Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| 6% | 2% |

Given time, you can improve your credit score. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down. Even the most damaging items only stay on your credit report for 7 to 10 years. 4

Regardless of your circumstances, there are steps that you can take immediately to increase your credit score.

Pay Down All Installment Loans

I was surprised by this one. I always assumed my credit score wouldnt be affected by the balances on my installment loans.

But I noticed that once I paid off my auto loans and student loans, my credit score jumped more than 20 points.

The key here is that you should pay off as much of the loan as possible, if not all of it. The closer the remaining balance is to zero, the more it will benefit your credit score.

For a little bit of perspective, I paid off a $30,000 auto loan, another $20,000 auto loan, and student loans totaling $11,000. Almost immediately after I did this, my credit score improved.

Can I Get A Mortgage & Home Loan W/ A 653 Credit Score

Getting a mortgage and home loan with a 653 credit score is going to be difficult. Can it be done? Maybe, but thereâs a few simple steps you can take to guarantee less headaches and higher chance of success.

The #1 way to get a home loan with a 653 score is repairing your credit.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Also Check: How To Check Credit Score With Itin Number

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

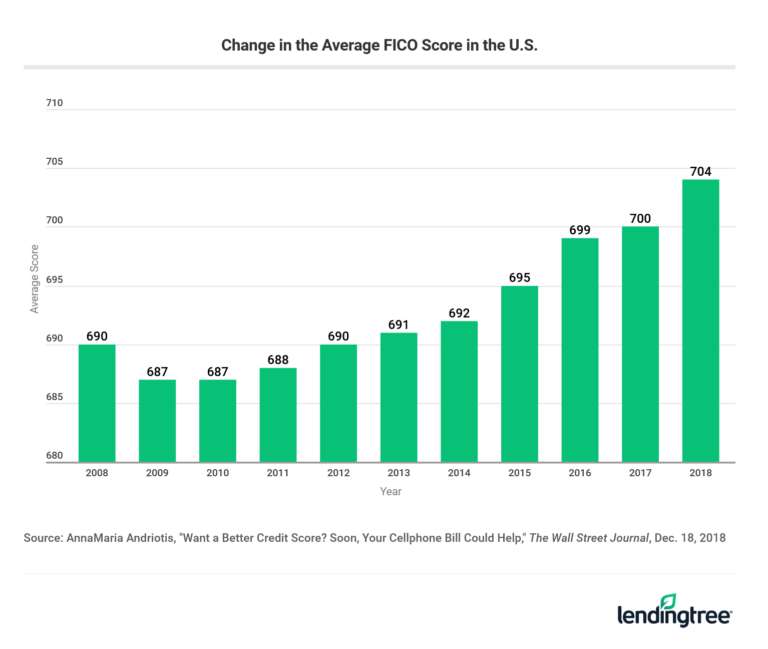

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

Rewards Can Lower The Cost Of Your Credit Card

One of the advantages of being in the 650 to 699 credit score range is that some cards offer rewards. If a card pays 1.5% cash back, and you charge an average of $500 per month, youll earn $7.50 per month or $90 per year. If you dont carry a balanceand dont pay interestitll be like earning an extra $90 per year. Or at a minimum, it will cover the annual fee, making the card essentially free to use.

Recommended Reading: How To Remove A Repo From Your Credit

Open A Secured Credit Card

If you dont qualify for unsecured credit cards, then a secured card could be the way to go. Secured credit cards are backed by a cash deposit, so even borrowers with poor credit scores can get one. Through this card, youll be able to improve your credit score by proving your creditworthiness with on-time payments.

Why A Very Good Credit Score Is Pretty Great

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 753 typically pay their bills on time in fact, late payments appear on just 23% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

Don’t Miss: How To Get A Repo Off Your Credit Report

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Credit Score: Good Or Bad

653 is a below-average credit score, but its approaching the good range. Its considered fair by every major credit scoring model. Scores in this range are high enough to get some types of credit, but you wont qualify for the best interest rates. Well explain what financing you can get with a score of 653 and what you can do to improve your credit score.

Recommended Reading: Voluntary Repossession Drivetime

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Is A Credit Score Of 700 Good Or Bad

VantageScore® is another commonly used credit score, which, like FICO®, runs on a scale from 300 to 850. Generally, good credit scores range from 700 to 749. If you have a score between 750 and 850, then you fall in the great range.

With a credit score of 700, youre likely to be approved with favorable loan terms. If you have a credit score of 700 or higher, you should feel confident applying for financing.

You May Like: Notifying Credit Bureaus Of Death

Buying A House With A Credit

The upside to buying a house withyour spouse or partner is that youre likely combining two incomes, which canhelp you qualify for a larger mortgage payment and therefore a more expensivehome.

The downside is that oneco-borrowers low credit score can tank the application for both borrowers.Thats because mortgage lenders look at the lower credit score betweenthe two of you to determine your loan options and interest rate.

Depending on your partners creditscore and income, there are a few different options for how you can approachthis issue on your mortgage application.

Consider applying for the loan on your own

Before undertaking a bad credit application, use a mortgage calculator to see if you can qualify for the loan on your own. If your income is sufficient, you can leave your partner off the mortgage altogether.

You can always add them tothe property title once the mortgage closes. However, doing this gives yourpartner some ownership interest in the property, while you would be the onlyone obligated to pay the mortgage.

Note that if you have jointbank and investment accounts, you can use this money for your down payment andcount it as an asset on your mortgage application. Your partner will have towrite a letter stating that you have access to 100 percent of thejointly-held funds.

Money in accounts that aresolely in your partners name wont be considered assets available to you under mostprogram guidelines.

Use your partners income, not their credit

Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with scores in the Fair range. As a result, your financing options are going to be somewhat limited. With a score of 653, your focus should be on building your credit and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

Also Check: Credit Check Experian Usaa

Your Car Loan Can Help You Build Better Credit

Once you’ve secured your car loan, it will help you build credit in two important ways: payment history and credit mix.

Payment history is your track record of paying bills on time. It accounts for more of your credit score than any other single factor. Traditional lenders report your payments to the three major credit bureaus, which provide the data to calculate your credit scores.

Improving Your Credit Score

Fair credit scores can’t be turned into exceptional ones overnight, and only the passage of time can repair some negative issues that contribute to Fair credit scores, such as bankruptcy and foreclosure. No matter the reason for your Fair score, you can start immediately to improve the ways you handle credit, which can lead in turn to credit-score improvements.

Look into obtaining a secured credit card. A secured credit card requires you to put down a deposit in the full amount of your spending limittypically a few hundred dollars. Confirm that the As you use the card and make regular payments, the lender reports your activity to the national credit bureaus, where they are recorded in your credit files. (Making timely payments and avoiding “maxing out” the card will favor credit-score improvements.

Consider a credit-builder loan. Available from many credit unions, these loans take can several forms, but all are designed to help improve personal credit histories. In one popular version, the credit union places the money you borrow in a savings account, where it earns interest but is inaccessible to you until the loan is paid off. Once you’ve paid the loan in full, you get access to the funds and the accumulated interest. It’s a clever savings tool, but the credit union also reports your payments to national credit bureaus, so regular, on-time payments can lead to credit-score improvements.

Don’t Miss: Hard Inquiry Fall Off

Can You Get A Mortgage With A 653 Credit Score In 2022

If your credit score is a 653 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s. Therefore, if you have a 653 or higher credit score, you should not be short on options.

The types of programs that are available to borrowers with a 653 credit score are: conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, and non-prime loans. With a 653 score, you may potentially be eligible for several different types of mortgage programs.

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.

Don’t Miss: Syncb/ppc Account

Compare More Recommended Credit Card

Is your credit score not 650, 660, 670, 680, or 690? Find more top credit cards for your credit score range:

Note: According to our research, these credit cards offer the best chance of approval for applicants with credit scores of 650, 651, 652, 653, 654, 655, 656, 657, 658, 659, 660, 661, 662, 663, 664, 665, 666, 667, 668, 669, 670, 671, 672, 673, 674, 675, 676, 677, 678, 679, 680, 681, 682, 683, 684, 685, 686, 687, 688, 689, 690, 691, 692, 693, 694, 695, 696, 697, 698 and 699. This does not mean guaranteed approval as credit decisions take into factors other than FICO score.

Petal credit cards are issued by WebBank, Member FDIC.

Different Credit Score Groups

Depending on your credit score , there are different pros and cons at hand. For someone in the very poor credit range, lenders will be very little likely to consider you an adequate borrower. Your ability to pay back money borrowed is exceedingly risky. Being in the poor FICO range is still viewed as a risk. On the bright side, there are some lenders who will accept those with an at-risk 653 credit score. If you have fair credit, however, you can expect most lenders to consider this score good enough. Those with good or excellent credit, likewise, will be considered a very dependable or an exceptionally dependable borrower, respectively. This is why it is crucial to seek at least fair credit, if not good or exceptional.

Americans FICO scores are all over the place with 20% in with exceptional scores, 18% with good, 22% with fair, 20% with poor, and 17% with very poor credit. While the latter statistics may or may not be surprising, many factors are put into calculating ones credit score.

Its important to note that calculating your 653 FICO credit score is a more complex task than what it sounds.Receiving your credit score may vary from source to source for this reason. Other information, besides the latter five, are also incorporated into the credit score evaluation process.

You May Like: Wipe Your Credit Clean

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip: You can view sample credit scores summaries from each bureau to get a sense of what to expect.

Formulating A Plan To Improve Your 653 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.

Don’t Miss: Navy Federal Mortgage Approval Odds