How To Remove Hard Inquiries From Your Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible. This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

Navigating your credit score can be confusing, since there are many personal finance factors to deal with. One issue is âhard inquiries.â A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible.

This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

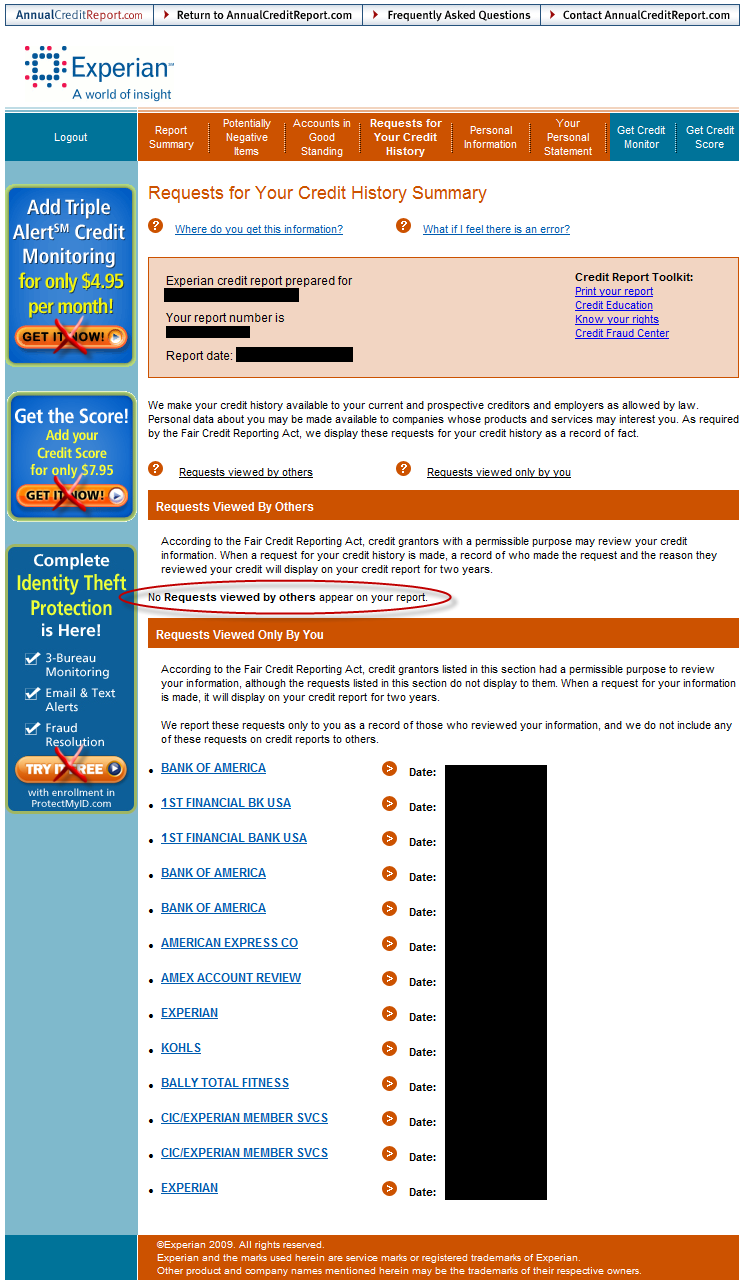

Generate Your Report Online

Once you access your credit reports, download them to your computer or print them before you exit out of the window for later review.

If you have trouble requesting an online copy of your credit reports, you can also request to receive a free copy by mail or phone. To receive a free copy by mail, fill out the mail request form and send it to this address:

Annual Credit Report Request ServiceP.O. Box 105281

The form asks you the same questions as the online form.

If you prefer calling instead, dial 877-322-8228.

Don’t Miss: Does Hsn Report To Credit Bureaus

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Also Check: What Score Is Needed For Care Credit

Sample Letter To Get Hard Inquiries Removed From Your Credit Report

If youâre going to dispute an error on your credit report, itâs best to write a letter to the credit reporting agencies. Though many bureaus have online forms, they often include forced arbitration forms, which will prevent you from filing a lawsuit over the dispute, something you may ultimately need to do.

Writing a letter may feel overwhelming. However, the Consumer Financial Protection Bureau and the Federal Trade Commission both provide a sample cover letter and a template of the information that the dispute letter needs to include. Your letter should contain the following info:

Information that identifies you:

-

The number from the account

-

You should number each item that you want corrected

-

The dates that the dispute occurred

-

Explain each inaccuracy

-

The company that has the information in dispute

Finally, make sure you include a summary or list of the documents you submitted to support your claim.

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

Recommended Reading: When Will A Repo Show On Your Credit

What Is The Fair Credit Reporting Act Or Fcra

The Fair Credit Reporting Act is an important law that gives you the right to know the information that the credit bureaus keep on you and how that information informs your credit scores.

This law includes a number of consumer rights and protections. For example, under the FCRA you have the right to dispute incomplete or inaccurate information on your credit reports. In most cases, the credit bureau must investigate your case and correct or remove any inaccuracies within 30 days.

How Can You Get A Free Annual Credit Report

You have three options for requesting your free annual credit report:

- Online: You can request a copy directly from AnnualCreditReport.com

- Phone: Call 322-8228

- Mail: Download and mail the complete the Annual Credit Report Request form to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

You May Like: Brksb Cbna

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

Q How Is The Transunion Personal Score Calculated

The credit industry uses various types of credit scores to assess risk for different types of credit. For example, a creditor may use one type of score when assessing risk for a credit card account and another type of score when assessing risk for a mortgage account.

Read Also: What Credit Score Do You Need For Chase Sapphire Reserve

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Don’t Miss: Does Zzounds Report To Credit Bureau

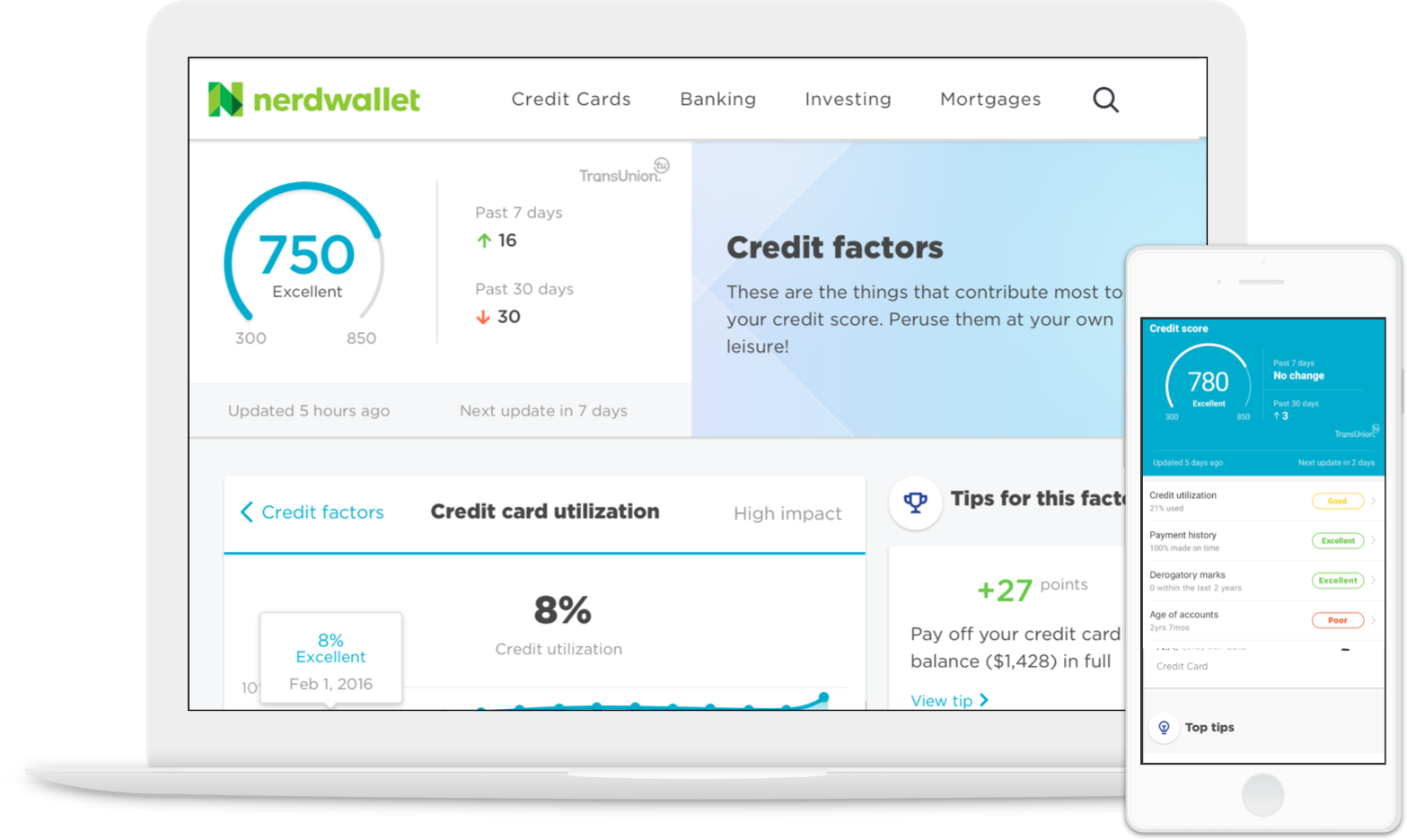

Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: Notify Credit Bureau Of Death

Specialty Consumer Reporting Agencies

Specialty consumer reporting agencies prepare reports on consumers’ histories for specific purposes. The reports cover employment, insurance claims, residential rentals, check writing, and medical records. Think about ordering a specialty report if you are ready to buy homeowners or automobile insurance, open a checking account, apply for private health or life insurance, or rent a home or apartment.

Property Insurance Claim Reports: Insurance companies often check reports of this kind when you apply for homeowners or automobile insurance. One of these reports is the CLUE report .2 CLUE reports contain information on property loss claims against homeowner’s insurance and automobile insurance policies. A CLUE report contains personal information, such as your name, birth date, and Social Security number. It also contains a record of any auto or homeowner property loss claims you submitted to an insurance company. It includes the type of loss, date of the loss, and amount paid by the insurance company. It lists inquiries, or companies that have checked your claim history.

Another property loss report is called A-PLUS . The A-PLUS database is compiled by a smaller company and is less commonly used than the CLUE database. You may order a CLUE report and an A-PLUS for free once every 12 months.

Tenant History Reports: Landlords sometimes check your tenant history as well as your credit history. You may order a free copy of your tenant history report once every 12 months.

I Got My Free Credit Reports But They Do Not Include My Credit Scores Can I Get My Credit Score For Free Too

Free credit reports provided by the nationwide credit reporting agencies currently do not include free credit scores. However, your credit card company may provide a free score. Be wary of programs offering free scores if you enroll they are generally not really free.

You can purchase your score directly from the credit reporting agencies and scoring companies. However, its important to check your credit report to make sure the information is accurate because your credit score is based on the information in your credit report. Its also important to note that the score you purchase may not be the same as the one lenders use to decide whether to give credit.

Your credit card company may share a credit score with you for free. Some companies include credit scores on your monthly statements.

- deny your application,

- increase the cost of your credit, or

- offer you a higher rate than other consumers get from that creditor.

Mortgage lenders also have to disclose your score when they check your score to approve a mortgage loan.

There are other third parties that claim to offer free credit scores. However, you should consider the following:

You may need to enroll in a program with a fee or purchase a product to get this free credit score. That means it is not really free. Sometimes there is period of time during which you can cancel without paying a fee. These programs are not free unless you remember to cancel within the allowed period of time.

Also Check: What Company Is Syncb Ppc

Q Why Cant I Dispute My Credit Score

A. A score is a numeric evaluation of your credit file made at a particular time . Therefore, a score is not part of your credit report.As the information in your credit report changes, the score may change. Credit history information in your credit report, such as the number of credit related inquiries, outstanding balances, number of accounts, age of account, etc, is considered when calculating the score. Therefore, we are unable to accept a dispute regarding your credit score. We can however, investigate the information on your credit report if you believe it is inaccurate or incomplete. If your report is updated, this may have an effect on your score if the change includes one of the factors mentioned above.

Is Everyone Eligible To Get Their Free Statutory Annual Credit File Disclosure

Yes. As of Dec. 1, 2005 all consumers are eligible to request their statutory annual credit file disclosure once every twelve months.

Monitor your Experian credit report for free

No credit card required.

- Access to your free Experian credit report and FICO® Score

- Get real-time alerts to help you detect possible identity fraud sooner

- Monitor your spending and know when your account balances change

Recommended Reading: Affirm Credit Score For Approval

Q How Can I Contact Your Fraud Department

A. Please contact the Fraud Victim Assistance Department through the following phone or mail channels:All information should be supplied to:Correspondence in EnglishTransUnion Fraud Victim Assistance Department3115 Harvester Road,Suite 201 Burlington ON L7N 3N8Correspondence in FrenchService daide aux victimes de la fraude TransUnion3115 Chemin Harvester,Suite 201 Burlington ON L7N 3N8

Identifying Credit Report Errors

Flubs occur because of human error or incomplete information being provided to a credit bureau. Errors can include:

- Reports of something you didn’t buy or a purchase you didnt authorize

- Reports of amounts differing from what you actually paid

- Inaccurate purchase dates

- Missing payments or credits to your account

- Accounts mistakenly attributed to you

- Reports of applications you didn’t fill out

The other credit report error is fraud, in which someone intentionally and illegally tries to mess with your financial statusfor example, by opening an account in your name.

In either situation, the best way to correct an issue is to find the source of the error. Of course, you wont know there is an error unless you check your report regularly. So, request a copy of your report and carefully review all the information it contains. Look for any entries that are mistakenly attributed to you because of confused names, addresses or Social Security information. Check for mixed account information that could be due to identity theft, incorrect payment status, an ex-spouses information mixed with yours, outdated information or remedied delinquencies not being reported.

Once you’ve discovered a possible problem, make sure to gather proof supporting your position that there is an error before you officially dispute it.

Don’t Miss: 686 Fico Score