How Often Do Credit Card Companies Report To The Credit Bureau

You can improve your credit score by knowing when your credit-card lender reports your activities to Experian, TransUnion and Equifax, the three main credit bureaus. Before you apply for a loan or new credit card, you can pay down your balance prior to the reporting date and raise your score. Your lender usually reports your information to the credit bureaus one time per month on or around your payment due date. If you check your credit report consistently, you will typically see changes or score updates occur around the beginning of the month. This is due to the fact that the credit-reporting agency assimilates all new data throughout the previous month and updates your credit file with the new information. Here are other strategies you can follow to keep your credit report in tiptop shape.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Best Overall Paid Service

-

Identity insurance

Yes, $1 million for all plans

See our methodology, terms apply. To learn more about IdentityForce®, visit their website or call 855-979-1118.

Who’s this for? IdentityForce® UltraSecure and UltraSecure+Credit offer the most extensive security features that monitor your information on a variety of sites and services, including the dark web, court records and social media .

Consumers receive alerts for potential fraud on your bank, credit card and investment accounts, as well as the use of your medical ID, social security number and address.

For a complete credit monitoring and identity protection service, opt for UltraSecure+Credit. This plan provides the added benefit of three-bureau credit monitoring and credit score updates. You can also track how your score changes over time and simulate how certain actions can impact your score .

UltraSecure costs $9.99 per month or $99.90 per year and $17.99 per month or $179.90 per year for UltraSecure+Credit. For a limited time, you’ll get 25% off all plans, including Family plans .

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Is A Social Security Number Required

Some banks may ask for an authorized users Social Security number. If so, the payment activity and being added as an authorized user will most likely report to the credit bureaus.

When the bank only requests the secondary users name and home address, there is a chance the account will not list on a credit bureaus credit report. In most cases, the information will report if the home address matches the address on record with the credit bureau.

What Happens To Credit After Death

After walking through all these steps, you might wonder what happens to your credit after a death? You might be surprised to learn that credit agencies dont erase a credit file immediately once they receive your letter. Instead, they place a death indicator on the account. This means theres a specific note that the person passed away.

Credit agencies actually keep the credit file as a way to prevent theft. If there was nothing to report to the lender , the lender would be more likely to approve the application. Instead, the credit agencies flag any accounts that submit credit applications after death.

Everything stays on a credit report for up to seven years. That means each account and marks will slowly delete within a period of seven years. Until then, the file stays with each bureau as a way to protect against fraud. This is why its so essential that the family reports the loved one as deceased with the correct agencies. Otherwise, your loved ones file is a risk.

Also Check: Does Carvana Report To The Credit Bureaus

Sample Death Notification Letter For Credit Bureaus

What do you need to include in your death notification letter? Simple is best. As long as you include all of the required information, youve done all you need to in terms of the letter. Here is a sample death notification letter to use for your deceased family members credit account.

Dear ,

This letter is to inform you of the death of . I request that a formal death notice be added to file. full name was and resided at . birthday was , and Social Security Number was .

died on . I have enclosed the death certificate with this request.

My name is and I am the deceaseds . I am . I have included documents proving our relationship.

Thank you for your assistance. My phone number is and my email address is . Please let me know if you require further information.

Sincerely,

When Does It Happen

To be honest, there is not a fixed time frame for when your card issuer will send your information to the credit bureau. However, what we can ask ourselves is when does this data appear on your own credit report? Well, the fact is that this process will widely depend on the credit bureau. On the other hand, it is also common that balances are usually reported to those bureaus on your statement closing date. It can take some days to process and update all your information.

All three major credit bureaus, Equifax, TransUnion, and Experian develop this process at a different pace, so there is no exact answer to the question. Sometimes, even after the end of your billing cycle, your financial information might have not delivered to your credit bureau. It can be quarterly or even monthly, as it will also depend on the practices of the lender.

You May Like: Syncb/ntwk Credit Card

When Credit Scores Update After Companies Report Changes

How often do credit bureaus update reports and scores? The simple answer is every day because companies are constantly furnishing refreshed data.

You may be asking this question because a few extra points on your rating will get you a better interest rate or improve your chances of approval on a new loan.

This question frequently pops up after something significant changes, like paying off debts and collection accounts, or when disputing a negative entry.

Break down the issue into three parts to get the correct answer.

What Do Creditors Have To Report To Credit Bureaus

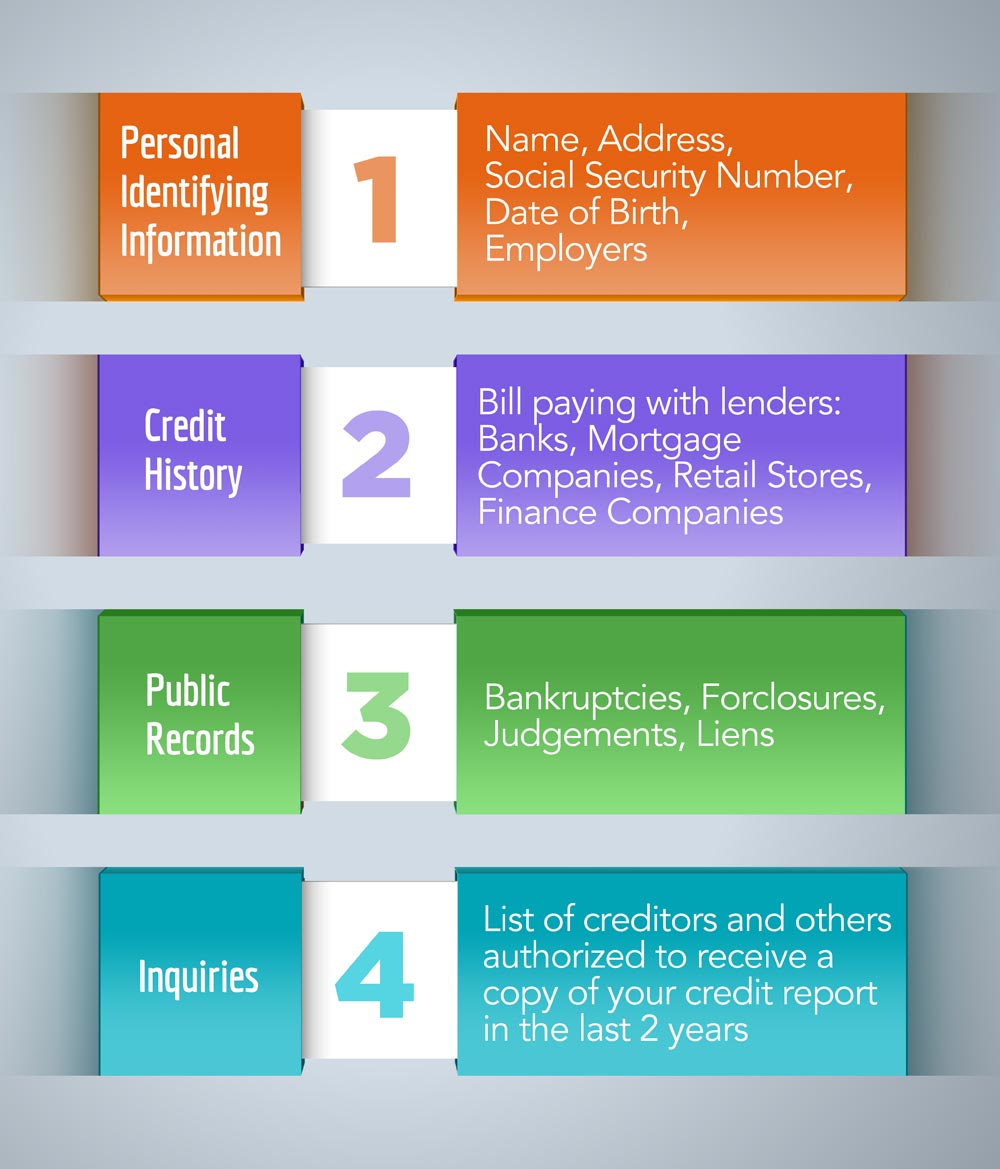

Creditors and lenders are not required by law to report anything to . However, many businesses choose to report on-time payments, late payments, purchases, loan terms, credit limits, and balances owed. Credit bureaus collect this data, and it helps create a person’s credit report, and often this information can impact credit scores.

Businesses usually also report significant events such as account closures or charge-offs. For example, if a mortgage is paid off, this information is reported.

Governmental organizations that maintain public records don’t report to the credit bureaus, but the bureaus usually obtain the documents on their own. For this reason, bankruptcy filings also typically show up on credit reports.

Another example, if a person owes the IRS money, chances are, a public record of a tax lien may find its way onto their credit report, and that can impact your .

Also Check: Capital One Rapid Rescore

Hector Molina Wallethub Analyst

Capital One reports to the credit bureaus on a monthly basis, usually on the monthly statement closing date or a few days after. Capital One doesnt disclose exactly when they report to the major credit bureaus , but users in online forums seem to agree that Capital One information reaches your credit report a few days after the date your statement is issued, and in some cases, on the statement date.

If you’re aiming to report 0% utilization on your Capital One card, pay the whole balance due before the statement closing date and you should be set. But to be absolutely sure, you can pull your credit report. The last date your Capital One card reported information will be listed.

What is the Capital One credit card payment posting date?

A Capital One credit card payment will post by midnight on the same day it is received, as long as you submit it before 8 p.m., ET Monday-Saturday. Otherwise, it will post the following day, by midnight.

When you submit a Capital One credit card payment, it is important to note that when a payment posts to your account, the amount submitted for payment will not immediately be available. Posting only means the payment has been processed and your account will reflect that payment was made. Funds will be available by 8 a.m. the day after the payment posts.read full answer

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

Read Also: How To Remove Repo From Credit Report

Common Credit Reporting Errors

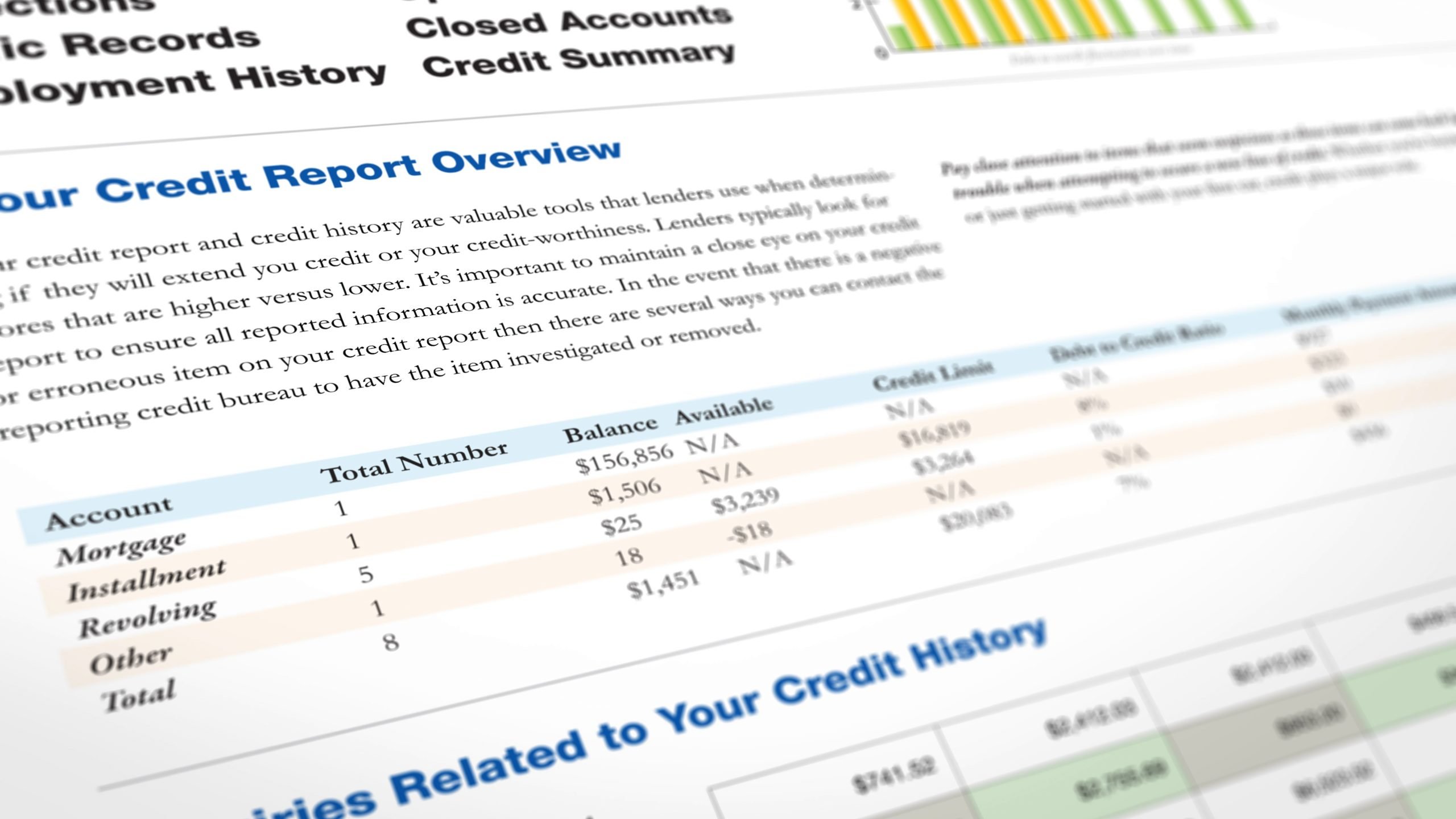

When reviewing your reports, some common personal information and account reporting errors include:

- Personal Information reporting errors. Check to see if your name, address, birthdate and Social Security number are correct. If your report contains inaccurate personal information, it could be a sign that your identity has been stolen.

- Accounts that dont belong to you. Its possible that someone with a similar name could have an account accidentally listed on one of your reports. This could also mean that someone has stolen your identity and opened an account in your name.

- Incorrect account status. When reviewing your reports, make sure your account balance, account numbers and credit limits are accurate. Also, double-check that closed accounts arent reported as open.

- Expired debt. Negative remarks, such as collection accounts and late payments, typically remain on your credit reports for up to seven years. In most cases, the negative information automatically falls off of your credit report. If it doesnt, this could mean the time clock on the debt was reset, which may be an error.

- Reinsertion of incorrect information. Incorrect information that was disputed and removed from your credit report in the past can sometimes reappear. This means you will have to redispute the incorrect information with the credit bureaus or the creditor that is providing the information to have it removed again.

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

Read Also: Does Paypal Credit Help Credit Score

Here Are The Capital One Credit Card Posting Dates:

- Payments submitted before 8 p.m., ET, Monday-Saturday will post the same day by midnight. Funds available by 8 a.m. ET, the day after the payment posts.

- Payments submitted after 8 p.m., ET, or on a Sunday/holiday would post the next day by midnight. Funds available by 8 a.m. ET, the day after the payment posts.

- ACH payments made through your Capital One online account, mobile app, Eno, or IVR payments made through the phone number on the back of your card may post immediately following the transaction.

Regardless of how you choose to pay your Capital One credit card bill, it is always a good idea to not wait until your due date to make a payment. Give yourself enough time to allow for system outages or slow mail delivery. Payments not received by 8 p.m. on the due date, or that are less than the minimum amount due will be considered late and will be charged a late fee up to $40.

Can I trust Credit Karma?

Theres little reason to question the credit data that Credit Karma provides, either, considering that its direct from the credit bureau. It could contain errors, sure. One in five credit reports has a mistake in it, according to the FTC. But that has nothing to do with Credit Karma so-called data furnishers such as financial institutions, landlords and employers are typically to blame. Credit Karmas credit scores are accurate as well, despite being a bit outdated.

With that being said, there are two areas in which doubt enters the trustworthiness equation:

How To Report Credit And Become A Data Furnisher

Establish Reporting Agreements

Companies reporting good credit or bad debt to the credit bureaus, must first establish a Data Furnishers or Service Agreement with each credit bureau to which you will be reporting. The Data Furnishers agreement is required whether you are reporting directly to the credit bureaus or through a processor/stacking service such as The Service Bureau. This is a separate agreement from pulling credit reports.

The credit bureau repositories also require a minimum number of active accounts and monthly reporting, even if you are reporting through The Service Bureau or another processor/stacking service –see example. We have provided phone numbers and account minimums for each credit repository for your convenience .

Companies reporting trade lines must use an application which is up-to-date with the Credit Reporting Resource Guide®, meets all credit reporting laws and regulations and is capable of accurately producing the Metro 2®* format layout such as.

Please Note: Consumers reporting personal loans are not eligible to report credit. Our software will upload to all bureaus that accept the Metro 2 format and support SFTP or HTTPS.

Dun & Bradstreet reviews each request individually and determines eligibility base on proprietary requirements. Participants have access to several incentives for contributing their data.

Procedures for reporting your accounts to the Credit Bureaus

Step 4 – Install Credit Manager software on your computer.

Also Check: Syncb Inquiry

After Filing A Dispute

The length of time it takes for credit scores to update after you file a dispute can range from days to months, depending on the resolution of your challenge to potential reporting errors.

- Filing a dispute does not change the underlying data and does not reflect on your score, as many consumers challenge negative entries just because they exist, not because they are errors.

Timing Is Everything With Credit

Your credit files can change every day. That’s because, as you open new accounts, pay your bills, close accounts and so on, the bureaus continue to collect information and activity from creditors and lenders. This collection alone changes the data in your files.

In addition, some lenders provide their information at the start of the month, others in the middle and some at the end. That means, not only will the information change on different days at different bureaus, but the information at each bureau may not match because it was received at different times.

In answer to the original question, “how do credit bureaus get your information?” it pretty much comes down to specific lenders and their processes regarding customer credit activity. Once they report that information to the bureaus, the bureaus provide the information in the form of a to the company or person who requested it.

Don’t Miss: Cbcinnovis Credit Inquiry

Get Another Credit Card

To get approved for another card, you’ll generally need to show consistent debt management, a good credit utilization ratio, and a timely, consistent payment history.

Keep in mind that applying for a new card will result in a hard inquiry on your credit report. In some cases, applying for a credit limit increase will do the same thing. So either way, apply sparingly. Each hard inquiry has the potential to reduce your credit score by a few points. Too many hard inquiries could make it hard for you to get credit in the future when you need to apply.

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

Don’t Miss: How To Unlock My Experian Credit Report

High Credit Utilization Ratio

Even if the primary user pays their balance in full every month, using more than 30% of the cards credit limit can have a negative effect. Banks and credit bureaus most likely wont overlook this credit factor. As an authorized user, try to be added to the card with the highest credit limit and oldest account age.

How Often Do Issuers Report To Credit Bureaus

Broadly speaking, all issuers have a vested interest in keeping credit profiles current . So they tend to report on a regular basis. Capital One’s reporting rate is not out of the ordinary.

This does not mean, however, that they always do so. There is no legal mandate to report cardholder activity, and there are issuers out there that don’t bother. Additionally, some credit card issuers report to one bureau, or two, but not all three.

So at the end of the day, there is no single reporting standard. Different issuers report at different paces, and at different times.

Nevertheless there are numerous situations in which you might want to know this information, like when you’re:

- About to apply for a job that requires a credit check

- Trying to get a mortgage

- Thinking about applying for a new credit card

In such instances, it’s good to know when those reporting dates occur . Take a few moments to contact your issuer to learn these particulars, then try to pay off chunks of your debt in advance of the reporting date if you have the means. Reducing balances always makes your credit file look better. It should also help raise your score.

Recommended Reading: 698 Credit Score Mortgage