Why Your Credit Report Matters

Its not uncommon for consumers to focus on their credit scores instead of whats in the credit report, and for a valid reason. Your credit score is the three-digit number lenders, and creditors use to determine if youre eligible for credit cards and loan products, along with the terms youll receive. In many instances, credit scores are also used by landlords to decide if they should approve or deny your application for an apartment, condo or rental home. And some insurance companies set coverage costs based on this number.

Still, ignoring your credit report isnt a smart move as the information in it is used to calculate your credit score. Below is a breakdown of how your FICO score, which is used by 90 percent of lenders and creditors to make decisions, is determined:

- Payment history

- Length of credit history

- New credit

So, its vital to review your credit report regularly to ensure its free of errors and file disputes promptly if needed. Otherwise, it could contain information thats dragging your credit score down. Its equally important to identify any negative items and take action to remedy them.

What To Do If You Dont Recognize An Inquiry On Your Credit Report

Did you know that an estimated 1-in-5 Americans have an error on their credit report that makes them appear riskier to lenders than they actually are?

Its now more important than ever to review your credit report on an annual basis to check for potential discrepancies.

According to Credit sesame Number of inquiries comprises of 10% of your credit score.

But why does this happen? Isnt FICO looking out for us?

The reality is, our credit reporting system is huge. And because of its size, it tends to be less accurate than it could be. The result is what was just mentioned above: millions upon millions of consumers end up with discrepancies on their credit report which should have never been placed there in the first place.

And the worst part is, this can affect your ability to get approved for a loan without you even knowing it .

Jeanne Kelly, a credit expert at Jeannekelly.net, suggests checking your credit at least 3 months before big purchases to give yourself enough time to fix these discrepancies.

So, start first by getting your free credit report.

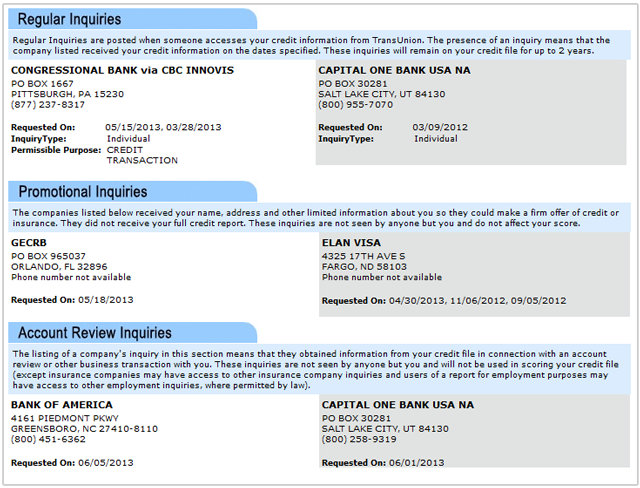

Once youve done this, skim through to the section called credit inquiries and look it over. Is there anything there you dont notice? Something you for a fact shouldnt be there?

If you do notice something on your credit report that wasnt authorized by you, you have two main options:

How Much Impact Do Inquiries Have On Your Credit Score

The good news is: even if youve made too many hard inquiries in a short period of time, the impact is unlikely to be significant. There are five factors that influence your FICO Score, one of which is new credit but it only makes up 10% of your score.

As a result, a hard inquiry usually will only result in a loss of five points to your FICO Score. The average credit score in the U.S. is 716, which is considered a good credit score since it falls between 670 and 739. Even after a five-point drop to 711, the score would remain in the good range.

Plus, the stronger your credit score and the longer your credit history, the less impact a single inquiry will have.

Keep in mind, there are times when multiple hard inquiries within a short time frame will only count as one inquiry. This is to account for rate shopping. FICO applies this rule to home, student and auto loans, and the rate shopping window can be anywhere from 14-45 days .

For example, if youre shopping around for a great mortgage rate and make five hard inquiries within a two-week time frame, that will only count as one hard inquiry.

Similarly, VantageScore has a window of 14 days and includes all types of hard inquiries.

Still, its smart to be careful about multiple inquiries. If they fall outside of the relevant windows outlined above, filling out lots of loan applications in a short period of time could have a more significant negative impact on your score than making a single inquiry.

Don’t Miss: How To Put A Lock On My Credit Report

Can You Remove Hard Inquiries From Your Credit

If you see a hard inquiry on your credit report that you do not recognize you should work to get it removed from your credit history.

And, you should make sure you havent been a victim of identity theft.

The Fair Credit Reporting Act requires the three major credit bureaus Experian, Equifax, and TransUnion to notify you about hard inquiries. Thats why inquiries appear on your credit report, to begin with.

So if youre seeing hard inquiries you didnt authorize, its very possible someone has been trying to apply for credit using your Social Security number. These types of inquiries could be the tip of the iceberg.

Your entire financial health could be at risk.

How Long Do Hard Inquiries Stay On The Credit Report

You might be wondering how much hard inquiry is too many hard inquiries. Well, you dont need to stress. You can learn everything here. Hard inquiries on credit happen when you apply for credit or a loan. It will stay on the credit report for at least 24 months. But a hard inquiry doesnt affect the score after 12 months.

Even though hard inquiries stay on the credit report for over two years, the credit Bureau considered for the past 12 months. It is seen that hard inquiries might cause harm to the credit scores of people with short credit history. If you are someone who is just starting out to build their credit, then hard inquiry can do severe damage to the credit score. But it doesnt mean that you have to stay away from applying for the credit. Its pretty fine to have a few inquiries regularly. It shows that you are trying to build an excellent credit score and ensure that you dont apply for too many credits in a short amount.

Also Check: How High Does Your Credit Score Go

How Rate Shopping Affects Your Credit Score

The FICO score ignores all mortgage and auto inquiries made in the 30 days before scoring. If you find a loan within 30 days, the inquiries wont affect your score while youre rate shopping.

The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. To compensate for this, multiple auto or mortgage inquiries in any 14-day period are counted as just one inquiry.

In the newest formula used to calculate FICO scores, that 14-day period has been expanded to any 45-day period, Watt said.

This means consumers can shop around for an auto loan for up to 45 days without affecting their scores.

If youre wondering how to get the most bang for your buck while rate shopping, a nonprofit credit counselor can help walk you through the process. The advice is free and can save you from committing a costly error while perusing over various rates.

To sum things up, soft inquiries have no effect on your credit score. They happen all the time without your knowledge, so dont worry about them. A single hard inquiry will go mostly unnoticed by the credit bureaus. Any damage done will mend itself in a couple months.

However, if you make too many hard inquiries in a short enough period of time, your credit score will plummet.

Does Your Credit Score Go Up When A Hard Inquiry Drops Off

Yes, your credit score does go up when a hard inquiry drops off.

Hard inquiries are used to track how much credit youve applied for in the last two years. When lenders see you applying a lot during this period, they may deny you for new credit.

Once the hard inquiry falls off, lenders never know you had it.

Read Also:

You May Like: Does Sprint Report To Credit Bureaus

How Do Credit Inquiries Affect Your Credit Score Overall

Inquiries make up 10% of your credit score, so their impact is relatively small. How much you can expect your score to change depends on your credit history. An inquiry might have a greater impact if you have few credit accounts or short credit history, or you have numerous inquiries. But most consumers see their score drop five points or less per inquiry, according to Fair Isaac, the company that created the FICO scoring model.

Although hard inquiries can affect your credit score for up to a year, their impact lessens within a few months, according to Experian.

Soft inquiries have no impact on your credit score.

Why Do Credit Inquiries Matter

When you apply for a credit card, begin shopping for a loan or prepare to take on a new financial responsibility, like renting an apartment, the lenders and companies involved want to know whether youre likely to be a financial risk. By conducting an inquiry into your credit history, these companies are able to assess your level of financial responsibility and the likelihood that you might default on your loan, miss credit card payments or skip out on the rent.

There are two different types of credit inquiries: hard inquiries, which can have a negative effect on your credit score, and soft inquiries, which dont affect your score at all.

Recommended Reading: Is American Express Good For Your Credit Score

Hard Inquiries Vs Soft Inquiries: Difference Between Hard And Soft Inquiry

There is generally a difference between a soft and hard inquiry into the credit score. The soft inquiry on the credit report is visible only to you. A soft inquiry generally does not have any impact on the credit score. Interest shows that you or any other company had checked the report. Therefore, soft inquiry does not play a crucial role in a lending decision. It is ideally for a background check or credit monitoring.

On the flip side, a hard inquiry is an inquiry on the credit report. The report intense to make a lending decision or offer any contract. A hard inquiry can minimize the credit score temporarily. The lender probably goes for a hard inquiry if you apply for a credit loan or any card.

What Is A Hard Inquiry Vs A Soft Inquiry

- Soft Inquiry. Soft inquiries will not affect your credit score. An example of a soft inquiry: you interview for a job and your potential employer pulled your credit report as part of its screening process.

- Hard Inquiry. This type of inquiry can affect your credit score. An example of a hard inquiry is applying for a credit card. In this case, the issuer pulls your credit report to help evaluate the risk of approving your application.

Per FICO, each hard credit inquiry can have a small impact on your FICO® Score1, and several inquiries over a short time period can have a greater impact on your score than just one. So, if youre trying to open several credit accounts in a short period of time , your FICO® Score will likely be affected.

But, if youre shopping for the best rate on a single auto, mortgage, or student loan over a short period of time, those inquiries are typically counted as one, minimizing their impact on your score.

You May Like: How To Get Free Credit Report In Georgia

What To Remember When You Are Rate Shopping

If you need a loan, do your rate shopping within a focused period such as 30 days. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which the inquiries occur.

When you look for new credit, only apply for and open new credit accounts as needed. And before you apply, it’s good practice to review your credit report and FICO Scores to know where you stand. Viewing our own information will not affect your FICO Scores.

As a general rule, it is OK to apply for credit when needed. Be mindful of this information so you can start the credit-seeking process with more confidence.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Sample Letter To Get Hard Inquiries Removed From Your Credit Report

If youâre going to dispute an error on your credit report, itâs best to write a letter to the credit reporting agencies. Though many bureaus have online forms, they often include forced arbitration forms, which will prevent you from filing a lawsuit over the dispute, something you may ultimately need to do.

Writing a letter may feel overwhelming. However, the Consumer Financial Protection Bureau and the Federal Trade Commission both provide a sample cover letter and a template of the information that the dispute letter needs to include. Your letter should contain the following info:

Information that identifies you:

-

The number from the account

-

You should number each item that you want corrected

-

The dates that the dispute occurred

-

Explain each inaccuracy

-

The company that has the information in dispute

Finally, make sure you include a summary or list of the documents you submitted to support your claim.

Recommended Reading: How To Remove Old Late Payments From Credit Report

How To Dispute Hard Credit Inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau, or CFPB, for further assistance.

This could be a sign of identity theft, according to Experian, one of the three major credit bureaus. At the very least, youll want to look into it and understand whats going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If youve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

How Much Do Hard Inquiries Impact A Credit Score

Remember, a soft inquiry will not have any impact on your credit score. Make sure you check your credit record regularly to maintain your credit score.

A single hard inquiry should not have a big impact on your credit score. You can expect a reduction of five points or less. If you have good credit, your score should bounce back in a few months.

If you have an extensive credit history, a single credit application might not affect your credit score at all.

If you do not have a good credit history you may be more affected by hard inquiries. If a lot of hard inquiries for different types of credit happen in a short amount of time, your overall credit score may be slightly reduced for as long as a year. After two years, hard inquiries drop off your credit report entirely.

If you have a short credit history or few accounts, you may also be more affected by hard inquiries.

Dont worry too much about how long hard inquiries stay on your credit report. Credit applications are not a major factor in calculating your credit score. Hard inquiries are part of your credit reports new credit category, but they dont weigh heavily relative to the other factors.

Recommended Reading: What Us A Good Credit Score

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Know Your Rights When Dealing With Credit Bureaus

The Federal Trade Commission enforces several laws that give you important consumer rights when you deal with creditors and the three credit reporting agencies.

One of the most important pieces of legislation is the Fair Credit Reporting Act of 1990 which requires creditors and the credit bureaus to report accurate information in your credit file.

So if a hard credit inquiry is not accurate, you have the right to have it removed within 30 days. Inaccuracies happen more often than most consumers think. All too often, consumers just accept the information in their credit report as true.

When its not true, you could be paying a lot more in interest rates than you should be. Your credit applications could also be denied when they shouldnt be. Or you could get low-balled on your new credit limits.

Thats your job as a consumer. To keep the best credit, check your credit file at least once a year for inaccuracies.

You can also sign up for a free service like or which will send you a text message when someone authorizes a hard credit check.

Some of your existing creditors such as Discover may offer this service, too.

Read Also: How To Remove Late Payments From Your Credit Report

How Long Does A Credit Check Take

Nowadays, most lending institutions have automatic systems to run credit checks for them. These systems can finish a check in less than five seconds. Of course, if you want to conduct a credit check on yourself, it will take a bit longer. First, youll need to request your report at annualcreditreport.com by entering your name, address, social security number, and date of birth in an online form. Once you take care of that, you should be able to access your report right away.

Third parties that are checking your credit without the help of an automatic system – e.g., landlords – may have to wait 2 to 10 days to get your reports.