How To Monitor Your Business Credit And Personal Credit

Its wise to claim your free credit reports once every 12 months from the consumer credit bureaus. But an annual credit check may not be enough to alert you if a problem arises . Instead, youll be better off checking your credit more frequently perhaps on a quarterly or even monthly basis.

Theres also no law that currently gives you free access to your business credit reports. You can, however, keep a closer eye on your credit historybusiness and/or personalif you sign up for a credit monitoring service.

Some credit monitoring services give you access to one or more of your personal credit reports. Others may allow you to access one or more of your business reports. With Nav, you can review business and personal credit information in one location.

Navs Final Word: Removing Inquiries from Your Report

The best way to prevent inquiries from hurting your credit scores is to apply very carefully, and only for loans or credit cards you think you are likely to get. If you are shopping for a vehicle, for example, get preapproved for a car loan ahead of time from a reputable lender. Dont let the dealership shop your credit application to dozens of lenders unless you want the risk of multiple inquiries on your credit reports.

On the other hand, unauthorized inquiries can be a sign of a serious problem. If you suspect that someone has been applying for new credit in your name or your companys name without your permission, its critical to take action right away.

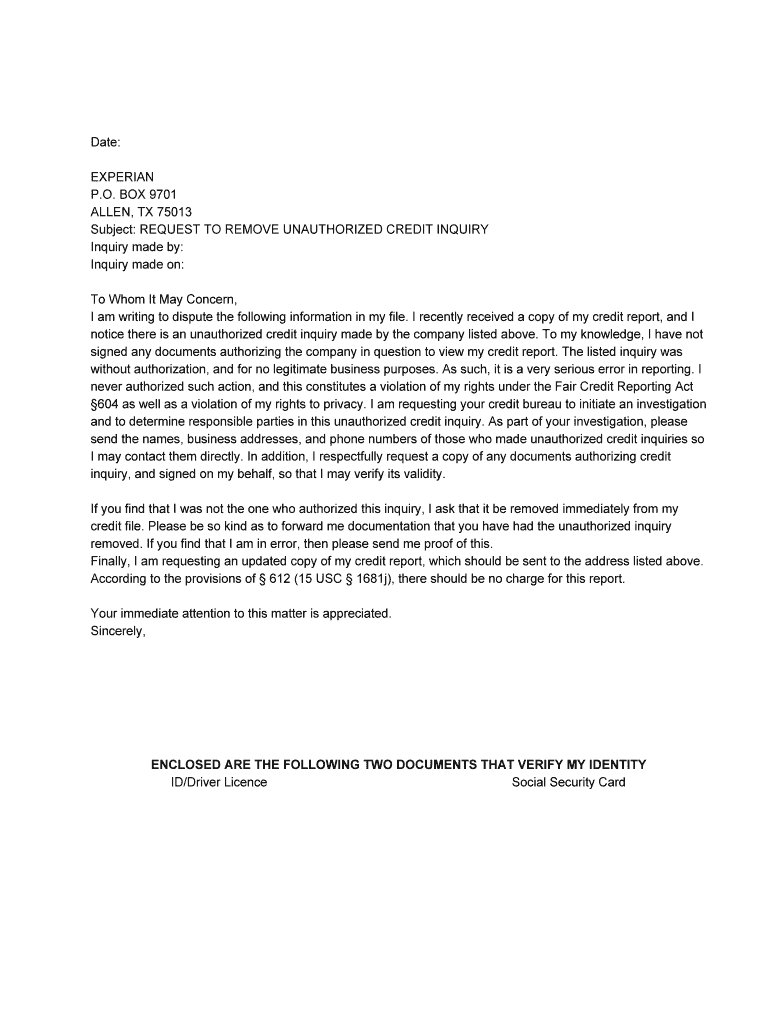

Disputing Inaccurate Hard Inquiries Yourself

It’s important to check your credit reports regularly for accuracy. If, while doing this, you’ve noticed a hard inquiry on your credit report that you believe is the result of identity theft, you can file a dispute with each of the three national credit reporting agencies and petition to have them update the inaccurate information.

The first step is to review your Experian credit report through our Dispute Center and verify your information. Next, confirm that the inquiry was not a result of identity theft.

There may be situations where you don’t recognize the name of a company that checked your credit or you don’t remember applying for a loan with a company you do recognize. Here are a few scenarios when inquiries you don’t recognize may be legitimate:

If you don’t recognize the company name that performed the hard inquiry, contact the company for more information. When you check your credit report through the Experian Dispute Center, the hard inquiry will be accompanied by the company name and typically the mailing address and a phone number.

If you have verified that the hard inquiry is due to identity theft, then the dispute would be handled over the phone with Experian specialists. You can visit our Dispute Center to find out support options. There is no charge to use this service.

File A Dispute If Necessary

Regularly checking your credit reports will help ensure that all the data is accurate. If you notice a mistake on your credit reports, file a dispute with each of the three credit reporting agencies Equifax, Experian, and TransUnion. Federal law allows you to dispute inaccurate information at no cost. If the credit bureaus cannot confirm the legitimacy of the inquiries, they are required to remove them.

If you need additional guidance on how to dispute errors, make sure to go to the FTCs website. If you were a victim of credit fraud, the FTC also helps you create a recovery plan.

Don’t Miss: Paypal Credit Report

Preventing Unauthorized Hard Inquiries

To prevent future unauthorized hard inquiries, consider placing a freeze on your credit report. This option prevents any lenders or creditors from accessing your credit information.

Its great for preventing identity theft because no one can open a new credit account using your financial information since they wont get approved without a credit check. However, it also helps prevent unwanted inquiries if you find this to be an ongoing headache.

Placing a freeze on your credit report and having it removed both incur separate fees in most states, so dont do this if youre planning on applying for a new credit card or loan in the near future. But if you anticipate your financials to remain the same for the time being, this can be a convenient option to keep your credit nice and clean.

Applying For Business Credit Hard Inquiries

When you apply for a business credit card or business loan, the potential lender will generally check your credit history as part of the application process. Depending upon the type of business financing you apply for, the creditor may want to review your business credit report, personal credit report, or both.

If a lender pulls your personal credit, a hard inquiry will be added to your consumer credit report with Experian, TransUnion, or Equifax. Business credit checks may also be recorded on your business credit reports, like those sold by Dun & Bradstreet, Experian, and Equifax.

Hard credit inquiries might impact your business credit score, depending on the business credit reporting agency and business credit score used. But a hard credit inquiry is typically less important when it comes to business credit scores than it is where your personal credit history is concerned. In fact, many business credit scoring models dont even take inquiries into account.

Read Also: When Does Opensky Report To Credit

A Guide To Credit Report Disputes

Reading time: 4 minutes

- Regularly checking your credit reports can help ensure information is accurate and complete

- If you believe information on your credit reports is inaccurate or incomplete, contact the lender

- You can also file a free dispute with the three nationwide credit bureaus

When reviewing your credit reports, its important to make sure all of the information is complete and accurate. This includes everything from the account information to the other personal information thats on your credit report such as your home address, name, and Social Security number.

Here are some steps you can take to address information you believe is inaccurate or incomplete:

What information can I dispute on my credit reports?

What should I expect after filing a dispute?

Review Your Credit Reports

You should make it a habit to regularly review your credit reports from the three major consumer credit bureaus Equifax, Experian and TransUnion. The may not know which information is incorrect unless you flag it.

To check for incorrect hard inquiries on your credit reports, look for a section labeled something like

- Requests viewed by others

- Regular inquiries

There may also be a separate section for soft inquiries, which should be labeled something like requests viewed only by you. Unlike hard inquiries, soft inquiries wont affect your credit scores.

Not sure how to read the information your credit reports? Learn more about whats on your credit reports and how to read them.

You May Like: How To Dispute A Repossession

How Do I Protect Myself From Fraudulent Hard Inquiries

Inaccurate information on your credit report is uncommon, but it does happen. Check your regularly to avoid fraudulent and other incorrect information going unnoticed. Review whats listed and keep an eye out for anything unfamiliar.

Its impossible to prevent all identity theft, but keeping track of your credit history will keep you in a better position to stop a bad situation from getting much worse.

You should also consider placing a fraud alert on your credit record as soon as you think you are or may be a victim of identity theft. This will make it more difficult for criminals to start a new account in your name.

Putting your credit report under a credit freeze provides even more security. A freeze prevents companies from making any inquiries. While youre looking for a loan or credit, you can unfreeze your credit report to allow a legitimate hard inquiry to go through.

How Long Do Hard Inquiries Stay On Your Credit Report

Hard inquiries stay on your credit report for two years. Each time a hard inquiry is made, it is recorded by each of the three major credit reporting agencies Equifax, Experian, and TransUnion. And each time a hard inquiry is logged, it can potentially impact your credit score.

Don’t Miss: What Does Leasing Desk Score Mean

What To Do If You Dont Recognize An Inquiry On Your Credit Report

If you see an inquiry you dont recognize, first check what kind of inquiry it is hard or soft. Soft inquiries dont affect your credit score and only you can see them. Hard inquiries typically happen when a lender or company accesses your credit report with the intention to extend you credit or apply for a new financial obligation.

Lenders can only access your credit report if they have a permissible purpose. That is, they must have a specific, allowable reason under the Fair Credit Reporting Act. If a hard inquiry is a result of fraud, it can be removed from your report. But just because an inquiry on your credit report doesnt look familiar, that doesnt mean its unauthorized or inaccurate.

Store credit cards are a great example. Sometimes, the name of the bank on the credit report isnt the same as the company the card is for. If you request to increase your credit line on a credit card you already have, that will often cause a hard inquiry too. These are easy to miss or forget about when reading through a credit report.

One quick way to double check if you applied for new credit is to search your email for the name of the creditor on your credit report. If you find an application, check the terms and conditions, which will say if you gave the creditor permission to access your report.

If you still think a hard inquiry on your credit report is unauthorized, run through this checklist for suggested steps to take and further protect your credit health:

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently annually, if not more often so you can catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major credit bureaus once a year. However, because of the pandemic, all three bureaus are offering free weekly reports until April 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to request and check your reports from all three bureaus since its not uncommon for each one to get different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance, or employment based on your credit in the past 60 days

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

Other ways to get your credit report

Each of the major bureaus offers credit monitoring services that include access to your report and your score, among other benefits.

Experian

TransUnion

Also Check: Notify Credit Bureau Of Death

What Is An Inquiry

An inquiry is a document record that has the details of who has reviewed your credit report. Whenever anyone reviews your credit report, it is shows up on your inquiry and is on your credit report for two years, unless the inquire is disputed and removed.

A has two different types of inquires hard inquires and soft inquires. You can learn how to remove authorized inquiries from credit report for either.

How To Remove Negative Items From Your Credit Report

![50 Best Credit Dispute Letters Templates [Free] á? TemplateLab](https://www.knowyourcreditscore.net/wp-content/uploads/50-best-credit-dispute-letters-templates-free-a-templatelab.jpeg)

First, it’s important to know your rights when it comes to the information in your credit history.

Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the information disputed is found to be incomplete or erroneous, the bureaus are obligated to remove it from your record.

Some common credit report errors include payments wrongly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number, or identifying information.

Bear in mind that correct information cannot be removed from your credit report. So, if your score is being dragged down by accurate negative information, youll need to repair your credit over time by ensuring you make payments on time and decrease your overall amount of debt.

Here are some tips to help you repair your credit history:

Don’t Miss: Can A Public Record Be Removed From Credit Report

Look For Inaccurate Hard Inquiries

Once you get the report, look over the whole thing. There should be a hard inquiries section. Make sure you recognize each hard inquiry on your report. But dont jump to conclusions if you see any information you dont recognize.

Often, companies will outsource their credit checks to other companies. This usually happens with store credit cards, so do a quick Google search to see if the name listed on the hard inquiry matches up with a company you recognize.

Is It Better To Dispute Online Or By Mail

There are mixed opinions among experts about whether its better to dispute by mail or online. Each approach has its pros and cons.

Pros and cons of disputing by mail

Many experts recommend disputing by certified mail because it provides a clear paper trail with dates and proof of receipt. However, it does have downsides. For example, it takes longer for your dispute to be received and processed, and you could be at risk of identity theft in the event that your letter is misdelivered or stolen.

Pros and cons of disputing online

Disputing your credit report online is quick and convenient, but it also comes with downsides that you should carefully consider. For instance, online dispute forms sometimes limit your options when it comes to describing your situation. This might prevent you from accurately explaining why you believe the hard inquiry is invalid.

More importantly, filing a dispute online sometimes requires accepting terms and conditions that will waive your right to sue the credit bureaus. Equifax, Experian, and TransUnion all have binding arbitration clauses in their service agreements, which seriously limits your right to hold them legally responsible in court if they fail to properly handle your dispute. 567

You can sometimes opt out of these arbitration agreements, but you have to do so proactively, and theres usually a time limit after which you cannot do so.

You May Like: Unlock My Experian Credit Report

Should I Dispute The Inquiry

Returning to the example of our commenter, we should verify that she is seeing a hard inquiry affect her score and not just the report of a soft inquiry. When checking your credit reports, you will see them in different columns. Someone pulling a credit report without authorization happens more often that you may think. If it is a confirmed hard inquiry, and if our commenter does decide to dispute the inquiry, she has a few options. Disputing errors on your credit report is something you can do on your own, or you can turn to a professional credit repair agency for help. Either way, these are the four steps a dispute requires:

Recommended Reading: When Do Companies Report To Credit Bureau

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

You May Like: Why Is My Credit Karma Score Higher