How To Help Get Medical Bills Off Your Credit Reports

There are two main ways to get medical bills off your credit reports. You can dispute an inaccurate item or wait for a collection account to fall off your reports.

Dispute the Medical Bill

Some medical collections accounts may have errors. If thatâs the case, contact your health care provider or collection agency first. You can also file a dispute with each credit bureau that lists the incorrect information. Itâs free to file, but you may need to show why you believe thereâs an error, according to Experian. This may include:

- Records from the collection agency.

- Documents from your insurance company or medical provider.

- Documents that show the bill has been paid, such as copies of a check or a credit card statement.

If the dispute is settled in your favor, the credit bureau will update or remove the collection account from your credit report. According to Experian, the three major credit bureaus will remove a medical debt reported by a collection agency if you can show that your health insurance company paid the bill.

Wait for the Item to Fall Off

If the collection account isnât an error and shows your unpaid debt, the item can remain on your report for up to seven years.

But, in the meantime, you might be able to reduce the impact to your credit. Call the collection agency to ask how you can pay the bill.

Why You Should Not Pay A Collection Agency

On the other hand, paying an outstanding loan to a debt collection agency can hurt your credit score. … Any action on your credit report can negatively impact your credit score – even paying back loans. If you have an outstanding loan that’s a year or two old, it’s better for your credit report to avoid paying it.

Ways To Minimize The Impact

On occasion, a medical bill you never received, or even one youve already paid, makes its way into collections. If you believe a bill was sent to collections unfairly or prematurely, ask the medical provider to take it back so you can pay directly.

If you question whether you owe all or part of the bill, you can dispute the debt with the collection agency. You have 30 days from when you are notified of the collection to dispute the debt, and its best to do so in writing.

Once notified of your dispute, the agency must stop collection activity until it gives you proof that the debt is genuine. If it cant do so, or wont, the debt must come off your credit report. The federal Consumer Financial Protection Bureau has an online guide to disputing a debt and sample letters you can use to send to collectors.

Even if the debt is valid, there are still ways to minimize the damage to your credit:

Free Planning Tool

AARP Money Map can help you take control of unplanned expenses and get you on back on track to financial stability.

Also Check: How Long Before Chapter 7 Is Off Credit Report

Medical Debts Now Weighed Differently

These older scoring models are designed to pay attention not so much to the type of collection or even the balance of a collection, but rather to the fact that a collection occurred in the first place. Michelle Black

Even a small medical collection account could potentially be just as damaging to your credit scores as any other type of collection account, she says.

But things are changing. The newest version of the FICO credit score, the FICO 9, and the VantageScore 3.0 weigh medical bills in collections less than other unpaid accounts. They also add a 180 day waiting period for medical bills. If the bill goes to collections, you have a 180 day grace period to resolve the issue before it shows up on your credit reports.

The bad news is that most lenders dont yet use the newer scoring model, Black says.

If you pay a medical bill with a credit card, you lose the new medical bill protection in FICOs latest credit scoring system if the credit card bill is paid late, says Kevin Gallegos, vice president of Phoenix operations for Freedom Financial Network.

Once debt is owed to a credit card provider, it is not possible to distinguish whether it was from a hospital, vacation, or a shopping spree, Gallegos says.

Personal loans are an alternative to credit cards for paying off medical debts. They dont come with 0% APR deals but tend to have lower interest rates, which makes them helpful if you want to pay the bill over time.

Do Medical Bills Hurt Your Credit

Medical bills will not affect your credit as long as you pay them. However, medical debt is handled a little differently than other types of consumer debt. Since most health care providers don’t report to credit bureaus, your debt would have to be sold to a collection agency before appearing on your credit report. Most medical providers won’t sell the debt to a collection agency until you are 60, 90 or even 120 days or more past due. Exactly when that happens depends on your health care provider.

Even after your bill goes to collections, the account won’t show up on your credit report right away. The three main consumer credit bureausExperian, TransUnion and Equifaxgive you a 365-day waiting period to resolve any medical debt before the collection account appears in your credit history. So medical bills won’t impact your credit score right away if they are unpaid or ever if they are paid.

This doesn’t mean you should ignore a medical bill. Unpaid medical bills may take a long time to show up on your credit report, but the damage to your credit score can be long-lasting once they do. Unpaid medical bills can remain on your credit report for seven years after they become delinquent however once they are paid, they will be removed from your report.

Recommended Reading: Does Checking Credit Karma Hurt Your Score

Changes To Reporting Paid Debts

Equifax, Experian and TransUnion announced changes to medical debt collection reporting starting this summer when the bureaus say they will change how they handle paid medical collections debt.

Stay informed during the severe weather season with our local news and weather app. for Apple or Android and pick your alerts.

Currently, once medical debts are paid, theyre still on your report for a time, but thats going to change in July. Once you have a medical debt that has been paid off, starting in July, it will come off of your credit report, explained Sara Rathner with NerdWallet.

Medical Bills With Health Insurance

Carefully re-read your policy contact your insurance agent if you think charges on a bill should be covered. If you are certain you should be reimbursed, or that your doctor or hospital should be paid by your healthcare provider, file an appeal in a timely manner, as most insurers limit the time you have to question a benefit. It often is just 30 or 60 days.

Be prepared for denials and delays and be careful to keep records of all phone calls and correspondence. That way, if you eventually must file a formal complaint with your states insurance commission or contact a consumer law attorney, you have accurate records.

Be aware that in the end, you may still have to pay the bill.

Read Also: Does Ppp Loan Show Up On Credit Report

The High Price Of A Healthy Life

Medical debt is a major source of debt for Americans. Around 20% of U.S. households report having medical debt, according to a 2022 report released by the Consumer Financial Protection Bureau . This issue is more prevalent among Black households, with 28% reporting to have past-due medical debt.

Medical collections debt often arises from unforeseen medical circumstances. These changes are another step were taking together to help people across the United States focus on their financial and personal wellbeing, according to a joint statement by the CEOs of Equifax, Experian, and TransUnion.

A poor credit report can have ripple effects on someones ability to make substantial life investments like buying a house, qualifying for insurance, or opening a bank account.

People who have or who are at risk of having medical debt may also avoid seeking out necessary medical care, according to the U.S. Census Bureau.

Medical Care Is Critical But The Bills Associated With It Can Be Expensive And In Some Cases They Could Affect Your Credit

If youâve ever had an injury, illness or surgery, you might know what comes nextâthe potential for expensive medical bills.

If youâre struggling to pay these bills on time, youâre not alone. But if they arenât paid, the medical provider could turn the account over to a collection agency. In fact, medical debt continues to be the top reason consumers are contacted by debt collectors, according to the Journal of the American Medical Association.

When medical debt ends up in collections, it could hurt your . And if you use a credit card to pay your medical bills, there could be an impact as well. Read on to learn more.

Recommended Reading: How To Improve Your Credit Score In 30 Days

Why Are The Credit Bureaus Removing 70% Of Medical Collections

Consumer credit reports and credit scores provide credit card issuers and lenders with a lot of valuable information. These tools help lenders and others predict risk, and that can help keep the cost of credit at a more affordable level for people with good credit.

When negative information shows up on your credit report , lenders may feel that doing business with you is a bigger risk. Even a medical collection on your credit report could damage your credit score and make it harder for you to qualify for financing.

Credit scores predict the likelihood that youll pay a credit obligation 90 days late or worse in the next 24 months. Yet research from the Consumer Financial Protection Bureau shows that medical collections may be less effective at predicting future credit behaviors.

People with paid medical collections on their credit reports are less likely to make late payments than other people with the same credit score. Per the CFPB, these consumers should have credit scores that are around 20 points higher on average. Therefore, it seems that medical collections may not be as accurate at predicting future defaults compared with other types of collection accounts.

Dont Miss: Comenity Bank Credit Bureau Dispute

Do Hospitals Forgive Bills

According to Walker, most U.S. hospitals are nonprofit, which means that if you make under a certain amount of money the hospital will legally have to forgive your medical bills. … If your medical bill has already been sent to collectors you can still apply for financial assistance and forgiveness.

Read Also: How To Get A Timeshare Off Your Credit Report

What Else You Should Know

The credit bureaus new ways of reporting medical debt are reminiscent of some other relatively recent changes in the credit reporting industry. Within the past few years, the bureaus removed almost all public records from credit reports. Examples include tax liens and collections resulting from library fines and traffic tickets. Like medical debts, these are often one-off scenarios that dont follow the same pattern as monthly loan payments.

In other words, your credit score is meant to be a numerical representation of how likely you are to repay a lender. Paying your monthly credit card, car loan or mortgage bill on time feels like a much better apples-to-apples comparison than repaying a medical bill that may have been an isolated event involving a life-or-death situation .

Furthering this idea, lenders and credit bureaus have started to add other financial obligations to some consumers credit reports. Experian Boost is one such program that can incorporate utility, telecom and streaming accounts. Buy now, pay later plans are also being added to credit reports. The credit bureaus seem to believe these payment behaviors are more predictive of credit risk than medical debts and traffic tickets.

Do Unpaid Medical Bills Appear On Your Credit Report

Unpaid medical bills can be sent to debt collectors, at which point they can appear on your credit reports. Collections accounts can take up to seven years to submit your credit reports, although the impact on your credit score will diminish over time. Medical bills won’t affect your credit as long as you pay them. However, medical debt is handled a little differently than other types of consumer debt.

Since most healthcare providers don’t report to credit bureaus, your debt would have to be sold to a collection agency before it appears on your credit report. Most healthcare providers won’t sell debt to a collection agency until you’re 60, 90, or even 120 days or more in arrears. The exact time this happens depends on your healthcare provider. From now on, paid and unpaid debts for medical collections generally remain on your credit history for seven years after being reported.

If your medical bills are overwhelming, you may want to consider getting help from a medical billing advocate or financial assistance from a charity or government organization . On July 1, paid medical charges will disappear from Equifax, Experian and TransUnion credit reports. If you think a bill was sent unfairly or prematurely for collection, ask your medical provider to return it so you can pay directly. According to credit bureaus, about 70 percent of medical debt will be removed from Americans’ credit reports once the aforementioned changes take effect.

References

Recommended Reading: Does Heloc Affect Credit Score

Knowing The Facts Can Help You Manage Your Credit And Medical Expenses More Proactively

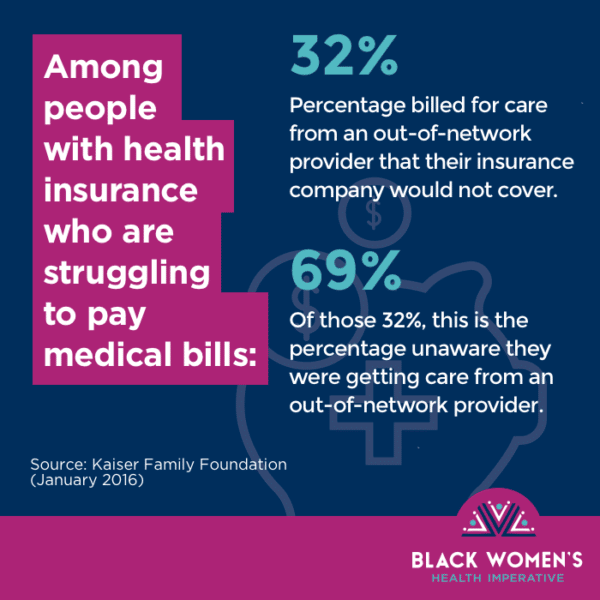

If you think youre immune to damage from a collection account on your credit report because you pay your bills on time, think again. Medical bills that you dont know about could be hurting your creditand the odds are not in your favor.

In fact, the Consumer Financial Protection Bureau reports that around 31.6% of adults in the U.S. have collections accounts on their credit reports. Thats almost one in three Americans. Medical bills account for over half of all collections with an identifiable creditor. Chances are good that you, too, have a medical bill in collections.

Many times, medical bills hit collections because you didnt even realize you owed anything. Here are four common medical bill myths that can cost you dearly and the truth you need to manage your credit and medical expenses more proactively.

Your insurance wont cover everything

Its a consumers obligation to know what theyre responsible for paying. A lot of people are under the impression that their insurance will cover all medical costs, so they dont owe anything. Due to how a visit or procedure is billed with insurance, this isnt always the case. Its always best to be prepared for the worst to prevent anything from being sent to collections.

Your medical bills can be sent to collections, even if youre paying

Tips for dealing with medical bills

How To Rebuild Your Credit After Medical Collections

Rebuilding your credit when you have a collection account on your report can seem daunting, but there are some steps you can take to start improving your credit right away:

- Pay off any past-due debts. Paying off your medical collection account is a good first step to rebuilding your credit. You should also bring any other past-due debts current as soon as possible.

- Make all your payments on time going forward. In time, consistently positive payment history on all your other accounts will help your scores rebound, and the longer ago the collection account occurred, the less it will impact you.

- Pay down your credit card balances. Your is the second most important factor in your FICO credit scores. Paying your credit card balances in full each month will help you keep your credit utilization as low as possible, which is good for credit scores.

- Sign up for Experian Boost®ø. With Experian Boost, you can get credit for your on-time utility, cellphone and streaming service payments going back up to 24 months.

Thanks for asking,

Recommended Reading: What Affects Your Credit Rating Canada

Do Medical Bills Sent To Collections Affect Your Credit

While most healthcare providers wont report your medical bills to a credit bureau, they may send the debt to a collections agency if you havent paid by a due date or negotiated a payment plan.

Debt assigned to a collection agency does not automatically appear on your credit report or affect your credit score.

Often, debt-collection agencies will report the unpaid amount to the consumer reporting agencies. Creditors are not required to report to every consumer credit agency and may not report to all three.

Debt-collection agencies may sue you in court, depending on state law and how aggressive they are about securing payment. If there is a lien or court judgment related to your medical debt, those public records may appear on your credit report.

How Will All This Affect My Credit Score

Having a debt go to collections can drop your credit score significantly and it gets worse the longer it hasnt been paid. For instance, your credit score is likely to drop more if a bill has gone unpaid for 150 days versus 30 days. Once a collection has been removed from your credit report, you could see a positive change in your credit score.

Read Also: Usaa Free Credit Score

You May Like: What Credit Score For American Express

Do Medical Bills Appear On Your Credit Reports

During a medical emergency, the last things that youre thinking about are how youre going to pay the medical bill or if there are unpaid medical bills on your.

You may not even know how much your healthcare will cost until you get the medical bill.

Medical bills are so dangerous because, at the time of an emergency, many of the costs are hidden in the complicated web of insurance policies.

If you dont pay your medical bills on time, it can negatively affect your credit scores. Medical debt thats paid late or not paid at all can go to collections and affect a credit report.

In this article, well look at what happens when medical bills go to collections, how medical bills affect credit, how to avoid that, and how to remove medical bills from your credit report.

Medical bills are different from regular expenses. When youre in the hospital emergency room, shopping for the best and cheapest service and confirming that your insurance company will cover the costs isnt an option.

When a child breaks her arm, it would be nice to shop around for the best price on a cast like you might for a new water heater, but it just doesnt work that way. Most of the time, you can only deal with medical expenses after the bill is in your mailbox.