Should I Hire A Credit Repair Company To Remove Late Payments

Generally speaking, the only reason a credit reporting agency or a data furnisher, such as a bank, would remove a late payment from your credit report is that it is either incorrect or has reached its credit reporting time limit.

Before you pay a credit repair company to attempt to have your late payments removed, ask yourself a few questions:

- Are the late payments accurate?

- Has seven years passed since the date of the late payment?

- Does my lender have a record of these late payments?

If you answered “yes” to these questions, then it’s unlikely you’ll be able to have the late payments removed, whether you hire a credit repair company or attempt to do it yourself.

Do Goodwill Letters Work

Unfortunately, there are not any specific studies that show how often goodwill letters work only anecdotal evidence. Further, many banks state specifically that they will not act in your favor if you send a goodwill letter. Bank of America is one of them. Per the banks website, theyre required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments.

Instead, Bank of America notes that the best way to address negative credit history is to rebuild your credit by moving forward and establishing a solid history of on-time payments.

Be aware that goodwill letters are more likely to work for late payment removal not for more serious credit offenses. If youve been wondering how to get an account in collections removed from your credit report, for example, a goodwill letter is unlikely to help.

Regardless of your banks stance on goodwill letters , you cannot lose anything by asking for this type of assistance. The goal of a goodwill letter is to try to remove negative information from your credit reports, knowing fully well you may or may not achieve the results you want.

How Will My Credit Be Affected

Depending on whether you were able to make an agreement or accommodation when you talked to your lender, there could be different impacts on your credit reports and scores. Your credit scores are calculated based on the information in your credit report. There are credit scores for different purposes and for loan products. Many factors go into computing your credit scores. Learn more about the relationship between credit reports and credit scores.

Two companies, FICO and VantageScore, among others, create scoring models that analyze your credit and generate a credit score. You can find out more information of how these companies are responding to the COVID-19 pandemic and treating forbearances and deferrals from FICO and VantageScore. It is important to keep in mind that different lenders use different credit scores including scores they build and manage themselves.

The CARES Act places special requirements on companies that report your payment information to credit reporting agencies. These requirements apply if you are affected by the coronavirus pandemic and if your lender gives you an accommodation to defer a payment, make partial payments, forbear a delinquency, modify a loan, or other relief.

If your lender does make an agreement or accommodation with you:

This CARES Act requirement applies only to agreements made between January 31, 2020 and the later of either:

- 120 days after March 27, 2020 or

- 120 days after the national emergency concerning COVID19 ends.

Recommended Reading: Minimum Credit Score For Carmax

How To Remove Late Payments From Credit Report

When you request your credit report from the three credit reporting agencies–Experian, Equifax and TransUnion–you should review the document to look for any late payments reported. According to the Credit.com website, payment history makes up about 35 percent of your credit score. If you have late payments reported to the credit bureaus, you can see a significant drop in your credit score. You can work directly with your creditors to remove late payments from your credit reports.

Ask for a goodwill adjustment to your credit file. If you have established a history of on-time payments with the creditor, the rep may be willing to remove the late payment violation from your credit report. Give a valid reason for the late payment. You can say something along the lines of, I have a history of payments made on time with your company. During the month of September, I was moving to a new house and my payment was delayed. I would appreciate if you could remove this late payment from my file.

Offer to sign up for an automated payment plan. If the rep wont budge on removing the late payment, let her know you are willing to sign up for an automated payment plan if she obliges your request. In this case, future payments are withdrawn directly from your bank account.

Tips

References

When To Use A Goodwill Letter

Theres no guarantee that a goodwill letter will remove late payments from your credit report. After all, this is not a dispute with the credit bureaus where youre challenging the validity of the item. But there are several situations where youll have the best chance of receiving a positive response from your creditor.

For example, if you tried to make your payment on time but encountered a technical error , youre a good candidate for a goodwill adjustment. Maybe their website was down or the phone line was busy for an unreasonably long time.

You can also try a goodwill letter if your autopay didnt work for some reason. Even if your bank account had insufficient funds, you could certainly ask and just explain why your funds were low. Perhaps a check took longer to deposit than you expected or you had an emergency expense pop up.

Finally, even if you simply missed a payment, but are otherwise a good customer making timely payments, you could still successfully request a removal through the goodwill letter.

Ultimately, youre still a paying customer. Many creditors appreciate the fact that they depend on people like you to keep their businesses running.

Read Also: Does Zzounds Report To Credit Bureau

After You Send A Goodwill Letter

Once your goodwill letter is sent in the mail, theres nothing left to do but wait. You may hear back from your creditor in as little as one to two weeks, which is an optimal situation. However, it may take longer than that, and some may never respond.

You can always call customer service to ask about the status of your request after a few weeks of waiting. You can determine how strong your case is by reviewing a few simple points about your account.

Categories

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.

You May Like: Does Zzounds Report To Credit Bureau

Why Check Your Credit Report

Your credit report is a record of how well you manage credit. Errors on your credit report can give lenders the wrong impression. If there’s an error on your credit report, a lender may turn you down for credit cards or loans, or charge you a higher interest rate. You may also not be able to rent a house or apartment or get a job.

Errors can also be a sign that someone is trying to steal your identity. They may be trying to open credit cards, mortgages or other loans under your name.

Take a close look at your credit report at least once a year to see if there are any errors.

What Is A Goodwill Letter

A goodwill letter is sent to the creditor that reported your late payments with the goal of having them remove the derogatory information.

Since negative reporting can stay on your credit report for seven years, its not difficult to understand how impactful a successful goodwill letter could be. If you were able to send a goodwill letter that results in late payments being completely removed from your credit reports, you could potentially enjoy a healthier credit score for years to come.

Note that goodwill letters are sent as a way of apologizing for your late payment, but also explaining your intentions to pay all your bills on time going forward. If a late payment is incorrectly reported on your credit report, you should instead take steps to dispute incorrect information with the three credit bureaus Experian, Equifax and TransUnion. To help in that respect, check out Bankrates .

When you send a goodwill letter, youre not asking the credit bureaus to do anything. Instead, youre asking a creditor like a credit card company, your auto loan provider or even your mortgage company to erase the late payment and give you a second chance. Theres no guarantee that a goodwill letter will work, but you have nothing to lose by asking for some relief.

Don’t Miss: Minimum Credit Score For Carmax

Request A Goodwill Removal From Your Creditor

While the credit bureaus can control the information that shows up on your credit reports, the information furnishers i.e., your creditors can also request that items be removed.

Known as a goodwill removal, some creditors will remove a late payment from a customers credit reports when requested. Of course, theres a catch: you need to be on good terms with your creditor, well above and beyond that late payment.

Basically, goodwill removals are just that: a gesture of goodwill by your creditor as thanks for your custom. As such, the best results will typically be seen by those who have an otherwise spotless payment history and/or a long-standing relationship with their creditor. Youll also need to be completely current on your debts.

Goodwill removals can be requested by writing a letter to your creditor and mailing it to the customer service department, but more modern methods such as calling the customer service line or sending an email can also be effective.

Perhaps the most important thing to remember when requesting a goodwill removal is to be polite. Your creditor is under absolutely no obligation to remove any legitimate items from your reports, so being rude will likely get you a quick and resounding, No.

Wait For The Late Payment To Age Off Of Your Report

At the end of the day, the only surefire way for a late payment to be removed from your credit report is for it to naturally age off. In essence, all negative items have a specific amount of time they can hang around your credit reports, after which time they have to be removed.

In the case of late payments, that time limit is seven years from the date of delinquency. After the seven years have passed, the late payment should come off of your credit report automatically. If outdated items dont automatically come off of your reports, you can file a DIY dispute with the bureau and have it removed fairly quickly.

You may not need to wait the full seven years to see your credit score recover from a late payment, however. Most, if not all, credit scoring models give more weight to your recent credit behavior and less to older items.

This means that negative items have less impact on your credit score the older they get, with some losing the bulk of their influence well before they age off of your report.

You can further offset the impacts of an aging late payment by ensuring you have a robust recent positive payment history. If your late payment looks more like an aberration than a trend, its impacts on your credit score will be greatly reduced.

Recommended Reading: Can You Get A Credit Report Without A Social Security Number

Will Creditors Delete My Late Payment History If I Submit A Goodwill Letter

Now that weve explored late payment disputes, lets talk about goodwill letters.

;If youre familiar with the subject, you may know that goodwill letters used to work to some extent to remove late payments from your credit record. However, that was 10-15 years ago.

However, at this point in time, the bottom line isgoodwill letters do not work. In fact, many bank websites say so explicitly.;

Whats more, submitting a goodwill letter may actually decrease the chances of removing a late payment from your record .

But the sad part is, every self-proclaimed credit expert still claim you will achieve forgiveness on a late payment with a goodwill letter.

As a result, many folks end up wasting their time sending courtesy removal requests to creditors. Lots of other people have wasted money with ineffective credit repair companies, including the likes of and Lexington Law Firm, whove been known to prey on customers and have been sued by one of the governments regulating agencies.

Want more proof that goodwill letters are a waste of time? check this out:

Here is Bank of Americas own website stating that goodwill letters will not work.

Bank of America says the following:

Were required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments.

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

Don’t Miss: Does Opensky Report To Credit Bureaus

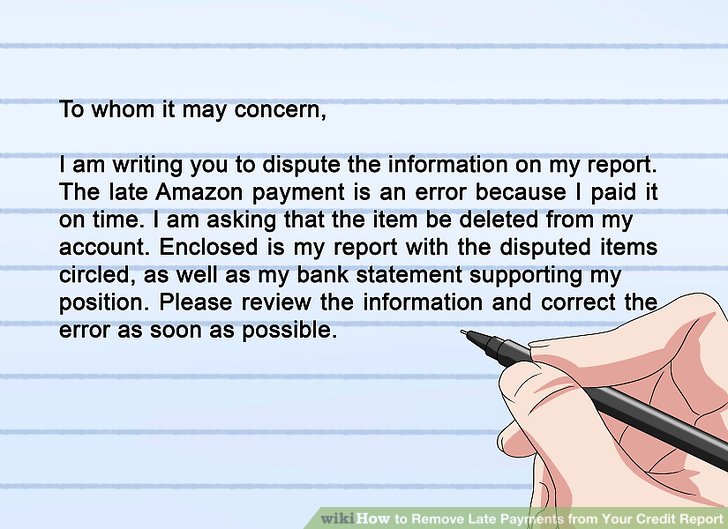

Dispute The Late Payment As Inaccurate

I certainly do not advocate lying or claiming negative information is inaccurate when you know that you really did make late payments.

BUT, if you find ANY inaccuracies on the late payment entry , you can begin disputing the late payment as inaccurately reported.

Sometimes creditors have a difficult time verifying the exact details of your account history.

Therefore, if you write a dispute letter protesting the inaccurate late payment and the creditor cant verify it, the negative entry can be removed in accordance with the Fair Credit Reporting Act .

ACCURATE INFORMATION FROM THE CREDITOR SHOULD INCLUDE:

- Your name

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

Don’t Miss: When Does Paypal Credit Report To Credit Bureau

What Is Considered A Late Payment

Technically speaking, a payment is late as soon as its past the due date, even if its one minute past midnight. If youre looking for the nitty-gritty details, check your contract to see when your payment is specifically due. For example, your payment might be due by 5 p.m. instead of midnight.

However, once the deadline passes, many creditors have whats called a grace period for you to make your payment before charging a late fee. Once the grace period is overor if there is no grace period outlined in your contractyour provider will typically charge a late fee.

Where To Send A Goodwill Letter

Since goodwill letters arent considered an official way to communicate with a creditor, you wont find a specific department to send your letter to. Instead, you should look for a customer service address for the creditor in question, then send your letter there.

This information is typically easy to find online, but you may also be able to find a customer service address on your monthly bill.

Also Check: What Is Syncb Ppc On My Credit Report

Removing Collection Accounts From A Credit Report

Whether your attempts to pay for delete are successful can depend on whether youre dealing with the original creditor or a debt collection agency. As to the debt collector, you can ask them to pay for delete, says McClelland. This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact.

What to keep in mind, however, is that pay for delete with a debt collector may not remove negative information on your credit history that was reported by the original creditor. The creditor may claim that its contract with the debt collection agency prevents it from changing any information that it reported to the credit bureaus for the account. That said, some debt collection agencies take the initiative and request that negative account information be deleted for customers who have successfully paid their collection accounts in full.

Before taking this step, consider how collection accounts may be impacting your credit score. The FICO 9 credit scoring model, for instance, doesnt factor paid collection accounts into credit score calculations. So if youve paid off or plan to pay off a collection account, then you may not need to pursue pay for delete if your only goal is improving your credit score.