Recent Changes To What Impacts Your Credit

There were some changes to credit reporting and scores over the last couple years that are positive for consumers. These may have positively impacted your credit score. These updates include:

- Tax liens are no longer included on your credit as of April 16, 2018. They dont impact your credit score anymore.

- Medical collections dont impact your credit as much as they previously did.

- A new credit score called the UltraFICOTM Score was introduced in October 2018 by Experian, FICO, and Finicity. This new score will take into account other factors like how you manage your banking accounts. It is supposed to launch in early 2019.

- Experian also announced a new product in December 2018 called Experian Boost, which allows consumers to get credit for on-time mobile phone and utility payments.

Other Credit Score Factors You Should Know About

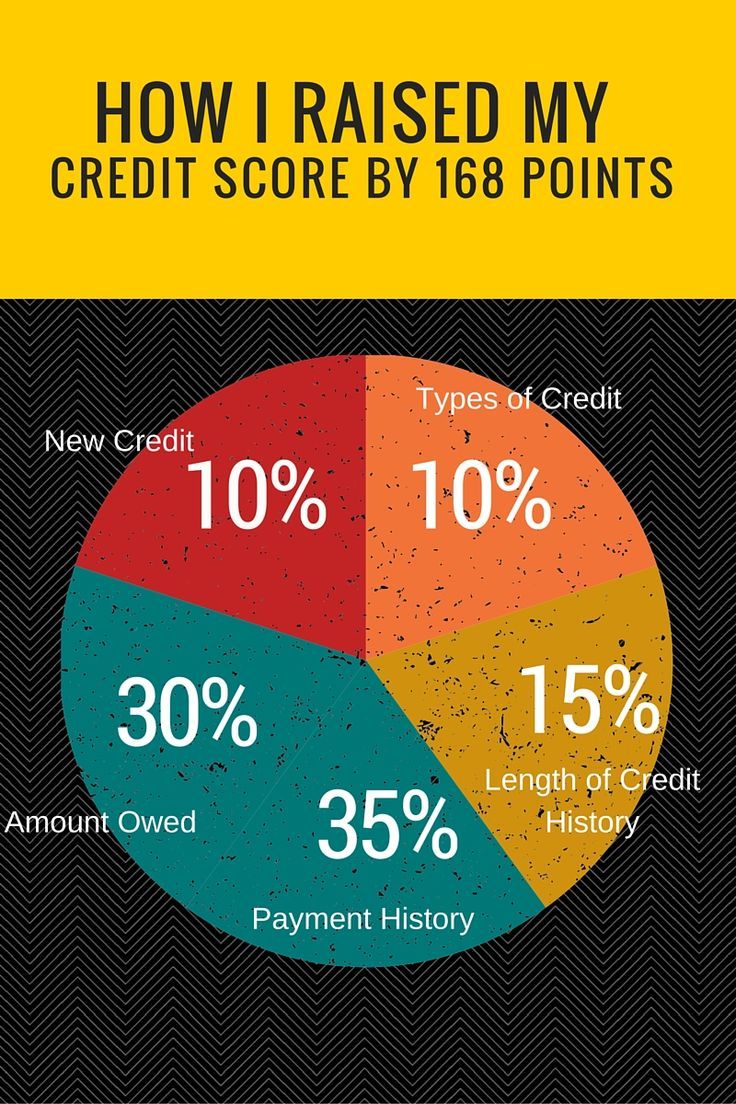

Once youve mastered paying on time and keeping credit utilization low, turn your attention to other credit factors. These also affect your scores, though not nearly as much:

The length of time youve had credit: Longer is better, so keep old accounts open unless there is a compelling reason to close them, such as an annual fee on a card you no longer use. You might be able to help yourself a little in this category by becoming an authorized user on an old account with an excellent payment record.

The kinds of credit you have, or credit mix: It’s best to have a mix of installment accounts those with a set number of equal payments, such as car payments or mortgages and .

The length of time since you’ve applied for new credit: Each application that causes a hard inquiry on your credit may take a few points off your score.

Total balances and debt: Its best if you’re making progress in paying off your debt.

Example Of Why Lenders Look At Your Debt

When you apply for a mortgage, for example, the lender will look at your total existing monthly debt obligations as part of determining how much mortgage you can afford. If you have recently opened several new credit card accounts, this might indicate that you are planning to go on a spending spree in the near future, meaning that you might not be able to afford the monthly mortgage payment the lender has estimated you are capable of making.

Lenders can’t determine what to lend you based on something you might do, but they can use your credit score to gauge how much of a credit risk you might be.

FICO scores only take into account your history of hard inquiries and new lines of credit for the past 12 months, so try to minimize how many times you apply for and open new lines of credit within a year. However, rate-shopping and multiple inquiries related to auto and mortgage lenders will generally be counted as a single inquiry since the assumption is that consumers are rate-shoppingnot planning to buy multiple cars or homes. Even so, keeping the search under 30 days can help you avoid dings to your score.

Recommended Reading: Realpage Credit Score

Payment History Impact On Credit Scores

One of the main tactics that lenders use when testing your credit repayment compatibility is checking your payment history. As a crucial factor that contributes about 35% towards your credit score, this aspect involves all of your previously-paid credits.

If you miss a single payment or arrange a delayed repayment with the lender, future lenders will recognize it as a threat. To ensure that your credit rating is above average, you should pay additional attention to repaying every installment on time.

To get leverage on this aspect, make sure you pay every installment on time, and especially avoid being late for more than 30 days. You can also arrange the terms previously with the lender, to prevent missing your future payments.

Opening Credit Accounts You Dont Actually Need

Under the VantageScore model, opening new credit accounts merely to improve credit mix or reduce credit utilization may backfire. VantageScore penalizes consumers for failing to heed its advice to only open the amount of credit you need a vague prescription, to be sure, but one that basically boils down to dont open too many credit cards at once.

You May Like: How Long Does Repo Stay On Credit Report

What Hurts My Credit Score The Most

4-minute readSeptember 08, 2021

Your credit score reflects your likelihood to pay back debts responsibly. This number is based on your credit history , and lenders use it to decide whether or not to grant you a loan or credit card.

The higher your credit score, the less youre perceived as a risk to lenders. Even if your credit score is pretty good right now, there are factors that can hurt your credit score.

Lets take a look at what helps and hurts your credit score the most.

Landing And Keeping A Job

Employers may want to know that youre financially responsible and dont have burdensome debts that could affect your judgment. Even if youre already employed, your credit could impact your ability to get a promotion or keep your job, particularly if it requires a security clearance.

Your credit score does not impact your employment, though thats a common myth but your credit report might. The important distinction is that employers may be able to review your credit report, but the version they receive doesnt come with a credit score. It also omits other pieces of information, such as your date of birth and account numbers, because employers dont need this data to make a hiring decision.

A company cant pull your credit as part of an employment check unless you give written consent, and some states outlaw the practice altogether.

Recommended Reading: How To Remove A Repo From Your Credit

You Let Debt Go To Collections

If you miss several payments, your debt could be turned over to a collection agency. You might even have a debt in collection youre unaware of, such as an old utility bill that wasnt paid when you moved. If that collection account is reported, your credit score could tumble.

I have seen it drop in a credit score 75 points for one collection, Kelly said. A collection account will stay on your report for seven years, even if you pay it off.

How to avoid it: Make payments on time, or reach out to the debt-holders for repayment assistance.

How to fix it: If you do get a letter from a collection agency for a debt you owe, try to pay what you owe as soon as possible so that its less likely to be reported. And check your credit report to make sure you dont have any debts in collection that need to be paid.

Check Out: How the Biden Presidency Will Impact the Economy by the End of 2021

Less Important: Recent Credit

Creditors may review your credit reports and scores when you apply to open a new line of credit. A record of this, known as a , can stay on your credit reports for up to two years.

Soft inquiries, like those that come from checking your own scores and some loan or credit card prequalifications, dont hurt your scores.

Hard inquiries, when a creditor checks your credit before making a lending decision, can hurt your scores even if you dont get approved for the credit card or loan. But often a single hard inquiry will have a minor effect. Unless there are other negative marks, your scores could recover, or even rise, within a few months.

The impact of a hard inquiry may be more significant if youre new to credit. It can also be greater if you have many hard inquiries during a short period.

Dont be afraid to shop for loans, though. Credit-scoring models recognize that consumers want to compare their options, so multiple inquiries for certain types of loans, like mortgage loans, auto loans and student loans, may only count as one inquiry. You typically have 14 days to shop for these kinds of loans. And though it could be longer depending on the scoring model, you may want to stick to getting rate quotes within those 14 days since you probably wont know which model is being used to generate your score.

Recommended Reading: Notify Credit Bureau Of Death

If You Have A Goal To Reach A Higher Score Or Just Want To Learn More About Credit Scores In General Its Important To Know What Affects Your Credit Scores And How Your Actions Could Improve Or Hurt Your Credit

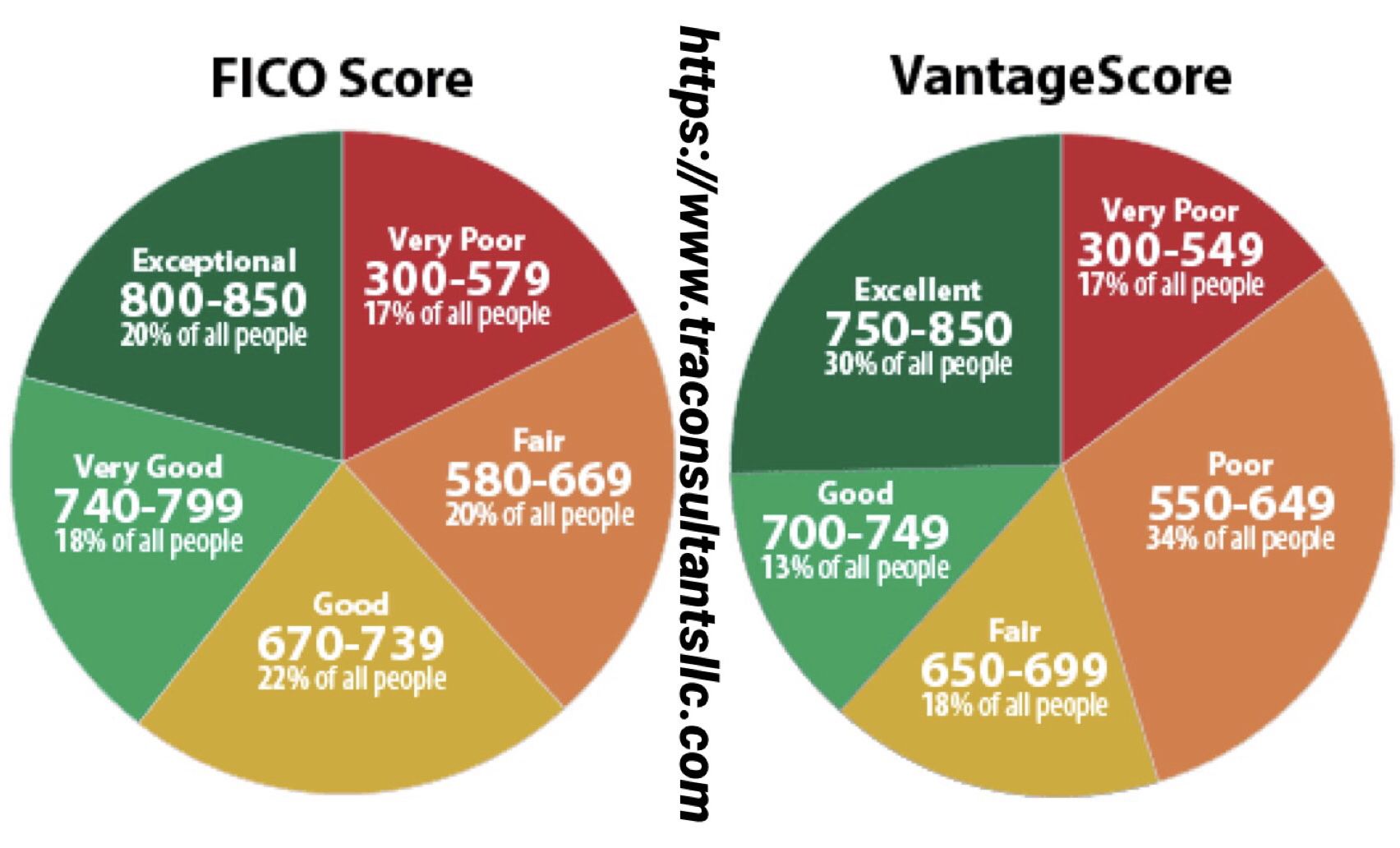

Although there are many credit-scoring models, the goal of these formulas is to figure out your credit risk that is, the likelihood of you paying your bill on time, or even at all. And whether youre looking at a FICO® or VantageScore® credit score, your scores are based on the same information: the data in your credit reports.

While various credit-scoring models may treat factors differently, the leading models, FICO® and VantageScore®, place similar relative importance on the following five categories of information. Weve ranked them by which ones are often most important to the average consumer.

You Have Too Many Credit Cards

Keeping too many credit cards open at one time can be problematic, even if you pay each of them off monthly. Having too many cards can negatively impact both your credit score and your ability to borrow money, said Julie Pukas, head of commercial product integration at TD Bank. Even if you dont use all your available credit, lenders might wonder what would happen if you did max out your cards.

How to avoid it: Having three to five credit cards is usually not a problem, Pukas said. But if you find your credit card balances are increasing, thats a danger signal. She advised limiting the amount of available credit you have at any one time.

How to fix it: If your ratio gets too high, consider closing one of your newer credit accounts to keep your utilization ratio low and your credit history long.

Also See: The Best Ways To Pay Off Every Kind of Debt

You May Like: Is 524 A Good Credit Score

What To Do If You Don’t Have A Credit Score

If you want to establish and build your credit but don’t have a credit score, these options will help you get going.

- Get a secured credit card. A secured credit card can be used the same way as a conventional credit card. The only difference is that a security deposittypically equal to your credit limitis required when signing up for a secured card. This security deposit helps protect the credit issuer if you default and makes them more comfortable taking on riskier borrowers. Use the secured card to make small essential purchases and be sure to pay your bill in full and on time each month to help establish and build your credit. Click here to learn more about how secured cards work and here to browse Experian’s secured card partners.

- Become an authorized user. If you are close with someone who has a credit card, you could ask them to add you as an authorized user to jump-start your credit. In this scenario, you get your own card and are given spending privileges on the main cardholder’s account. In many cases, credit card issuers report authorized users to the credit bureaus, which adds to your credit file. As long as the primary cardholder makes all their payments on time, you should benefit.

Want to instantly increase your credit score? Experian Boost helps by giving you credit for the utility and mobile phone bills you’re already paying. Until now, those payments did not positively impact your score.

You Close Old Or Inactive Credit Cards

Although its smart to limit the number of credit cards you have at any given time, Pukas noted that closing old or inactive cards can come back to haunt your credit score. The length of your credit history affects 15% of your score, she said. This is why its important not to close credit card accounts that you have had for years.

How to avoid it: Strive to keep older credit cards active by using them sparingly once every few months and paying off the balances on time.

How to fix it: If you dont trust yourself not to rack up debt on those cards, consider canceling newer accounts rather than old ones, so that the length of your credit history is not impacted, Pukas said.

Read Also: Does Kornerstone Credit Report To The Credit Bureaus

How To Get Financed For A Motorcycle With Bad Credit

Category: Credit 1. Motorcycle Loans for Bad Credit: MotorcycleLender MotorcycleLender helps secure loans for people with bad credit. Did you know around 61 million people in the US are living with bad credit? Thats why Apply to finance a motorcycle with us with bad credit and get approved. We offer

Biggest Factors That Impact Your Credit Score

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note: This post has been updated with more recent information on credit card scores. It was originally published on Oct. 2, 2015.

Earning points and miles through lucrative credit card bonuses can open up some amazing travel options. But to really work this hobby to your advantage, you need a solid credit score. Today, TPG Contributor Michelle Lambright Black goes back to basics with a look at eight factors that you may not even realize can influence your credit score.

Want more credit card news and advice from TPG? !

Read Also: Chase Preferred Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Payment History Is 35% Of Your Credit Score

Of your score, 35% is based on your payment history. Paying on time can mean the difference between average and exceptional credit. If you have a history of paying on time across most of your accounts, but have an occasional slip-up and pay late, it wont affect your credit score as much as it used to.

Heres what you need to know:

- A few days late does not count against you. A payment cannot be reported late unless it is 30 days or more past due.

- The big picture matters more now. With the older system prior to 2009, one big problem could cause havoc with your credit score. Now, if all other accounts are in good shape, one serious issue will not matter as much.

- Small problems hurt less. Previously, if you missed a small bill and it went to collections, you would see a negative impact on your credit score. Now your credit score will not suffer as much from a small misunderstanding.

Since this category has such a big impact on your overall credit score, when you go through a foreclosure or short sale it is not just the foreclosure that impacts your credit, but also the months of late payments that precede the foreclosure.

Read Also: Does Home Depot Report Authorized Users

Somewhat Important: Length Of Credit History

A variety of factors related to the length of your credit history can affect your credit, including the following:

- The age of your oldest account

- The age of your newest account

- The average age of your accounts

- Whether youve used an account recently

Opening new accounts could lower your average age of accounts, which may hurt your scores. But the hit to your scores could also be more than offset by lowering your utilization rate and increasing your total , making sure to make on-time payments to the new card and adding to your credit mix.

Closed accounts can stay on your credit reports for up to 10 years and increase the average age of your accounts during that time. But once the account drops off your credit reports, it could lower this factor, and hurt your scores. The impact could be more significant if the account was also your oldest account.

How To Improve Your Credit Score

Improving your credit score can be easy once you understand why your score is struggling. It may take time and effort, but developing responsible habits now can help you grow your score in the long run.

A good first step is to get a free copy of your credit report and score so you can understand what is in your credit file. Next, focus on what is bringing your score down and work toward improving these areas.

Here are some common steps you can take to increase your credit score.

Don’t Miss: Does Speedy Cash Check Your Credit