What Is A Credit Score

As far as your bank is concerned, your credit score is a big number above your head that tells them how much of a risk you are.

Your credit score indicates to your bank whether your past debt repayment behaviour will make you a good risk or not. Through various calculations based on your transactional records, the credit bureau will provide your bank with a three-digit number ranging between 0 and 999. Naturally, the higher the better, and a high credit score rating is one of the most valuable personal finance assets you can have.

How To Turn A 661 Credit Score Into An 850 Credit Score

There are two types of 661 credit score. On the one hand, theres a 661 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 661 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

What Would Be Considered A Good Credit Score

- A score of 600+ will give you a fair chance of home loan approval. although this may vary according to which bank you use.

- A score of 670+ is considered an excellent credit score, significantly boosting your chances of home loan approval.

- Scores below 600 would be considered high to very high risk. In this case youll want to look at ways to clear your credit record.

Each bank uses both the credit bureau score and their own internal risk assessment criteria which looks at a number of factors specific to a particular home loan application, such as the loan size compared to the property value .

If you are classified as very high risk, the chances are you wont be successful in your home loan application as the banks will question your ability to pay them back.

A good to excellent credit score will have the opposite effect, possibly opening the way for you to negotiate preferential terms and interest rates.

Don’t Miss: Chase Sapphire Preferred Credit Score Requirement

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 711 in 20202.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

Recommended Reading: 688 Credit Score

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Auto Loan Rates For Fair Credit

Theres no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair range may limit your options to loans with higher rates and less favorable terms.

Building your credit over time is a good way to potentially get access to better terms, but thats not an overnight process. If youre on a shorter time frame, there are a few things you can do to help.

Compare car loans on Credit Karma to see your options.

Recommended Reading: Navy Federal Personal Loan Approval Odds

How To Improve A 664 Credit Score

Its a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law. They can help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items from your credit report. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

How To Turn A 662 Credit Score Into An 850 Credit Score

There are two types of 662 credit score. On the one hand, theres a 662 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 662 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Don’t Miss: Will Paypal Credit Affect Credit Score

Select Explains What Is A Good Credit Score How Good Credit Can Help You Tips On Getting A Good Credit Score And How To Get A Free Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Credit scores range from 300 to 850. Those three digits might seem arbitrary, but they matter a lot. A good is key to qualifying for the best credit cards, mortgages and competitive loan rates.

When you apply for credit, the lender will review your to determine your eligibility based on this information, which includes that three-digit number known as your .

That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history from your current and past credit accounts.

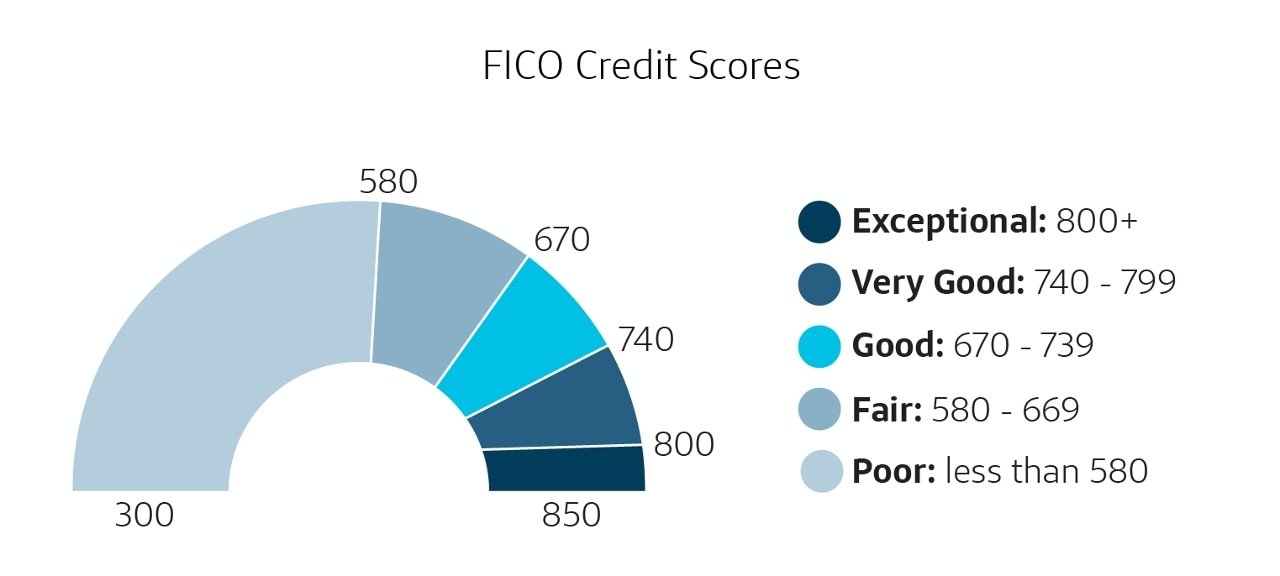

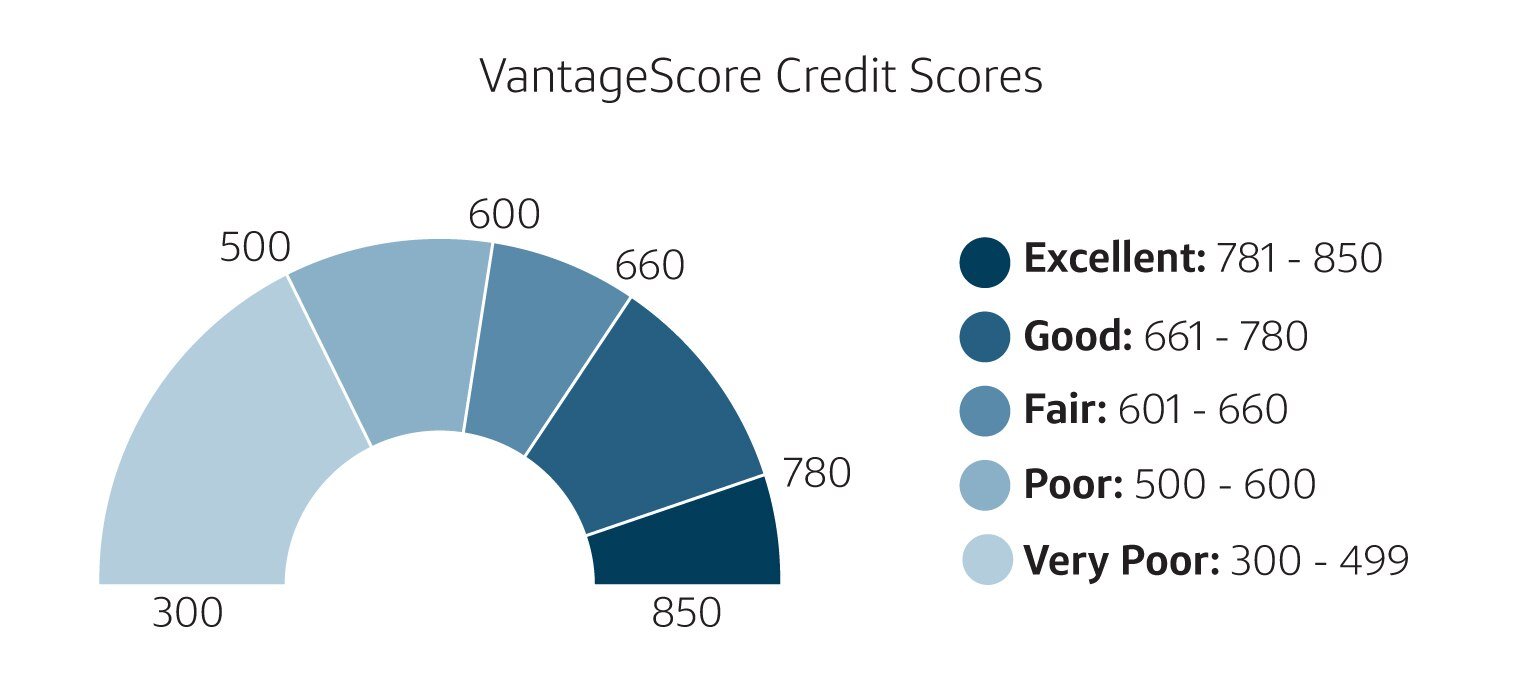

There are two main credit scoring systems: FICO and VantageScore, and they aren’t created equal. FICO Scores are more valuable, as lenders pull your FICO Score in over 90% of U.S. lending decisions.

Below, Select explains what is a good for FICO and VantageScore, how good credit can help you, tips on getting a good credit score and how to check your score for free.

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

You May Like: Tri Merge Credit

How To Improve A Bad Credit Score

If you have bad credit, take some time to review your credit score and identify the cause. Perhaps you’ve missed payments or carried a balance past your bill’s due date. In order to achieve a fair, good or excellent credit score, follow the below.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Consider setting up autopay to ensure on-time payments, or opt for reminders through your card issuer or mobile calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate, which is the percentage of your total credit limit you’re using. To calculate your utilization rate, divide your total credit card balance by your total credit limit.

- Don’t open too many accounts at once. Every time you submit an application for credit, whether it’s a credit card or loan, and regardless if you’re approved or denied, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score by roughly five points, though they rebound within a few months. Try to limit applications as needed and shop around with prequalification tools that don’t hurt your credit score.

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

Don’t Miss: What Credit Card Can I Get With A Score Of 570

Can I Get A Home Loan With A Credit Score Of 664

The minimum credit score is around 620 for most conventional lenders.

However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%. Those with a credit score of 580 can qualify for a down payment as low as 3.5%.

See also: 9 Best Mortgage Loans for Bad Credit

What Is The Average Credit Score By Age Group

The average credit score across various age groups in the U.S. reveals an upwards trend in the average credit score, with each age group experiencing a minor credit score increase in comparison to average credit scores reported in 2019.3

Here is the following average score breakdown by age group:

- Ages 18-23: 674

Recommended Reading: Qvc Collection Agency

Can I Get A Rewards Credit Card With Fair Credit

You may struggle to get approved for a cash back or travel rewards credit card with fair credit. While you might be able to find a card that earns a limited amount of cash back on purchases, the most-rewarding credit cards generally require good or excellent credit.

If a top-notch rewards card is your ultimate goal, dont be discouraged. You may be surprised by how much good, persistent habits can affect your credit scores.

And thats one nice thing about credit cards. Even the ones that arent the absolute best can help you build credit by reporting your account activity to the three major credit bureaus. This information makes its way into your credit reports and ultimately can impact your credit scores. So, as long as you make on-time payments and follow the other credit-building tips outlined above, you can put yourself in a position to qualify for a better credit card in the future.

Compare offers for on Credit Karma to learn more about your options.

What’s In A Credit Score

Here’s a more detailed breakdown of the specific factors that influence your FICO® Score:

Public Information: If bankruptcies or other public records appear on your credit report, they can have severe negative impacts on your credit score.

Among consumers with a FICO® Score of 661, the average credit card debt is $13,429.

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It’s pretty straightforward, and it’s the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

. To determine your , add up the balances on your revolving credit accounts and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

Also Check: Credit Score With Itin Number

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

Can I Get A Home Loan With A Credit Score Of 661

The minimum credit score is around 620 for most conventional lenders.

However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%. Those with a credit score of 580 can qualify for a down payment as low as 3.5%.

See also: 9 Best Mortgage Loans for Bad Credit

Read Also: Shopify Capital Eligibility Review Changed