needed To Buy A House

Your FICO score plays a major role in your ability to secure a mortgage. The type of mortgage that youre looking to secure will determine what your score should be. According to QuickenLoans, these are the following credit scores you need to work with lenders14:

- Conventional Mortgage: 620

- FHA Loan With 3.5 Percent Down: 580

- FHA Loan With 10 Percent Down: 500

If you fall below these guidelines, ask yourself, how long does it take to build credit? Then, come up with a plan of action to help you work towards your goal.

Also Check: Does Opensky Report To Credit Bureaus

Dont Cancel Cards Needlessly

As you can see, both models look favorably on consumers who have longer credit histories and lower credit utilization ratios.

Unfortunately, you cant magically create 10 years of credit history. What you can do is choose one or two credit cards to keep active and never cancel. Not only will this help you build a longer credit history, but it can also help you keep your credit utilization rate low, since more active credit cards in your name means more available credit.

Are Fico Scores Unfair To Minorities

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

Also Check: How To Get Car Repossession Off Credit Report

Ways To Improve Your Credit Score

If youre looking to improve your score, there are some basics that you can work on. Those are:

If you put some of these strategies into play, its not difficult to move from one credit ranking to another.

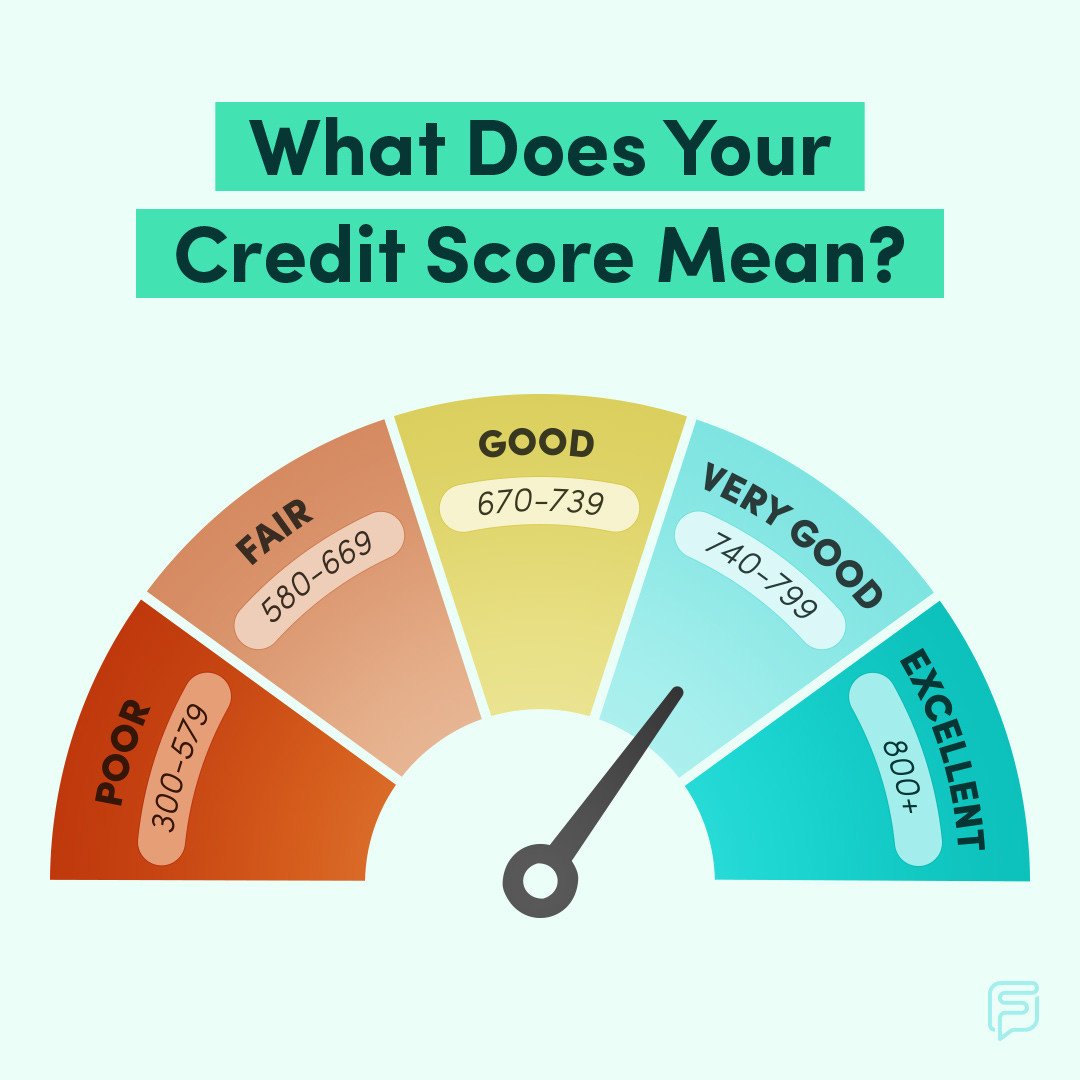

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

You May Like: Is 698 A Good Credit Score

What Are Fico Scores

FICO® Scores are the most widely used credit scores and are used in over 90% of U.S. lending decisions. Your FICO® Scores are based on the data generated from your credit reports at the three major credit bureaus, Experian®, TransUnion® and Equifax®. Each of your FICO® Scores is a three-digit number summarizing your credit risk, that predicts how likely you are to pay back your credit obligations as agreed.

How Does It Work

Although there are many different , your main FICO score is the gold standard that financial institutions use in deciding whether to lend money or issue a credit card to consumers. Your FICO score isnt actually a single score. You have one from each of the three credit reporting agenciesExperian, TransUnion, and Equifax. Each FICO score is based exclusively on the report from that credit bureau.

The score that FICO reports to lenders could be from any one of its 50 different scoring models, but your main score is the middle score from the three credit bureaus, which may have slightly different data. If you have scores of 720, 750, and 770, you have a FICO score of 750.

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will give you access to the best rates on credit cards, auto loans, and any other loans.

Recommended Reading: Aargon Collection Agency Payment