Cibil Asks Lenders To Speed Up Monthly Credit Data Submission

TransUnion CIBIL credit bureau has asked lenders such as banks and non-banking finance companies to submit borrowerâs credit data much faster, according to a report from The Mint. The credit information company has asked banks to submit the credit data of borrowers within a week, instead of 15 days. Harshala Chandorkar, chief operating officer, TransUnion CIBIL told the publication that the credit bureau is taking measures to make sure that they get the credit data at the earliest. They are aiming to receive the data within a week of every month-end, instead of a fortnight at present, she added.

In 2015, Reserve Bank of India directed all banks and non-banking financial companies to become members of credit information companies and share all credit data with them. CICs maintain data on borrowings and payment details of consumers on a monthly basis. Thanks to the credit data, lenders are able to analyse the ability of a borrower before sanctioning a loan. CIBIL credit bureau offers CIBIL score to individuals which is a measure of their creditworthiness. The 3-digit number ranges from 300-900. You can check your CIBIL score for free by visiting CIBILâs website.

25 March 2019

How To Get Your Credit Score To 800

A credit score in the 800s is a remarkable milestone. Although it will take time, its completely possible to achieve. Heres how to get started:

- Pay all of your bills on time.

- Never max out your credit cards.

- Dont apply for every credit card you see.

An 800 credit score is a great goal but itll likely take many years to reach this elite status as credit scores factor account ages into the score. As your average account age grows, so can your credit score.

Use Experian Boost To Report Council Tax And Netflix Subscriptions

In November 2020, Experian launched a new tool to help people quickly improve their credit scores.

Experian Boost uses open banking to allow you to grant Experian access to your current account information.

The tool allows you to unlock previously hidden information on your salary, council tax payments, savings habits and even your subscription payment information.

Experian says that 17 million people could boost their credit scores by up to 66 points by using the tool.

Find out more:Experian Boost explained

Also Check: How To Get A Repo Off Your Credit Report

Customise Your Credit Limit

Your credit utilisation ratio has a significant impact on your credit score. The more you are able to restrict your credit usage as per the allotted limit, the better it is for your credit score. Reaching the limit has the opposite effect as it lowers your credit score. One way of tackling this is to get in touch with your lender and customise your credit limit based on your expenses.

Dont Waste Your Money

Many debt relief companies make big promises. But you should be wary. The CFPB issued a consumer advisory warning people about paid . The fees these companies charge are often high, and you can accomplish the same results on your own. If someone promises a quick fix, go somewhere else because theres no such thing as a quick fix, advises Griffin.

Despite what some companies might claim, accurate negative information cant be removed from your credit reports, says Griffin. So you could end up paying your hard-earned money for nothing. Instead, focus on keeping up with your payments, keeping your credit card balances low, and avoiding new credit lines to improve your credit.

You May Like: Aargon Agency Payment

Buy A Home With Renewed Confidence

Once youve taken the necessary steps and seen an improvement in your credit score, its time to apply for a home loan with improved confidence. ooba Home Loans can apply to multiple banks on your behalf, giving you the best chance of home loan approval, as some banks may have stricter lending criteria than others.

They also offer a range of tools that can make the home-buying process easier. Start with their Bond Calculator, then use the ooba Home Loans Bond Indicator to determine what you can afford. When youre ready, you can apply for a home loan.

Do you know your credit score?

Check your credit score for free in minutes.

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

You May Like: Kroll Factual Data Complaints

How Long Do Derogatory Marks Stay On Your Credit Report

No ones perfect, and thats very clear when youre dealing with credit scores and credit reports. Your credit report is a history of how youve handled credit in the past. If youve made mistakes, such as late or missed payments, those will stay on your credit report for a long time. But just how long depends on the type of derogatory mark:

- Late payments: Because lenders usually report to the bureaus every 30 to 45 days , you may have a small window of time after missing a payment to make it up before it appears on your report. But once a late payment is on your report, it will stay for seven years from the original delinquency date.

- Collection accounts: If you have an account that is sent to collections, the account will remain on your credit report until seven years after your initial missed payment that led to the account ending up in collections.

- Bankruptcies: Depending on the type of bankruptcy you declared, it will remain on your credit report for seven to 10 years.

- Other negatives: Other derogatory marks, such as repossession, will typically stay on your credit report for seven years from the date of the first payment you missed.

How To Safely Use This Strategy To Increase Your Credit Score Fast

Honestly this strategy wont work for everyone.

I recommend this strategy only if, you implicitly trust the person youre adding to your credit card.

WARNING: If you add someone to your credit card and they abuse it it will hurt your credit. And you do not want to end up back at square 1.

My husband and I did this together because were on the same page regarding our financial goals. If we werent, Id have to take extra precautions to make sure that I was protecting my credit.

If your parent has great credit and is responsible with managing their credit, you can ask them to add you as an authorized user on one of their credit cards.

Do your homework before trying to use this strategy:

Before adding someone to your credit card as an authorized user, please double check the credit issuers policy on authorized users. You want to ensure that the card issuer will report the authorized user to the credit bureaus. If the card issuer doesnt report the authorized user, it wont help their credit.

Also, find out who youre allowed to add as an authorized user. Some card issuers only allow you to add a spouse. Other card issuers are more lenient so do your homework to find a credit card that will work for your situation.

Set Ground Rules:

Whether youre adding someone to your credit card or asking to be added, the safest thing to do is establish some ground rules.

Here are 2 easy ones:

LIKE THIS POST? PIN TO SAVE FOR LATER

Recommended Reading: How Can I Check My Credit Score With Itin Number

Negotiate A Lower Interest Rate

A lower rate can help you pay off your balance faster, because more of your payment can be applied to your principal balance than interest. Lower balances can mean a lower credit utilization ratio . Learn more about how to negotiate a lower interest rate.

How To Improve Your Credit Score By 100 Points In 30 Days

As a member, I frequently check in to see how my credit is doing and make sure theres nothing suspicious going on there.

I really like Credit Karma, because its free and provides detailed information about changes to your credit score. Also, you can link all your accounts to monitor your debt-to-savings ratio.

Another feature I like to play around with is my spending. When I connect my bank account, I can categorize each transaction and see where all my money is going, which gives me a clear view of my spending habits.

One day when I logged in to my account, I was very excited to see that my credit score had increased by almost 100 points! I had managed to raise my credit score by 92 points in just one month.

In this article, Im going to share with you the steps I took to improve my credit.

Don’t Miss: How To Get Repossession Off Credit Report

How To Raise Your Credit Score By 100 Points In 45 Days

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, it’s important to keep your credit scores in good shape so that your insurance premiums stay in line.

Check And Understand Your Credit Score

Its important to know that not all credit scores are the same, and that they fluctuate from month to month, depending on which credit bureaus lenders use and how often lenders report account activity. So, while you shouldnt worry if you see your scores rise or fall by a few points, you should take note when a big change occurs.

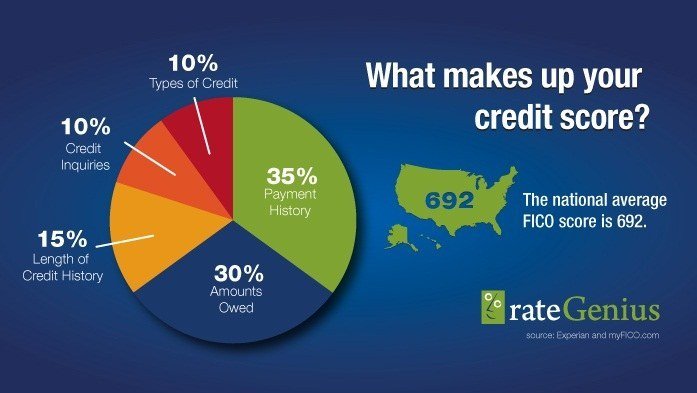

The two main consumer credit scoring models are the FICO Score and VantageScore. Here are the factors that comprise your FICO Score and how much each factor is weighed:

- Payment history

- Amounts owed

- Length of credit history

- New credit

Here are the factors influencing your VantageScore:

- Total credit usage, balance and available credit

- Payment history

- Age of credit history

- New accounts

There are a variety of options for checking your credit score for free.

For example, consumers can get a free FICO Score from the Discover Credit Scorecard even without having a Discover credit card, and a free VantageScore by creating a LendingTree account. American Express and Capital One also offer free credit scores to both card account holders and the general public, though many other card issuers offer free access only to their cardholders.

Here are the tiers that credit scores can fall into, according to FICO:

| FICO Score tiers |

| Poor credit |

Also Check: How Do I Notify Credit Bureaus Of A Death

Does Paying A Car Loan Help Your Credit Score

After you have paid your auto loan on time, your credit rating will rise. When you complete all the required factors to contribute toward a credit score, your score will increase. This will include the payment history, your amount owed, the length of your credit history, the new credit history, a combination of those factors, and the overall credit mix within your financial status.

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

You May Like: Credit Inquiry Removal In 24 Hour Free

How To Get Your Fico Score For Free

Understand the reasons that help or hurt your FICO® Score, including your payment history, how much credit you are using, as well as other factors that influence your overall credit.

- Which Debts Should I Pay Off First to Improve My Credit?: Prioritizing certain bills can be important when you’re trying to increase your credit scores.

- : Learn the truth and don’t get caught off guard.

Monitor Your Credit Report

Youre entitled to a free copy of your credit report every year from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Visit AnnualCreditReport.com to access a free report and familiarize yourself with it. Check for inaccuracies and signs of fraud, and if you find something amiss, report it immediately.

You May Like: When Does Paypal Credit Report To Credit Bureau

How To Increase Your Credit Score Immediately

Home \ \ How to Increase Your Credit Score Immediately

Join millions of Canadians who have already trusted Loans Canada

When it comes to getting approved for a loan at a low-interest rate, your credit score matters. If its not as high as it should be, its time to step up to the plate and take measures to increase it. Not only will a higher score help improve your odds of getting approved for a loan, it will also afford you lower interest rates, thus making your loans less expensive.

Read this for more information about your Canadian credit score.

Correct Errors On Your Credit Report

Correcting errors on your credit report is a relatively quick way to improve your credit score. If its a simple identity errorlike a credit card thats not yours showing upyou can get that corrected within one to two months. If its an error on one of your accounts, though, it could take longer, because you need to involve your creditor as well as the credit bureau.

The entire process typically takes 30 to 90 days. If theres a lot of back-and-forth between you, the credit bureau, and your creditor, it could take longer.

The first step to correcting errors is to get a copy of your free credit reports from TransUnion, Equifax, and Experian . You can do this at no cost once a year at annualcreditreport.com.

Next, review your credit report for errors. If its an error on one of your accounts, you must refute that error with the bureau by providing documentation arguing otherwise. For example, if you paid a credit card on time and the card issuer is reporting a late payment, find a bank statement showing that you paid on time.

Recommended Reading: Serious Delinquency On Credit Report

Check Your Credit Report And Correct Mistakes

These days, its worth checking your credit report at least once a month to make sure that the information it contains is correct and up to date.

With the rise in identity theft and millions of coronavirus-related payment holidays being processed, its a good idea to keep a frequent watch on the information being recorded in your credit report.

You should check the information each of the three main credit reference agencies have about you. You have the right to get your statutory credit report for free from these firms.

If you notice any mistakes, it’s important to get them rectified as soon as possible to ensure they arent dragging down your credit score unnecessarily and wont have any adverse effect on future credit applications.

You can do this by contacting the company that provided the incorrect information or the credit reference agency itself, which will investigate on your behalf.

How long will it take to correct mistakes on your credit report?

Correcting an error can be one of the fastest ways to change your score. By law, your credit report should be accurate. Lenders and CRAs have up to 28 days to respond to a dispute, but Experian says it usually resolves issues in less than two weeks.

Sign Up For Free Credit Monitoring

Whether its with Credit Karma or someone else, keeping a close eye on your credit is essential. Signing up for credit monitoring can help alert you to important changes in your credit, so that you can check for suspicious activity. Fraudulent activity can weigh down what could be an otherwise good credit score, so its important to dispute any details you identify as inaccurate. If the credit bureau rules in your favor, the fraudulent activity will be removed from your credit report, which can help raise your credit scores.

You May Like: Syncb/ppc Credit Inquiry

The Bottom Line About Building Credit Fast

When youre working to fix your credit, it takes good behavior over time. However, lowering your utilization rate by paying down existing debt, getting a new credit card or requesting a credit line increase on an existing card can provide the quickest credit score boost.

Any late payments and debts sent to collection should be handled promptly otherwise, theyll just cause more pain once they hit your credit reports. Its also wise to review your credit reports on a regular basis. in order to spot errors that might be dragging down your credit score.

Knowing what actions to take that can help improve your credit score and being a responsible borrower can boost your chances of increasing your credit score by 100 points or even more.

Why Did My Credit Score Drop When I Paid My Car Off

As soon as you pay off debt, there are frequently some factors that pull down your credit score. These include your average age on credit cards, your personal creditors, and your usage on credit. Credit score drops associated with paying off debt, however, are very short-lived as long as credit is restored.

Recommended Reading: How Long Do A Repo Stay On Your Credit