Pay Off The Debt Quickly If Possible

Paying off collection account balance will improve your credit. Paid off debt will always look better than having debt you still have to repay. This will also help your credit utilization ratio, the ratio between your debt and your available balances. And finally, the last reason you want to pay off your collection account as quickly as possible is that the sooner you pay it off, the sooner the debt will be removed from your credit reports.

Ask For Medical Debt Forgiveness

Medical debt forgiveness isnt an option for everyone. But in some cases, you may qualify for forgiveness. For example, many hospitals offer financial assistance programs to borrowers with low or moderate incomes.

Additionally, several organizations and charities offer financial assistance for your medical bills. A few include HealthWell Foundation, PAN Foundation, and United Healthcare Childrens Foundation.

How Long Does A Delinquent Debt Stay On Your Credit Report

As you know, your credit score is calculated from information on your credit report. Credit card issuers report their customers histories to the , beginning with when you applied for the card. From there, your transactions are reported about every month. These include both the amounts of charges and payments you made and the dates those things happened. If you paid at least your minimum payment by the due date, you will get good marks for paying on time, as agreed.

But if you are late paying your bill, it may be reported, which can hurt your credit since payment history makes up 35% of your overall FICO score. This only happens if you go beyond the 30-day late mark. You will likely incur a late fee if you are even a day late, but you probably wont be reported.

For all other bills, if you dont make at least the minimum payment by the due date, you will be reported late after 30 days. If this continues, you will be reported the next month as 60 days late, with calls likely becoming more frequent. Eventually, you will be 180 days late and your account will be charged off. Now you run a serious risk of having your account turned over to or sold to collectors.

See related: How to pay off a debt in collection

Don’t Miss: Does Capital One Report Credit Limit

How Does A Debt End Up In Collections

Every lender has its own guidelines on how many payments a borrower can miss before theyre in default. With some lenders, a debt defaults as soon as the borrower misses a payment. With others, youll be charged late fees on your initial missed payments before the lender takes additional action.

Typically, it takes three to six months before a creditor marks your account as default. Once the debt is in default, the lender may try to collect the money itself or sell the debt to a collection agency.

How To Choose The Best Personal Loan

There are many different personal loan lenders that charge different interest rates and fees and offer various repayment terms. Thereâs no one set of standards that personal loans follow, which means you could see a wide range of offers based on what you qualify for. When exploring personal loan options, consider:

Don’t Miss: Do Hospital Bills Affect Credit Score

Ways To Pay Off A Debt In Collections

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Paying off a debt in collections can get debt collectors off your back and put you on the path to restoring your credit and reclaiming your finances.

Before you make a payment on a debt, first determine whether the debt is past the statute of limitations so you can handle it properly. If it’s not, you have three main options to pay off a debt in collections:

Create a payment plan.

Pay it off in one lump sum.

Settle the debt for less than you owe.

Heres a breakdown of each tactic to pay off a collection agency. No matter which route you take, make sure you get the agreement between you and the debt collector in writing to ensure both parties stick to the plan.

You May Earn A Lower Interest Rate

You could pay 20% APR or more if you carry a credit card balance, although borrowers with excellent credit could pay roughly 12% to 17%, depending on the type of card they own.

Personal loans, on the other hand, charge an average interest rate of less than 10%. The best personal loans are even cheaper than that if you have a high credit score. That means you could cut your total interest payment in half and even pay off your debt sooner since youâll be paying less in interest.

Also Check: How Long Do Closed Credit Accounts Stay On Your Report

How Long Does A Collection Stay On Your Credit Report

If the creditor sent your account to collections, it could remain on your credit report for seven years. The clock starts from the original date you were delinquent. This means the original debt and the collection can sit there for seven years.

Even if the collection agency doesnt report the debt to the credit bureaus right away, hoping youll pay it, the clock starts on the original date of delinquency.

Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

You May Like: How To Request A Copy Of My Credit Report

Send A Pay For Delete Letter

Collection agencies and lenders may remove collection accounts if you negotiate with them. One tool is the pay for delete letter, which is a written request to have negative marks removed in exchange for a partial or full payment.

A collection agency is contracted to collect payment on a debt for the original creditor or lender. They receive a percentage of the amount collected. In order for it to be an incentive, a pay for delete letter may need to offer an amount greater than the collection agency paid for your debt.

Your pay for delete letter should include relevant information such as:

- Payment amounts

- Negotiation terms

If the creditor agrees, always make sure to receive the creditors agreement in writing before making any payment. If you want to learn more or are looking for a letter template to use, read about how to use a pay for delete letter as a negotiation tool.

Not all creditors will accept pay for delete letters. Most banks and mainstream creditors are not open to negotiation, but small utility bills that go to collections might be more receptive to this strategy.

Limits Your Requests For New Creditand The Hard Inquiries With Them

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because youre facing financial difficulties and are therefore a bigger risk. If you are trying to raise your credit score, avoid applying for new credit for a while.

Recommended Reading: What Credit Score Is Needed For Chase Sapphire

How Long Are Collections On A Credit Report

Unfortunately, collection accounts can stay on your credit report for up to seven years, plus 180 days from the date that the debt became past due. After this time, we say that they fall off, meaning they are no longer visible to anyone checking your credit score or credit history. This is a good incentive to pay all of your bills on time and check your credit report frequently to make sure there is no inaccurate information.

How Long Does It Take To Rebuild Credit After Debt Settlement

Your overall credit history will play a role in how fast your credit bounces back after settling a debt. If you otherwise have a solid credit history and have successfully paid off loans or are in good standing with other lending institutions, you could rebuild your credit more quickly than if you have a larger history of late payments, for example.

The further in the past your debt settlement, the better your credit report will look. Still, there are some things you can do to help your over time by focusing on establishing a solid credit repayment pattern:

You May Like: How To Get A 700 Credit Score

Pay Down Your Old Debt

As you trim expenses out of your budget and find new sources of income, it will generate a lot of new money that you can use to pay down old debts. This is the heart of your plan to get out of debt.

Use as much of this money as possible to pay down debts week by week, month by month. There are two primary methods of paying down debt:

- The snowball method. You completely pay off your smallest debt before moving on to the next-smallest debt. The goal is to create momentum by paying off a debt completely and quickly, so that you are motivated to tackle the next debt.

- The avalanche method. You start with the debt with the highest interest rate, even if it is large and will take a long time to pay off. When you finally pay off the debt, you move to the debt with the next-highest interest rate.

The snowball method feels the best, and might keep you motivated because you will see the debts fall quickly, one by one.

The avalanche method requires more patience because it might take more time to pay off those larger debts completely. Some people find this frustrating, but the avalanche method usually will save you more money because you pay off debts with higher interest rates first compared to using the snowball method.

Choose the method that works best for you.

How Quickly Will My Credit Score Update After Paying Off Debt

Financial consumers who pay off debt deserve praise. They also deserve to know when their credit scores will reflect those payments.

Americans are taking a hard line on debt in 2021, with many households making debt reduction a priority.

According to a December 2020 study from Fidelity Investments:

- 44% of Americans vowed to save more money in 2021

- 43% said they were going to aggressively pay down household debt

- 54% said they wanted to lead a debt-free life

The link between debt reduction and credit scores

Increasingly, Americans who pay down debt are asking a simple question “When will I see my credit score rise after I pay down debt?”

“There is nothing worse than actively trying to improve your credit score, and we’ve all been there,” said Chris Panteli, founder of Life Upswing, a U.K.-based financial news and advice platform. “Its frustrating not knowing if all that hard work has actually had an effect.”

If fingers need to be pointed at delayed credit scoring cycles, then point them at the credit card companies, banks, retailers and other lenders who provide the credit to consumers in the first place.

Not sure where you fit on the credit score spectrum? Then you should start using a credit monitoring service to track changes to your credit score. Credible can get you set up with a free service today.

Checking schedules

Read Also: How Is My Credit Rating Calculated

Smart Money Podcast: Money Hot Takes And Too Many Credit Cards

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Welcome to NerdWallets Smart Money podcast, where we answer your real-world money questions.

This weeks episode starts with two hot takes from our hosts about buy now, pay later loans and credit reports.

Then we pivot to this weeks money question from Lauren, who left this voicemail:

Check out this episode on any of these platforms:

Summary Of Moneys Guide For Getting Negative Items Removed From Your Credit Report

- Order a copy of your credit report through AnnualCreditReport.com and search for inaccurate information, like missed payments or accounts that don’t belong to you.

- If you find any, file a dispute online or through the mail with the credit bureaus Equifax, Experian and TransUnion.

- You should also notify your bank or credit card issuer. They can help you verify that the information in your report is, in fact, erroneous and notify the bureau.

- Be on the lookout for a response from the bureau. It should arrive in around a month or less. If they accept your dispute, request your credit report again to make sure the negative information was removed.

- If your report is riddled with errors or you’re finding the dispute process difficult, consider hiring a .

Read Also: Does Asking For A Lower Interest Rate Affect Credit Score

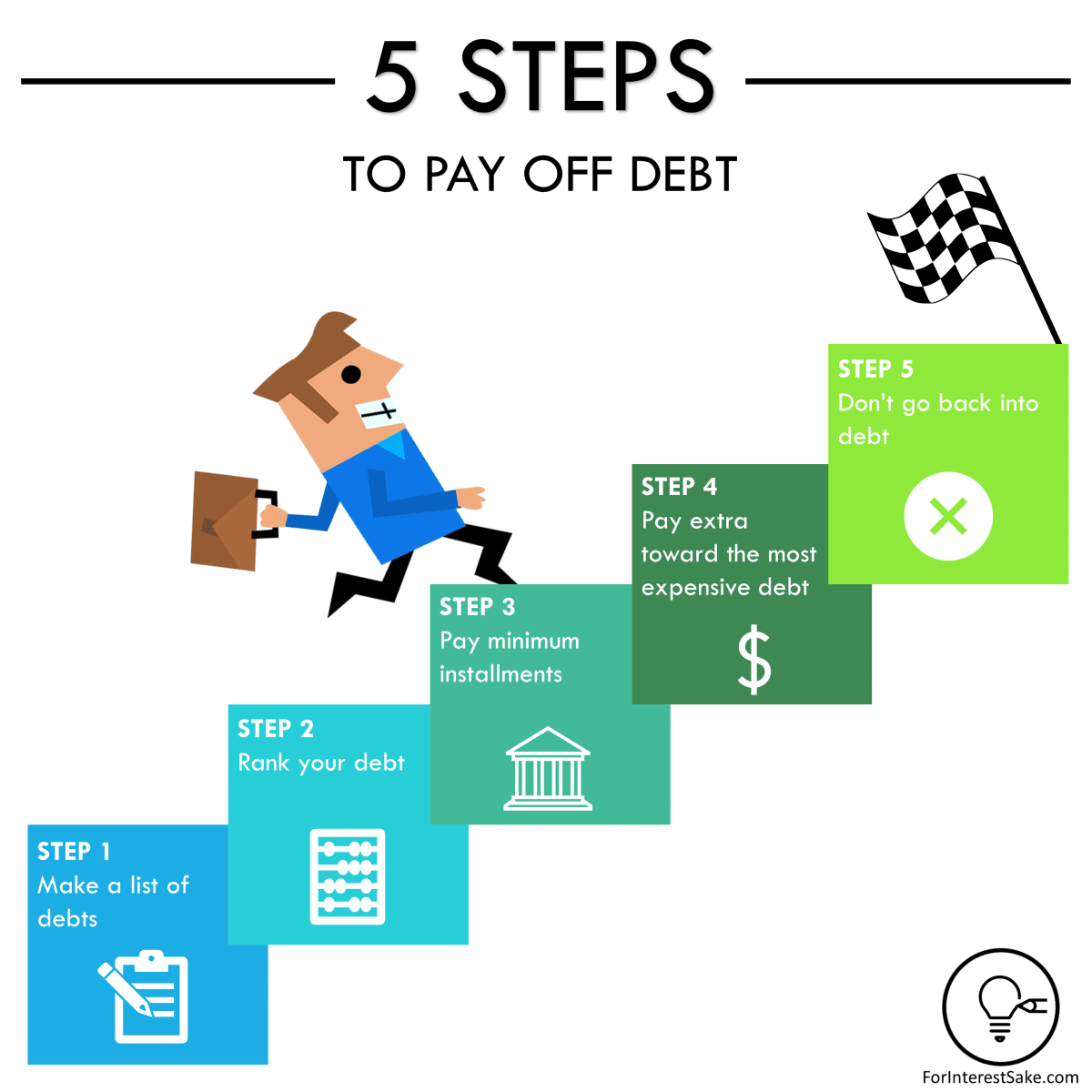

How Can I Prioritize My Debt Payments

How can I prioritize my debt payments? Try these two strategies if youre juggling multiple debts and unsure how to get started on repayment.

Reading time: 3 minutes

Carrying multiple debts at one time is often overwhelming, and it can be difficult to figure out where to focus your repayment efforts first. Plus, the longer you keep your debts open the more you end up paying in interest over time, only compounding the problem.

It’s important to find a debt repayment strategy that works for you and your unique financial situation. That way, you know exactly where to channel your payments so that they’ll make the biggest impact on what you owe.

When deciding which debts to knock out first, there are two main methods you can try: The highest-interest-first plan and the snowball plan.

How Long Does Improving Your Credit Score Take

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to boost your credit depends on the specifics for why your credit score is low. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

Also Check: Does Sezzle Report To Credit Bureaus

Tips On How To Pay Off Apartment Debt

Sometimes, life has a way of coming at us fast. An employment situation suddenly changes, a relationship ends, finances get upended and for one reason or another, the need to move suddenly appears. Since you never were much of a fan of your landlord anyway, you decide to skip out on the remaining months of your lease. No big deal, right? Or maybe you do no such thing, but instead, prior to completing the lease, you cause damages to the apartment beyond the amount of your security deposit.

What happens then? Or what about if youre simply behind on your rent and your landlord has gotten tired of cutting you slack and instead creates a record of your unpaid rental debt on your credit report? In any of the above instances, apartment debt gets created and like any other delinquent debt, apartment debt needs to be addressed before causing any further damage to a credit score and profile. A low credit score due to apartment debt could hurt your chances of renting in the future. Learn what apartment debt is and how to pay off your apartment debt.

Does Having An Account In Collections Hurt My Credit Score

Yes, having . For one, if your credit account is in collections, it is likely because you missed multiple payments and defaulted on the loan, which will hurt your credit score considerably. Another thing to remember is that a collection account will stay on your credit report for up to seven years, which can look bad to prospective lenders.

Also Check: What Happens When Credit Score Dropped During Underwriting