Video: What You Should Know About Credit Disputes

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

What’s In Your Credit Reports

A credit report may include basic information about a consumer’s debts, creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. The data in the reports from the different credit reporting agencies can vary to some degree, depending on which company produces the report.

What If You Disagree With The Credit Bureau’s Investigation

If you tell the information provider that you dispute an item, a notice of your dispute must be included anytime the information provider reports the item to a credit bureau while that dispute is being investigated.

Finally, if the investigation does not produce the results you feel are correct, and inaccurate information in your credit report is causing you harm, you may consider hiring a lawyer to help resolve your dispute as a last resort.

The secret to success is to be vigilant and tenacious when it comes to reviewing, repairing, and correcting the record regarding your credit reports.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Also Check: Speedy Cash Collections

Bottom Line: How To Dispute An Error On Your Credit Report

All in all, there are multiple ways to dispute errors on your credit report. Your best bet is to use a credit monitoring service and start on any existing credit errors early.

Use all of the methods outlined above if you have to and dont give up remember, the bureaus eventually have to correct any error you notice, so keep at it even if progress seems slow at first.

Kim Pinnelli is a Senior Writer, Editor, & Product Analyst with a Bachelors Degree in Finance from the University of Illinois at Chicago. She has been a professional financial writer for over 15 years, and has appeared in a myriad of industry leading financial media outlets. Leveraging her personal experience, Kim is committed to helping people take charge of their personal finances and make simple financial decisions.

A Guide To Credit Report Disputes

Reading time: 4 minutes

- Regularly checking your credit reports can help ensure information is accurate and complete

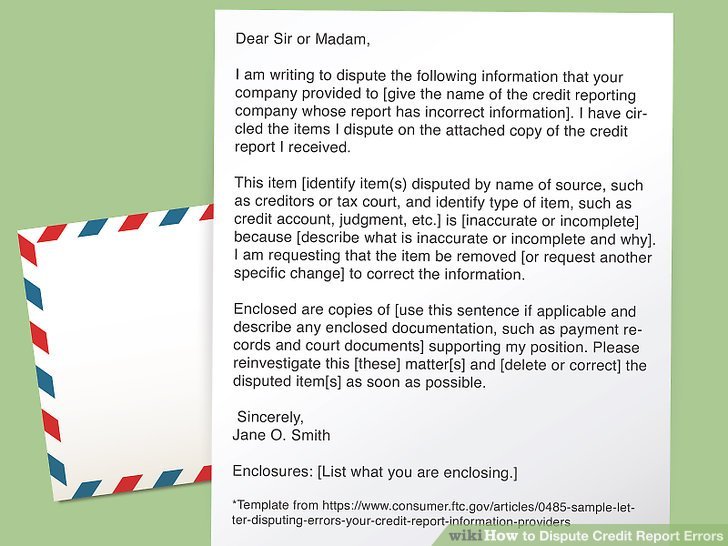

- If you believe information on your credit reports is inaccurate or incomplete, contact the lender

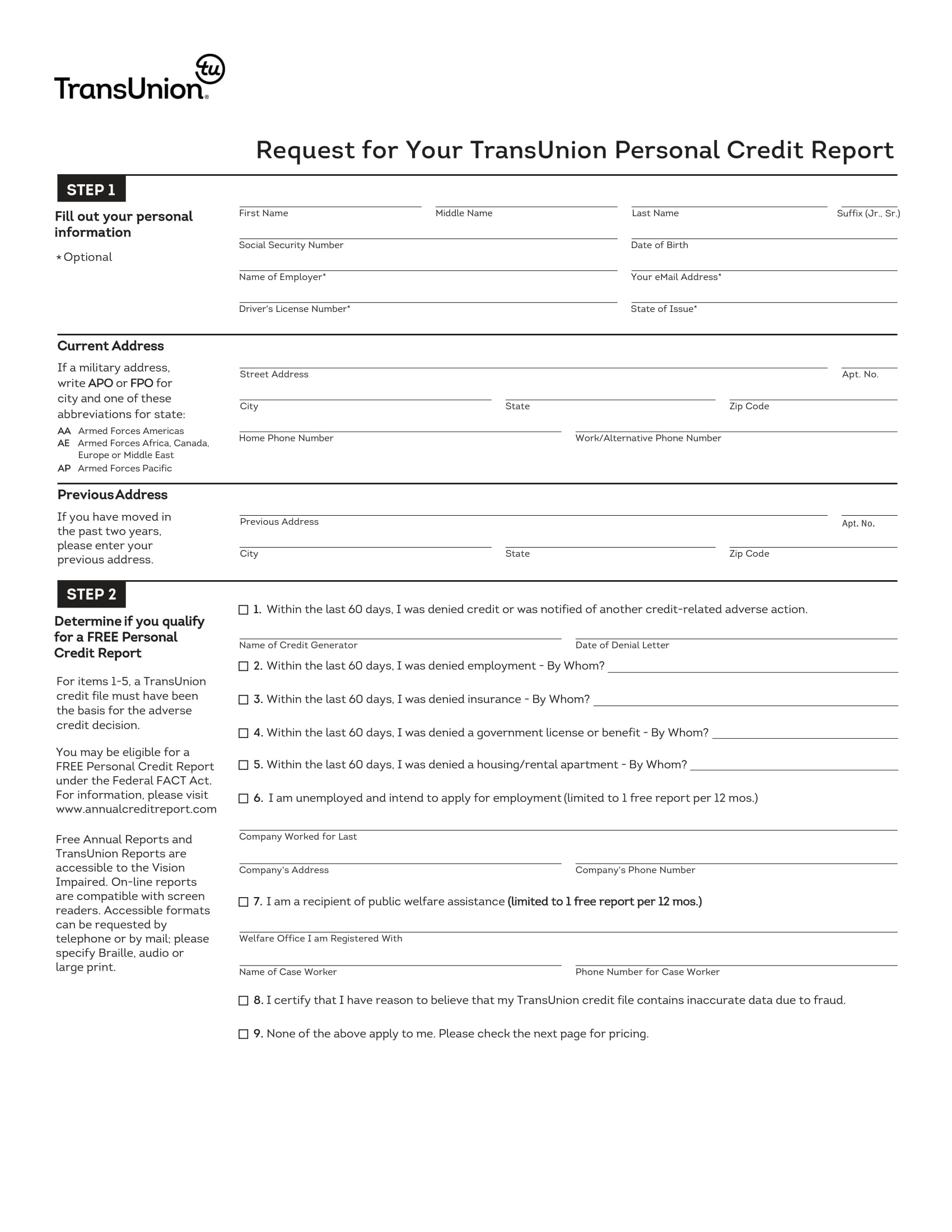

- You can also file a free dispute with the three nationwide credit bureaus

When reviewing your credit reports, its important to make sure all of the information is complete and accurate. This includes everything from the account information to the other personal information thats on your credit report such as your home address, name, and Social Security number.

Here are some steps you can take to address information you believe is inaccurate or incomplete:

What information can I dispute on my credit reports?

What should I expect after filing a dispute?

Don’t Miss: Free Credit Report Usaa

How We Make Money

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the authors alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To support our work, we are paid in different ways for providing advertising services. For example, some advertisers pay us to display ads, others pay us when you click on certain links, and others pay us when you submit your information to request a quote or other offer details. CNETs compensation is never tied to whether you purchase an insurance product. We dont charge you for our services. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

Our insurance content may include references to or advertisements by our corporate affiliate HomeInsurance.com LLC, a licensed insurance producer . And HomeInsurance.com LLC may receive compensation from third parties if you choose to visit and transact on their website. However, all CNET editorial content is independently researched and developed without regard to our corporate relationship to HomeInsurance.com LLC or its advertiser relationships.

What Should I Expect After Filing A Dispute

Investigation of your dispute

When reviewing your dispute, if we are able to make changes to your credit report based on the information you provided, we will do so. Otherwise, we will contact the company that reported the information to us to verify the accuracy of the information you’re disputing.

Your dispute will be processed in approximately 10-15 days for electronic submission and 15-20 days for postal mail

After our investigation is complete, a confirmation letter or email will be sent to you with the results and outcome of the investigation. If we require additional information in order to complete our investigation, we will notify you. If you submitted your dispute electronically, we will notify you by email. If you mailed in your completed form and documents, we will send you a letter. Due to COVID-19, we are experiencing longer than normal processing times. We appreciate your patience.

Read Also: How Long A Repossession Stay On Your Credit

Through Our Transunion Service Center Where You Can:

- Manage or fix any inaccuracies on your credit report

- Place Fraud Alerts to protect your identity

- Control who can access your credit information with Credit Freeze

Are you applying for credit or has a lender referred you here to lift a freeze on your TransUnion credit report? Youre in the right place.

- Add a note to your report around any COVID-19 or other financial considerations

Stay On Top Of The Process

Finally, its important to understand that getting an error removed from your credit report isnt an overnight thing. Its a process that can take weeks or even months. Give it time to play out, but make sure no one is dropping the ball. If you dont hear anything from anyone for a while, follow up with a phone call or email to see where things stand.

Once Everything is Resolved, Follow Up

When you do get the error removed from your report, your job isnt finished. There are still a couple of things you need to do:

If You Dont Get Resolution, Escalate

If you cant get the error on your credit report removed to your satisfaction by following the steps above and youre sure that its there through no fault of your own, you may need to escalate your situation to the CFPB and possibly even your states Attorney General.

| 1 vote |

How Dispute Credit Report Items and Win

How did he do it? He disputed those items and got them removed even though they were true.

Recommended Reading: What Is Cbna Bby

Figure Out If You Need To Reach Out To The Loan Furnisher

Donât remember who you owe money to? Youâre going to want to check your credit report to find out who to reach out to.

The CFPB recommends that you reach out to the company that provided that information in your report to the credit bureau aka a furnisher .

Sometimes, you can go directly to the furnisher which will actually save you a step because if youâre correct, theyâll be responsible for reaching out to the credit bureau to correct your report.

But, if the error is identity related, like somehow your social security number is wrong, youâll want to reach out to the credit bureau itself because they own that mistake and can fix it without reaching out to anyone.

Option : Filing Dispute By Phone

Lastly, you can contact each of the three credit bureaus independently by phone and try to file a report that way.

This is the least effective way to file a dispute, however, as each bureau will likely request some time to investigate the matter personally before getting back to you.

They will not correct an error immediately due to the need to check your claim against their records.

As a side note: if the credit report error in question is a furnisher error, consider contacting the furnisher themselves. They might also contact the credit bureaus to work to correct the error on your behalf.

Read Also: What Credit Bureau Does Affirm Use

Can Submitting A Credit Dispute Hurt Your Credit

It is important to challenge questionable negative information on your credit reports as this information can negatively impact your credit score. It is best to have your credit reports as accurate as possible before applying for a mortgage, car loan, insurance or even a job.

Filing a dispute has no impact on your score however, your credit scores could change if information on your credit report changes after your dispute is processed. For example, removing a mistakenly reported late payment could improve your credit score. Updates to personal information have no impact on your score.

A lower credit score resulting from questionable negative information on your credit report can unfairly prevent you from qualifying for a loan, keep you from getting approved for a low-interest rate, cause your car insurance premiums to increase, or come between you and a new job.

You have the will, we have the way. Let us help you fix your credit. Call today to get started

Whathappens If Your Initial Dispute Is Rejected

Ifyou happen to submit a dispute on your credit report that issubsequently denied, dont panic: you still have options. Initialinvestigations are generally not overly detailed, and typicallycomprise solely of creditors being asked to verify the informationyou claim. If your dispute does eventually get rejected, you canescalate your claim further by sending supporting information.

Somerelevant examples of documentation you can use to make your caseinclude:

-

Correspondencewith the creditor

-

Accuratebills or online statements

-

Copiesof canceled checks

Also Check: When Do Closed Accounts Fall Off Credit Report

Consider Contacting Your Lenders

If there is something specific to one of your accounts that you dont understand or looks wrong, it may be easier and faster to reach out to your lenders directly. You can find their contact information on your credit report. Lenders will have more details about the status of things like credit card balances and recent payments. They may be able to provide answers and resolve certain concerns quickly. If youre unsure if account information on your report is inaccurate or if an account balance just hasnt been updated yet, your lender may be able to help you. Any updates they make will be sent to us to add and/or change on your credit file.

Review The Results Of The Investigation

The credit bureau involved must provide you with results of the investigation in writing and also a free copy of your credit report if the dispute results in a change to that report. The credit bureau must also provide you with the name, address and phone number of the furnisher that reported the incorrect information.

If a furnisher continues to report a disputed item, it is required to notify the credit bureau involved about your dispute. If the disputed information is found to be inaccurate, the furnisher must tell the credit bureau to update or delete the item. The furnisher must also notify all the credit bureaus to which it sent the incorrect information so that the bureaus can correct their records.

Even if the furnisher insists that the disputed information is accurate, you can still request that the credit bureau include a statement in your credit file explaining the dispute.

Read Also: Credit Report Without Ssn

Invest In Credit Monitoring

Whats this? Step six!?

In truth, the best way to avoid having long-term errors on your credit report is to invest in credit monitoring services from the get-go.

For instance, such services can quickly tell if:

- someone opens a strange bank account or credit account in your name

- your Social Security number is used in an abnormal way

- mysterious charges have appeared on your account without explanation

The best credit monitoring services are effective and invaluable in this day and age due to the possibility of identity theft.

Plus, they can help save your credit score in the long run since any errors that do crop up can be caught and corrected much more quickly.

How To Object To Something On Your Credit Report

Its not uncommon for credit reports to contain errors, though. Anything from inaccurate late payments to accounts that arent yours, or maybe even a falsely reported bankruptcy could mistakenly end up on your report. For this reason, it’s critical to check your credit report for errors on a regular basis.

Federal law gives you the right to an accurate credit report. Credit bureaus arent allowed to report anything thats inaccurate, incomplete, or unverifiable. Thanks to that provision in the Fair Credit Reporting Act, you have the right to dispute errors to have them removed from your credit report.

Recommended Reading: Syw Mc Cbna

What Is The Best Way To Add A Statement To My Equifax Credit Report

If you dispute an item and the inquiry does not settle the issue, you have the liberty to add a free statement to your credit file by stating the basis of your complaint. The document needs to be 400 words or fewer. If your statement is shorter than 400 words, it will be posted to your credit profile and appear every time your credit report is accessed.

Please send your complaint, along with your name, location, date of birth, and mobile number, to Equifax in writing. You shall also have to submit photocopies of two pieces of proof of identification. Its also beneficial to have the Equifax unique identifier from your credit report.

Is It Wrong To Dispute Correct Information

Im not the morality police, and you can do what you want to do, but you do have the right to challenge any information on your report whether its correct or not.

Its your right to have correct and verifiable information on your credit reports. I cant speak for them, but I imagine theyd also want your credit report to be fully accurate and verifiable.

Recommended Reading: How Long Repossession Stay On Credit Report

What If The Information Is Rightbut Not Good

If theres information in your credit history thats correct, but negative for example, if youve made late payments the credit bureaus can put it in your credit report. But it doesnt stay there forever. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years.

Act Fast If You Suspect Fraud

If you suspect that someone else used your information to apply for credit, your identity may have gotten stolen. In that case, you need to act quickly to prevent them from continuing to use your identity. Some actions you can take include: putting a fraud alert on your credit reports, filing a report with the Federal Trade Commission , filing a police report, or freezing your credit.

If you see an unauthorized inquiry, make sure to keep checking your credit reports and contact the creditor to close the fraudulent account. If your credit got pulled without your permission, it could still hurt your credit until you get it removed.

Don’t Miss: Comenity Capital Bank Credit Score

Common Mistakes That Cause Credit Report Errors

To begin, it’s important to know if the person responsible for the error is you. Often, a person may have applied for credit under different names . Make sure you’re consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person with a similar name. Likewise, apply the same consistency and care with things like your Social Security number and address.

Or it could be a case of what you didn’t put in your report. If you were denied credit because of an “insufficient credit file” or “no credit file,” it may be because your credit file doesn’t reflect all your credit accounts. Though most national department store and all-purpose bank credit card accounts will be included in your file, not all creditors voluntarily supply information to the credit bureaus, nor are they required to report consumer credit information to credit bureaus.

If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different creditor who does report regularly to credit bureaus.

Other common errors to look for: