Lower The Limit On Any Credit Cards You Have

If you have any credit cards open in your name, you could consider reducing the credit limits. This will put a firmer limit on the amount of debt you can accrue. It could also help to improve your credit score, according to Moneysmart.

If youre currently comparing credit cards, the comparison table below displays some of the low rate credit cards currently available on Canstars database for Australians looking to spend around $2,000 per month. Please note that this table features links direct to the providers website, and is sorted by Star Rating , followed by provider name . Consider the Target Market Determination before making a purchase decision. Contact the product issuer directly for a copy of the TMD. Use to view a wider range of credit cards. Canstar may earn a fee for referrals.

Although your credit score wont completely change overnight, it can improve over time for example, as more positive information is added to your report and negative information eventually drops off.

Original author James Hurwood.

Thanks for visiting Canstar, Australias biggest financial comparison site*

This content was reviewed by Sub EditorJacqueline Belesky and Deputy Editor Sean Callery as part of our fact-checking process.

How Do You Build Or Establish Credit

As previously mentioned, payment history can significantly impact your credit score. If you have a thin credit file meaning you have few or no credit accounts and only a brief credit history then there may not be enough information in your credit report to calculate a credit score or it may be lower than you’d like.

If this is the case, you’ll need to take steps to establish a longer credit history before you can focus on improving your credit score.

Pay Existing Loans And Debts On Time

A record of consistent and punctual payments can contribute to a stronger credit score. Since the introduction of comprehensive or positive credit reporting, positive data can now be included on credit reports. On the flipside, if you miss your repayments this can also be recorded and can have a negative impact.

You May Like: How To Get Fed Loans Off Credit Report

Limits Your Requests For New Creditand The Hard Inquiries With Them

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because youre facing financial difficulties and are therefore a bigger risk. If you are trying to raise your credit score, avoid applying for new credit for a while.

How Will Paying Off Credit Cards Improve My Score

Paying the balance on your credit card bills on schedule can have the most significant impact on your credit score. The FICO score tends to give this behavior the most weight in their accounting method. However, credit scores also assign points based on a historical record of your open accounts. So, it may help your score to keep these accounts open even if theyre paid down.

Read Also: What Is Considered A Bad Credit Score

Check Your Credit Report For Any Inaccuracies

It could be worth checking your credit report carefully to ensure all the information listed is accurate. If your credit report does contain incorrect information, it could be having a significant impact on your overall credit score.

Examples of potential credit report inaccuracies could include:

- Incorrect debt amounts or duplicate debt listings

- Debt you didnt take out being shown

- Repayments you made not being recorded

By cross-referencing your credit report against bank statements and other financial documents, you may be able to spot any inaccuracies on your credit report. You can then contact your credit provider or the credit reporting body and ask them to amend your report. In turn, this could help to improve your credit score. You can request a copy of your credit report from Australias three main credit reporting bodies: Equifax, Experian, and Illion.

How Do You Get An 800 Credit Score

To get an 800 credit score, youll typically need years of good credit history, higher credit limits, and low or no utilization/debt. Only about 20% of Americans have an 800 credit score.

While its a great achievement, it isnt always necessary to reach other financial goals. But, if you want to reach an 800 credit score, we will discuss how you can make it easier to achieve.

Related Podcast: The Super Serious Guide to Modern Money Management

Read Also: How To Pay Off Bad Debt On Your Credit Report

Only Apply For Credit You Need

Every time you apply for a new line of credit, a hard inquiry is pulled on your report. This type of inquiry lowers your score temporarily. Applying just to see if you get approved or because you received a pre-qualified offer of credit is not a good idea.

If its a single hard credit pull, the drop will be slight. However, a string of hard inquiries could signal to lenders that you are taking on too much debt. The effects of a hard credit pull on your score, according to a representative of TransUnion, can last up to 12 months.

If you do need to apply for new credit, research your likelihood of approval to ensure youre a good candidate before applying. If possible, get a pre-approval or pre-qualification, as in many instances these result in a soft rather than hard credit pull. Soft pulls dont affect your credit score You dont want to risk lowering your score for a denied application.

You should also refrain from applying for several credit cards within a short time frame, or before taking out a large loan like a mortgage.

When you shop for a mortgage, auto, or personal loan, you can keep hard inquiries to a minimum by making rate comparisons within a short time period. Applications for the same type of loan within a designated time frame will only appear as a single hard inquiry. According to FICO, this span can vary from 14 to 45 days.

Be Patient And Persistent

Patience isn’t a factor that’s used to calculate your credit score, but it’s something you need to have while you’re repairing your credit. Your credit wasn’t damaged overnight, so don’t expect it to improve in that amount of time. Continue monitoring your credit, keeping your spending in check, and paying your debts on time each month, and over time you will see a boost in your credit score.

Don’t Miss: Does Qvc Report To Credit

Tips To Help Improve Your Credit Scores

Doing the things you want to do. Seeing the places you want to see. Living life with a little less worry and a little more freedom. The flexibility that comes with higher credit scores can make decisions about money a little easier. While increasing your credit scores may not happen overnight, these six tips can help you start moving in the right direction.

Key Takeaways

- Monitoring your credit can give you an idea of your creditworthiness and a chance to check your credit reports for errors.

- Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores.

- Focusing on good credit-building habits, rather than quick fixes, can help improve your credit over time.

Ways To Check Your Credit Score

Checking your credit score counts as a soft query and is an excellent method to understand more about your financial health. It may give vital insight into your likelihood of being approved for a loan or credit card. Following are some of the simplest ways to check your credit score:

1. Through Credit Bureaus

Each of the credit bureaus is required to provide you with a free credit report once a year. But because of the COVID-19 pandemics financial strains, you can see your report every week without any extra charges.

2. Through Particular Banks

Depending on where you do your banking, your bank or credit union may access your credit score. Most banks now offer their customers the convenience of checking their credit reports, which any of the bureaus can provide.

3. Through Independent Contractors or Third-party Companies

In addition to banks, some independent websites allow you to create a profile and view your credit score online. However, you should be aware that these sites are not subject to the same data protection regulations as banks.

Scammers may use the promise of free credit reports or credit scores to trick you into handing over your personal and financial data.

Also Check: Is 745 A Good Credit Score

Take Advantage Of Score

The number of accounts and the average age of your accounts are both important factors in your credit score, which can leave those with limited credit history at a disadvantage.

Experian Boost and UltraFICO are programs that allow consumers to boost a thin credit profile with other financial information.

After opting into Experian Boost, you can connect your online banking data and allow the credit bureau to add telecommunications and utility payment histories to your report. UltraFICO allows you to give permission for your banking data, like checking and savings accounts, to be considered alongside your report when calculating your score.

Pay On Time And Stay Within Your Limits

Lenders want to know they can rely on you to make regular repayments. A missed payment is likely to negatively impact your credit score.

Your payment history in the last 12 months will be most important to lenders. If you’ve missed payments in the past, but have since become more reliable, your credit score might not be affected as much as you think.

And spending near, or over, your every month is going to give the impression you’re struggling to manage your finances. So, try to keep within your limits.

Explore: What to do if you fall behind on debt repayments

You May Like: How Long Does Delinquency Stay On Credit Report

How Much Credit Score Do You Start Within Canada

Fortunately, your starting position isnt the scales minimum of 300. That is just for those who failed to make payments and dropped their credit score to that point by declaring bankruptcy.Instead, you dont have a single point to your name when you start. If you follow the measures you give you, you will be able to build up your credit score from this point forward.

Become An Authorized User

If a relative or friend has a credit card account with a high credit limit and a good history of on-time payments, ask to be added as an . That adds the account to your credit reports, so its credit limit can help your utilization. Also called “,” authorized user status allows you to benefit from the primary user’s positive payment history. The account holder doesnt have to let you use the card or even give you the account number for your credit to improve.

Make sure the account reports to all three major credit bureaus to get the best effect most credit cards do.

Impact: Potentially high, especially if you are a credit newbie with a thin credit file. The impact will be smaller for those with established credit who are trying to offset missteps or lower credit utilization.

Time commitment: Low to medium. You’ll need to have a conversation with the accountholder you’re asking for this favor, and agree on whether you will have access to the card and account or simply be listed as an authorized user.

How fast it could work: Fast. As soon as you’re added and that credit account reports to the bureaus, the account can benefit your profile.

Read Also: Why Did My Credit Score Drop 100 Points

How To Improve Credit Rating

A credit report is a more comprehensive summary of your financial history, one of the most important factors a lender considers when deciding whether or not to extend credit. Many factors are associated with your credit rating and must be kept in mind.

- Know the Factors That Affect Your Credit Score

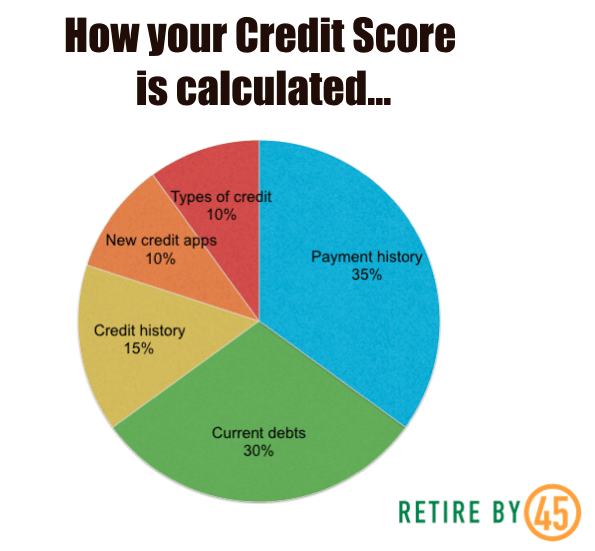

Late payment might harm credit. Payment history is 35% of your Score. 30% of your Score depends on . 15% of your score is . Top scores include car loans, credit cards, student loans, and mortgages.

- Always Pay Your Payments on Time

Your payment history is also one of the most significant variables determining your credit score. Kudos if you have never missed a bill payment. Those who have missed payments in the past need not be concerned

You may plan automatic monthly withdrawals from your KOHO account to pay recurring bills on time. Thus, it will be challenging to miss a payment, and your credit score will gradually improve.

- Take Out Credit Only When Necessary

Avoid exceeding your credit limit. Try not to exceed the $5,000 limit on your credit card if it has one. Your credit score will suffer if you use a credit card above its allowed borrowing limit. Having a bigger credit limit and using less each month is preferable.

- Clear Your Debt

If you pay off a sizable portion of your credit card debt, you could be able to raise your credit score. Even if you cannot lower your utilization rate below 30%, lowering it as low as you can still be beneficial.

- Budget Carefully

How Long Does It Take To Repair Bad Credit Anyway

How long it takes to repair bad credit depends on your individual circumstances. Your current scores, the factors that are affecting your scores and more all go into how long it takes to repair bad credit.

If an error on your credit reports is dragging your scores down, you can dispute the error with the credit reporting agency. Unless the reporting agency considers your dispute frivolous, it has to investigate, usually within 30 days.

If bankruptcy or delinquent payments are the reason for lower scores, it might take a little longer to repair.

But most things wonât impact your scores forever, and the effects of negative factors may lessen over time.

Recommended Reading: How Much Does A Hard Inquiry Affect Your Credit Score

How Can You Quickly Improve Your Credit Score

Sign Up For Free Credit Monitoring

Whether its with Credit Karma or someone else, keeping a close eye on your credit is essential. Signing up for credit monitoring can help alert you to important changes in your credit, so that you can check for suspicious activity. Fraudulent activity can weigh down what could be an otherwise good credit score, so its important to dispute any details you identify as inaccurate. If the credit bureau rules in your favor, the fraudulent activity will be removed from your credit report, which can help raise your credit scores.

Read Also: Is American Express Good For Your Credit Score

Apply For New Credit Sparingly

Though applying for a new credit card can help boost your credit score, its important to note that you should limit how often you apply for new credit products. Applications can hurt your situation in a few ways:

- Generating hard inquiries. When you apply for credit, this typically generates a hard inquiry, where the lender pulls one or more of your credit reports to evaluate your creditworthiness. A hard inquiry will typically hurt your credit score by 5 to 10 points, and will stay on your reports for two years .

- Reducing your average age of accounts. Length of credit history accounts for 15% of your FICO Score, and part of this is the average age of all your accounts. Opening new accounts reduces that average age, particularly if youre new to credit and dont have many other accounts to balance things out.

- Signaling that youre desperate. If lenders see a lot of recent inquiries on your credit reports, it might signal that youre desperate for credit and unlikely to pay back what you borrow and that means lenders will be more likely to reject your applications going forward.

Consider Signing Up For Experian Boost

Offered by the credit bureau Experian, this free service lets you build credit with payments that normally might not count toward your credit score, like your phone bill, utilities and for eligible streaming services.

The average credit score increase with Experian Boost is 13 points , according to the credit bureau. Its worth noting this service will only help your credit score in cases where lenders pull from Experian, but it can still be worthwhile for consumers with limited credit history.

Recommended Reading: Does Credit Report Show Credit Score