Will Checking My Credit Score Hurt My Score

In a word, no. Checking your own credit wont have any effect on your score. When you check your own credit, you create whats known as a soft inquiry. Soft inquiries arent attached to requests for credit, so they dont make a dent in your credit. Hard inquiries, which happen when you apply for credit, are attached to requests for credit, which is why they do change your credit score.

Getting Your Free Credit Report And Score

Getting your free credit report and score

Since the acquisition of Compuscan in 2019, Experian provides free credit reports and free credit scores on My Credit Check and My Credit Expert, which are our easy-to-use, online portals that allows all South African citizens with valid South African ID numbers to access their credit information via their personal extensive credit reports.

Whether you are a first-time credit report user or not, My Credit Check and My Credit Expert will help you understand your credit data, show you how to monitor accounts, manage debt, and improve your credit profile.

You can access your personal credit reports through either the My Credit Check or My Credit Expert portals.

- My Credit Check

- The My Credit Check portal, available at www.mycreditcheck.co.za, references data from the Experian Sigma database, which is the historical Compuscan bureau database.

- Your My Credit Check credit report and credit score are generated from the Experian Sigma database.

Note: Your credit score based on the Experian Sigma Database may be different to the one based on the Experian Database because the formulas and variables used to create the scores differ. Currently, these two databases and the scoring models are kept separate.

Should I Ever Buy My Credit Scores

I get this question from time to time and I always give the same answer. There are so many ways to get free scores that I cant think of a reason to buy them at this point. The scores you would buy, in most instances, are the exact same scores you can get for free elsewhere.

So, the next time you go online looking for a free credit score, Id suggest you keep your credit card in your wallet because youre not going to need it.

Also Check: Does Paypal Pay In 4 Affect Credit Score

What Is The Credit Score For Beginners

There isnt a specific credit score for beginners. People who are newly eligible for credit or move to different countries and have to rebuild credit histories generally have thin credit files. Thin credit files dont contain much information, so theyre hard to use as the basis for credit scores.

Your credit report card isnt a full credit monitoring solution, but it does give a you great credit overview. You can use the information in your credit report card to start improving your credit or to check your credit score before applying for a new card or loan. Your Experian VantageScore 3.0 updates every 14 days, so keep checking back.

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

Don’t Miss: What Credit Score Do You Need For Affirm

How Are Interest Rates Of Banks And Financial Institutions Linked With Credit Score

When you make an application for a loan, banks do a thorough check of your application to ensure your creditworthiness and ability to pay back the loan on time. This is done with the help of a credit score.

An individual with high credit score presents a lesser risk to the bank or financial institutions as he/she comes across as a creditworthy person. When the risk is lesser, lenders are fine with allowing lower rates of interest to those individuals. But when the credit score is lesser, the risk on the part of the bank is higher, hence higher interest rates.

Check Your Credit Report With Annualcreditreportcom

Youre entitled to one free credit report from each of the three credit bureaus Equifax, Experian, and TransUnion each year. But because of the financial pressures of the COVID-19 pandemic, you can check your report weekly without any additional costs through April 2021. Visit AnnualCreditReport.com to access your credit report for free. Check out this article for detailed steps on checking your credit report.

Don’t Miss: Removing Inquiries From Credit

How To Download Cibil Report

The CIBIL report can be obtained easily:

Does Equifax Score Affect My Chances Of Getting A New Loan Or Credit Card

Equifax is one of the credit bureaus operating in India based on the mandate of the RBI. The credit score assigned by Equifax is as valid as credit score assigned by any other credit bureaus like CIBIL , Experian and CRIF High Mark.

A good Equifax credit score increases your chances of getting a loan or credit card, while on the other hand, a bad score can negatively affect your prospects. To maintain a good credit score, always remain responsible towards your credit and be prompt in your payments.

You May Like: Syncb Toys R Us

Where Does The Information On Your Credit Report Come From

The data included in Experians free credit reports comes from credit providers you have borrowed from. Whether its a clothing account, a loan from the bank, or cell phone contract, all credit data gets sent to registered credit bureaus, like Experian, which enables credit bureaus to do credit bureau checks.

Regarding Negative Information In Your Credit Report

When any negative information in your report is correct, there is only so much you can do. Correct negative information cannot be disputed. Only time can make it go away. A credit agency can report most correct negative information for seven years and bankruptcy information for up to 10 years. Information about an unpaid judgment against you can be reported until the statute of limitations runs out or up to 7 years, whichever is longer. Note that the seven-year reporting period starts from the date the delinquency took place.

Read Also: Is 517 A Good Credit Score

What Do Your Free My Credit Check And My Credit Expert Reports Look Like

Each of Experians free credit reports includes your credit score and payment behaviour in a simple and easy to understand format. Information is grouped for you to see what activity has the biggest impact on your credit score and finances. The free credit report is an in-house credit bureau check.

We have included quick tips to explain the data and give advice on how to better manage your credit. On the dashboard, you will be able to see an overview of your credit report you dont need to spend hours sifting through a lot of data.

The free credit check platform includes:

- Your personal details

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Best For Credit Monitoring: Credit Karma

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

What Is A Free Credit Report

The free My Credit Check and My Credit Expert services generate full free credit reporst which provide a comprehensive records of your financial history, detailed information on your borrowing and spending habits, payment trends and contact details. Information includes accounts you opened, payments youve skipped, judgments taken against you and what you owe your creditors.

Don’t Miss: Is 626 A Good Credit Score

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

Whats A Conditionally Free Credit Score

When it comes to accessing your credit scores, it may help to understand the difference between free and conditionally free. If a website or app requires you to input your credit card information at any point, you are not getting a truly free credit score but are instead getting a conditionally free score.

For example, some websites may offer you a free or inexpensive trial of a credit monitoring service. In exchange for signing up for the trial offer, you may be offered a copy of your credit report and what appears to be a free credit score. These websites will ask you for your credit card information.

When you sign up for one of these conditionally free credit services you must proactively cancel the service before the free trial period expires. If you fail or forget to cancel, you will be charged a monthly fee in perpetuity until you do cancel. Fees for monthly credit monitoring services generally run about $20 per month but can be considerably more expensive.

You May Like: How To Remove Repossession From Credit Report

Is It Safe To Check My Credit Score For Free

Checking your free credit scores on Credit Karma wont affect your credit, and any attempts to monitor your credit with Credit Karma will not appear on your credit reports.

If you want to learn more about how Credit Karma collects and uses your data, take a look at our privacy policy.

You can also read Credit Karmas security practices to learn more about Credit Karmas commitment to securing your data and personal information as if it were our own.

Ready to help your credit go the distance? Log in or create an account to get started.

What’s The Difference Between A Credit Score And A Credit Report

Your credit score is different from your . A credit report is a more holistic view of your credit that shows detailed information about your credit activity and current credit situation. Credit reports detail personal information , credit accounts , public records and inquiries into your credit. The three main credit bureaus who issue reports are Experian, Equifax and TransUnion.

“Your credit scores are a proxy for the health of your credit reports,” says Ulzheimer. “So if you’re not going to take the time to pull and review all three of your credit reports, then at the very least you should check your credit scores.”

Don’t Miss: Does Paypal Credit Report To The Credit Bureau

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

How Does A Credit Rating Agency Work

When any company wants to issue any bonds or securities into the market, they rate this debt instrument in order to attract more customers. The reasoning is that the higher the rating of the debt, the lower the risk associated with that debt and vice-versa. The intended buyer of the debt instrument makes their decision about buying the instrument by having a look at the credit rating of the instrument before investing their funds so that they can have a fair idea about the risk associated with their investments.

The credit rating agencies have a few parameters in place to evaluate and rate the debt instrument of a company. These are:

- Independent evaluation of the capacity of the company to repay the debt

- Overall debt of the company

- The impact of the overall debt on the financial position of the company

- A thorough analysis of the finances of the company. This is done to ascertain the areas through which the principal and interest would be paid

- Past debt repayment behavior of the company

- A general study of the economy and industry in which the company is operating

- The willingness of the company to repay its debt

Recommended Reading: Does Snap Finance Build Credit

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check

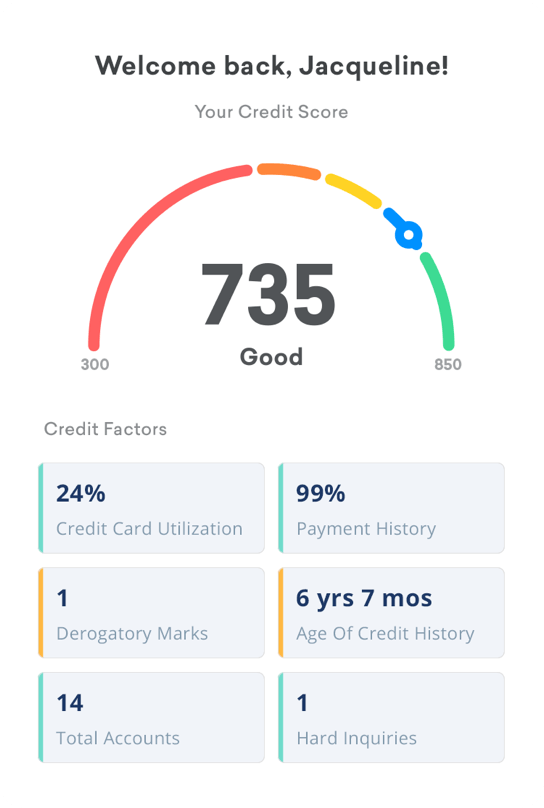

How To Interpret Your Credit Score

Checking your credit score is easy, but merely knowing the number isnt enough. To get the most out of your scoreand improve itits necessary to interpret your score and your credit report as a whole. This involves understanding the five credit score ranges and what each means to lenders. FICO scores fall into the following ranges:

Poor . A score between 300 and 579 is well below the national average FICO Score of 711. Because of this, lenders consider borrowers with a poor credit score to be risky and are less willing to extend credit to them. That said, some lenders offer bad credit personal loans tailored specifically to low-credit borrowers.

Fair . Still below the national average, fair credit scores between 580 and 669 typically qualify borrowers for loans. However, these loans or lines of credit are more likely to come with high interest rates, lower limits and shorter terms. Borrowers with fair credit may access better terms by choosing a secured loan that poses less risk to the lender.

Good . If your score is close to or above the national average, lenders consider it to be in the good range. This means youre less of a lending risk and more likely to qualify for favorable terms.

Very Good . An above-average credit score indicates to lenders that a borrower is reliable and more likely to make on-time payments. For this reason, borrowers with a very good credit score typically have access to more competitive credit cards and better loan terms.

You May Like: Paypal Credit Score Requirement

Our Credit Repair Services

Credit repair involves fixing your bad credit. It refers to the process of disputing errors on credit reports. You can go through the dispute process for free with each of the credit bureaus on your own. As mentioned in this article, this involves filing a formal dispute with the credit bureau and lender in question either online or by mail. Provide a detailed explanation of the error in your formal dispute and include any supporting documentation you have along with it. Many people dont have the time to do their own credit repair or dont understand the process. Thats why we are there for you. We can dispute errors for you and get you back on track. There are times when the extra help could be valuable to you. For instance, if you have multiple errors across credit reports or youve been the victim of identity theft, we can help you dispute the error and lead you through the whole process in a hassle-free manner.