Seek A Credit Product For Your Situation

Your pre-bankruptcy payment history will make you look like an extremely risky borrower to lenders. You can fix that problem by providing extra assurances that they wont lose money by lending to you.

Here are some credit products designed to do that as well as other ways to improve your financial profile:

Get a secured loan or credit-builder loan: This comes in two varieties, and most often is offered by credit unions or community banks. One kind of secured loan involves borrowing against money you already have on deposit. You wont be able to access that money while youre paying off your loan. The other kind can be made without cash upfront, though the money loaned to you is placed in a savings account and released to you only after you have made the necessary payments. In return, the financial institution agrees to send a report about your payment history to the credit bureaus.

Get a secured credit card: This kind of card is backed by a deposit you pay, and the credit limit typically is the amount you have on deposit. A secured card often has annual fees and may carry high interest rates, but you shouldnt need it for the long term. It can be used to mend your credit until you become eligible for a better, unsecured card.

This route wont lift a score by nearly as much as the other methods, because authorized users dont have ultimate responsibility for repaying debt. But this path wont hurt, so you may want to pursue it.

Improve Your Credit Score After Bankruptcy

The best way to improve your credit after a bankruptcy is to make regular payments on new debt. You can do this by spending a small amount on an unsecured or secured line of credit, installment loan, rent, or utilities. Remember, this credit repair strategy only works if you know youll be able to make regular payments and keep your debt to income ratio below 40%.

Financial Life After Bankruptcy Can I Get Credit Again

While bankruptcy does affect your ability to get credit it is possible to rebuild and reach your financial goals. For first time bankrupts, the fact that you filed a bankruptcy and the debt that was part of that bankruptcy will remain on your credit report for six years from your date of discharge. You do not have to wait six years in order to start rebuilding your credit history. Once you are discharged you can start right away.

The first step to rebuilding your credit is to take a look at how your credit bureau reports look after you receive your discharge from bankruptcy. Making sure that your credit report is accurate will ensure that when you begin rebuilding your credit there are no inaccuracies that may lengthen the process. If there are errors you can complete a form provided by the credit bureau indicating what items need to be updated on your report.

Upon receipt of this new credit card you can use the card responsibly, paying it in full each month. This will establish a positive credit report which will begin to increase your overall credit score even during the six months after your bankruptcy is finished. After several months of using this card it is possible to apply to get your security deposit back.

Also Check: Does Paypal Credit Report To Credit Bureaus

How Accounts Appear On Your Credit Reports

Before filing for bankruptcy, you probably had bills you struggled to keep up with credit cards, medical debt and more.

When you include those accounts in a bankruptcy filing, theyll still be reported on your credit reports. Accounts discharged in bankruptcy can be reported as discharged or included in bankruptcy with a zero balance. Even though you owe $0 for them, theyll still appear on your reports. If you apply for credit, lenders may see this note when they check your reports, and they may deny your application.

But heres that good news we promised: Accounts included in a bankruptcy filing wont be reported as unpaid or past due anymore, and you may feel relief without those financial burdens.

Your credit scores will eventually start rebounding with those positive effects, Huynh says. Thats assuming, of course, you use credit responsibly from here on out.

Check Your Credit Report

If youre trying to repair your credit after bankruptcy, start by familiarizing yourself with your . All consumers can access a free copy of their credit report through AnnualCreditReport.com. Free reports are typically only available once a yearbut in the wake of the Covid-19 pandemic, consumers can access free weekly reports through April 20, 2022.

Understanding what makes up your credit score can make it easier to make targeted improvements and provide insight into why your score is or is not increasing. Youll also be able to spot any errors that are bringing your score downsuch as incorrect account information or inaccurate public records.

Reviewing your credit report can also help you confirm that your bankruptcy is removed from your report as soon as possibleafter seven years for a Chapter 13 bankruptcy and after 10 years for a Chapter 7.

Also Check: What Company Is Syncb Ppc

Credit Score After Chapter 7 Discharge File Bankruptcy Now

Aug 29, 2018 Credit score after bankruptcy momentarily come down by 150 points on an average after bankruptcy. Sometimes you are already in debt with

Jun 2, 2021 Have you filed for bankruptcy and wondering how you can rebuild your credit score? Are you discharged from bankruptcy?

Jun 9, 2021 Its possible to get a credit card after filing for bankruptcy, but your The bankruptcy will have damaged your credit score, and making

How Will Bankruptcy Affect Your Credit Score

Thomas J. Brock is a Chartered Financial Analyst and a Certified Public Accountant with 20 years of corporate finance, accounting, and financial planning experience managing large investments including a $4 billion insurance carrier’s investment operations.

One of the biggest fears people have about filing bankruptcy is the impact to their credit scores. Will your credit score be trashed forever? How low will it go?

Credit has become such a staple in our lives that living without good credit can be a huge inconvenience. People are so afraid of losing their good credit their mediocre credit even that they struggle with debt for months or years and still end up filing bankruptcy. Unfortunately, theres not much good news about your credit score when it comes to bankruptcy, but that doesn’t mean you should hold up on filing bankruptcy just to hold on to your credit score.

You May Like: Does Speedy Cash Report To Credit Bureaus

Be Mindful Of Your Credit Habits

A good rule of thumb when rebuilding your credit is that whatever you did to ding your credit, you must do the reserve to rebuild your credit. For instance, if you hurt your credit score by having too high a debt-to-income ratio, then make a point to keep your DTI low. Youll want to keep your credit usage to 30 percent or under.

If you fell into the habit of missing payments, then do whatever it takes to stay on top of your credit card payments. Remember: your payment history makes up 35 of your credit score. If you tend to rack up a huge credit card bill over the holidays, and experience holiday debt hangover, avoid it at all costs this holiday season.

Why this matters: Your credit habits play a big part of keeping your credit score in tip-top shape. And when youre rebuilding your credit after bankruptcy, it is particularly important to show to lenders that youre financially responsible.

How to get started: Start by making on-time payments, monitoring your financial habits around using credit. It might also help you to sign up for a free credit monitoring service, which can show you how much progress youve made on building your credit back up.

Learn more:

Why Is A Credit Report Important

Everybody has a credit rating.

Your credit score is a figure that represents the level of risk you pose to a lender.

If you want to borrow money or youre keen to take out a mortgage, the higher your credit score, the better the chances of a successful application.

If your credit rating is low, you may struggle to borrow money, and you wont have access to preferential rates and terms.

Once you go bankrupt, you have a chance to improve your credit rating over the course of time.

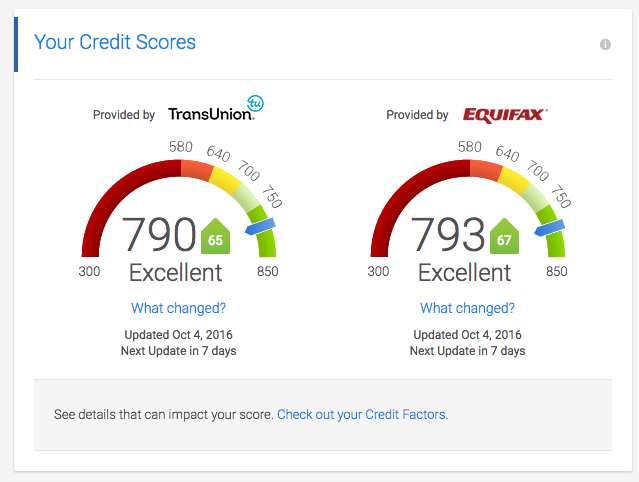

According to TransUnion, the average credit score in Canada is around 650.

Over 65s tend to have the highest credit scores.

Summary

If youre considering filing for bankruptcy, you may be worried about the long-term impact.

Depending on the credit agency, your bankruptcy will be removed from your credit report within 6 or 7 years.

If you have any questions about bankruptcy, or youd like to find out more about consumer proposals, we have a team of experts on hand to provide information and tailored advice.

Also Check: Does Paypal Credit Report To Credit Bureaus

Think Twice About Working With Credit Repair Agencies

Instead of paying a credit repair agency, consider using that money to increase your emergency fund and savings. Focus your efforts on the habits and circumstances that led to your bankruptcy and how you can change them.

There are many unscrupulous agencies out there that will claim they can remove a bankruptcy or fix a credit report, says Samah Haggag, a senior marketing manager for Experian. There is nothing a credit repair organization can do that you cannot do yourself.

Why this matters: Credit repair agencies take the heavy lifting out of credit-building, but they charge fees. If youre willing to put in the work of checking your credit reports and disputing errors, you can save that money and use it to continue paying down existing debt.

How to get started: Take a look at your budget and request copies of your credit report yourself before looking into credit repair agencies.

How Can I Rebuild My Credit File After Bankruptcy

The good news is that bankruptcy isnât the end of the road financially. Here are some steps you can take in the short term:

- Order a copy of your statutory credit report to ensure your credit details are correct

- Add a short statement to your report explaining why you got into debt

- Register for the electoral roll at your current address

- Update all personal details on your credit profile

In the long term, itâs important to show lenders that you can borrow money responsibly. You can do this by using and repaying credit. But before you do so, you need to be 100% sure you can afford and meet the repayments.

- Consider credit designed for people with low credit ratings. This usually means low limits and high interest rates. You may be able to improve your rating by using this type of credit for small purchases and repaying the money in full and on time.

- Space out your applications. Each application for credit will leave a mark on your credit report, so aim to apply no more than once every three months.

- Check your eligibility before you apply for credit. Doing this can help you reduce your chances of being rejected and having to make multiple applications. You can see your eligibility for credit cards and personal loans when you create a free Experian account.

You May Like: How To File Bankruptcy In Wisconsin

Also Check: Creditwise Accurate

Become An Authorized User On A Credit Card

If you dont want to take out a secured credit card, you can ask a family member or friend who has good credit to add you as an on one of their credit cards. You may see an increase in your credit score if the issuer reports the cards positive payment history to the three main credit bureaus. However, your score could take a dip if the primary cardholder makes a late payment or maxes out their credit limit.

Will I Be Able To Get Loans Or Credit After I File For Bankruptcy

Whether you can get loans or credit immediately after bankruptcy depends on what kind of credit you’re seeking.

Many bankruptcy filers are bombarded with credit card offers after the bankruptcy is over. Credit card companies know you can’t file again for several years , so they might be eager for your business. But bewarethe credit card offers will likely have very high interest rates, annual fees, and other high charges.

Car loans. Most likely you’ll be able to get a car loan right away. But you’ll be dealing with subprime lenders, which means high interest rates and other unfavorable loan terms.

Mortgages. How long it will take to qualify for a mortgage depends, in large part, on the mortgage lender. You might qualify for an FHA-insured mortgage even before you complete a Chapter 13 plan and two years after a Chapter 7. For conventional loans, if your lender sells its loans to Fannie Mae, for example, you’ll have to wait at least two years from the discharge date after a Chapter 13 bankruptcy and four years after a Chapter 7 bankruptcy discharge or dismissal date . If your lender doesn’t sell its loans to Fannie Mae, you might have to wait even longer.

These are minimum wait periodsit might take longer to qualify for a mortgage. Other factors that affect your qualification include your income, your debt load, how large your down payment will be, and more.

You May Like: Does Speedy Cash Check Credit

Track Your Credit Score

Its not going to be fun, but sign up to Experian so you can see your credit score. Check back every month and see if your credit score has improved and try to be realistic about what credit you might get. If you apply for credit and get refused, wait for a while and try again once your score is better.

Employing Other Types Of Credit

Car dealerships may actively market to people who have recently emerged from bankruptcy. A few months after receiving their bankruptcy discharge, consumers may start receiving letters from dealerships offering to help them re-establish credit through the purchase of a new car . The terms on these types of loans may fall in line with the terms offered in other parts of the subprime marketthey aren’t good, but they are not horrible, either. Since you recently filed for bankruptcy, you’re considered a risky borrower. Whereas folks with a decent credit score might get loans at a rate of 5%, these loans could come with rates as high as 18% or more. If you can afford to stick to payments with such high rates, you could use these loans as a way of building credit. However, this strategy is generally not advisable unless you have the cash or income to support such a high interest payment. A good rule of thumb for interest payments is that you should try to avoid any interest rate that is higher than the rate you could reasonably expect to earn by investing your money in the stock market .

Also Check: Does Speedy Cash Report To Credit Bureaus

How Long Does A Bankruptcy Or Consumer Proposal Stay On My Credit Report

How long bankruptcy stays on your credit report in Canada will depend on the credit bureau that is reporting.

The largest credit bureau in Canada, Equifax, maintains this record on your credit report for a period from the date of your discharge or last payment:

- A first bankruptcy for six years from the date of your discharge.

- A second bankruptcy for 14 years.

The TransUnion web site states that they keep a bankruptcy on your credit file for six to seven years from the date of discharge or fourteen years from the filing date .

At this point the bankruptcy will leave the credit report and you will need to start to rebuild your credit.

How long a consumer proposal stays on your credit report again depends on the credit bureau that is reporting.

With Equifax, a consumer proposal is reported for three years after your last payment.

Bankruptcy And Your Credit Report

The type of bankruptcy you choose to file will determine how long it is listed on your consumer credit report. Chapter 7 and Chapter 11 bankruptcies stay on your credit report for 10 years after you file. Chapter 13 bankruptcies remain on a credit report for seven years after the bankruptcy is completed, but Chapter 13 proceedings can take up to three to five years to finish.

In many cases, it is not your damaged credit score that makes it hard to obtain credit. Some lenders do not grant credit to anyone with a bankruptcy, regardless of their FICO score. If you are having difficulty obtaining credit following a bankruptcy, it may be a good idea to open up a secured credit card, which is a credit card that you back with a cash deposit.

Building a personal relationship with a lender can be one of the fastest ways to secure credit after filing for bankruptcy.

Recommended Reading: Synbc Ppc

Fixing Your Credit Score After Bankruptcy

No matter what your score was prior to filing for bankruptcy, you can raise it back up with smart credit moves. The first step is getting a credit card. It wont be easy after a bankruptcy, but some cards are easier to get than others. Consider a department store card, a secured card, or a card specifically for people with poor credit. Watch out for the fees. Some lenders offer subprime cards with extremely high interest rates and fees that send people straight back into debt.

Use the card wisely. Dont exceed 25% of your credit limit and pay the card off in full every month. When youve built up some good credit, youll be able to get a credit card with more favorable terms. If you borrow to purchase a car or a home, make those payments in full and on time. You can boost your score back up into the 700s in just a handful of years.

See also: Will I be able to get credit after bankruptcy?