Why Is It Important To Check My Credit Score

Now that you know that you can check your credit score without negatively impacting your score, its time to make it a habit. A lower score may indicate errors or fraud on your credit report. The sooner you catch something, the faster you can address it.

Keeping tabs on your credit score can be motivational, too. People who checked their score 12 or more times a year were almost twice as likely to report an improved score, compared to those who only checked it once, according to a survey conducted by Discover. After all, to improve your credit score, you need to know your current number and track your progress.

How Long Will Hard Inquiries Last

Hard inquiries stay on your credit reports for 24 months, but their effect on your credit score diminishes with time. For instance, many people can fix a marginal drop in their credit score after a hard inquiry within a few months by maintaining responsible financial habits.

Your FICO score only accounts for hard inquiries that have taken place in the preceding 12 months. You may expect even more leniency with your VantageScore, which tends to rebound within three to four months of a hard inquiry, so long as there is no further negative activity.

When To Be Cautious

New lines of credit represent only 10 percent of your credit score, according to myFICO.com, but that doesnt mean you should rack up hard inquiries without giving it a second thought.

- Although credit checks are factored into your credit score for only 12 months, they remain on your credit report for two years.

- Credit checks can have a greater impact for someone with a short credit history and few accounts, compared with someone who has a long history and wide range of credit experience.

- To a lender reviewing your credit report, many hard credit checks in a short time may indicate higher credit risk because it could appear that you are trying to get a lot of credit quickly.

- Drops in your credit score can result in higher interest rates when you borrow, which means you pay more over the life of a loan.

Recommended Reading: Paypal Credit Affect Credit Score

Will Hard Inquiries Affect Your Credit Score

Hard inquiries have a bearing on your credit score. However, the impact is more pronounced for people with few credit accounts for limited credit histories. The number of inquiries also plays a role in the significance of the effect.

FICOs page on credit checks suggests that a single hard pull takes fewer than five points off the credit scores of most individuals.

If you have good to excellent creditworthiness, you likely dont have to worry about the effect that a single hard credit check will have on your credit score. However, the same cannot be said for someone with poor, limited or no credit history. In such a case, more points will likely be docked from your credit score after a hard inquiry.

Too many hard inquiries on your credit report within a short span can be a red flag to prospective lenders. However, this is not true in cases of rate shopping. For example, if your search for a mortgage, a student loan or an auto loan has led to multiple hard inquiries and you apply for one within a 14-day window, all the pulls will be viewed as a single inquiry through the VantageScore and the older FICO scoring models. Under the revised FICO model, this extends to a 45-day window. Keep in mind that applying for credit cards doesnt fall under the scope of the rate shopping exception.

How To Remove Hard Inquiries From Your Credit Report

If you find hard inquiries on your report that you didnt authorize, dispute the error by calling or writing to the creditor to have it removed from your report. Otherwise, you cant remove the inquiries, but you can minimize their impact.

Most importantly, avoid applying for credit you dont need. When you do need it, research a few lenders ahead of time so you can apply to all of them at the same time the longer the time between applications, the more they can impact your score.

Daria Uhlig contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content thats accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates processes and standards in our editorial policy.

Read Also: Does Paypal Credit Report To Credit Agencies

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

Read Also: Derogatory Marks Removed

How To Quickly Improve Your Credit Score

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: When Does Comenity Report To Credit Bureaus

Why Credit Inquiries Affect Everyone Differently

Its important to keep in mind that FICO does treat different types of credit inquiries differently and that the same credit inquiry can affect people in different ways.

According to Tina Hay of Napkin Finance, different peoples scores will be affected differently by a hard pullsome may not lose any points, while others may lose several for a single new inquiry.

The reasons for this ultimately come down to your own credit history. However, theres one more important point that can change how individual hard credit inquiries affect your credit score. And its a neat little trick that everyone should be aware of .

Ready for the trick on dropping hard inquiries from your credit report with minimal effort? Here it is:

FICO considers multiple same hard credit inquiries done within the same period of time as one single hard inquiry.

Why is this important? When youre searching for a business loan or are looking to rent an apartment, people often apply at several different locations before they find a deal that works best for them. For this reason, FICO considers these inquiries as one single hard inquiry provided it falls within the 45-day window .

This is great to keep in mind the next time youre shopping for a loan or are looking to apply for credit to make a purchase because you can use this to your advantage to not only maintain your current credit score while maximizing your opportunities to shop around for the best deal possible.

How Do Hard Credit Inquiries Affect Your Credit

Lenders and credit scoring models consider how many hard inquiries you have on your credit reports because applications for new credit increase the risk a borrower poses. One or two hard inquiries accrued during the normal course of applying for loans or credit cards can have an almost negligible effect on your credit. Lots of recent hard inquiries on your credit report, however, could elevate the level of risk you pose as a borrower and have a more noticeable impact on credit scores.

Hard inquiries can stay on your credit report for two years, but the degree to which they affect your credit diminishes over time. While they could initially reduce your FICO credit score by several points, your scores will likely recover after a few months. The credit score sting caused by many hard inquiries in a short period of time will take longer to go away. At any rate, both types of inquiries are automatically removed from credit reports after two years.

Again, your overall credit health is what matters most. If you have a consistent track record of making on-time payments and keeping your revolving credit balances low, it isn’t likely that a few hard inquiries will have enough of an impact on your credit scores that it affects your interest rates or credit approval.

Also Check: Shopify Capital Eligibility Review Changed

How Much Will Hard Inquiries Drop Your Credit Score

According to FICO.com, a single hard inquiry will drop your FICO score by no more than 5 points or less. This is not to say that each hard inquiry will drop your score by as much as 5 points.

Since the credit score ranges are 350-850 and inquiries only make up about 5% of your score, the maximum points credit inquiries account for is about 40-45 points regardless of how many inquiries you have.

Suppose you have a long-established credit profile with many different types of credit accounts. A single inquiry will have less of an impact on your score than someone with little credit history.

For those with long-established credit profiles, a single inquiry may not impact your credit score at all. It is important to limit your credit reports number of hard inquiries to maximize your credit score.

New accounts make up 10% of your FICO credit score inquiries make up a portion of the New Account category, and only one factor. Because of this, inquires account for 5% or less of your total FICO score.

A single hard inquiry can drop your credit score by as much as 5 points. However, someone with a long, established credit profile will not be as affected by a hard pull as someone with little credit history.

How Many Points Does A Hard Inquiry Affect Your Credit Score

In general, hard inquiries dont have as much of an impact on your credit score as other credit factors. Credit inquiries are only responsible for 10% of your credit score while your payment history makes up 35% of your score.

For most people, according to FICO, a new hard credit inquiry will only drop your credit score between one and five points. While a hard inquiry stays on your credit report for two years, it only impacts your score for one year.

Its important to note that these inquiries can stack up. For example, if you get a new mobile phone and service plan in January and then apply for a new credit card in February, you may see a bigger hit to your credit score than just five points due to multiple hard inquiries.

However, there is a way around racking up multiple hard inquiries if youre rate shopping for a loan or mortgage. Heres how.

You May Like: Syncb/ppc Credit Card Login

How Do Hard Credit Inquiries Affect Your Credit Score

When you let a bank or lender do a hard credit check on your credit report, what does that mean for that all-important, three-digit numberâa.k.a your credit score?

And how long do hard inquiries stay on your credit report? Are you permanently branded a credit-checker?

Hereâs what you need to know:

When a lender hard pulls your credit, your credit score will take a small hit regardless of whether youâve been approved or declined. According to FICO, credit inquiries tend to correlate with higher risk borrowersâand your credit score will reflect that correlation.

Why do credit inquiries correlate with riskier borrowers?

Itâs hard to pay off debt. And as you open more and more new credit accounts , it becomes less and less likely that youâll be able to pay off each and every one of your existing credit accounts. And because a credit inquiry comes along with each new credit account you open, credit inquiries are the signal that indicate youâre opening a lot of new accounts.

Back to the issue credit inquiries staying on your credit report.

All in, donât worryâcredit inquiries donât impact your credit score that much.

So, if thereâs a credit inquiry thatâs on your credit report, donât panicâit doesnât have a huge impact on your credit score. According to Tina Hay, CEO of Napkin Finance, âA hard credit pull can take off several points from your credit score, but itâs typically a 1 to 5 point impact.â

Do Hard Pulls Hurt My Chances Of Getting A Mortgage

First, if I were planning to buy a house Id probably sit out from applying for credit cards for 6 to 12 months, leaning more towards 12. This would definitely be the case if I knew my potential lender used FICO.

But this might still make you curious about the impact of inquiries that are over one year old. Would those count against you when trying to get a mortgage?

Ive spoken with a mortgage lender about this issue and this is the response I received verbatim:

We dont really look at the number of inquiries but rather if those inquiries have resulted in new debt. If they are just inquiries that didnt result in new debt then we dont care about them.

That means that they are more concerned with installment loans like personal loans, car loans, etc., and wouldnt care about additional credit card accounts .

I know lenders can vary dramatically, so dont take this advice to be universal. However, its good to know that even if you have inquiries that will take another 12 months to fall off your report , they may not have any negative impact on you getting approved for a mortgage. Again, always check up on this stuff with your local real estate experts and lenders, since Im sure this varies.

Recommended Reading: Comenitycapital Mprc

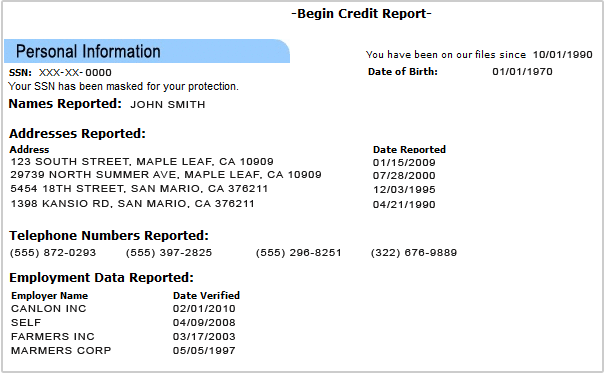

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

Bad Credit Scores Are Affected More

Lets say you have a very weak credit profile. Maybe you have a low credit score and little to no credit history.

If thats the case, then the overall impact from the hard inquiry may be much worse.

Its possible that your score could drop 10 points or more. This can be very discouraging to people trying to build up their credit score but as shown below the negative impact is only temporary.

Recommended Reading: Credit Score Itin Number

How Many Points Will A Hard Inquiry Impact Your Credit Score

A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably wont be that significant. As FICO explains: For most people, one additional credit inquiry will take less than five points off their FICO Scores.

FICO also reports that hard credit inquiries can remain on your credit report for up to two yearsbut when FICO calculates your credit score, it only considers credit inquiries made in the past 12 months. This means that if your credit inquiry is over a year old, it will no longer affect your FICO credit score.

Limits Your Requests For New Creditand The Hard Inquiries With Them

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because youre facing financial difficulties and are therefore a bigger risk. If you are trying to improve your credit score, avoid applying for new credit for a while.

You May Like: What Is Syncb Ppc On My Credit Report