Improving Your Credit Score Can Get You A Better Rate And More

Improving your credit score for a home loan can benefit you in other ways besides lower mortgage rates. For example:

So, its always a good idea to improve your credit score if you can to ensure you have the best options for a home loan.

Here are a few ways you can raise your score:

How The 3 Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

- Equifax

- Transunion

- Experian

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge.

There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

How Do I Find Out My True Credit Score

With so many credit scoring models, you really dont have just one true score, but many. Your scoredepends on all of the factors mentioned above in addition to what type of lender you apply to for credit.

Its important to remember that everyones scores are different because they represent a snapshot in time of the particular individuals current and past credit habits. By following the tips mentioned above long term, you can definitely build and maintain scores to be proud of.

Don’t Miss: Does Titlemax Report To Credit Bureau

Assess Your Unique Circumstances Before You Decide

On the other hand, applying on your own means the lender will only take into account your income and not your partners. This means you might qualify for a smaller mortgage. Regardless of whether one partner name is on the mortgage, his or her name can still be on the title of the home.

Understanding the ins and outs of credit scores and joint mortgages will help you and your partner take this major step together and get you closer to becoming homeowners. For answers to any questions you might have about joint mortgages, give our home lending advisors a call. Theyre happy to help.

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Read Also: Carmax Auto Finance Defer Payment

Which Credit Scores Do Mortgage Lenders Use

When you apply for a mortgage, lenders will generally request all three of your credit reports and a FICO® Score based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

Why Are There Different Fico Scores

When you apply for credit, whether its your first credit card or a second mortgage, lenders need to decide whether youre enough and likely to repay the money. To do this they check your credit scores or get credit reports from one or more of the major credit bureaus: Equifax, Experian, and TransUnion. Each has its own credit score that is developed by FICO, and these scores are calculated based on your credit history and other information that goes into your credit report.

There are also multiple versions of FICO scores, reflecting the evolution of the credit market and consumer behavior since the scores first became a tool for lenders back in 1989. Just in terms of the amount of credit we use, theres been a big increase over the past few decades, with consumer borrowing rising by approximately 15% over the last four years. A typical borrower today probably would have been considered a higher credit risk under older methods of calculating credit scores.

FICO has rolled out 10 versions of its base score over the years, and most of them are still in use by lenders to some extent. Lenders can choose from the following base versions:

- FICO 2

- FICO 9

- FICO 10 and 10T

Don’t Miss: Klarna Approval Odds

What If Your Credit Score Isnt Good Enough

If youre nowhere near 660, you may want to take some steps to raise your credit score for a home loan application by reducing the amount of debt you owe or paying your bills on time. Its not a fast process, so dont expect to see results for at least a few months.

Send me news, tips, and promos from realtor.com® and Move.

If you dont have time to boost your credit score into a more acceptable range before buying a home, all is not lost. You may still be able to get a mortgage through a government-backed program like those offered by the Federal Housing Administration. The FHA accepts credit scores for home loans as low as 580and may even go as low as 500 if you can throw down a larger down payment.

If you are an active or former military member, you may also qualify for a loan program backed by Veterans Affairs. Such programs can be particularly forgiving on the credit score front, so its worth checking out if you qualify.

Last but not least, if your , it may make sense to work with a mortgage broker or credit union. Often, small institutions like these are more willing to look at your whole financial picture and work with you if your past mistakes are really in the past.

Credit unions dont flat-out deny somebody immediately, Williams-Barrett says. To me, it is the whole picture, not just the score by itself.

Work With A Trusted Mortgage Loan Officer

Your mortgage lender is the ideal resource for asking questions about any part of the homebuying process before you are even ready to apply.

The professional loan officers at Homefinity can get you pre-approved so you can solidify your budget and take the proper next steps. or apply now to get started.

Read Also: Does Affirm Do A Hard Credit Check

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

What If Your Spouse Has Bad Credit

The lower middle score system means both applicants’ credit scores matter, but the lower score matters most. Therefore, the decision of whether to include a spouse on a mortgage application comes down to which option makes the most financial sense.

If your co-borrower does have bad credit, there are a few options available:

Read Also: Does Usaa Report Authorized Users

Can You Get A Home Loan With Bad Credit

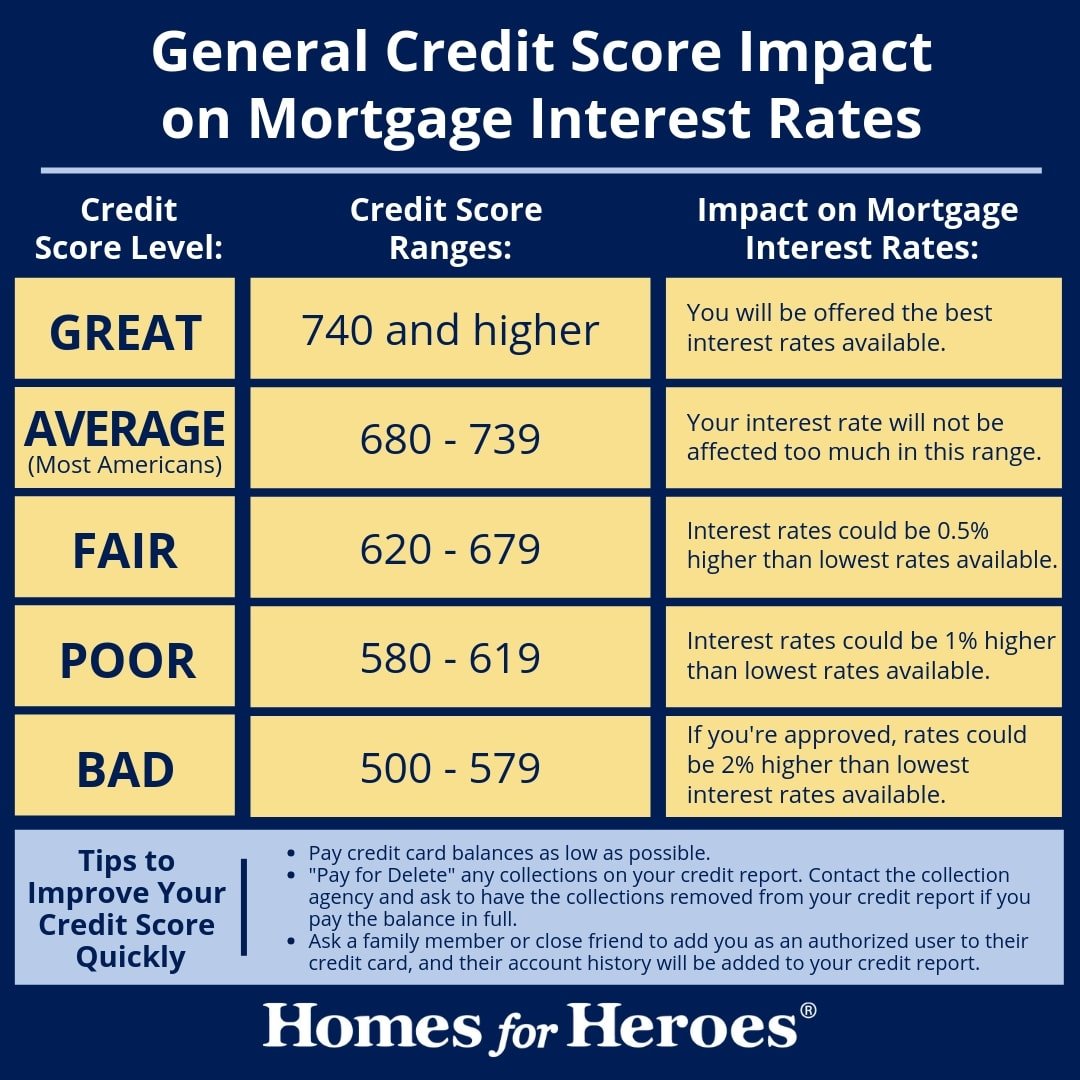

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

How Long Will It Take To Improve My Credit Score

Its tricky to say how long it will take for you to see improvements in your credit score. If youve picked up a negative mark, such as a missed payment or a time when you went over your credit limit, it will stay on your report for six years.

Even if youre taking all the right steps to improve your credit score, delays in reporting from lenders can mean it takes a good few months to see your score move in the right direction. For example, it could take weeks for a positive action like registering on the electoral roll to show up on your credit report.

Recommended Reading: Credit Score With Itin Number

What Credit Score Do I Need For A Mortgage

There isnât a specific credit score you need for a mortgage, and thatâs because there isnât just one credit score.

When you make an application for a mortgage or other type of credit, lenders work out a credit score for you. This is to help them decide if they think youâll be a risk worth taking – if youâll be a responsible, reliable borrower and likely to repay the debt. Usually, a higher score means youâre seen as lower risk â the more points you score, the more chance you have of being accepted for a mortgage, and at better rates.

What Numbers Do Mortgage Lenders Look At

Lenders use credit scores to determine a borrower’s level of risk.

Three credit bureaus Equifax, Experian, and TransUnion calculate an individual’s credit score. The higher your credit score, the better interest rate you’re likely to get which also means you’ll have a lower monthly mortgage payment. Before you apply for a mortgage, it’s a good idea to check your credit score and review your credit report to make sure everything is correct.

Read Also: Chase Sapphire Preferred Credit Score Needed

How Do Lenders Use New Fico Scores

When a new FICO® Score version like FICO Score 10 or FICO Score 10 T is developed, we release it to the market.

From there, each lender determines if and when it will upgrade to the latest version. Some lenders make the upgrade quickly, while others may take longer. This is why some lenders are currently using different versions of the FICO® Score. As an example, FICO Score 5 at Equifax is the FICO Score version previous to FICO Score 8 at Equifax.

Other FICO® Score versions, including industry-specific auto and bankcard versions, are also included in the FICO Score products on myFICO.com so you can see what most lenders see when looking at your scores.

Stay Away From Hard Credit Inquiries

When you apply for any conventional loan or credit card, the lender will ask one or more of the credit bureaus for a copy of your credit report. The credit bureau will make a note of this on your credit report as a hard inquiry.

Each hard inquiry on your report drops your credit score by a few points. Lots of hard inquiries in a short period of time can really damage your score. This is because a borrower who is applying for a lot of loans in a short period is probably having financial problems.

When youre thinking about applying for a big loan, especially a mortgage, make sure you try to avoid any unnecessary hard inquiries.

The good news is that most credit scoring models wont punish you for rate shopping. If you apply for a mortgage from multiple lenders within a short period of time, typically a few weeks, most models will treat all of those applications as a single inquiry.

Also Check: Can Landlord Report To Credit Bureau

How To Get Started

If youre ready to begin the homebuying or refinance process but are unsure about your credit situation, check with your bank or credit card issuer to get an idea of your score. You also should download your full report yearly to evaluate your history and ensure there are no errors.

Your credit history might be complicated.

To help you learn more about your situation and improve your score, consider working with your lender or a financial counselor to help you get where you need to be.

How To Find Your Credit Score

You can request a free copy of your credit report online through each of the major credit bureausEquifax, Experian, and TransUniononce a year, but it doesnt include your credit score. For a fee, you can get credit scores and access credit reports through the Fair Isaac Corp. to see where you fall.

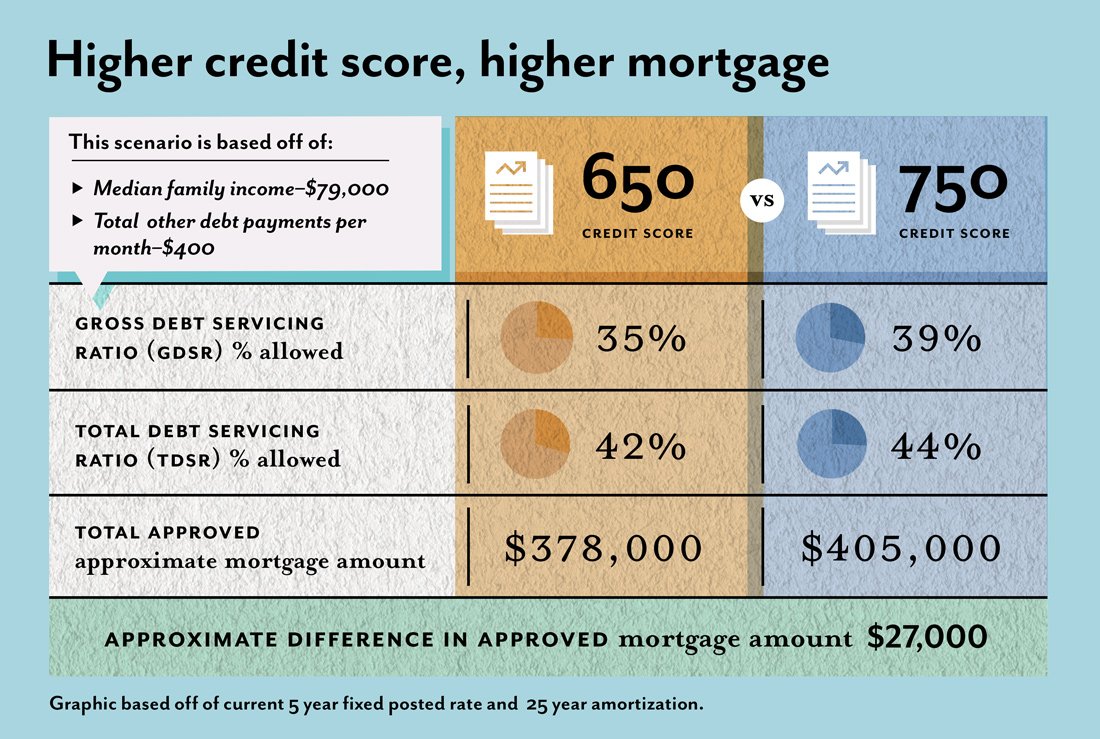

Once you know your own credit scores, youll have a good idea of whether youll be approved for a mortgage. However, while a minimum credit score of 660 probably means youll get approved for a loan, you wont get the best rates or terms. For instance, you may have to pay a higher interest rate than someone with better credit .

As such, if your score hovers around the minimum range, you may want to make an effort to boost your score before you start house hunting.

Also Check: How Long Do Repos Stay On Your Credit

Good Credit Score Home Loans

Once your credit score climbs into the 700 to 749 range, youre in the good credit score range for a home loan. Qualifying will usually be easier and loans will most likely be less expensive. All types of mortgages are available once you have good credit:

- Conventional loan: A conventional mortgage becomes easier to get with good credit, even if youre carrying a lot of debt relative to your income. Instead of needing a debt-to-income ratio of 36% or less, you might get approved with a ratio as high as 45%. That means your existing monthly obligations and proposed mortgage payment must total no more than 45% of your gross income. If youre putting down less than 20% on a conventional mortgage, a good credit score will reduce your PMI premiums.

- Jumbo loan: If your income is high enough, jumbo loans become accessible with a credit score of 700 or higher.

- FHA loan: These loans become less advantageous as your credit score increases because youre more likely to qualify for a less expensive conventional loan.

- VA loan: Veterans Administration loans are still a great option for those who qualify. The average VA borrower in June 2020 had a credit score of 733 if they were refinancing and 720 if they were buying, according to Ellie Mae.

Learn More: Mortgage Qualifications: How to Qualify for a Mortgage

Are There Any Mortgage Providers That Dont Use A Credit Score

There are mortgage providers that will accept customers with a poor credit score and/or negative marks on their credit record. For example, Buckinghamshire will accept people with poor credit, small County Court Judgements that are more than six months old and even an Individual Voluntary Arrangement as long as it was paid off five or more years ago. However, it states that this is only for certain products, and theres no guarantee youll be accepted.

If youre looking for expert advice and to access the best rates, its wise to speak to a specialist mortgage broker or provider who deals with customers with bad credit. Theyll advise you on how to improve your chances of being accepted and find products that suit your circumstances.

You May Like: Average Credit Score For Care Credit

What Is A Fico Score

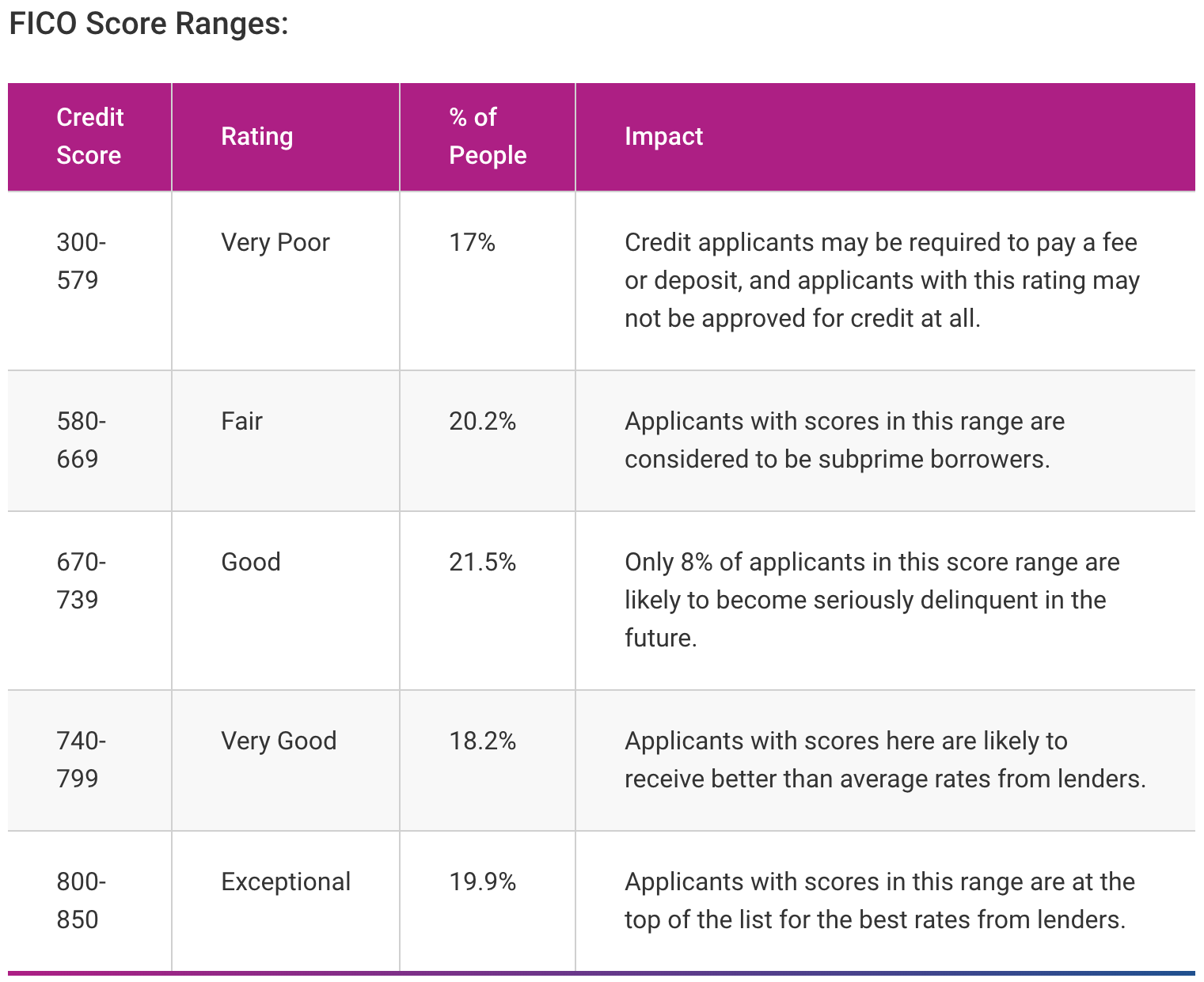

FICO is the type of credit score used by 90% of the U.S. lending community, including mortgage lenders. FICO scores are determined by your payment history, how much of your available credit youre currently using, how long youve had credit accounts , and how much new credit youve opened and applied for.

When you apply for a mortgage to buy a home, your lender will look at your FICO scores from the three major credit bureaus: Experian, Equifax, and TransUnion.

The information in your credit report contributes to your credit scores. Each of the credit bureaus maintain a credit profile on you that includes a detailed credit history, showing the types of accounts you have held or currently hold, and whether you paid them on time. Your credit report will show credit cards, student loans, car loans, personal loans, and past or current mortgages.

Your payment history is the biggest factor in your credit score. Other elements that influence it are your credit utilization ratio , and the age of your credit .

Below, youll see the minimum FICO credit score needed for popular mortgage loan programs.

Related reading: What Credit Scores Do Mortgage Lenders Use?